Overview of the Income and Expenses. While the tax liability will appear as an expense in the profit and loss account the provision for income-tax will be shown in the Balance Sheet as a current liability and the Advance Tax of Rs.

It is shown under. NoAdvance Tax is not an expense and an asset as said by others. It is a charge on income and not considered as an expenditure. In case the assessee falls under any of the above cases the simple interest 1 for a month or part thereof is chargeable for the period from 1 st day of April next following the financial year to the date of determination of total income.

Advance income tax paid in cost sheet.

Download Cost Sheet With Cogs Excel Template Exceldatapro Subsidiary Audit What Is Total Assets On A Balance

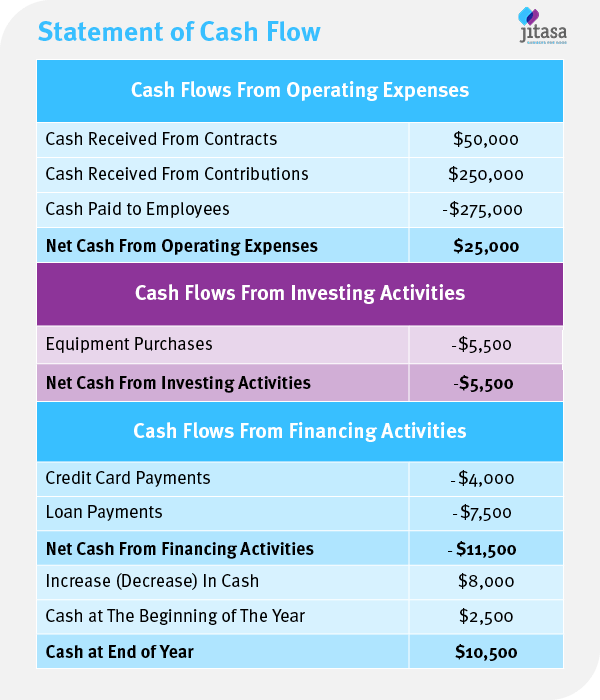

You can take deductions like Section 80C into account while estimating your tax liability. It is a cost statement which is prepared in advance before the actual production of goods or services take place. Advance Tax is not an expense. Net Cash position 1—-.

The balance that is owed if any is paid once delivery is made. The assessee has paid the advance tax however the same is less than 90 of total tax payable. It is made to predict or determine the cost which will be incurred by the organization the potential or.

Provision of Income-tax Provision of income tax recorded in books of account by debiting Profit Loss ac and it will show under liability in the Balance Sheet. They are initially treated like assets their value is expensed over time onto the income statement. Code 0021 for paying income tax by an individual.

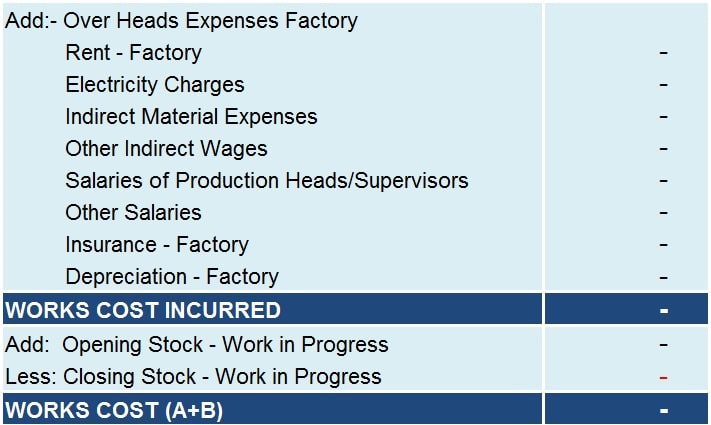

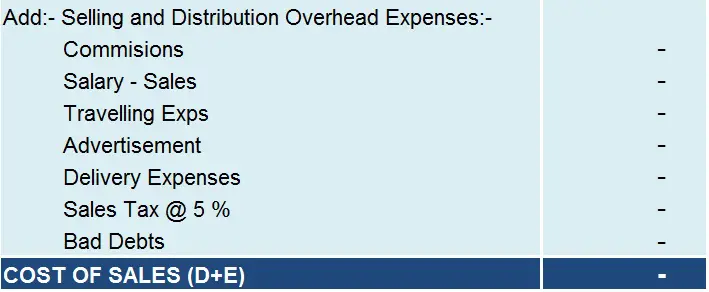

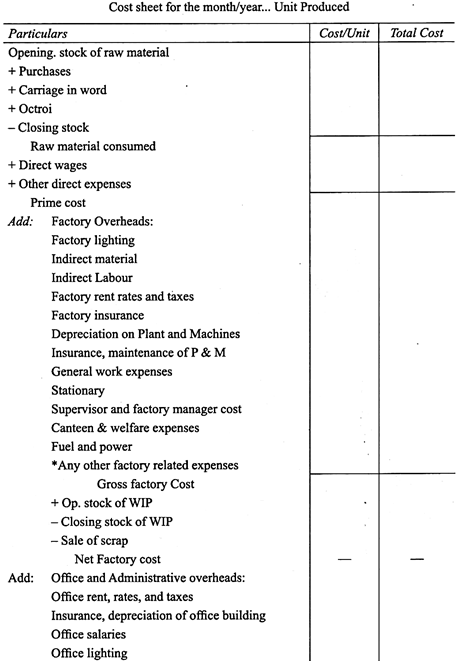

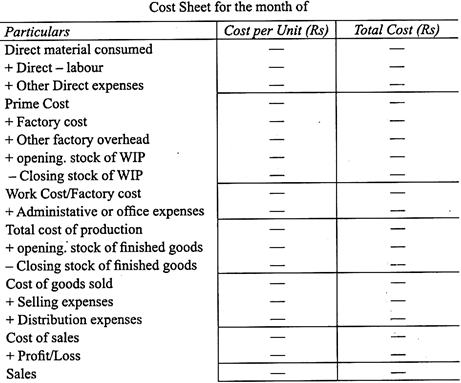

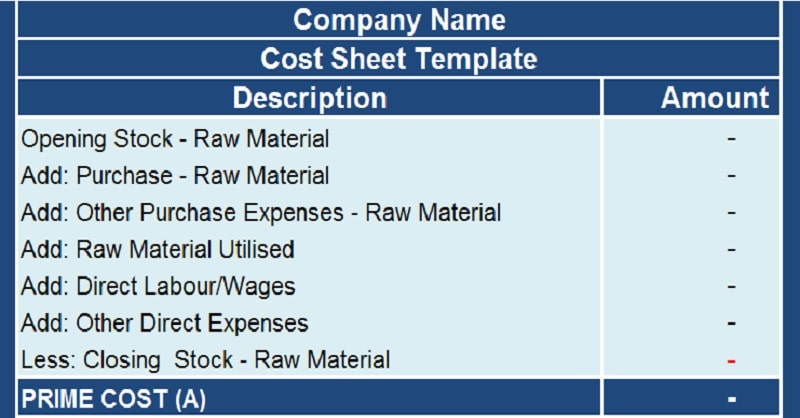

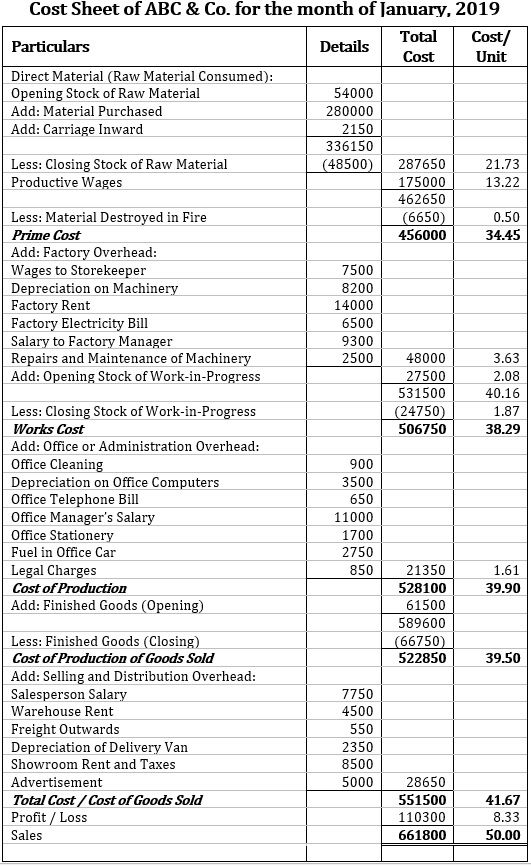

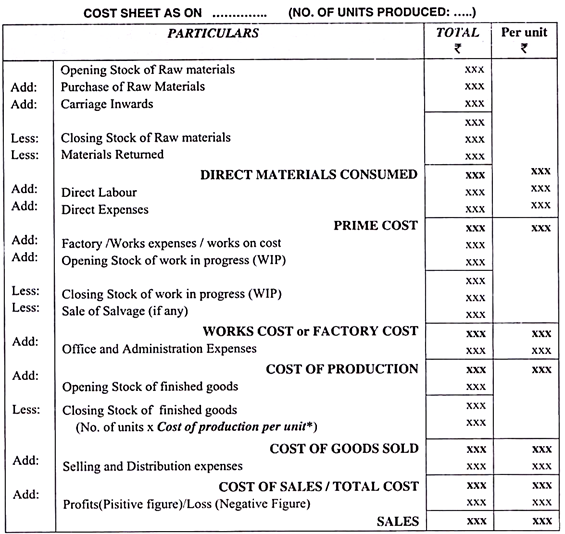

Cost Sheet Meaning Format Examples Problems Elements Specimen Proforma And Advantages Stocks With The Best Balance Sheets Financial Viability Ratios

Mode of Payment. Expenses that are to be charged in the future or simply the future expenses that are paid in advance are known as prepaid expenses. Financial Statement Analysis 10th Edition Edit edition Solutions for Chapter 1 Problem 8P. Long Term Capital Gains Charged to tax 20 20.

Vasu Co Total Income Tax Payment Amount is Rs. It is essential to fill the below details correctly. CHICO ELECTRONICSBalance Sheet thousandsAs of December 31 Year 4Year 5Assets Current assets Cash.

This is done through an adjusting entry. Choose the name of the bank which you will use to pay the advance tax. Preliminary expenses and goodwill written off iii.

Cost Sheet Meaning Format Examples Problems Elements Specimen Proforma And Advantages Retained Income Statement Cash Used In Investing Activities

A contributing factor has been the increase in the cost of goods sold selling general and administrative expenses and interest paid all as a percent of sales. It is considered as an asset and adjusted against ones tax liabilities at the time of finalization of the Balance Sheet. Examples of Revenue Received in Advance The following are a few examples of revenue received in advance. Hire purchase installment paid and other such financial expenses.

This will be adjusted against ur tax liability. 683 325Accounts receivable. 616m Underlying profit before tax 583m 2018.

2016-17 then Advance Tax is paid Rs10000 on 15032017 through Axis Bank and balance Rs2000 paid on 01062017 through Axis Bank. Long Term Capital Gains Covered us 112A 10. It is also known as Unearned Revenue Unearned Income Income Received but not Earned because it is received before the related benefits are provided.

Download Cost Sheet With Cogs Excel Template Exceldatapro Provident Fund In Trial Balance Tesla Financial Performance

With a nonrefundable payment the payee is guaranteed it can keep the money. The following expenses should not be taken anywhere in the cost sheet-i. Permanent Ac No. Interest on deposits us 80TTB Any other deductions.

The Court confirmed advance payments are generally taxable and defined advance payments as a non-refundable payment. Indianapolis Power Light Co. It includes salary paid to managers cleaning staff security staff drivers etc.

While the tax liability will appear as an expense in the profit and loss account the provision for income-tax will be shown in the Balance Sheet as a current liability and the Advance Tax of Rs. Supreme Court made a distinction between the taxation of refundable deposits. This tax liability amount will be deducted from the profit in your books but you will not get any benefit as deduction while calculating profit as per Income Tax.

Cost Sheet Meaning Format Examples Problems Elements Specimen Proforma And Advantages Closing Inventory In Trial Balance Total Debt On

Advance Income tax payment Advance income tax will show under Assets in the Balance Sheet. You can deduct your 426 share of real estate taxes on your return for the year you purchased your home. Give your PAN card number here. 3 50000 paid will be shown as an advance on the asset side of the balance sheet.

Advance payments are amounts paid before a good or service is actually received. You must reduce the basis of your home by the 426 122 365 1275 the seller paid for you. It is usually done on the basis of previous income trends of the taxpayer.

As the amount received in advance is earned the liability account should be debited for the amount earned and a revenue account should be credited. Advance tax is payment of Income Tax on Pay As You Earn basis. Income Received in Advance Sometimes earned revenue that belongs to a future accounting period is received in the current accounting period such income is considered as income received in advance.

Download Cost Sheet With Cogs Excel Template Exceldatapro Deliveroo Financial Statements 2018 Income Statement Same As Profit And Loss

Income Liable to Tax at Normal Rate —. Click Services – epayement. The assessee has to estimate his future income and pay the taxes accordingly. 589 1990 The US.

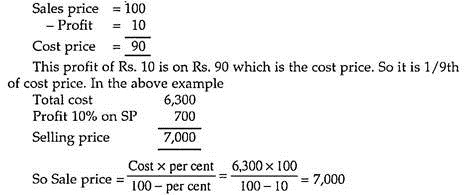

The balance sheet and income statement for Chico Electronics are reproduced below tax rate is 40. Home Accounting Advance Tax Income Tax advance tax payment entry advance tax payment entry Eg. Advance tax installments are to be paid on the basis of estimated income for a financial year.

Research and analyze 3 Million companies. Long Term Capital Gains Charged to tax 10 10. Interest paid on borrowed capital iv.

What Is A Cost Sheet Definition Components Format Example Types Advantages The Investors Book Cash Inflow Outflow Blank P&l Statement

Type of Payment. Youll have to fill in details such as the right assessment year address phone number email address bank name captcha code and other such important details. Income tax paid ii. You didnt reimburse the seller for your share of the real estate taxes from September 1 through December 31.

In this the benefit of the expenses being paid in advance is recognized. Select the right challan to pay your income tax Advance tax Fill in the correct details in the form. These types of payments are in contrast to deferred.

Journal Entry of Income Tax Accounting. 3 50000 paid will be shown as an advance on the asset side of the balance sheet. Short Term Capital Gains Covered us 111A 15.

Cost Sheet Meaning Format Examples Problems Elements Specimen Proforma And Advantages Vertical Analysis Income Statement Formula What Is The Normal Balance Of Common Stock

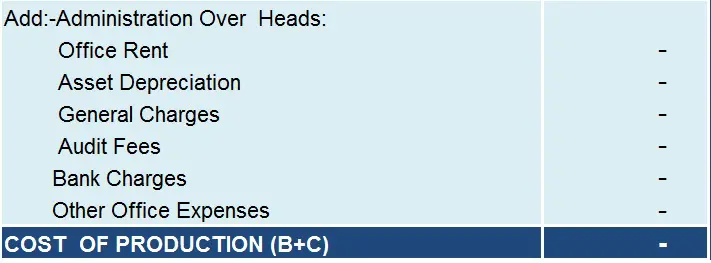

It involves estimation of total income from all sources for the year calculation of estimated Income Tax Liability and its payment instalments as per due dates provided in income Tax Act Rules. Code 100 for payment of advance tax. Information to be Included in Cost Sheet.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Partial Balance Sheet Stockholders Equity List Of Ratio Analysis