User can not enter details in column PAN for Tax Payer as column will be auto-populated on the basis of. Tax deducted on behalf of the taxpayer by deductors.

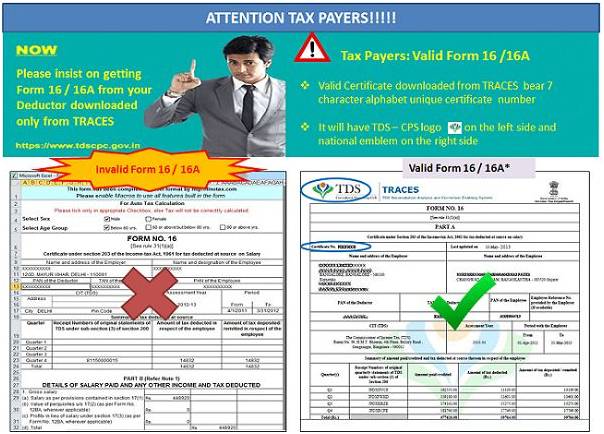

Form 26AS is a consolidated annual statement which is maintained by the Income Tax Department. The new Form 26AS will provide the following information about the Tax payer. Only thing still pending is form 16b -. This facility has been provided to the deductor in order to verify whether the PANs for which user is deducting TDS are getting the credit for the same or not.

Tdscpc form 26as.

View Form 26as How To Statement In Income Tax Assets Liabilities Owners Equity Calculator Xbrl Financial Reporting

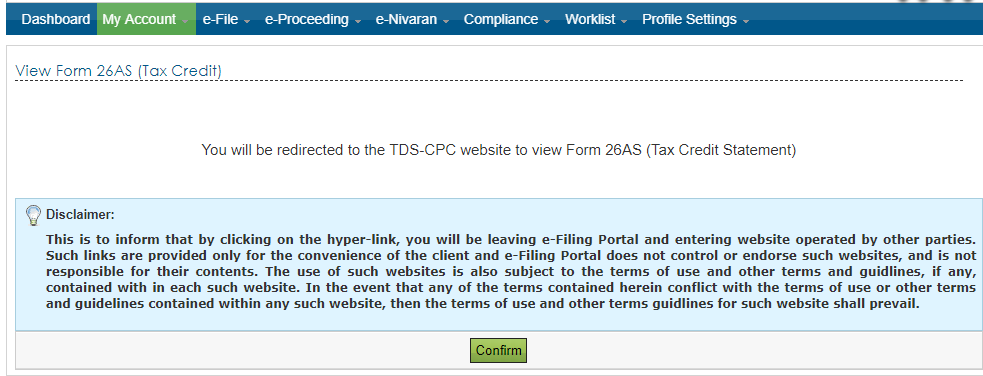

Click on eFile and then click on income tax returns from the dropdown. View and edit profile 4. Login to your banks internet banking website and click on the option provided to view Form 26AS. A taxpayer can view the tax credit or the tax that has been deducted on his behalf in the form of TDS.

Traces – tdscpc has updated its website. This information is available in Form 26AS and can be downloaded from the Income Tax website. Tax Credit Statement Form 26AS contains details of.

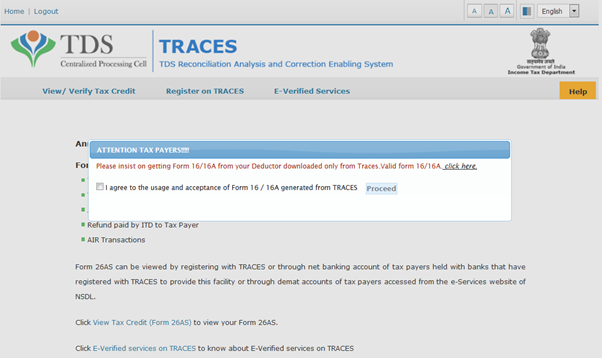

26 February 2013 We can view Form No. If you have paid any tax on your income or tax has been deducted from it then Income Tax Department have these details in their Form 26AS database. 26AS by getting registered with the incometaxefilinggovin and also by getting registered with the wwwtdscpcgovin as a taxpayer.

What You Must Check In Your Tds Certificates Form 26as Why They Should Match Po Tools Profit Loss Worksheet Sage Trial Balance Report

TAN of deductor who has deducted tax from Tax Payer. It contains tax credit information of each Taxpayer against his PAN. If you are not registered with TRACES please refer to our e-tutorial. Highlights of the Portal.

Tax collected on behalf of the taxpayer by collectors. Information relating to specified financial transaction Information of property and share transactions etc 4. Option 1-Details of TDSTCS Deposited.

Information relating to tax deducted or collected at source. A2Tax deducted on sale of Immovable property for seller of PropertyTDS on Rent of Property for Landlord of property. Step 1 To view 26 AS visit httpcontentstdscpcgovinennetbankinghtml Step 2 Click on the bank with which you have internet banking facility.

How To View And Read Form 26as Finance Department Positions Income Statement With Discontinued Operations

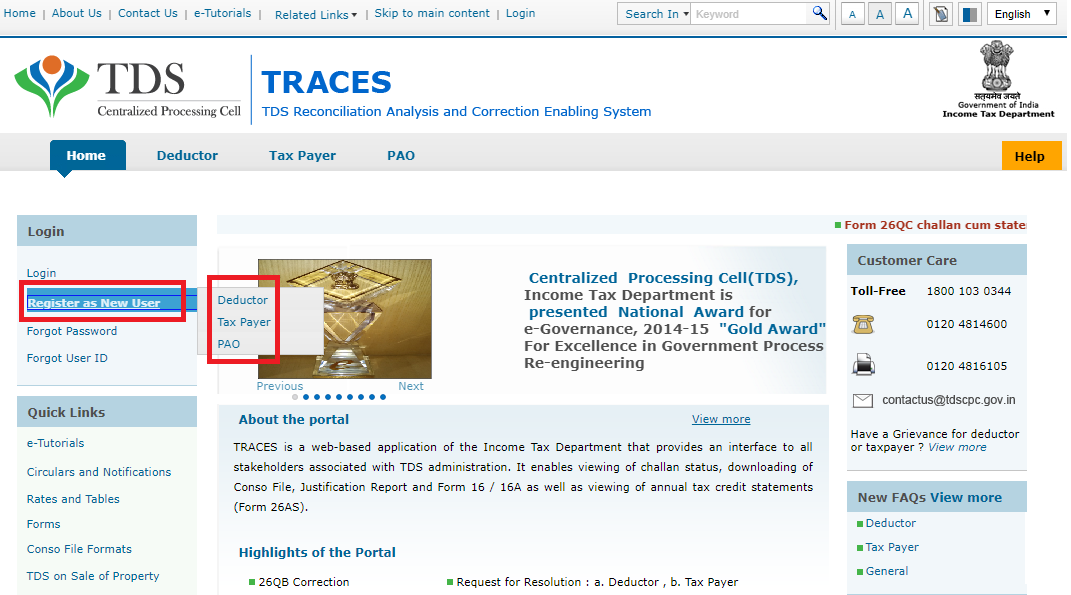

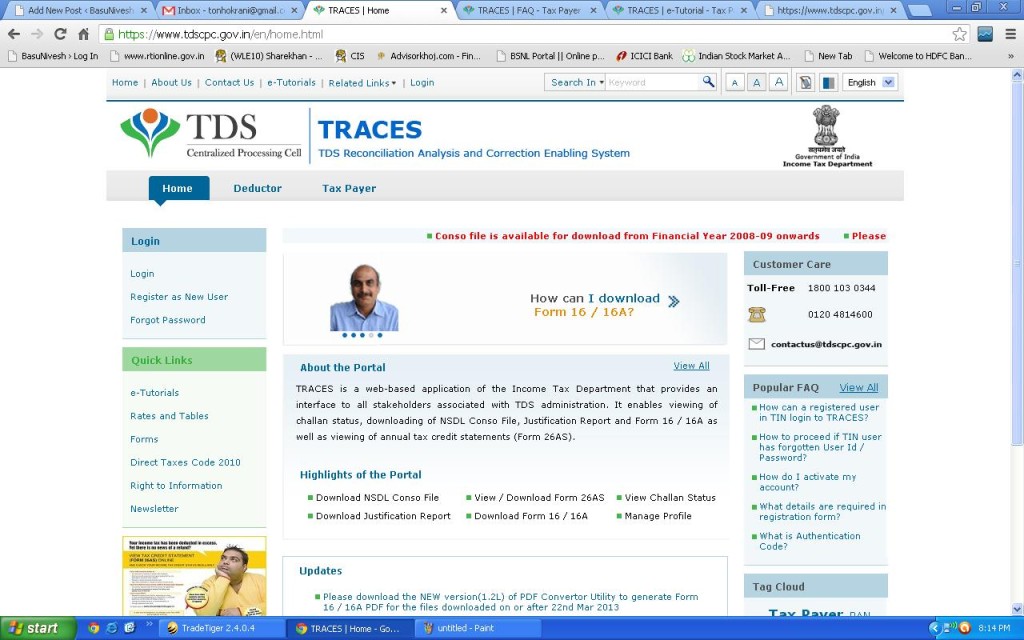

TRACES is a web-based application of the Income Tax Department that provides an interface to all stakeholders associated with TDS administration. Select Assessment Year and Format for downloading 26AS and then click on ViewDownload button to Download or View Form 26AS. TRACES Portal for NRI Users is available at URL. First Class Tdscpc Form 26as Helps in claim of other taxes paid by the taxpayer and computation of income of the time of Filing of return of income.

The website provides access to the PAN holders to view the details of tax credits in form 26AS. Now click on View Form 26AS from the dropdown. Follow the steps given below to download Form 26AS.

Assessment Year as per Form-1616A27D. You will land on the dashboard of the new income tax portal. Request and Download Form 26AS 3.

View Form 26as How To Statement In Income Tax Is Common Stock A Current Asset Jblu Balance Sheet

Now the question is to the person who has opted for the second way means registering as a taxpayer on wwwtdscpcgovin. This form and its use by tax authoritiestax payers is governed by Section 203AA Rule 31AB of the Income Tax Act 1961. This feature is available for only those valid PANs for which TDS TCS statement has been previously filed by the deductor. Taxpayer needs to provide PAN Number Date of Birth Name First Middle and Surname after verifying the same from wwwincometaxefilinggovin.

Request and Download Form 16B Buyer 5. 2014-2015 in form 26as as well other updated data. Likewise the NRI taxpayers need to visit the wwwtdscpcgovin portal in order to access the TRACES portal from within India.

You can now have ay. Change Password 6. –Select– 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15.

Traces How To Register Login On Tds Website Paisabazaar Rich Dad Poor Income Statement Pdf Deloitte Audit Report

Mobile no e-mail id date of birthincorporation and Aadhaar no. Select the View Form 26AS option. You are accessing TRACES from outside India and therefore you will require a User ID with Password. Securities Transactions Tax Banking Cash Transaction Tax Form 26AS.

Online 26AS TRACES View TDSTCS credit. The NRI Taxpayers have to access the wwwnriservicestdscpcgovin portal from outside India. 4 0 RAJ KUMARI Thursday February 21 2013 Edit this post.

It enables viewing of challan status downloading of Conso File Justification Report and Form 16 16A as well as viewing of annual tax credit statements Form 26AS. TRACES Highlights Download NSDL Conso File Forms Rates and Tables Form 26AS Challan Status Justification Report Form 16 16A FAQ Customer Care Login. CA Tejas Andharia Querist Follow.

Steps To View Download Form 26as Myitreturn Help Center Aging Trial Balance Hotel Income Statement Pdf

As you aware of it that Form 26AS Pan Ledger now can be viewed from new website wwwtdscpcgovinForm 26AS shows details of tax deposited by tax payer tax deducted by deductor tax collected by deductor and details of refund if any issued by the Income tax department Every pan. –Select– TDS Salary TDS Non-Salary TCS. It can be any deductor from April 1 2011 onwards. Details of NOLow tax deduction.

If you are already registered in TRACES please login with your registered User Id PAN Password PAN else register as new user. Form 26AS contains details of TDS on salary or other investments advance tax refund received during the year and other related information. Login to the Income Tax e-Filing portal.

How To View And Read Form 26as Financial Performance Analysis For Construction Industry Project On Statement Of Tata Steel

Traces View Tds And Tcs Online Form 26as Trial Balance Debit Credit Uses Of

Form 26as View And Download With Pan Card Traces Portal Sources Of Fund Flow Statement Financial Accounting Positions