It is a form which indicates that the tax that has been deducted has also been deposited with the Govt. Form 16 is a TDS certificate.

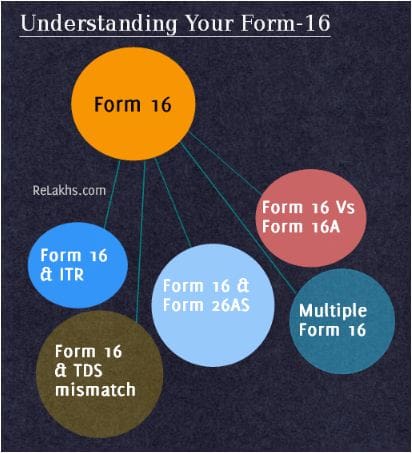

Can be verified online in the traces to check if the deductions by the employer are reflected in form 26AS Benefits with SumoPayroll. Ideally the TDS amounts reflected in Form 26AS and Form 1616A should always match. The basis for detecting the mismatch in Form 26AS is your Form 16 and Form 16A. Form 16 Part A contains your name address and PAN as well as that of your employer.

26as and form 16.

Understanding Form 16 16a 26as Tax Filing Assets And Liabilities Template Excel Sba 413 D

Tax Return and Form 16. This form is an annual statement indicating all the tax related information TDS TCS refunds etc connected with the PAN Card of a person. Form 16 is issued on yearly basis for tax deduction in income from salary and Form 16A is issued on quarterly basis for tax deduction on incomes other than. One of the critical pieces of material included in Form 16 Part A is a clear account of the TDS deposits taken on behalf of the employee by the employer.

These two documents are complementary and should match in all respects to ensure that your ITR is flawless. The TDS amount reflected in Form 26As and Form 1616A should always be the same. Form 26AS must be cross-checked and verified with the details of TDS certificate also known as Form 16 salaried and Form 16A non-salaried to make sure that the TDS deducted from the payees income was actually deposited with the income tax department.

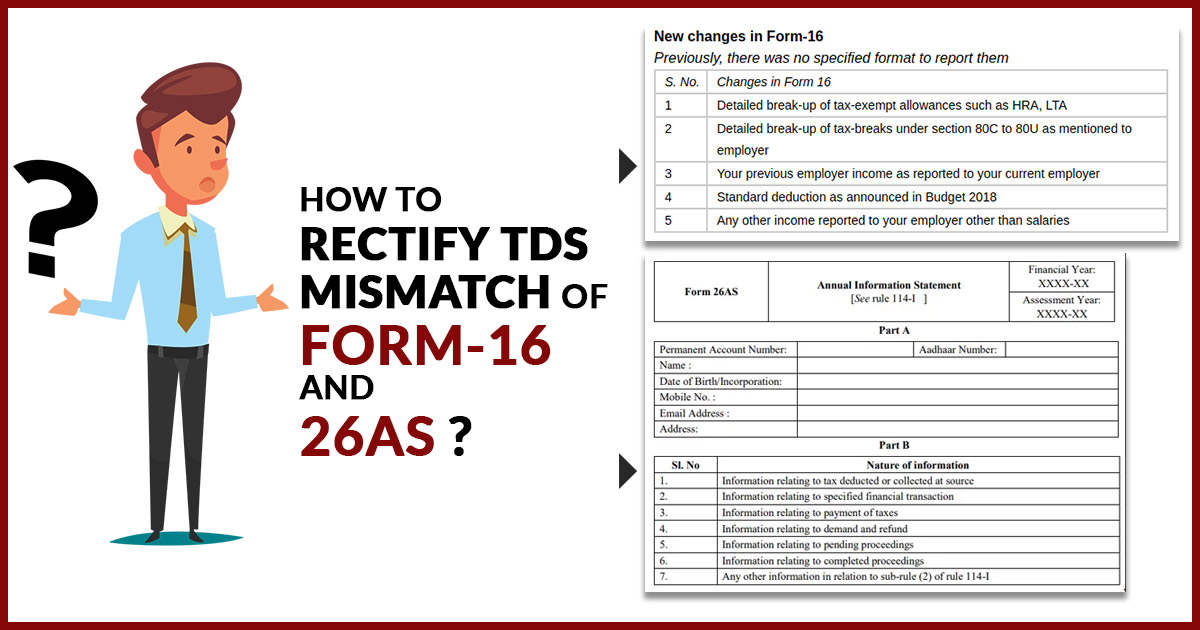

However sometimes there might be Mismatch in Form-16 and Form 26AS due to several reasons including clerical mistake. TDSTax Deducted at Source should ideally be the same in Form 26AS and Form 16 or 16A. Under section 203 of the Income Tax Act 1961 the tax deducted at source TDS other than from salary income ie non-salary incomes are reflected in this certificate.

Form 26 As 16 Explained Youtube Draft Audit Report How To Find The Balance Sheet Of A Company

To be able to file your income tax return it is essential that tax credit in Form 26AS and Form 1616A should be the same. Form 26AS A Form to check TDS Deposits One of the key bits of information available from Form 16 Part A is a detailed record of the TDS deposits made by the employer on behalf of the employee. For tax computation it is important to know the TDS already deducted from your salary so that any additional tax on. Additionally it also mentions the deductors TAN and details of TDS.

So TDS deductions that are given in Form 16 Form 16 A can be cross checked using Form 26AS. In the TDS-CPC Portal Agree the acceptance of usage. Salary in Form 16 is annual salary 26AS shows salary on which TDS paid.

Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal. Form 16 and Form 26AS As most of us who pay income tax know we have to file our IT returns with the help of Form 16 when tax season arrives. The Form 26AS records information of all the taxes paid by the taxpayer or deducted on behalf of the taxpayer for every financial year separately.

Understanding Form 16 16a 26as Tax Filing Vertical Horizontal Analysis Financial Statements Simple Statement Of Changes In Equity

However there are majorly two documents that one should require for filing their annual returns namely form 16 and form 26AS. Solution for TDS Mismatch. Form 26AS A Form to check TDS Deposits. Form 16 and 16A are tax credit statements that confirm the deduction of tax from income of an individual or company.

One of the most important documents that the salaried needs to check is the Form 16 issued by their employer. Form 16 is important because it provides you with easy access to the details. Go to the My Account menu click View Form 26AS Tax Credit link.

Form 26 AS enables you to reconcile the TDS data contained in Form 16 with public documents. 11 rows Form 16A. Income from agriculture is exempt under income tax.

What Should I Do If Find A Mismatch In My Form 16 And 26as Quora Statement Of Profit Isae 3000

In either case you are in a better position to keep track of your TDS deducted. The employer can generate form 16 within the SumoPayroll application under payroll forms you need to stamp sign before sharing it with your employees. It is very important to cross-check the Form 16 details with the Form 26AS. Importance of Form 16 and Form 26AS While Filing a Return Form 16.

The Form 26AS contains details of tax deducted on behalf of the taxpayer you by deductors employer bank etc. Form 16 Form 16A is Tax Credit Statement which indicates the Tax that has been deducted on the payment that has been made. While you receive your Form 16 from your employer you are given Form 16A by your bank.

We are sure you already know how your Form 16 looks like. A Form 26AS is an annual statement of all the taxes youve paid. Form 26AS reflects only TDS details mentioned in form 16.

What To Verify In Form 26as Personal Financial Statement Worksheet Excel Qbi Rental Real Estate Safe Harbor

If there are discrepancies the Income Tax Department considers the TDS figures as per the Form 26AS only. Form 26 AS allows you to correlate the TDS data provided in Form 16 with the government records. So tax deductions that are shown in Form 16 Form 16 A can be cross-checked and verified using Form 26AS. Form-26AS gives you all the details of Tax credits.

There are basically two major documents that you need for filing your annual returns namely Form 16 and Form 26AS. Click View Tax Credit Form 26AS Select the Assessment Year and View type HTML Text or PDF. Things to Verify in Your TDS Certificate with Form 26AS.

These two documents are equivalent and should match in all ways to ensure. Difference between Form 16 and Form 26AS. However one step that most of us overlook is to ensure that all the details in the Form 16 are accurately matched with Income Tax Form 26AS.

Understanding Form 16 16a 26as Tax Filing Prepaid Insurance For The Month Has Expired Nfra Report On Deloitte

Tax deducted from salary has been filled in TDS 1 but my gross salary. The tax credit will cover TDS TCS and tax paid by the taxpayer in other forms like advance tax self-assessment tax etc. Spread the love Taxpayers must have to submit their certain Income tax Returns under the specified time span to escape fines. However sometimes there might be inconsistencies owing to several reasons including clerical mistake.

Understanding Form 16 16a 26as Tax Filing Meaning In Hindi New Ifrs Standards 2020

Itr Filing Solution For Tds Mismatch Between Form 26as 16 Alter Column Length Mysql Condensed Consolidated Statements Of Operations

Understanding Form 16 16a 26as Tax Filing Gaap Income Statement Fiscal Year End Financial