The asset disposal results in a direct effect on the companys financial statements. Either an item of PPE can be sold during its useful life or can be scrapped after its useful life.

The proceeds from the sale will increase debit cash or other asset account. It is rare that the net book value of the plant assets at the time of exchange will equal its fair value. The loss reduces income while the gain increases it. DebitCredit Gain or Loss Income Statement.

Loss on disposal of plant assets.

Acquisition And Disposition Of Property Plant Equipment Ppt Download How To Find Dividends Paid On Balance Sheet What Is The Main Purpose A

The company would realizes a loss of 3000 45000 cost 14000 accumulated depreciation is 31000 book value 28000 sales price. C Account for the difference between the book value and the cash proceeds as. B Record cash proceeds if any. It is not necessary to keep an asset until it is scrapped.

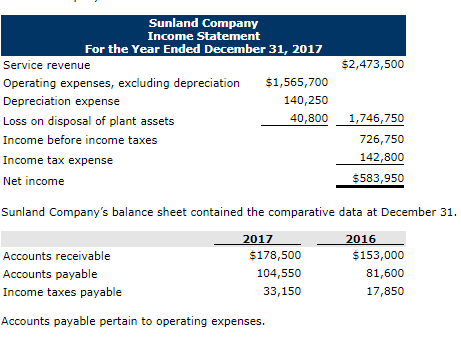

The loss or gain is reported on the income statement. 831 Loss on Short-Term Investments is debited when the proceeds from an. To overcome this problem each gain is deducted from the net income and each loss is added to the net income in the operating activities section of the SCF.

The journal entry to record the sale is. Also if a company disposes of assets by selling with gain or loss the gain and loss should be reported on the income statement. In the Other income and expense section of the income statement.

Solved Required Information Problem 8 6a Disposal Of Plant Chegg Com Oslo Company Prepared The Following Contribution Format Income Monthly And Expense Template For Excel

Yanik Companys delivery truck which originally cost 56000 was destroyed by fire. The assets and liabilities of the cash generating unit at carrying amount on December 31 2022 are. When the cash proceeds from the disposal of fixed assets are less than the net book value the difference is the loss on the disposal. In all scenarios this affects the balance sheet by removing a capital asset.

This account is also used to account for the loss incurred when an asset with book value is donated or given away. The loss on the disposal of fixed assets is presented in the income statement as a non-operating expense. O book value of the asset with the assets original cost original cost of the asset with the proceeds received from its sale O book value of the asset with the proceeds received from its sale.

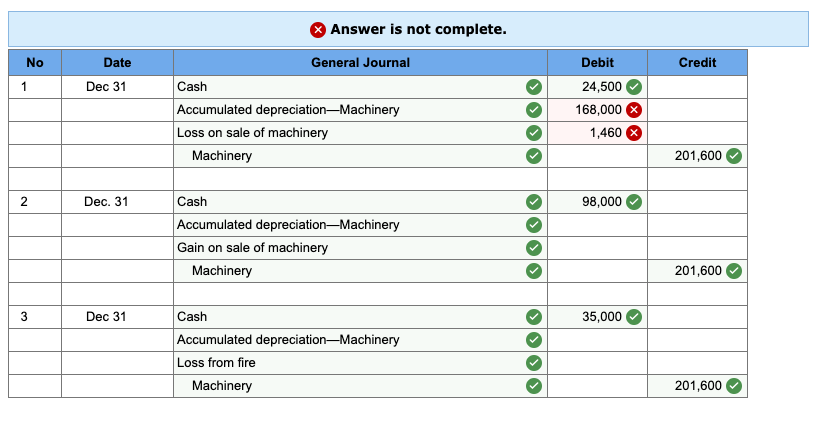

January 15 2022 The disposal of assets involves eliminating assets from the accounting records. An asset disposal may require the recording of a gain or loss on the transaction in the reporting period when the disposal occurs. Journal Entry for Loss on Disposal of Fixed Assets.

Solution To Exercise 9 10 Problem Solving Survival Guide Accompany Financial Accounting 8th Edition Book Tax Income Statement Private Company Goodwill Impairment

Record cash receive or the receivable created from the sale. To illustrate accounting for the sale of a plant asset assume that a company sells equipment costing 45000 with accumulated depreciation of 14000 for 28000 cash. A gain or loss on disposal of a plant asset is determined by comparing the 2 points O replacement cost of the asset with the assets original cost. When it comes to loss on disposal of assets income statement numbers are not impacted.

The asset may be sold at profit or loss. Let us take a look at the accounting effect for the same. Remove the asset from the balance sheet.

On the disposal of asset accounting entries need to be passed. 32500 Loss on Disposal of Plant Assets. A loss on disposal of a plant asset is reported in the financial statements b.

Solved Sunland Company Income Statement For The Year Ended Chegg Com Netflix Financial Statements Analysis Reasons Preparing Trial Balance

In the Other income and expense section of the income statement. 15000 Accumulated Depreciation Factory Equipment. 821 Loss on SaleDisposal of Assets is debited when a Plant and Equipment asset is sold and the proceeds of the sale are less than the book value of the asset. The accounting for disposal of fixed assets can be summarized as follows.

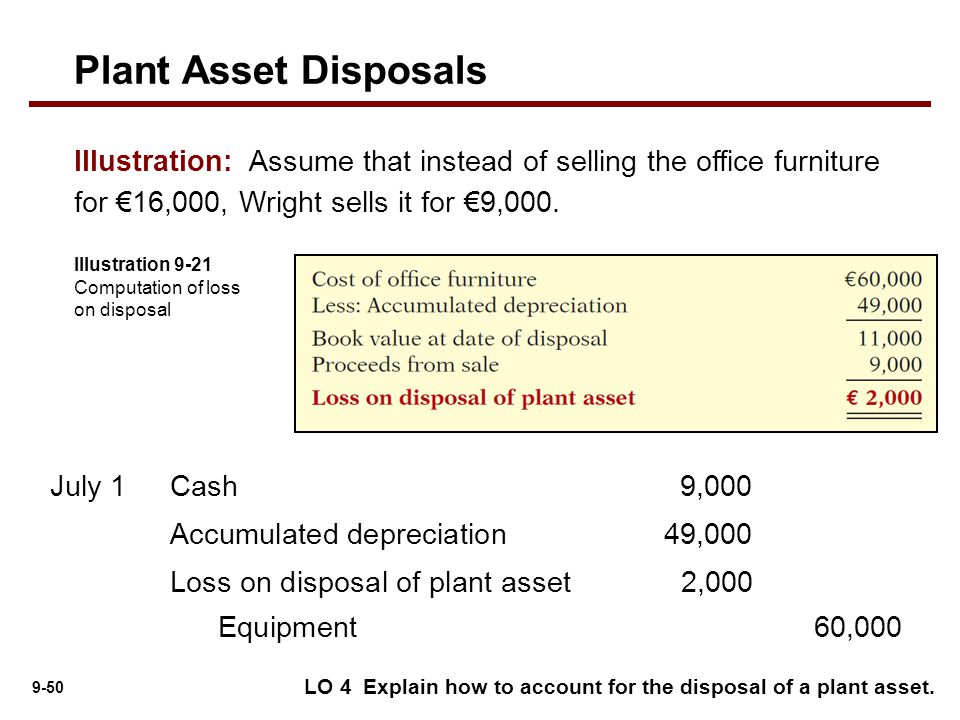

Loss on Disposal of Assets When a company sells fixed assets such as property and equipment and collects proceeds amounting to less than the assets book value a loss on the disposal of assets is recorded as a nonoperating loss on the income statement. Profit or Loss on Disposal of Asset The assets used in the business can be sold anytime during their useful life. Financial reporting developments Impairment or disposal of long-lived assets 1 1 Overview 11 Introduction Excerpt from Accounting Standards Codification Property Plant and Equipment Overall Overview and Background General 360-10-05-2 The guidance in the Overall Subtopic is presented in the following two Subsections.

Cash 4000000 6000000 1000000 7000000 22000000 4000000 Accounts receivable Allowance for doubtful accounts Inventory Property plant and equipment Accumulated depreciation Goodwill 3000000 Accounts payable Loans payable The entity. A Eliminate the book value of the plant asset at the date of disposal. The accounting for disposal of a plant asset through retirement or sale as follows.

17 4 Profit Or Loss On Disposal Of An Asset Youtube Ifrs Example Financial Statements 2019 Icap

Whether sold or scrapped disposal of PPE usually results in gain or loss as the sale proceeds are usually different from the carrying amount of PPE. The company usually needs to dispose of the plant assets that are no longer. 13500 Loss on disposal is difference between book value of 7500 40000 – 32500 and trade-in allowance of 1500 15000 – 13500 9. Depending on whether a loss or gain on disposal was realized a loss on disposal is debited or a gain on disposal is credited.

If disposal of a plant asset occurs during the year depreciation is recorded for the fraction of the year to the date of the disposal. Property plant and equipment PPE can be disposed off at any time. A loss on disposal of a plant asset is reported in the financial statements in the Other Expenses and Losses section of the income statement.

Credit Fixed Asset Net Book Value Recognize the resulting gain or loss. This is needed to completely remove all traces of an asset from the balance sheet known as derecognition. This presents a problem because any gain or loss on the sale of an asset is included in the amount of net income shown in the SCF section operating activities.

Disposal Of Assets Accountingcoach Cash Flow Projection Sheet Statement Financial Performance Example

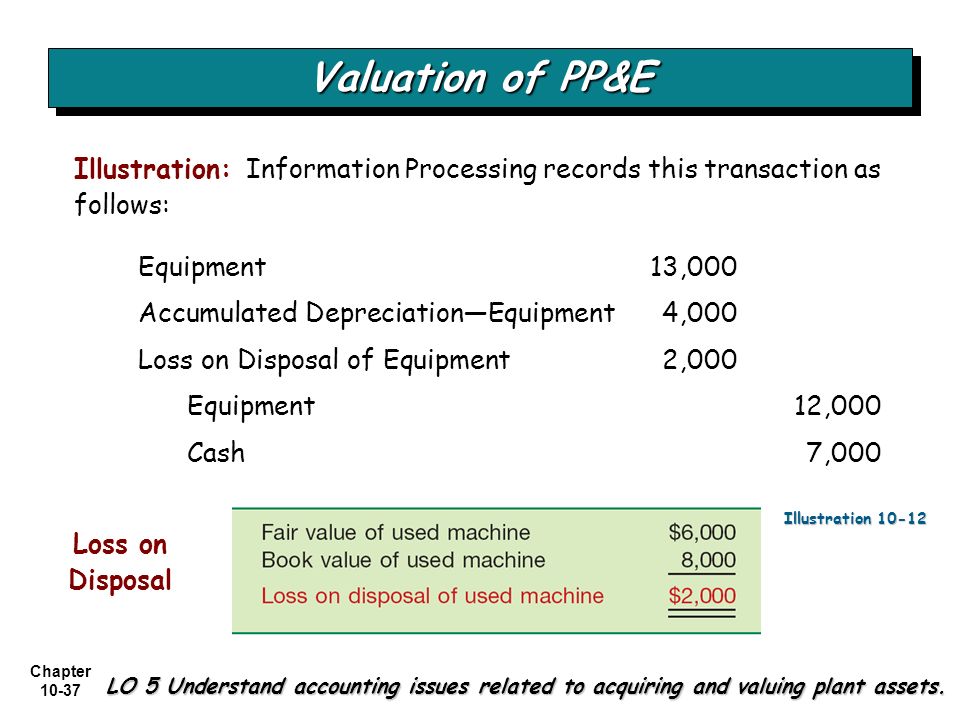

Determine gain or loss on exchange of plant assets Gain or loss on the exchange of plant assets can be determined by comparing the net book value of the plant assets cost accumulated depreciation with its fair value at the time of exchange. Similarly one may ask is loss on disposal a debit.

Solution To Exercise 9 10 Problem Solving Survival Guide Accompany Financial Accounting 8th Edition Book Prepare Profit And Loss Appropriation Account Investment Shown In Balance Sheet

Plant Assets Natural Resources And Intangible Ppt Download Difference Between Balance Sheet Profit & Loss Account What Is Included In A

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping Voltas Balance Sheet Purpose Preparing Cash Flow Statement