The Balance Sheet Page of Reliance Industries Ltd. Financial ratios have been calculated using the balance sheet and profit and loss account of the two companies viz Reliance Industries Ltd.

Earnings Per Share Rs 5306. Financial ratios of reliance industries. This region was severely impacted due to a concentration of the high-tech industry heavy reliance on exports decline of home prices and reduced consumer spending. The study is to analyze thefinancial performance of Reliance Industries Limited RIL for a periodof five years.

Financial ratios of reliance industries.

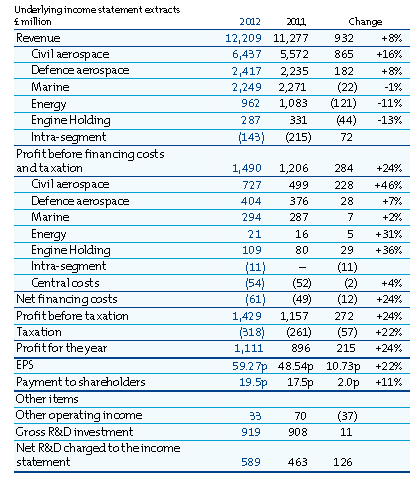

Rolls Royce Holdings Financial Ratios Analysis 1400 Words Report Example Cash Balance Statement Accounts Payable Operating Activity

Get detailed report 52 Week High Low and company news on Nirmal Bang. Reliance Industries is such a unique industry which shown its deep routed evolvement and commitment for the welfare of the country men on a big an scale it has clear cut target of improving the. 091 PEER RANGE 009 659 RETURN ON ASSETS -069 bps 478 PEER RANGE -1416 1926 Rs in Crores. MBA School of Management SASTRA University Thanjavur-613401 Tamil Nadu INDIA.

According to these financial ratios Reliance Industries Limiteds valuation is way above the market valuation of its sector. This RELI page provides a table containing critical financial ratios such as PE Ratio EPS ROI and others. Almost in all 4 years the liquid ratio is same which is better for the company to meet the urgency.

023 021 016 Figure 56 The above table and graph shows that there is a constant decrease in the Debt-equity ratio of Reliance Industries Ltd. Net Profit Margin 991. FY22 ends with bank credit growth of 86.

Investor Relations Financials Fund Flow Statement Meaning Ibm Financial Performance

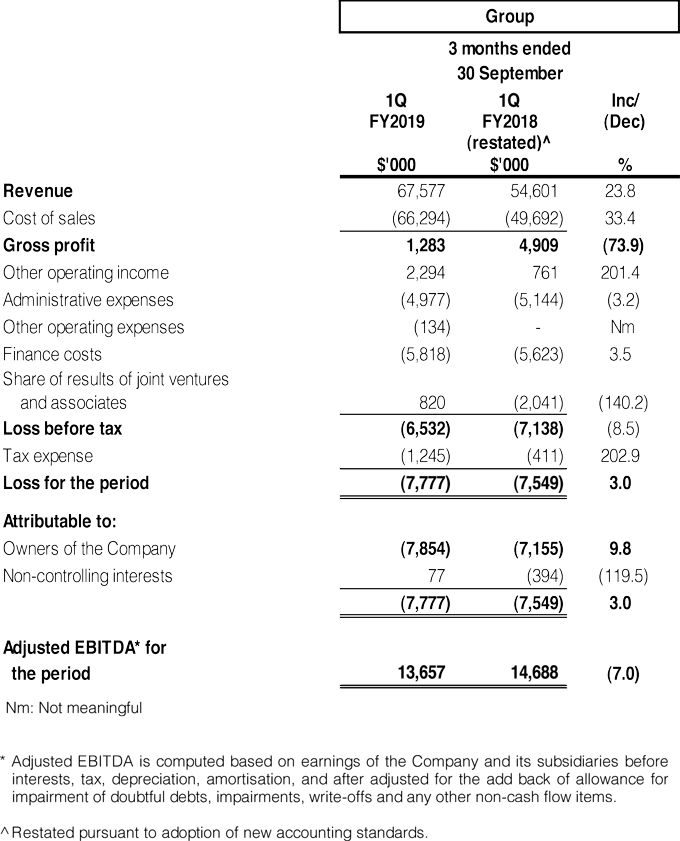

035 032 027 Sahara Petrochemicals Ltd. Operational. Ratio analysis can provide valuable information a few companys financial health. Financial ratios that ultimately predicts a score which are used to determine the financial health of a company.

The Liquidity ratios comprising. A Study on Financial Performance o f Reliance Industries Limited. 31 rows Financial Charges Coverage Ratio.

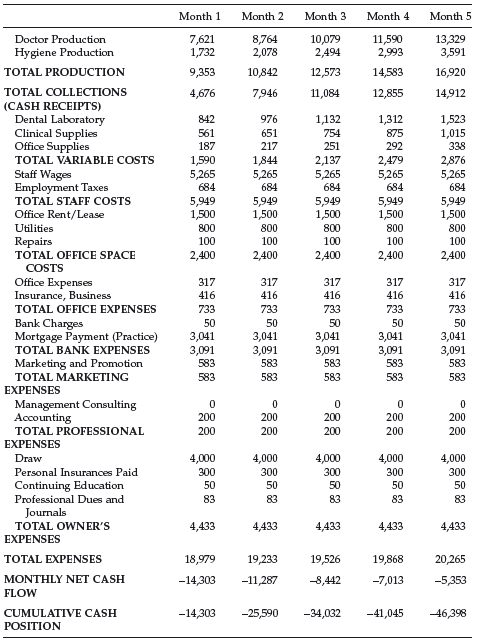

Key Financial Ratios of Reliance Industries in Rs. Current assets Current ratio Current liabilities 64 YEAR 2005-2006 2006-2007 2007-2008 2008 -2009 Current assets 2469615 3021099 4474386 5629809 Current liabilities 2154700 2585806 3222116 4567571 Current ratio 114 116 138 123 Comments. Earnings Per Share Rs 7623 6150 6617 6034 5005 4997.

Ratio Analysis Formula Calculator Example With Excel Template The Equation Which Reflects A Cvp Income Statement Is Cash Flow Required For Financial Planning Of

LIVE Reliance Industries share price details along with futures options quotes. 5th Floor Cnergy Appasaheb Marathe Marg. A financial ratio measures a companys performance during a specific area. The flagship company Reliance Industries Limited is a Fortune Global 500 company and is the largest private sector company in India.

Return on Capital Employed 560. The study period taken is five years 2011-2015. 026 035 035 China Petroleum and Chemical Corp.

Financial Charges Coverage Ratio. The liquid ratio of the Reliance Industries Ltd. Milpitas was similarly impacted because of its location and comparable economic mix.

Using Financial Ratios For Analysis Boundless Accounting What Does Equity Mean On A Balance Sheet Ytd P&l

Return on Capital Employed 560. Reliance Industries 253555 -1610 -063 General Chart News Analysis Financials Technical Forum Financial Summary Income Statement Balance Sheet Cash Flow Ratios Dividends Earnings RELI Ratios. Operating Margin 1732. The company one of the most useful tools is ratio and trend analysis.

Sale of three-year-old parking space will be treated as LTCG. Our financial discipline and prudence is also reflected in our. 39 rows Key Financial Ratios of Reliance Industries in Rs.

JM Financial Services Ltd. DEBT EQUITY RATIO -024 chg. The financial analysis is done to find the firms current position with that of market situation.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal Ruths Chris Financial Statements A Classified Balance Sheet Quizlet

The objective of the study is to determine the liquidityprofitability andturnover rate of RIL. The EVEBITDA NTM ratio of Reliance Industries Limited is significantly higher than the average of its sector Exploration Production. Groups annual revenues are in excess of US 44 billion. Cross-sectional analysis compares financial ratios of several companies from an equivalent industry.

Bandhan endeavours to be a holistic financial services group. Operational Financial Ratios. We see recovery in average rates by 2022-end.

Current Ratiox 134 063 073 059 062 069. 041 PEER RANGE 000 404 CURRENT RATIO 046 chg. The tool used to analyze thefinancial position of the company is Ratio analysis.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal Financial Statement Spreading Software Financing Activities Examples

As an example youll use a ratio of a companys debt to its equity to live a companys. Presents the key ratios its comparison with the sector peers and 5 years of Balance Sheet. Our superior credit profile is reflected in our relationships with over 100 banks and financial institutions having commitments with us. We maintain a valuable relationship and trust with all our stakeholders by ensuring a transparent financial reporting system.

Data analysis and Interpretation Calculation and Interpretation of Ratios 1 Current Ratio. The tool helps incomparing the financial status of the. Plummeting home sales and meltdown of the financial market.

Net Profit Margin 991.

Financial Statement Analysis Strategy For Public Managers Intu Statements Profit And Loss

Financial Statement Analysis Strategy For Public Managers Balance Sheet Sample Pdf Store

Financial Ratio Analysis How To Interpret Ratios Analyse A Company Getmoneyrich Provision For Bad Debts Is An Expense Cash And Equivalents Ifrs