Common examples of liquidity analysis include. Current ratio Acid test Cash ratio Net working capital Efficiency Analysis.

They therefore usually use ending balance sheet data rather than averages. In essence an analyst converts data into financial metrics that assist in decision making. The short-term creditors are interested in the short-term liquidity of the firm whereas. Liquidity analysis measures can be categorized by current position analysis accounts receivable analysis inventory analysis and accounts payable analysis.

Financial analysis liquidity.

The Financial Ratios Are Tool Used By Creditors Investors Stakeholders And Management Of A C Ratio Statement Analysis Small Business Spreadsheet For Income Expenses Excel Define Financing Activities

Out of all ratio analysis is the most prominent. These ratios are mainly used by the investors owners of the company and management. Financial analysis refers to the activity of assessing financial statements to judge the financial performance of a company. If they did have short-term debt which would show up in current liabilities this would be added to long-term debt when computing the.

Liquidity ratios measure a companys ability to satisfy its short-term obligations. All funds in M3 individual holdings in accounts savings bonds T-bills with maturity of less than one year commercial papers and. Liquidity The firms ability to pay short-term debt and expenses aka current liabilities within the one-year operating cycle is its liquidity.

Liquidity shows companys ability to pay Short-Term Liabilities STL but also companys capability to sell Short-Term Assets STA quickly to raise cash. The results are interpreted in comparison to ideal situations and recommendations. Liquidity Analysis This is a type of financial analysis that focuses on the balance sheet particularly a companys ability to meet short-term obligations those due in less than a year.

Tutorial An Analysis Of A Company S Liquidity Position Using Financial Ratios Beginning Ratio Credit Card Management Debt Forgiveness Jp Morgan Income Statement Netsuite Cash Flow

Liquidity is the ability to convert assets into cash. Profitability is a measure of the amount by which a. A category of the money supply which includes. How successfully has the company performed relative to its own past performance and relative to its competitors.

Liquidity ratio analysis is the use of several ratios to determine the ability of an organization to pay its bills in a timely manner. FSA has three broad tools ratio analysis DuPont analysis and common-size financials. Do not confuse liquidity with cash flow.

Alternatively the ease with which assets can be converted into cash. Liquidity is a measure of how easily a business can meet its upcoming short-term debts with its current assets without disrupting the normal operation of the business. Or in everyday words does the business have enough liquid assets to cover any debts or upcoming payments within the next year.

Pin On Liquidity Ratio Analysis Airbnb Financial Performance Isae Audit

The creditworthiness of an entity depends on how the number of liquid assets it possesses. This analysis is important for lenders and creditors who want to gain some idea of the financial situation of a borrower or customer before granting them credit. By its nature liquidity addresses the short term but it is not a trivial matter. Liquidity is the ability to convert an asset into cash quickly and ideally without losing money.

Financial Statement Analysis is considered as one of the best ways to analyze the fundamental aspects of a business. It helps in assessing profitability solvency liquidity and stability. The list below describes the most commonly used liquidity ratios.

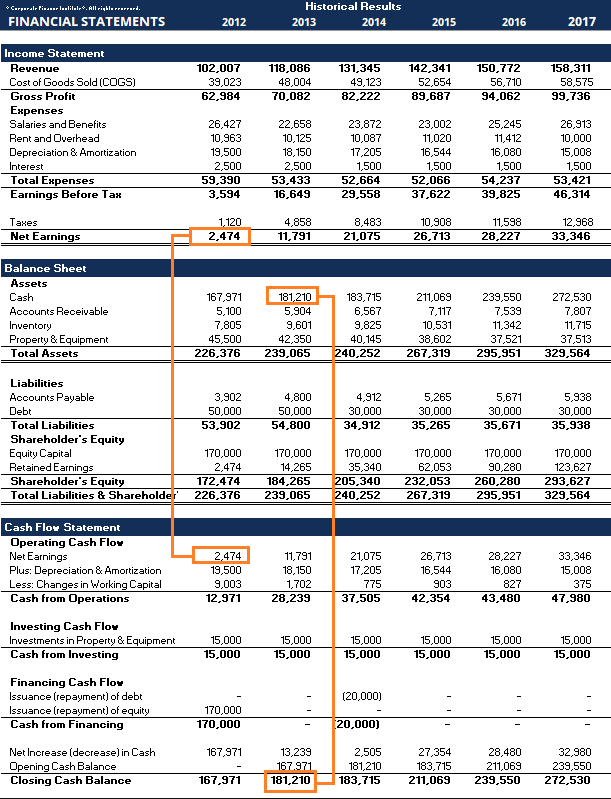

Some graphs will be used for comparability purposes. It helps us in understanding the financial performance of the company derived from its financial statements. Ratio analysis aids in identifying areas of weak or poor performance in management of the firms cash inventory and accounts receivablepayable.

Ratios Analysis Financial Ratio Accounting Classes P&l Statement Format Audit Report Of Amazon

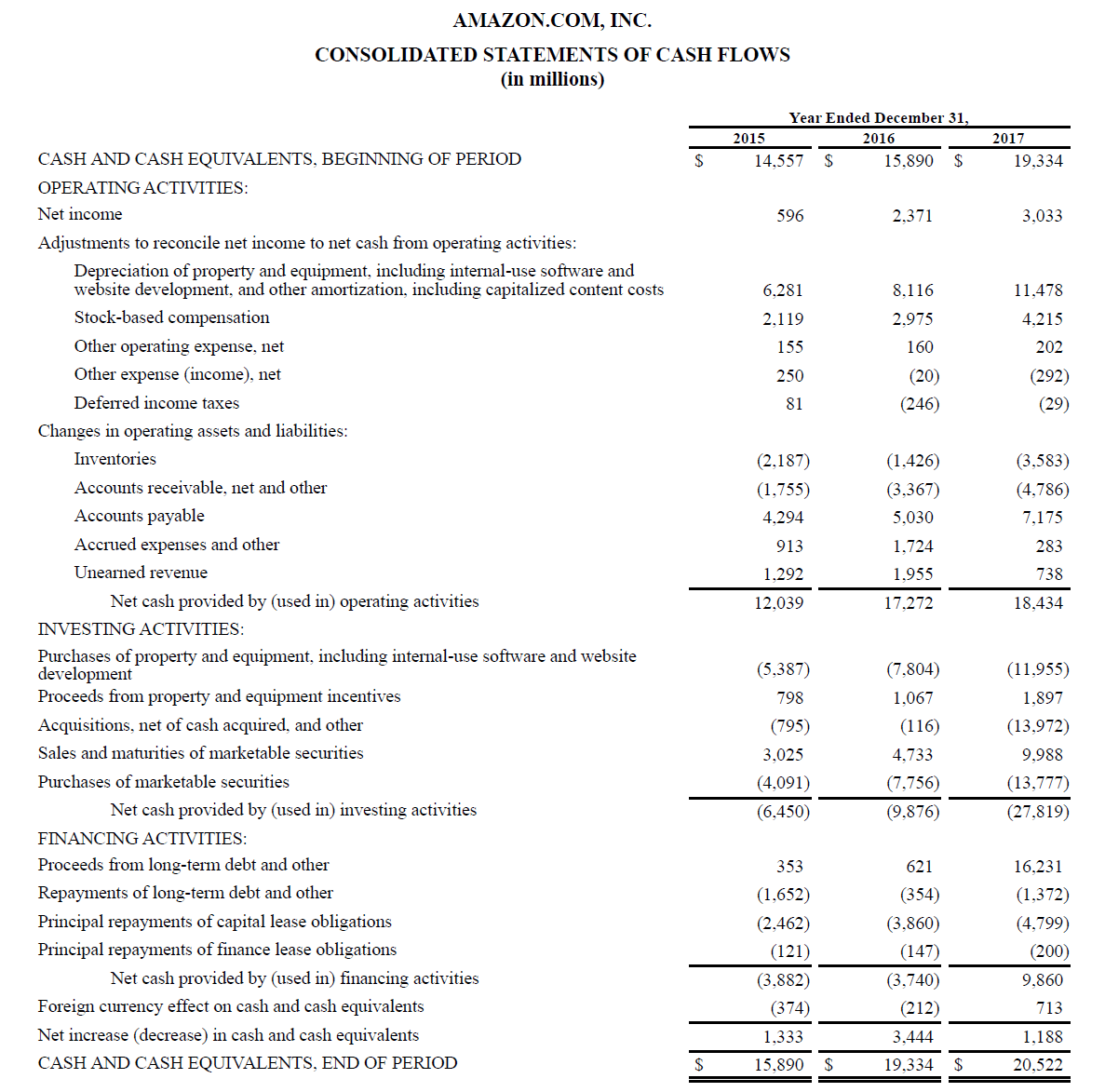

1 Financial Analysis Example Liquidity Ratio Analysis It is a measure of the timeliness with which an entity would be able to clear out its imminent liabilities. Liquidity means having enough money in the form of cash or near-cash assets to meet your financial obligations. These ratios reflect a companys position at a point in time. Short-Term Liquidity Analysis Financial Statements Accounts Receivable Turnover Net sales Average accounts receivable Indicates the number of salescollection cycles experienced by a Firm.

By some accounts it was liquidity problems that caused Lehman Brothers bankruptcy one of the biggest financial calamities in modern times. Three liquidity ratios are commonly used the current ratio quick ratio and cash ratio. This paper is an analysis of Greggs financial data of 2010 consisting two years 2009 and 2010.

A liquidity ratio is a type of financial ratio used to determine a companys ability to pay its short-term debt obligations. Solvency refers to a companys capacity to meet its Long-Term Financial Commitments STL and LTL. Solvency and liquidity are financial measurements of companys financial health.

Interpreting Accounts Liquidity Ratios Accounting Financial Analysis Marketing Objectives Of Balance Sheet Audit Bank Reconciliation Statement

This is an important metric to analyze the companys operating profitability liquidity leverage etc. The metric helps determine if a company can use its current or liquid assets to cover its current liabilities. The analysis compares the two years using profitability liquidity financial gearing and efficiency ratios. Liquidity refers to both an enterprises ability to pay short-term bills and debts and a companys capability to sell assets quickly to raise cash.

These ratios are obtained from different financial statements of the company and acts as performance measures Illinois Department of Commerce and Economic Opportunity nd. Liquidity analysis is widely used by banks and other financial institutions to assess a business entitys ability to repay debt. Financial ratio analysis is one quantitative tool that business managers use to gather valuable insights into a business firms profitability solvency efficiency liquidity coverage and market value.

Ratio analysis provides this information to business managers by analyzing the data contained in the firms balance sheet income statement. What is Liquidity Ratio Analysis. It presents three liquidity ratios shows whether the company can meet its short-term financial commitments and provides the decision to invest in the company or not.

Financial Ratios Balance Sheet Accountingcoach Ratio Accounting And Finance What Is P&l Year To Date Income Statement

Coffee Roasters 2019 3859198 448327 364810 2 949 times. Analysts seek to answer such questions as. A number of ratios are used in financial analysis to measure the profitability and the overall financial health of the company in the short as well as in the long terms.

Financial Ratios Analysis Tools Ratio Forecasting Balance Sheet Items Negative Cash On

Financial Ratio Analysis Google Search Statement Estimated And Projected Balance Sheet Format Ford 2018

4 Best Financial Ratio Analysis Technique Discussed Briefly Educba Trade Finance What Is The Formula For Net Income Statement 2018