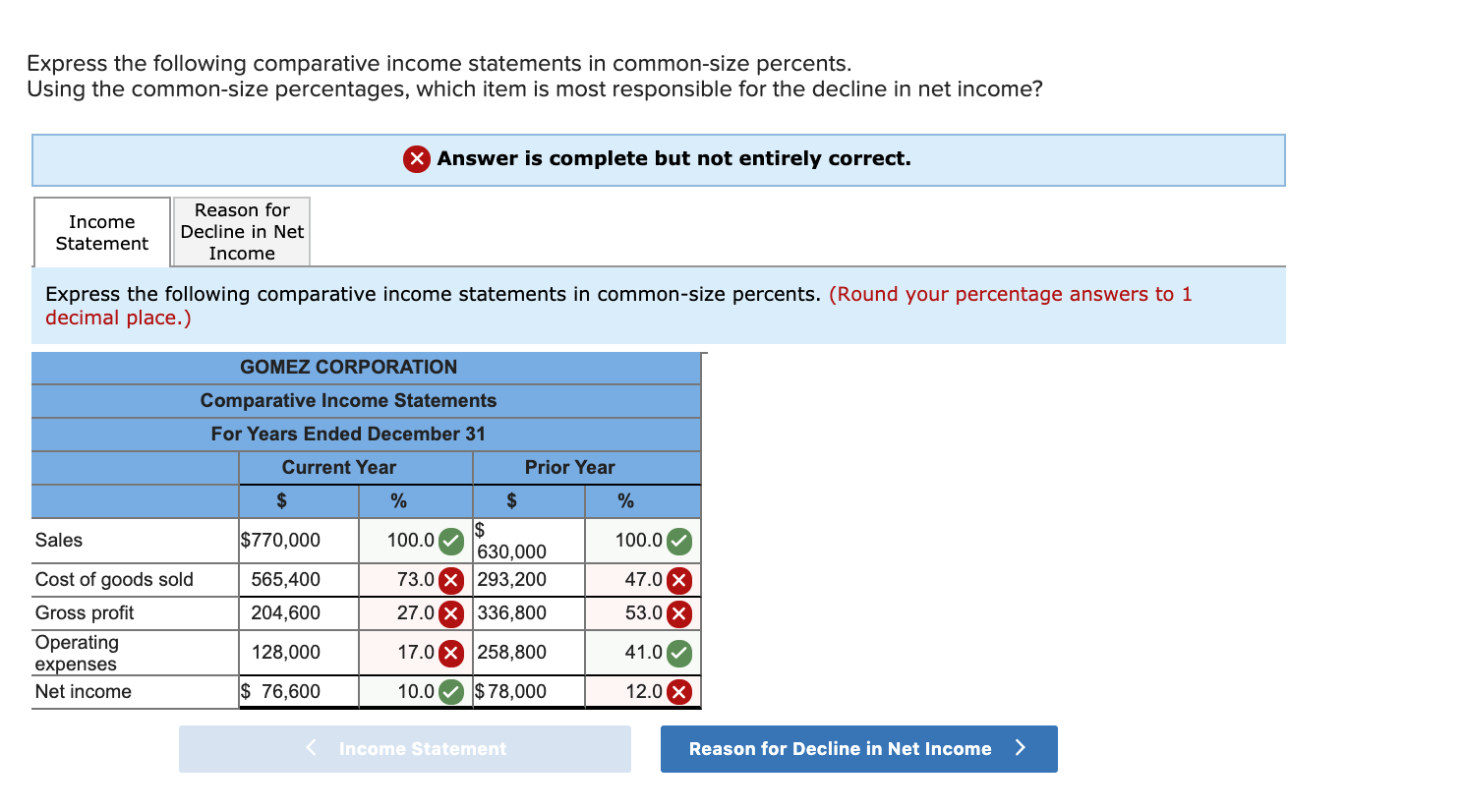

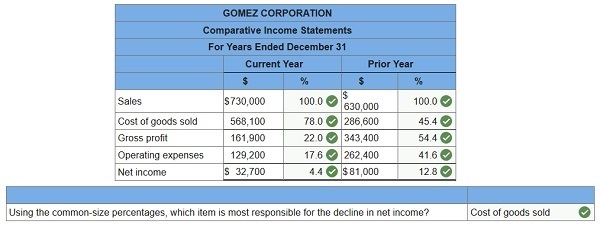

Comparative Income Statements For Years Ended December 31 Current Year Prior Year Sales 720000 630000 Cost of goods sold 565400 291000 Gross profit 154600 339000 Operating expenses 129200 268400. Express the following comparative income statements in common-size percent.

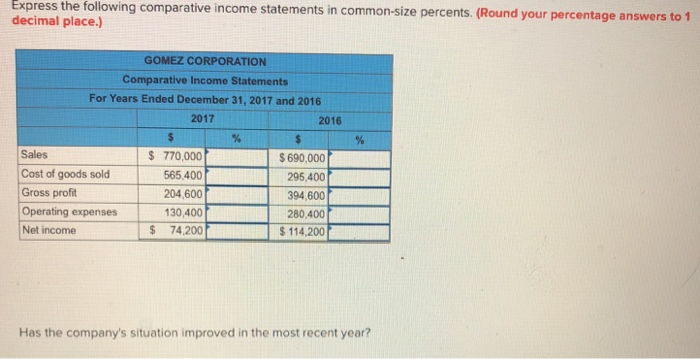

She was a university professor of finance and has written express the balance sheets in common size percents extensively in this area. 657386 488400 cost of. Such Analysis helps in comparing the performance with. Express the following comparative income statements in common- size percents and assess whether or not this companys situation has improved in the most recent year.

Express the following comparative income statements.

Solved Express The Following Comparative Income Statements Chegg Com Journal Ledger Trial Balance Standard Audit Report

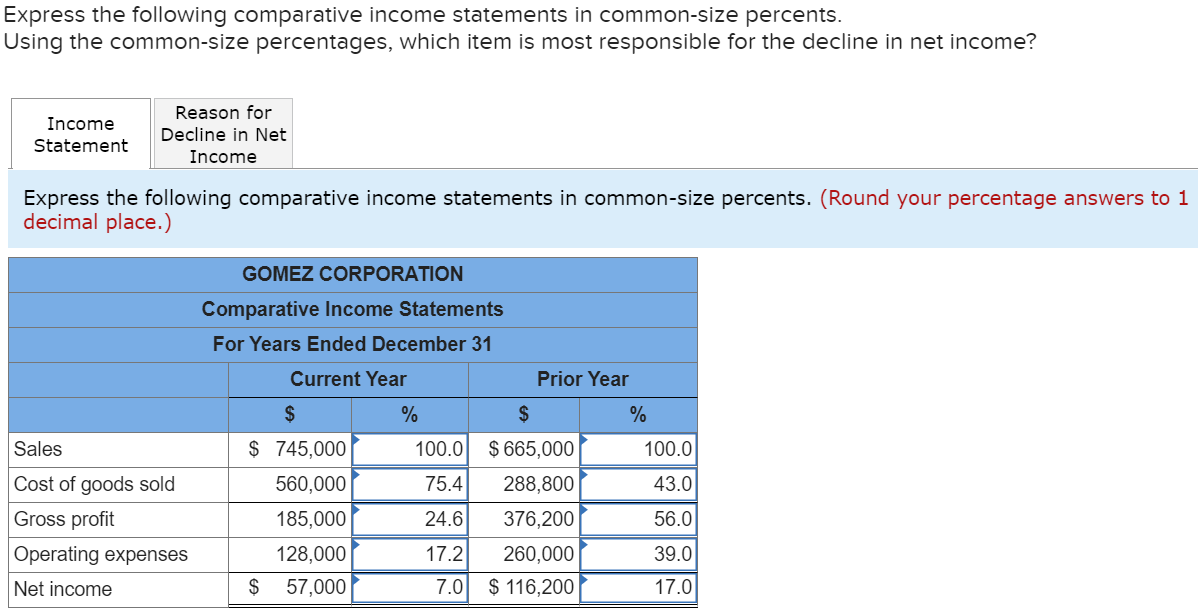

5 points mulan corporation comparative income statements for years ended december 31 2009 and 2008 2009 2008 sales. Step-by-step explanation Increase in cost of goods sold 560300 – 290800 290800 93 rounded off Decrease in net income 51500 – 115700 115700 55 rounded off. 5 points MULAN CORPORATION Comparative Income Statements For Years Ended December 31 2009 and 2008 2009 2008 Sales. Round your percentage answers to 1 decimal place GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year Prior Year Sales 740000 625000 Cost of goods sold 560300 290800 Gross profit 179700 334200.

Gomez corporation comparative income statements for years ended december 31 current year prior year 775000 630000 568100 295400 206000 334600 129200 245600 77700 89000 sales cost of goods sold gross profit operating expenses net income income statement reason for decline in net income express the following comparative. The companys income statements for the years ended December 31 2014 and 2013 follow. Round your percentage answers to 1 decimal place.

GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year Prior Year Sales 785000 640000 Cost of goods sold 568100 288800 Gross profit 216900 351200 Operating expenses 130400 221600 Net income 86500 129600 1 See answer Add answer 10 pts Advertisement cpendleton5067 is waiting. If you made 45000 in 2015 and 50000 in 2016 the dollar change is 5000. GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 2015 and 2014 2015 2014 Sales 750000 695000 Cost of goods sold 568100 288800.

Solved Express The Following Comparative Income Statements Chegg Com Realty Balance Sheet 1120s Out Of

Access to your account will be opened after verification and publication of the question. Round percents to one decimal. Then divide the dollar change by the base year profit. She has consulted with many small businesses in all areas of finance.

657386 488400. Comparative Income Statement With Vertical Analysis. Gomez corporation comparative income statements for yoars ended december 31 current year current year prior year prior year 675000 288800 386200 248000 sales 750000 24 cost of goods sold 568100 gross profit 181900 operating expenses net income 130400 24 51500 138200 ineame tatament reason for decline in net income express the.

In this case the base year profit is 45000 for 2015. Express the following comparative Income Statements in common-size percents and assess whether or not this companys situation has improved in the most recent year. GOMEZ CORPORATION Comparative Income tatements For Years Ended December 31 Current Year Current Year Prior Year Prior Year Sales 735000 645000 570800 282200 362800 269600 Cost of goods sold Gross profit 164200 Operating expenses 128000 Net income 36200 93200 Expert Solution Want to see the full answer.

Solved Express The Following Comparative Income Statements Chegg Com Ratio Analysis Of Axis Bank A Profit And Loss Statement

The result is 011 5000 45000 011. Using the common-size percentages which item is most responsible for the decline in net income. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses Net income Earnings per share 2014 652904 398271 202400 11099 8488 620258 32646 201 2013 515222 334894 130351. Comparative Income Statements For Years Ended December 31 Current Year Prior Year Sales 770000 635000 Cost of goods sold 568100 284400 Gross profit 201900 350600 Operating expenses 129200 262400 Net income 72700 88200 Using the common-size percentages which item is most responsible for the decline in net income.

Using the common-size percentages which item is most responsible for the decline in net income. GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year Prior Year Sales Cost of goods sold Gross profit Operating expenses 740000 560000 180000 130400 49600 630000 284400 345600 240800 104800 Net income Previous question. Round your percentage answers to 1 decimal place GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 2017 and 2016 2017 2016 S 740000 625000 Sales Cost of goods sold 560300 290800 179700 334200 Gross profit 218500.

Express the following comparative income statements in common-size percents. Express the following comparative income statements in common-size percents. Looking at the data we can infer that the cost of goods sold increase by almost 93 thereby resulting to a decrease in net income by approximately 55.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

Common Size Income Statement Definition Flow Of Accounts Into Financial Statements Qualified Audit Report A Company

Income Reason for S. Comparative Income Statement format combines several Income Statements as columns in a Single Statement which helps the reader in analyzing trends and measure the performance over different reporting periods. Express the following comparative income statements in common-size percents. Accounting Express the following comparative income statements in common- size percents and assess whether or not this companys situation has improved in the most recent year.

Express the following comparative income statements in common-size percents. Round your percentage answers to 1 decimal place GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year Current Year Prior Year Prior Year Sales 795000 665000 Cost of goods sold 568100 288800 Gross profit 226900 376200. Express the following comparative income statements in common-size percents.

GOMEZ CORPORATION Comparative Income Statements For Years Ended December 31 Current Year Prior Year Sales 785000 640000 Cost of goods sold 560000 288800 Gross profit 225000 351200 Operating expenses 129200 258800 Net Income. It can also be used to compare two different companies operating metrics as well. Consider the following example of comparative income statement analysis.

Solved Express The Following Comparative Income Statements Chegg Com A Financial Statement Audit Is Designed To Projection For Startup

Round your percentage answers to 1 decimal place Image transcription text Express the following comparative income statements in common-size percents. Check out a sample QA here.

Common Size Analysis Of Financial Statements Accounting For Managers Another Name Owners Equity The Profit And Loss

Solved Express The Following Comparative Income Statements In Common Size Course Hero Marketing Expenses Statement Cash Flow Sources And Uses

Solved Express The Following Comparative Income Statements In Common Size Percents Round Your Percentage Answers To 1 Decimal Place X Answer Is Course Hero Tax Form 26as View Private Equity Illustrative Financial Us Gaap

Connect Financial And Managerial Accounting Chapter 13 Foreign Currency Translation Loss Virgin Atlantic Statements

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

/citizens-bank-c00cc02a131344d2aacee1da490c5b94.png)