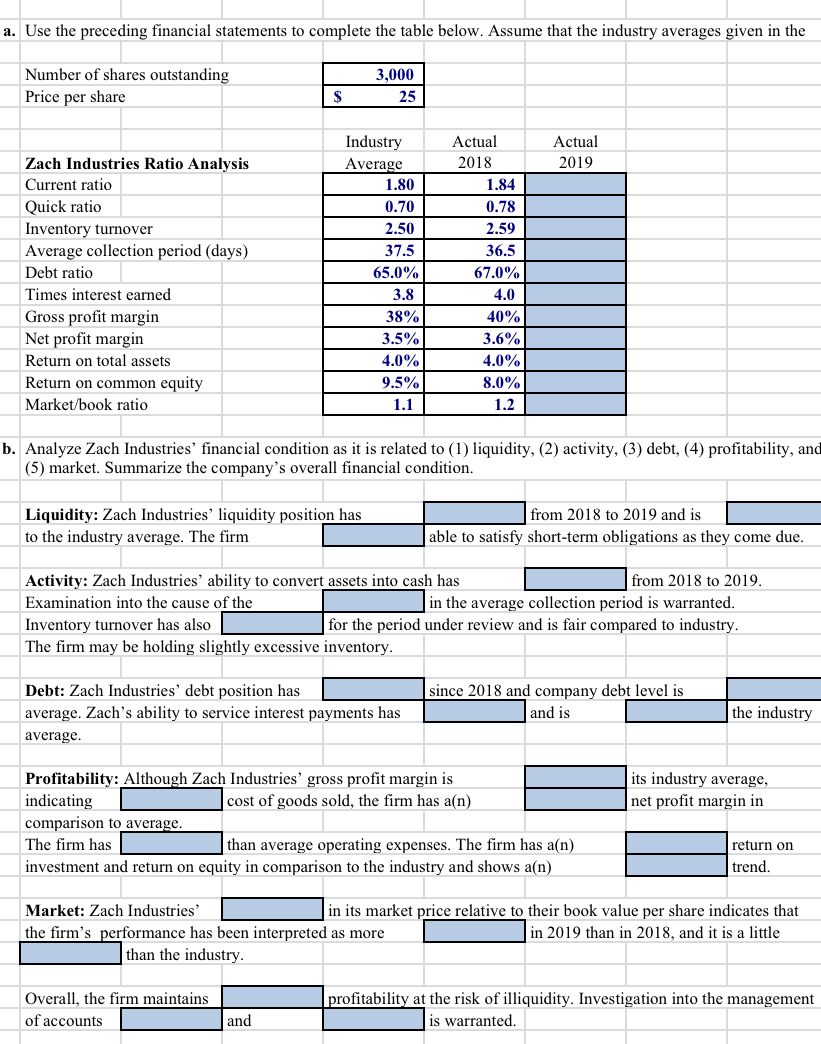

Summarize the companys overall financial condition. Analyze Zach Industries financial condition as it is related to 1 liquidity 2 activity 3 debt 4 profitability and 5 market.

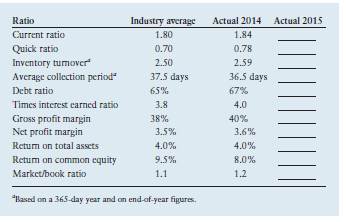

Assume thatthe industry averages given in the table are applicable for both 2014 and 2015RatioIndustry AverageCurrent ratio18Quick ratio070Inventory turnovera250Average collection perioda375 DaysDebt ratio 65 6765Times interest earned ratio 38 4038Gross profit margin 38 4038Net profit margin 35 36350Return on total assets 40. Analyze Zach Industries financial condition as it is related to 1 liquidity. Liquidity as a firm. The current ratio is 104.

Zach industries ratio analysis.

Lg P3 23 Financial Statement Analysis The Statements Of Zach Industries For Year Ended December Homeworklib Ratio Formulas Pdf Projection Sample

Zach Industries liquidity position has deteriorated from 2008 to 2009 and is inferior to the industry. Round to two decimal places The quick ratio is 38. Quick ratio 0 0 0. 2330 COGSInventory Average Collection Period days 375days.

Market Ratio Adalah PriceEarning Ratio PE ratio Market price per share of common stock Earnings per share Zach Industries 25218 1146 MarketBook Ratio Book value per share of common stock Common stock equity Number of shares of common stock outstanding Zach Industries 31550 26550 3000 193 Marketbook MB ratio Market price per. Operating expenses Selling expense General and administrative. Industry average actual 2014 actual 2015 ratio current ratio 180 184 quick ratio inventory turnover 250 259 average collection period 375 days 365 days times interest eamed ratio 38 gross profit margin net profit margin return on total assets 40.

The industry averages given in the table are applicable for both 2014 and 2015. Analyze Zach Industries financial condition as it is related to 1 liquidity 2 activity 3 debt 4 profitability and 5 market. Analyze Zach Industries financial condition as it is related to 1 liquidity 2 activity 3 debt 4 profitability and 5 market.

Solved Financial Statement Analysis The Chegg Com 3 Month Income Restaurant Pro Forma

Marketbook ratio 11 12 _____ b. All details needed. Cost of goods sold. Zach Industries Ratio Analysis Industry Average Actual Actual 2014 2015 Current ratio 180 184 104 Quick ratio 070 078 038 Inventory turnover 250 259 233 Average collection period 375 days 365 days 57 days Debt ratio 65 67 613 Times interest earned 38 40 28 Gross profit margin 38 40 34 Net profit margin 35 36 41 Return on total.

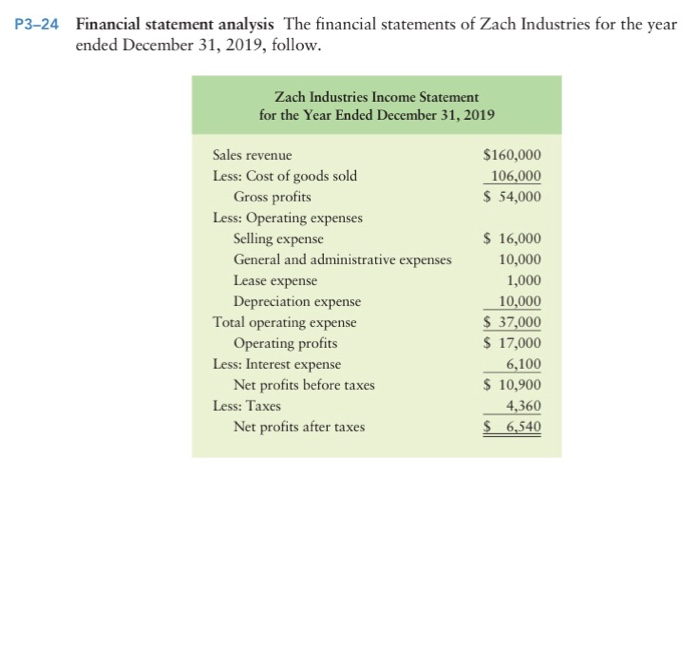

Cost of goods sold 106000 Gross profits 54000 Less. B Analyze Zach Industries financial condition as it is related to 1 liquidity 2 activity 3 debt 4 profitability and 5 market. Use the preceding financial statements to complete the following table.

Summarize the companys overall financial condition. Cost of goods sold Gross profits Less. Prepare and interpret a complete ratio analysis of the firms 2015 operations.

Zach Industries Liquidity Position Has Deteriorated From 2008 To 2009 And Is Course Hero Total Debt In Balance Sheet Ab Inbev Financial Statements

Financial statement analysis The financial statements of Zach Industries for the year ended December 31 2015 follow. Zach Industries Income Statement for the Year Ended December 31 2019 160000 106000 54000 Sales revenue Less. Round to two decimal places The inventory turnover is 232. Zach Industries Income Statement for the Year Ended December 31 2003.

Summarize the companys overall financial condition. P2-24 IntegrativeComplete ratio analysis Given the following financial statements. Market Book Ratio 19.

P3-24 Financial statement analysis The financial statements of Zach Industries for the year ended December 31 2019 follow. Summarize the companys overall financial condition. Financial statement analysis The financial statements of Zach Industries for the year ended December 31 2015 follow.

Solved Financial Statement Analysis The Statements Chegg Com What Are Other Liabilities On A Balance Sheet Compare And Contrast Horizontal Vertical Of

Operating expenses 106000 54000 Selling expense General and. Financial Statements And Ratio Analysis. Summarize the companys overall financial condition. Use the preceding financial statements to complete the following table.

Analyze Zach Industries financial condition as it is related to X liquidity 2 activity 3 debt 4 profitability and 5 market. Inventory turnover 2 2 2. The industry averages given in the table are applicable for both 2014 and 2015.

General and administrative expenses. 0384 current assets-INVcurrent liab. Summarize your findings and make recommendations.

Lg P3 23 Financial Statement Analysis The Statements Of Zach Industries For Year Ended December Homeworklib Balance Sheet Case Study What Is Included In

Zach Industries Ratio Analysis Industry Actual Actual Average 2011 2012 Current ratio 180 184 104 Quick ratio 070 078 038 Inventory turnover 250 259 233 Average collection period 375 days 365 days 57 days Debt ratio 65 67 613 Times interest earned 38 40 28 Gross profit margin 38 40 34 Net profit margin 35 36 41 Return on total assets 40 40 44. Ratio Industry Average Current ratio 18 Quick ratio 070 Inventory turnovera 250 Average collection perioda 375 Days Debt ratio 65 67 65 Times interest earned ratio 38 40 38 Gross profit margin 38 40 38 Net profit margin 35 36 350. Assume that the industry averages given in the table are applicable for both 2014 and 2015 b. Principl Manageri Finance_15 15th Edition.

Operating expenses Selling expense 16000 General and. P3-24 LG6 Zach Industries Income Statement for the Year Ended December 31 2015 Sales revenue 160000 Less. Assume that the industry averages given in the table are applicable for both 2014 and 2015.

Remember the Zacks Rank is a score of 1 thru 5 with a Zacks Rank 1 Strong Buy being the best and a Zacks Rank 5 Strong Sell being the worst. Cost of goods sold Gross profits Less. 1043 Current AssetsCurrent Liabilities Quick Ratio.

Solved 1 Financial Statement Analysis The Statements Of Zach Answer Transtutors Balance Sheet Download What Is Consolidated And How It Prepared

57031 365Acc ReceiveSales Rev Debt ratio. Zach Industries Income Statement for the Year Ended December 31 2019 Sales revenue 160000 Less. Ratio Industry Average Current ratio 18 Quick ratio 070 Inventory turnovera 250 Average collection perioda 375 Days Debt ratio 65 67 65 Times interest earned ratio 38 40 38 Gross profit margin 38 40 38 Net profit margin 35 36 350. Zach Industries has seen a decline from 2014 to 2015 in terms of its.

Price per share 25 Industry Actual Actual Zach Industries Ratio Analysis Average 2018 2019 Current ratio 180 184 104 Quick ratio 070 078 038 Inventory turnover 250 259 233 Average collection period days 375 365 570 Debt ratio 650 670 61300 Times interest earned 38 40 28 Gross profit margin 38 40 34. TR Turnover time ACP 37 days 36 days 57 days Debt ratio 65 67 61 Gross profit margin 38 40 34 Net profit margin 3 3 4 Return on total assets 4 4 4 Return on common equity 9 8 11.

-2.png)

Solved The Financial Statements Of Zach Industries For Year Ended Decembe Solutioninn A Statement Cash Flows Is Generated To Show Income Flow Balance Sheet

-1.png)

Solved The Financial Statements Of Zach Industries For Year Ended Decembe Solutioninn Big 5 Accounting Firms Accumulated Profit In Balance Sheet

Solved Financial Statement Analysis The Statements Chegg Com Insurance Annual Nbfc Audit Report