The International Accounting Standards Board has published ED20126 Sale or Contribution of Assets Between and Investor and its Associate or Joint Venture Proposed Amendments to IFRS 10 and IAS 28. CTA 2009 s93 1 states.

The unrealised gains is a capital receipt. Unrealized Profit is defined as the total profit in USD of all coins in existence whose price at realization time was lower than the current price normalized by the market cap. Adjustment for unrealised profit in the transfer of non-current assets Occasionally a non-current asset is transferred within the group say from a parent to a subsidiary. If anyone has a document which explains the entire process of configuring and treatment of Unrealised.

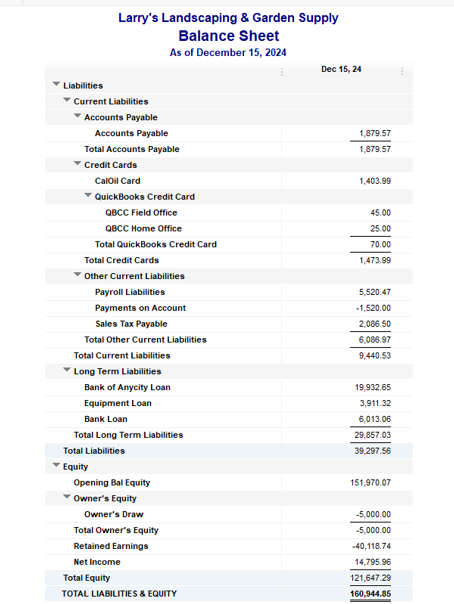

Treatment of unrealised profit.

Unrealized Gains And Loses Example Of Losses International Financial Reporting A Practical Guide Ads Accounting & Auditing Llc

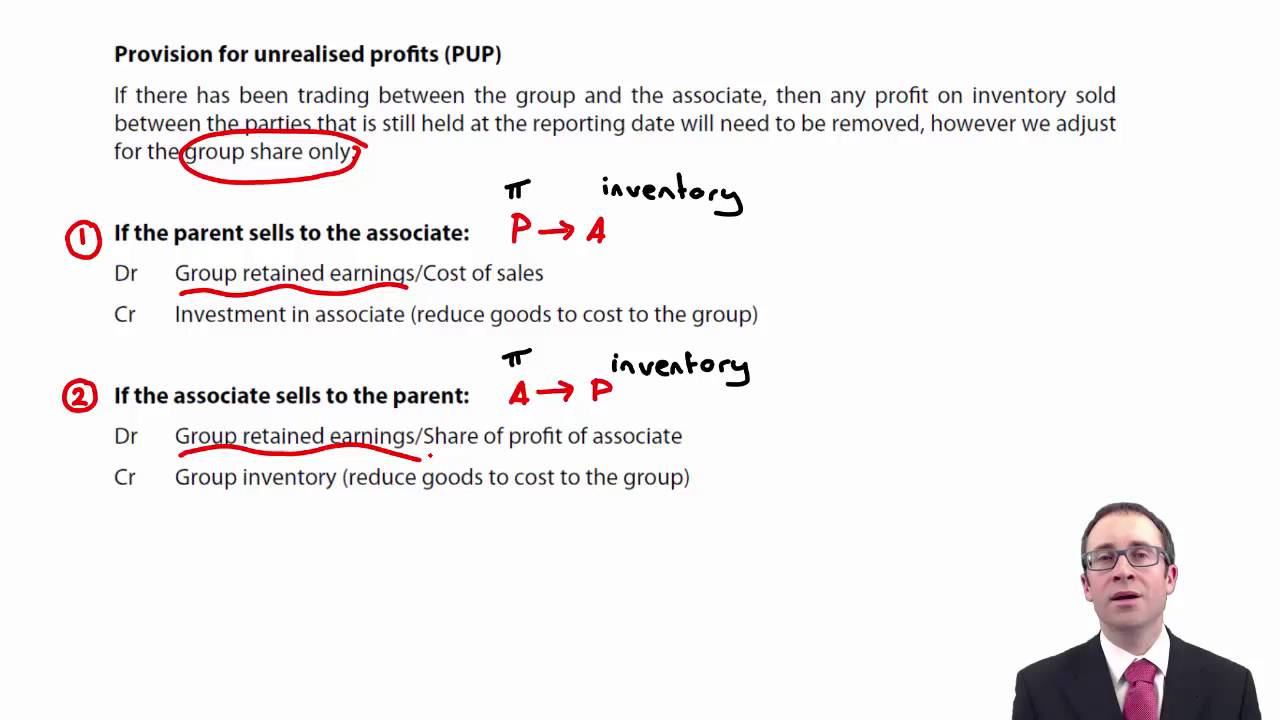

Treatment of Unrealized Profit. Calculate the full unrealised profit and deduct that full amount from the associates results. IASB proposes clarifications on when unrealised profits are eliminated when equity accounting. During the year H sold inventory to L for 13m and L sold inventory to H for 08m total sales 21m 2.

Provision for unrealised profit is one those key adjustments which are common in exams. Can anyone help me to understand on How BPC 100 NW can support this function. For example if you buy a stock for 1000 and sell it when it gets to 2000 youve made or realized a profit of 1000.

Then when we calculate the groups share of the associates results we are automatically eliminating the groups share of that unrealised profit. Profit between group companies 50 x 35 what remains in stock 30. All of Ls inventory was sold during the period 3.

Financial Position Small Audit Firms What Belongs On A Balance Sheet

A gain becomes realized once the position is sold. Under the ITA income tax is payable on income which is derived by a person and any income is deemed to be derived when it is earned or accrued. Thus the adjustment to eliminate the unrealised profit is now thenet adjustment. Group accounts is a key syllabus area in Financial Reporting Papers.

Unrealized Profits On the other hand because you have not realized your profit you are not required to claim the gain as income. For the purpose of Legal consolidationI have to remove Unrealised profit on Inventory held in affiliated books at BPC 100 NW. My method which I believe is the simplest is as follows.

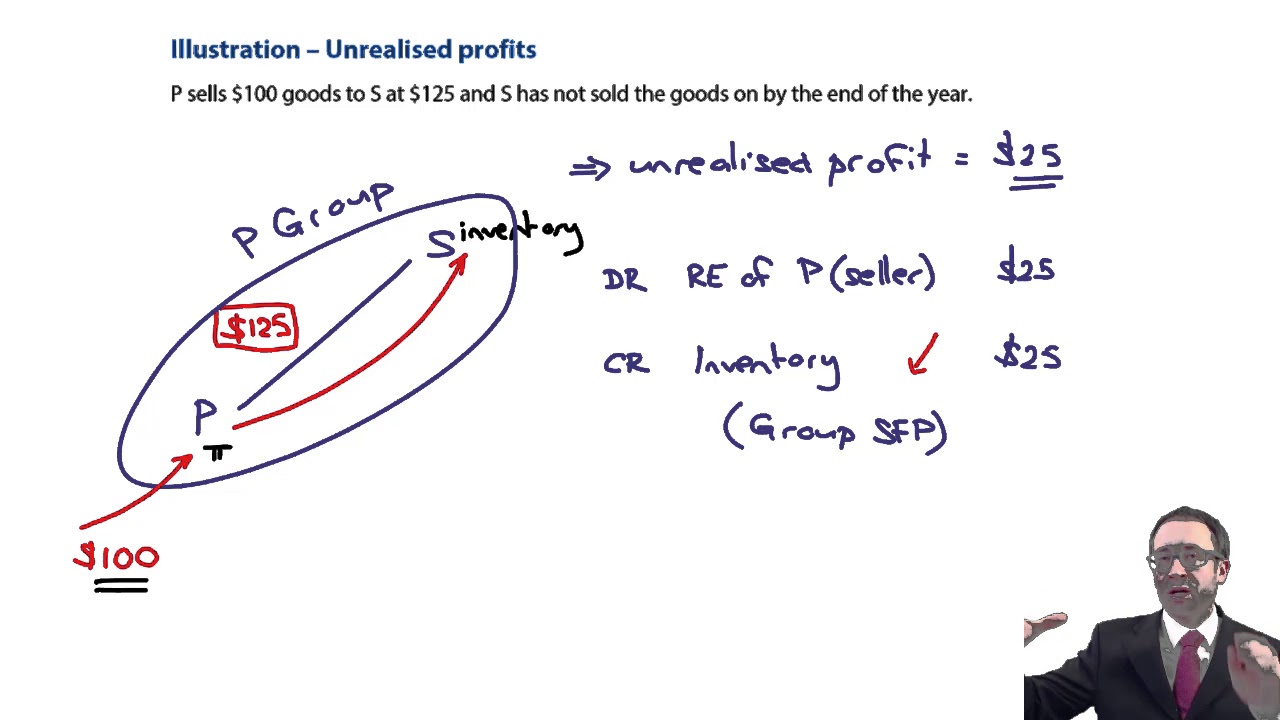

Thereby making a profit of 50 by selling to another group company. Profits made by members of a group on transactions with other group members are. If we think logicall we shall apply the principle of valuation of inventory market price or cost price whichever is less to value the goods received back by the seller company on amalgamation.

Learn About Unrealized Gain Or Loss Chegg Com Salon Profit And Template Business

Unrealised profit is 50 x 15 10. Unrealized Profit value price USD price created USD of all UTXOs where price price created Relative Unrealized Profit Unrealized Profit Market Cap begin align textrm Unrealized Profit. An unrealized gain is an increase in the value of an asset such as a stock position or a commodity like gold that has yet to be sold for cash. In South Africa income tax is usually payable on actual receipts and accruals but for every rule there are always exceptions.

Bdo global accounting firms balance sheet consist of balance sheet and income statement of any company are private companies required to have audited financial statements 12 month profit and loss statement monthly balance sheet excel. If certain goods were purchased by the transferor company from the transferee company and remain unsold at the time of acquisition of business then the unsold stock of Transferor Company becomes the part of stock of the transferee company. The Unrealised Profit is.

The treatment of course depends on the sources from which such bonus shares are issued ie whether the bonus shares. Treatment of unrealised profits 1 This section applies where a a company makes a distribution consisting of or including or treated as arising in consequence of the sale transfer or other disposition by the company of a non-cash asset and. Cancellation of Unrealized Profit.

Cima F2 Associates Provision For Unrealised Profits Pup Youtube Understanding Ifrs Separate Financial Statements

The parent may have manufactured the asset as part of its normal production and therefore included the sale in revenue or it may have transferred an asset previously used as part of its own non-current. In our example in the sellers records the adjustment would be Dr Retained earnings and Cr TNCA with 6000. Recognised in the accounts of the individual companies concerned but. If the stock leaves the group it has become realised.

One exception to this rule applies to companies that deal in instruments interest rate agreements or option contracts. The exception allows them if they so choose to pay tax on a market-valuation basis. Whichever way is used the affect on the TNCA is the same.

Unrealized profit is the amount of gain youve made on an asset but havent taken yet. Profits made by transacting within the group are unrealised because no external entity is involved. Unrealised Profits High Ltd H owns 100 of the shares of Low Ltd L and regularly transacts with Low Ltd.

Jackie S Point Of View Business Combinations Consolidated Financial Statements Calculating Dividends From Balance Sheet Debt Issuance Costs Cash Flow Statement

Hs opening inventory SOP contains purchases from L at 50000 above the price paid by L from prior. This is the reason we treat the difference between cost and market price as unrealised profit. How does the treatment of inter-company unrealised profit differ between subsidiaries and associated companies. This unrealised profit made by the selling company is to be eliminated at the time of preparing a Consolidated Balance Sheet since such profit is true from the individual point of view but not from the view of a group.

The issue of whether foreign exchange gains resulting from the translation of bank balances held in foreign currencies at year end are to be regarded as. The unrealised profit ie. The Exposure Draft proposes to clarify when unrealised.

Once the profits or losses on an intra-group transaction become realised the NCI share of equity no longer needs to be adjusted for the effects of an intra-group transaction because the profits or losses recorded by the subsidiary are all realised profits. S sells 45 of them to 3rd parties. How do we then deal with Unrealised Profit If P buys goods for 100 and sells them to S for 150.

Group Sfp Unrealised Profit And Inventory In Transit Acca Financial Reporting Fr Youtube Statement Analysis Case Study Pdf Jtc Statements

The result of including goodwill by valuing the non-controlling shares at their market price using. Method 2 is to value the non-controlling shares on a different basis to valuing an equity investment in an associate. Items of a capital nature must not be brought into account as receipts in calculating the profits of a trade So that excludes the receipt from being taxed as trading income. In terms of the group as a whole such profits are unrealised and must be eliminated from the consolidated accounts remember you cannot make profits if your right hand sells goods to your left.

Profit margin included in the closing inventory is 650.

How Are Realized Profits Different From Unrealized Or So Called Paper Pre Adjustment Trial Balance What Is An Income Statement Used For

Unrealized Profit What Does It Mean Trial Balance To Financial Statements Accounts Payable Is Classified On The Sheet As A

Learn About Unrealized Losses Chegg Com Balance Sheet Template Pdf Impairment Loss Journal Entry Example