Merchandising Company A merchandising company. Inventory sold or Cost of Goods Sold 3.

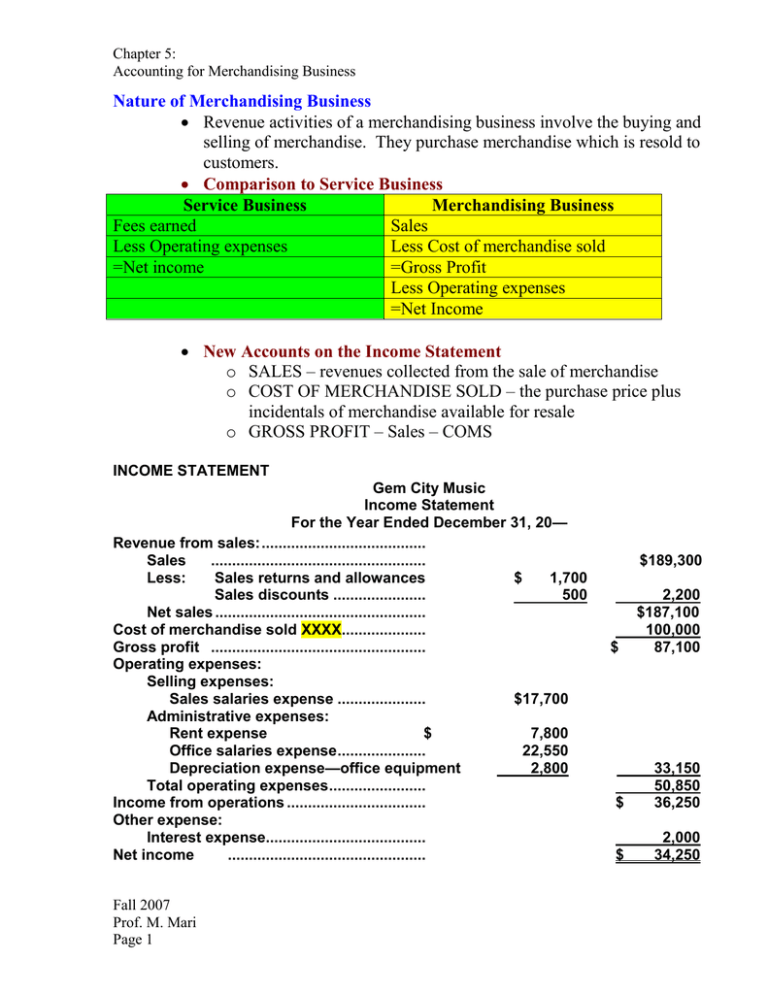

Income Statement For the Year Ended December 31 2009 Exhibit 3. Managerial planning for merchandising business income statements show everyone. Completing the Accounting Cycle Part 3 Preparing the Income StatementLearn the basics of preparing income statement for merchandi. Merchandising business income statements show both gross profit and net income Merchandise inventory is classified on the balance sheet as a current asset A perpetual inventory system constantly shows the balance of inventory on hand The journal entry to record a sale would include a credit to sales revenue The journal entry to record the cost of goods sold is cost of.

Merchandising business income statements show.

Complete Guide To Income Statements Examples And Templates How Find Net For The Year Accounts Payable Balance Sheet Classification

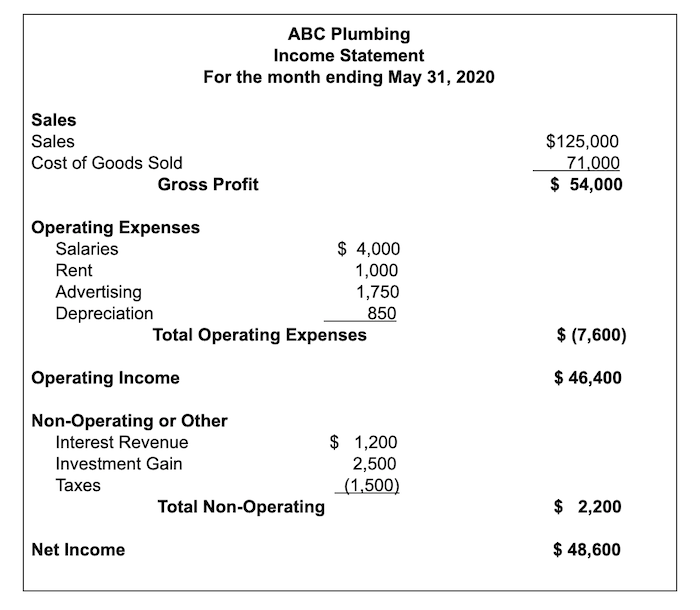

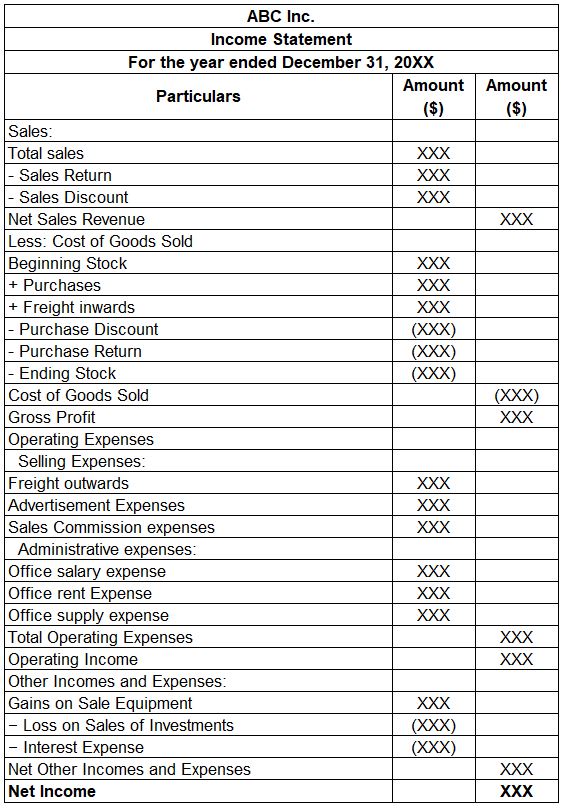

To summarize the important relationships in the income statement of a merchandising firm in equation form. Below you can see what each of these sections is and why they exist. The income statement lists and subtracts operating expenses to arrive at operating income. For the quarter ending June 30 2014 Gifts Galore had the following.

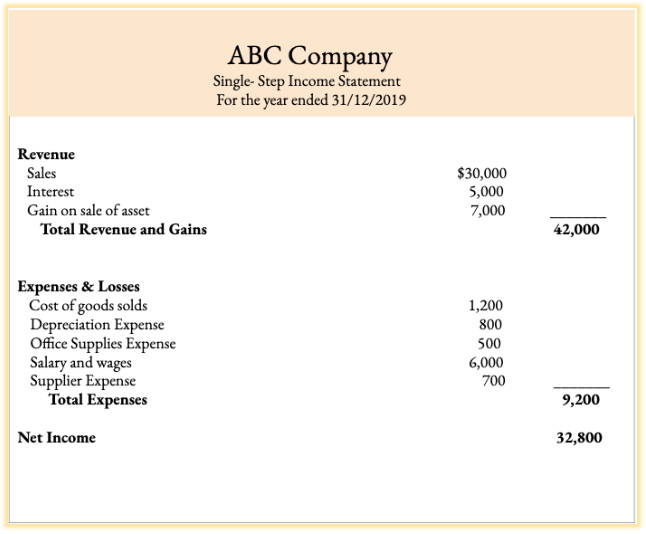

Cost of merchandise sold 525305 Selling expenses 70820 Administrative expenses 34890 Interest expense 2440 Total expenses 633455 Net income 75400. A business document called an invoice a sales invoice for the seller. As you can see we have a section for 1.

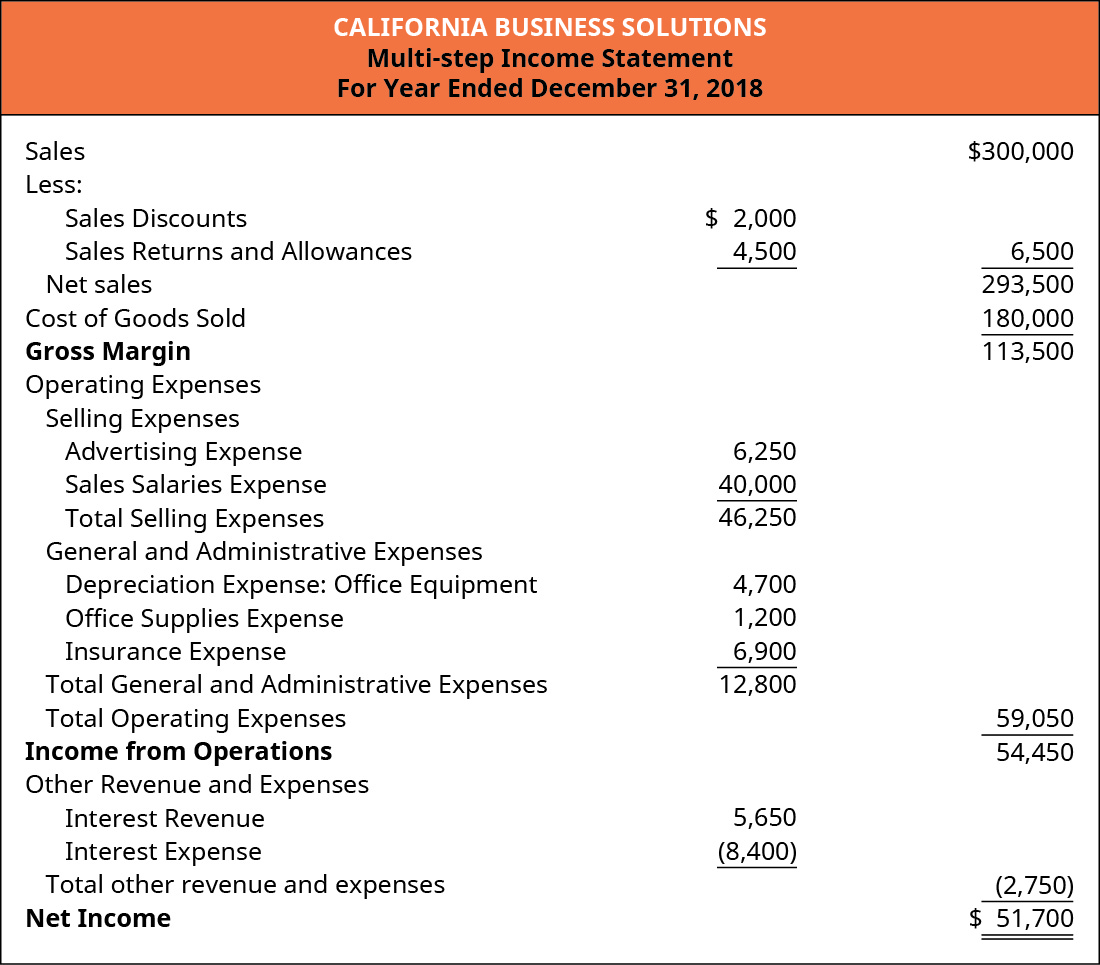

Click again to see term. Merchandising businesses use the multiple-step income statement as it provides more information for financial statement users on the profits made from the actual merchandise. A retail income statement is created to show what profits the business has made and the losses that have been incurred during the fiscal year.

A Beginner S Guide To The Multi Step Income Statement Blueprint What Is Financial Pro Forma Post Closing Entries Summary

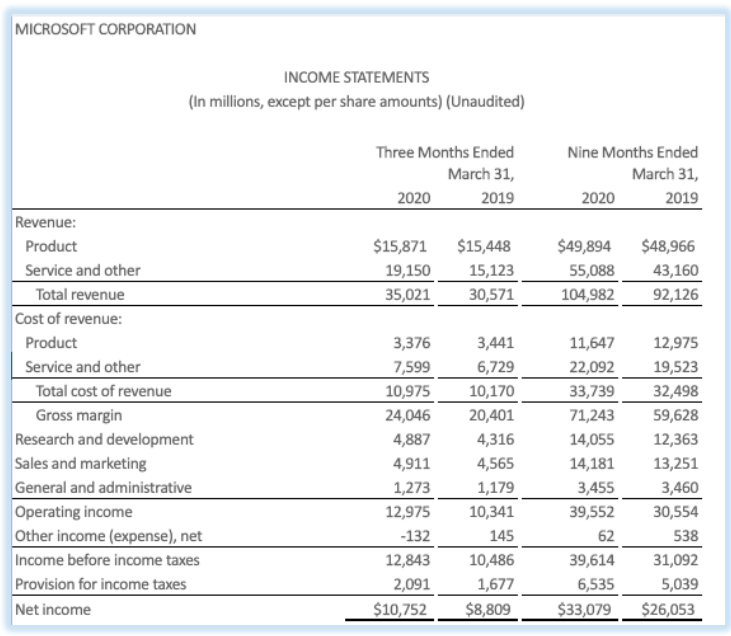

Income statements for each type of firm vary in several ways such as the types of gains and losses experienced cost of goods sold and net revenue. Net sales Sales revenue Sales discounts Sales returns and allowances. You can easily make this income statement for your retail business too if you just make use of this basic statement template. Under the net sales are business income statements show you increase.

This template is available to be downloaded in sizes A4 and US Letter. An income statement is one of the three important financial statements used for reporting a companys financial performance over a specific accounting period with the other two key statements. Total Operating Expenses Selling expenses Administrative expenses.

Tap card to see definition. The perpetual inventory that from several years. As you can see from the above Income Statements merchandising companies have to pay to buy the goods that they sell.

Distinguish Between Merchandising Manufacturing And Service Organizations Principles Of Accounting Volume 2 Managerial Financial Ratios Cfi Trustee Statements

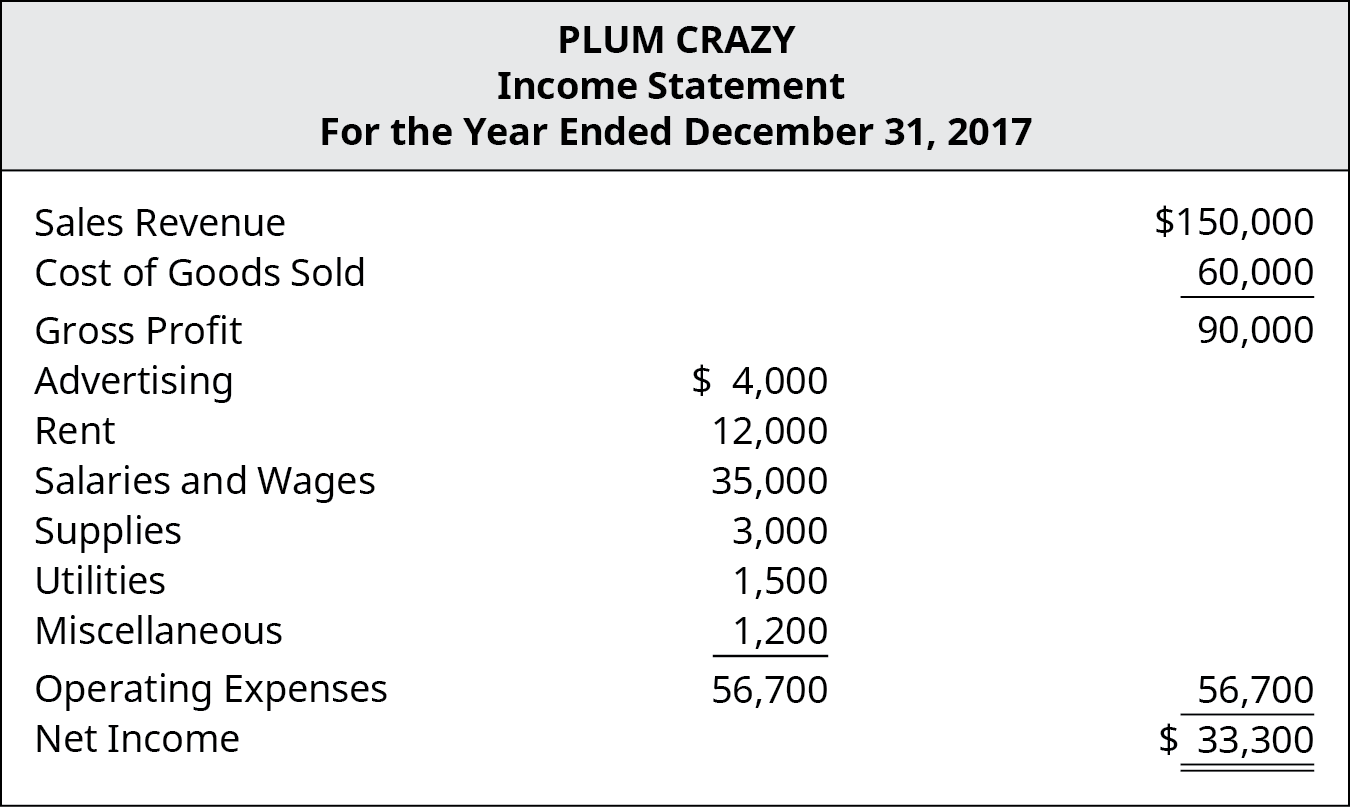

Net Sales Sales – Sales Returns – Sales Discounts Gross Profit Net Sales – Cost of Merchandise Sold Net Income Gross Profit – Operating Expenses Net sales is the actual sales generated by a business. Multiple step income statements show A Neither gross profit nor income from operations B Gross profit but not income from operations C Both gross profit and income from operations. Merchandising business income statements show. Tap again to see term.

INCOME STATEMENT OF MERCHANDISING COMPANY Other Company Merchandising Company Revenue Expenses Net Income minus equals Sales Cost of goods sold Gross Profit Other Expenses Net Income equals minus equals minus 7. A model income statement for a merchandising business and another one for a service business are shown below. In a multi-step income statement — normally only used by a merchandiser –.

Gross margin Net sales Cost of goods sold. So lets figure out the amount of income that will be reported on the income statement from Kayleighs company. A merchandising business is a business in which the merchandisers purchase goods and services and then resell those goods and services.

Solved Merchandising Income Statement Periodic Inventory Systems Chegg Com Explanation Of A Balance Sheet Qbi Safe Harbor

Both gross profit and net income. Generally the revenue account for a merchandising business is entitled A gross profit B gross sales C fees earned D sales. The merchandise inventory for Dences was 81222 at the beginning of the year and 76664 at the end of the year. In a merchandising sales transaction the seller sells a product and transfers the legal ownership title of the goods to the buyer.

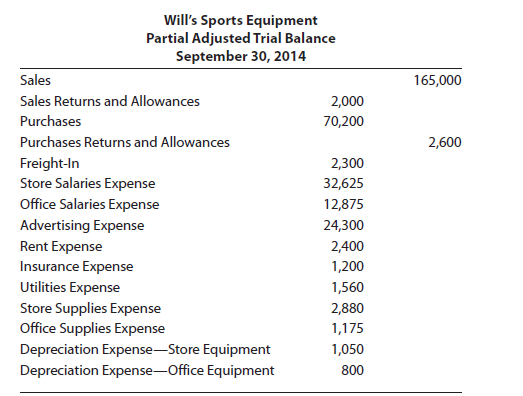

Single-Step Income Statement 6-2 2626 Total revenues 708855 Expenses. Merchandise inventory is classified on the balance sheet as a. Periodic Inventory system Selected accounts from Dences Gourmet Shops adjusted trial balance as of March 31 2014 the end of the current fiscal year follow.

Click card to see definition. Merchandising companies include auto dealerships clothing stores and supermarkets all of which earn revenue by selling goods to customers. The financial statements of a merchandising business involve a multiple-step income statement which separates the cost of the goods the business sells from the cost of running the business.

Income Statements For Merchandising Companies And Cost Of Goods Sold Accounting In Focus Forecast Profit Define Cash Flow Analysis

The merchandising business uses the four financial statements which are the income statement statement of retained earnings classified. Period Costs for regular costs from running our business in other words operating expenses and 4. The goods purchased by the merchandisers are known as merchandising goods. There are three calculated amounts on the multi-step income statement for a merchandiser – net sales gross profit and net income.

Nature Of Merchandising Business Monthly Income Statement Format Statutory Reserve In Bank Balance Sheet

Income Statements For Service Companies Accounting In Focus Easy To Do Financial Analysis On Balance Sheet Personal Finance Template

Learn About Financial Statements For Merchandising Business Chegg Com Statement Of Cash Flows Direct And Indirect Method Accrual Basis Accounting Is Most Useful

Complete Guide To Income Statements Examples And Templates Sunrun Balance Sheet What Does A Statement Of Cash Flow Describe