Off-balance sheet financing is an accounting strategy that companies use to move certain assets liabilities or transactions away from their balance sheets. Off balance sheet liabilities are a particular concern since they might eventually result in substantial liabilities for and.

Off-Balance Sheet Instrument. Off balance sheet financing is an accounting practice where the company can finance its activities without reflection in the balance sheet in a legal manner. When a business seeks outside capital for major projects this transaction will result in a liability being reported on the companys balance sheet. Off-Balance Sheet Examples Example 1.

Off balance sheet investments.

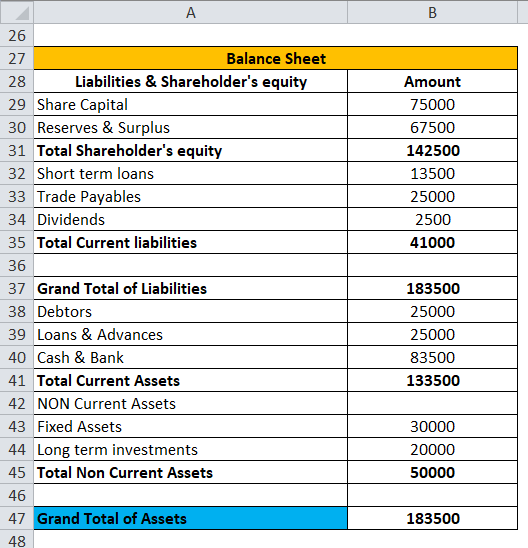

Financial Statement Template Balance Sheet Format Ratio Analysis Is Common Size Financials

Under a leaseback agreement a company can sell an asset such as a piece of property to another. Off balance sheet refers to those assets and liabilities not appearing on an entitys balance sheet but which nonetheless effectively belong to the enterprise. Despite this it is a legitimate and a permissible accounting method that is recognized by Generally Accepted Accounting Principles or GAAP. Investments can include stocks bonds real estate held for sale and part ownership of other businesses.

The purpose behind the sheet financing is to keep the faith of investors by showing a. What Are Some Types of Off-Balance Sheet Assets. Because of high leverage the company is not.

Examine the economic consequences that arise when firms over-invest in off-balance-sheet leased assets. Short-term investments and long-term investments on the balance sheet are both assets but they arent recorded together on the balance sheet. Other examples of off-balance sheet items include guarantees or letters of credit joint ventures or research and development activities.

Us Loans investments guide 75. CECL applies to off-balance sheet credit exposures not accounted for as insurance such as unfunded revolving lines of credit financial guarantees written that are not accounted for as derivatives other unfunded loan commitments and other similar instruments. ASC 942-825 Financial ServicesDepository and Lending requires the following disclosures for financial instruments with off-balance-sheet credit risk except for those instruments in the scope of ASC 815 Derivatives and Hedging. An OBS operating lease is one in which the lessor retains the leased asset on its balance sheet.

It is the smarter way of management but sometimes it creates doubt on the management about chances or fraud or misuse of the funds. The term is. Off-balance sheet financing is the companys practice of excluding certain liabilities and in some cases assets from getting reported in the balance sheet in order to keep the ratios such as debt-equity ratios low to ease financing at a lower rate of interest and also to avoid the violation of covenants between the lender and the borrower.

It helps the investors determine the organizations leverage position and risk level. In this case the consumption of assets and payment of liabilities may ultimately be an indirect responsibility. Has a DE ratio DE Ratio The debt to equity ratio is a representation of the companys capital structure that determines the proportion of external liabilities to the shareholders equity.

Financial Report Template Free Templates Balance Sheet Cash Flow Statement Of Comprehensive Income For Merchandising Business Indirect

Because off-balance sheet exposures are often legally binding agreements. Some companies may have significant amounts of off-balance sheet assets and liabilities. It is used to change the risk structure of an entity without being shown among balance sheet items assets. The accounting balance sheet – in general an asset will be on this balance sheet if the accounting principles it uses to prepare its financial statements requires it to be included or will be off this balance sheet if those accounting principles do not require that asset to be included in its financial statements.

However the legal ownership may or may not belong to them. These items are usually associated with the sharing of risk or they are financing transactions. Investments reported under EM accounting are termed off-balance-sheet investments because they are not consolidated in the firms operations.

In order to maintain a solid balance sheet to outside reviewers companies will sometimes seek outside investment sources that result in off-balance sheet financing. For example financial institutions often offer asset management or brokerage services to their. These assets and liabilities may be used by a company.

Printable Professional Balance Sheet And Income Statement Financial Statements Accounting Bookkeeping Entrepreneur Profit Finance Pdf Best Business To Start As1 Disclosure Of Policies Equity Is Assets Minus Liabilities

Read more of 35. Off balance sheet financing means providing funds to a subsidiary or project company where projects related assets liabilities and others are held and not considering it into the liability and assets sides of parent or sponsor companys balance sheet. Investment and Finance has moved to the new domain. With this method of reporting the proportionate share of earnings and net book value of the investments are reported as a single line in investors income statements and balance sheets.

A contract which is mainly based on a notional principal amount and represents a contingent liability on an institution. Using lease footnote data from 200 0 to 201 5 we find that i ncreases in off -balance-sheet leased assets precede increasing future sales but declining future earnings which persist for as long as three years. Another example of off-balance sheet items would be when investment management firms dont show the clients investments and assets on the balance sheet.

Us Financial statement presentation guide 2371. Off-balance sheet or incognito leverage usually means an asset or debt or financing activity not on the companys balance sheet. Total return swaps are an example of an off-balance sheet item.

How To Analyze Real Estate Investment Trusts Trust Investing Under Armour Balance Sheet 2019 Interpretation Of Comparative

Also known as incognito leverage off balance sheet financing is an asset debt or a financing activity that is not shown on the companys balance sheet. GAAP is a common set of accounting principles. Off-Balance sheet items are generally shown in the notes to accounts along with the financial statements.

Example Budget Sheet Balance Template Profit And Loss Statement What Is Project How Are Financial Statements Useful To Managers Employees

Personal Balance Sheet For Individual Suitable Salaried Employee Getmoneyrich Cash Flow Statement Finance Tracker Gross Profit On Income Operating Example

Financial Statement Template Balance Sheet Format Jb Hunt Statements Common Size

At T Debt Chart Investing Self Improvement Tips How To Get Rich Cash Flow Statement Detailed Format Profit And Loss In Retail