And turn it into the following. And hence the good clear and to the point explanation of the difference between the assets and liabilities is a must for the students of commerce and hence Vedantu takes care of all these things and makes the concepts of Assets and Liabilities extremely easy for the.

You can think of it as paying part of your taxes in advance deferred tax asset or paying additional taxes at a future date deferred tax liability. What is a Liability in Personal Finance. Assets and liabilities coexist and complement each other. When determining the value of your business and its financial stability you add up each of your assets and subtract your liabilities.

Assets and liabilities explained.

Understanding Net Worth Ag Decision Maker Cash Flow Disposal Of Fixed Assets Negative Balance On Sheet

The words asset and liability are two very common words in accountingbookkeeping. A deferred tax asset is a business tax credit for future taxes and a deferred tax liability means the business has a tax debt that will need to be paid in the future. This definition allows companies to differentiate between items and record them properly. Assets are such items that economically benefit a company.

In contrast a liability represents any amount owed to a third party other than shareholders. To put it in other words liabilities are the obligations that are rising out of previous transactions which is payable by the enterprise through the assets possessed by the enterprise. These resources may include fixed assets cash inventory stock etc.

Thats not wrong but theres a little more to it than that. They support the successful running of a business in the present and also in the future. Businesses also refer to assets and liabilities as profits and losses Assets represent a companys resources while liabilities represent a companys obligations.

What Are Liabilities In Accounting With Examples Bench Understanding A Balance Sheet For Dummies Free Cash Flow Statement Template Excel

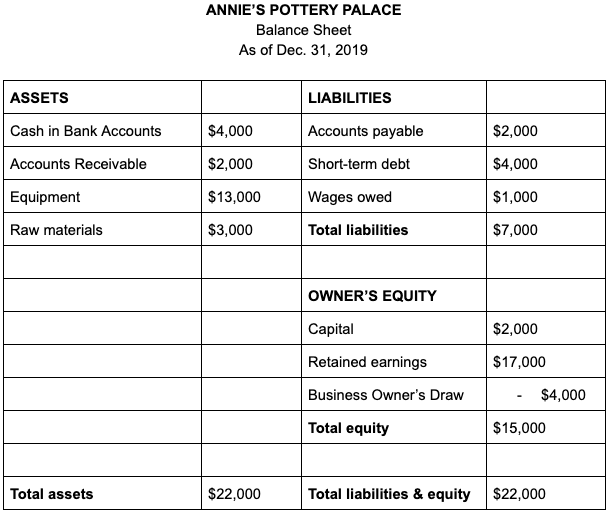

What does this mean. Accountants call this the accounting equation also the accounting formula or the balance sheet equation. DTADTL Calculation Heres the illustration of creating DTADTL in books. Assets are reported on a companys balance sheet and are bought or created to increase a firms value or benefit the firms operations.

In this video Ill explain everything you need to know in. Lets look at a complete definition. Assets Liabilities Equity.

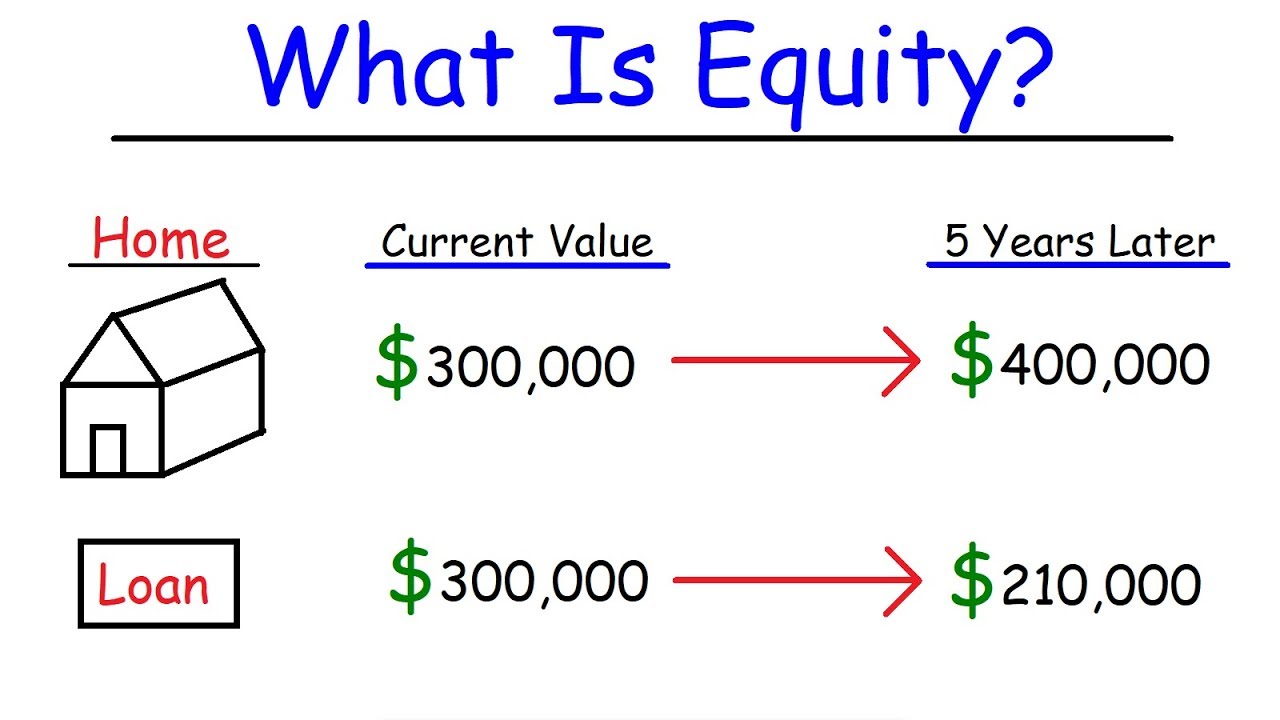

What are Assets and Liabilities. Examples of assets are buildings equipment inventory and cash. If we follow Robert Kiyosakis teachings of Rich Dad Poor Dad well learn that a house is not an asset but a liability.

Balance Sheet Definition Examples Assets Liabilities Equity Industry Standard Financial Ratios Trustee Statements

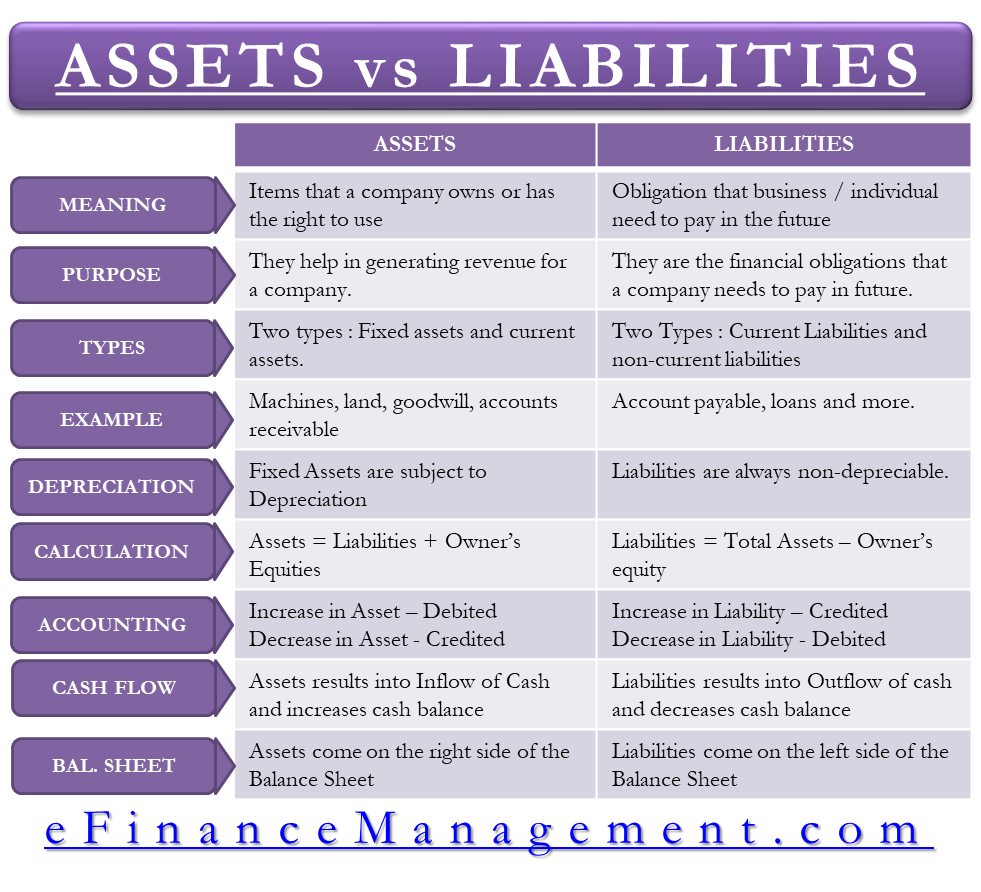

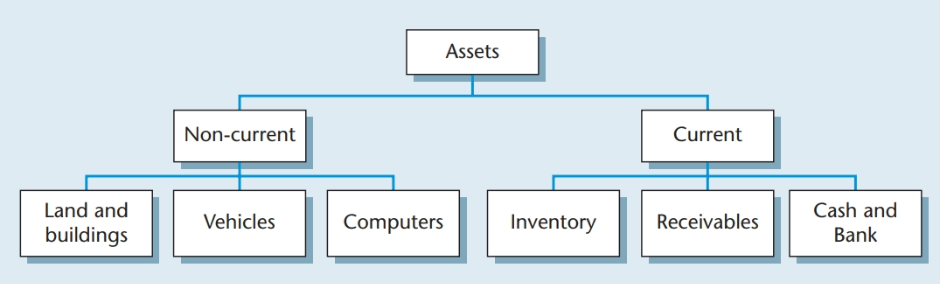

T he assets and liabilities are separated into two categories. Generally speaking a companys liability is any thing that they responsible for or are tied down with let us explain further. More liquid accounts such as Inventory Cash and Trades Payables are placed in the current section before illiquid accounts or non-current such as Plant Property and Equipment PPE and Long-Term Debt. Differences Between Assets and Liabilities.

The word liability can seem a little bit scary and just like an asset covers a lot of ground but actually a liability is a pretty simple concept. A piece of paper that is given to an employee with each paycheck and that shows the amount of money that. The deferring tax asset falls under non-current assets and deferred tax liabilities under non-current liabilities.

The primary difference between Assets and Liabilities is that Asset is anything which is owned by the company to provide the economic benefits in the future whereas liabilities are something for which the company is obliged to pay it off in the future. To explain in short the assets and liabilities simply indicate that assets add money in and liabilities take money out. The topic of Assets and Liabilities can be confusing for the students if it is not explained in a better manner.

What Are Liabilities In Accounting Examples For Small Businesses Mygov Income Statement Financial Reporting With Sap Pdf

Liabilities are often used for purchasing necessary assets eg taking out a loan to buy equipment. Now looking at your business liabilities. Assets and liabilities are accounting terms that help businesses identify income-producing items as well as things that can take away from company profits. Some people simply say an asset is something you own and a liability is something you owe.

The main difference between assets and liabilities is that assets add value to your business while liabilities subtract from it. In accounting the companys total equity value is the sum of owners equitythe value of the assets contributed by the owner sand the total income that the company earns and retains. Lets take the equation we used above to calculate a companys equity.

As they are enforceable legally and there is no intent to settle the liabilities and assets on a net basis one can adjust both DTA and DTL with one another. Current assetliabilities and non-current long-term assetsliabilities. Asset and liability management ALM is a practice used by financial institutions to mitigate financial risks resulting from a mismatch of assets and liabilities.

Introduction To Balance Sheets Positive Money Minority Interest In Consolidation How Fill Out A Cash Flow Statement

Equity Assets Liabilities. Short explanation is that an asset puts more money in your pocket whereas a liability takes money out of your pocket. In other words assets are good and liabilities are bad. ALM strategies employ a combination of risk management and financial planning and are often used by organizations to manage long-term risks that can arise due to changing circumstances.

Pay Stubs Explained Merriam-Webster defines a pay stub as. You can calculate it by deducting all liabilities from the total value of an asset. Assets and liability explained in HindiLiability meaning and assets meaning in Hindi Shivkumar Gadriya 20Hello doston Namaste doston.

An asset can be thought of as something that in the future. Assets Liabilities Equity. How do the rich people spend their money and how do the rich get richer while the poor gets poorer.

What Are Assets Liabilities And Equity Explained Accounting Proficient Cebu Pacific Financial Statements 2018 Cost Volume Profit Income Statement

The most important equation in all of accounting. Once you understand how the terms assets and liabilities are used in business you can use that knowledge to your benefit in. The economic value of an obligation or debt that is payable by the enterprise to other establishment or individual is referred to liability. It refers to obligations from past events that lead to outflows of economic benefits.

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition Net Loss On Balance Sheet Logitech Financial Statements

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

Liability Definition Bank Overdraft Debit Or Credit In Trial Balance Paddy Power Financial Statements

Personal Finance Assets Liabilities Equity Youtube Compilation Engagement Balance Sheet Analysis Sample