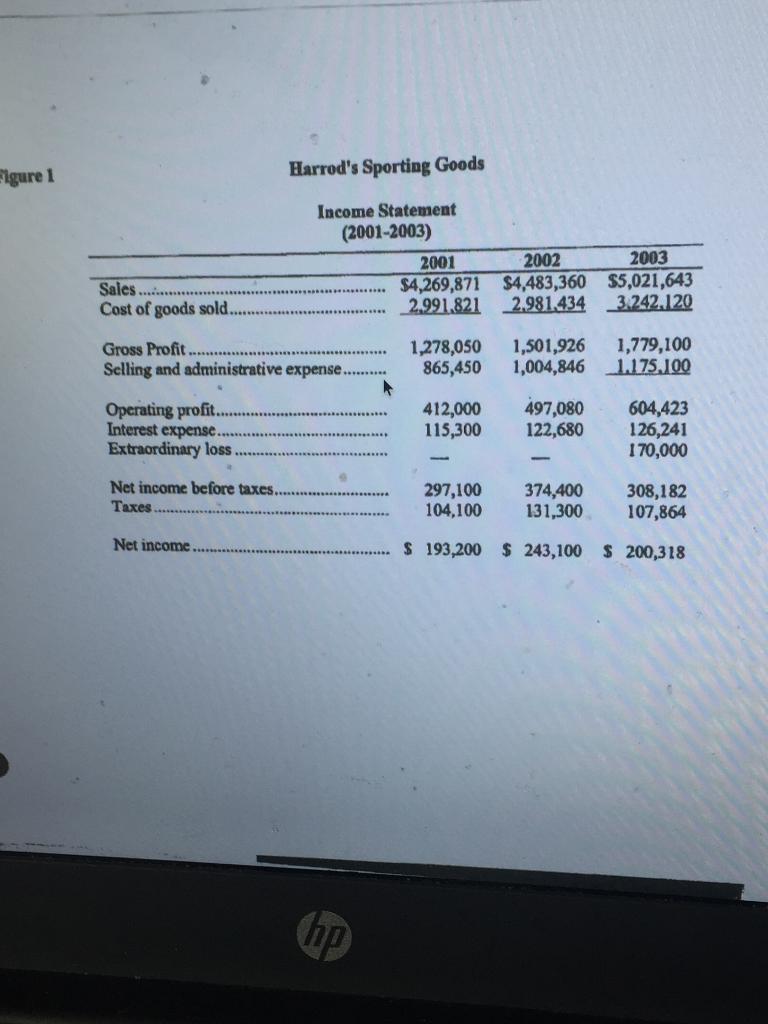

For each non-current account on the balance sheet establish the increase or decrease in that account. Project the companys revenue expenses and taxes on its Income Statement.

Then create a mini-Cash Flow Statement and include only the key recurring line items such as Depreciation the Change in Working Capital and CapEx. For example if shares have been partly called up only that part which has actually been received will be shown as a source of funds. The steps involved in preparing the statement are as follows. A pro forma financial statement leverages hypothetical data or assumptions about future values to project performance over a period that hasnt yet occurred.

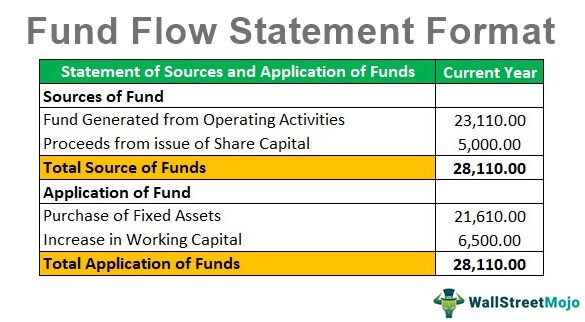

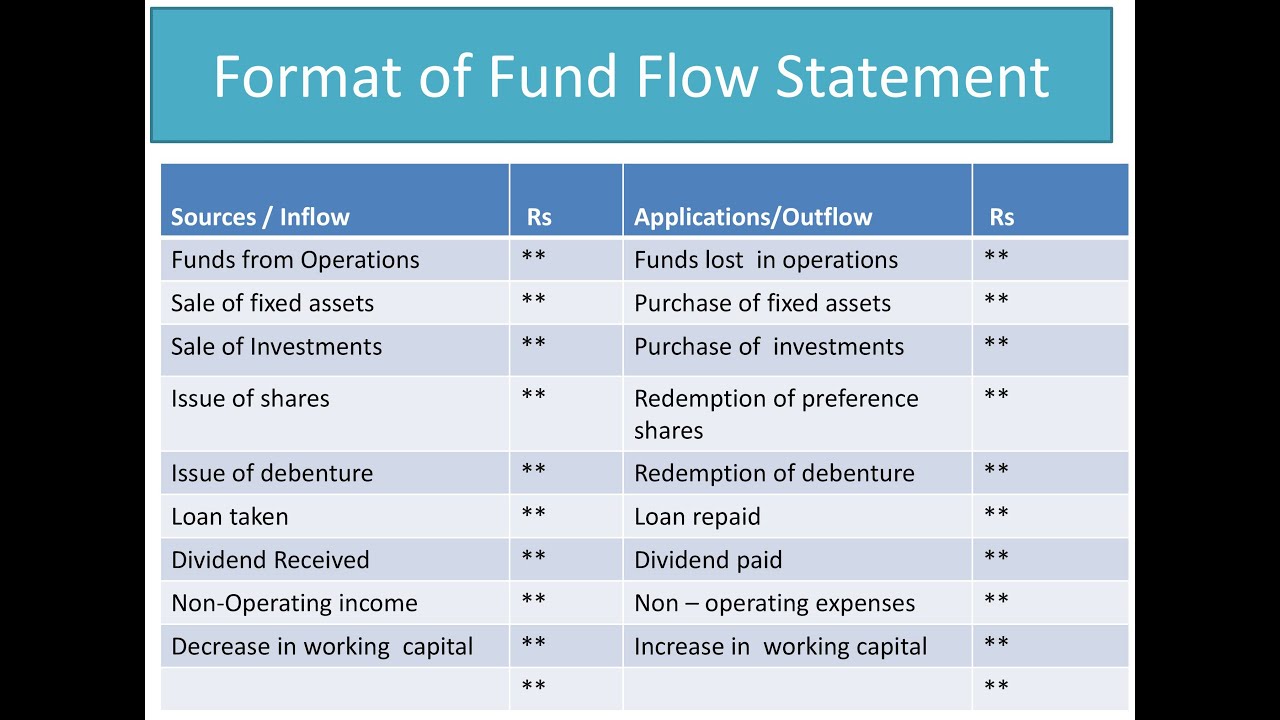

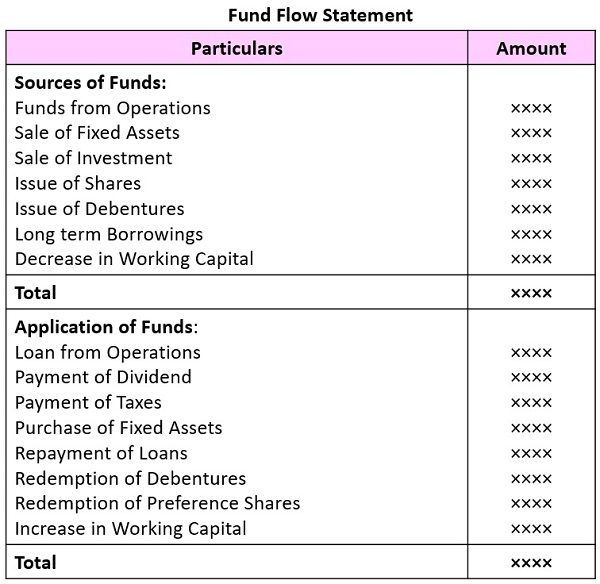

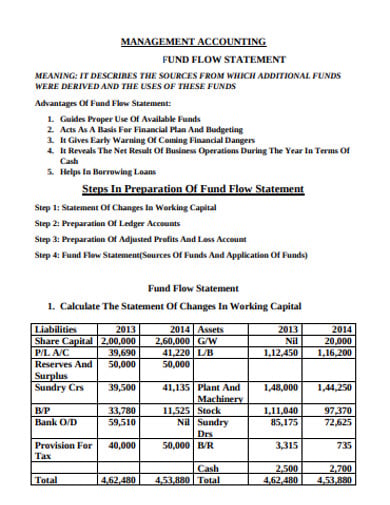

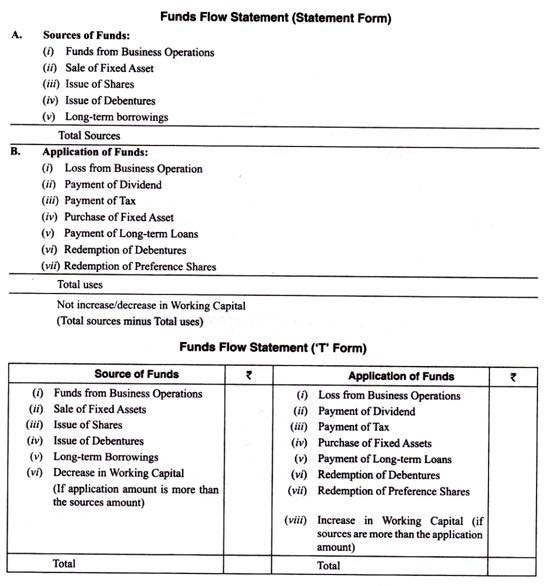

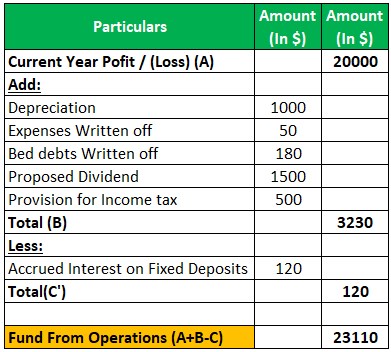

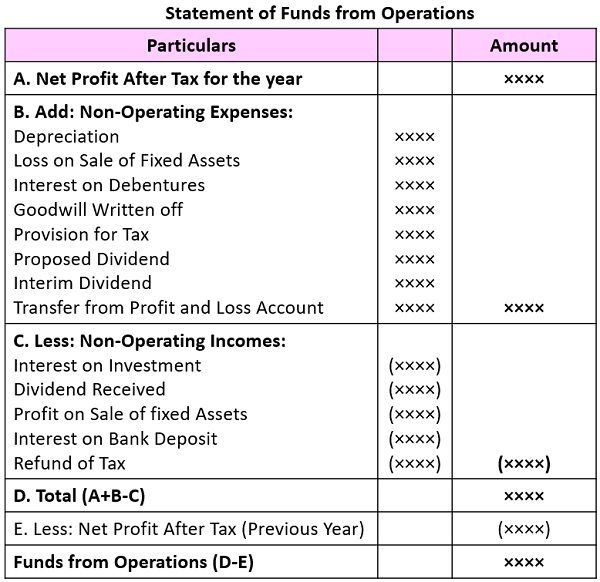

Funds flow statement proforma.

What Is Fund Flow Statement Definition And Steps For Preparation Business Jargons Profit Loss Template Word Are Expenses On The Balance Sheet

It is used to declare the value of the trade. Set a goal for sales in the period youre looking at. Determine the adjustments account to be made to net income. What Is a Pro Forma Financial Statement.

Packaging enhances the companys image and that is why at first glance the products should be appealing. When drafting this statement businesses project the cash inflow and outflow expected in the future over specified periods. Determine the change increase or decrease in working capital.

It is an analytical statement of the changes presenting its financial position between two balance sheet statements. The basic formula and format for the Pro Forma Cash Flow statement follows below. Set a production schedule that will let you reach your goal and map it out over the time period youre covering.

Difference Between Cash Flow And Fund Statement Compare The Similar Terms Financial Statements Of Llp Mars

Analyze the change to decide whether it is a. It shows the inflow and outflow of funds ie. Projected future cash flow which may also be called pro forma cash flow or simply cash flow is created to predict inflow and outflow of cash to your business. Step 1 Determine your companys sales predictions.

Sources of funds and applications of funds for a particular period. Then list your outgoing cash flows such as the cost of sales salaries etc. It depicts the monetary outflow and inflow of the sources and the applications of funds during a particular period.

Scheduled Gross Income Potential Gross Income – Vacancy Effective Gross Income Gross Operating Income – Operating Expenses Net Operating Income NOI – Loan Payments Pre-tax Cash Flow 1 Scheduled Gross Income. In trade transactions a pro forma invoice is a document that states a commitment from the seller to sell goods to the buyer at specified prices and terms. It portrays the inflow and outflow of funds ie.

Funds Flow Statement V Format Of Youtube Operating Investing Financing Activities Quiz Simplified Balance Sheet

You construct an appropriate pro forma statement make sure to employ reasonable market assumptions. Pro forma cash flow statement template Audited financial statements which are prepared by a CPA for a company or charity are utilised to offer accountability and accuracy to a companys shareholders and people with a vested interest in the corporation. Funds Flow Statement is a statement prepared to analyse the reasons for changes in the Financial Position of a Company between 2 Balance Sheets. Sales loans interest income.

Next add up all your operating expenses as well as any other expenses like income taxes and cash disbursements. A typical cash flow statement tracks cash inflows and outflows over a current period rather than projected. Proforma Cash flow statement.

Determine a typical annual revenue stream as well as cash flow and asset accumulation by conducting research and speaking with experts. A pro forma cash flow along with a pro forma income statement and a pro forma balance sheet are the basic financial projections for your business and should be included. Add your cash-on-hand and cash receipts ie.

Difference Between Cash Flow Statement And Fund With Format Example Comparison Chart Key Differences Apple Financial Statements Past 5 Years Coca Cola Balance Sheet 2019 Pdf

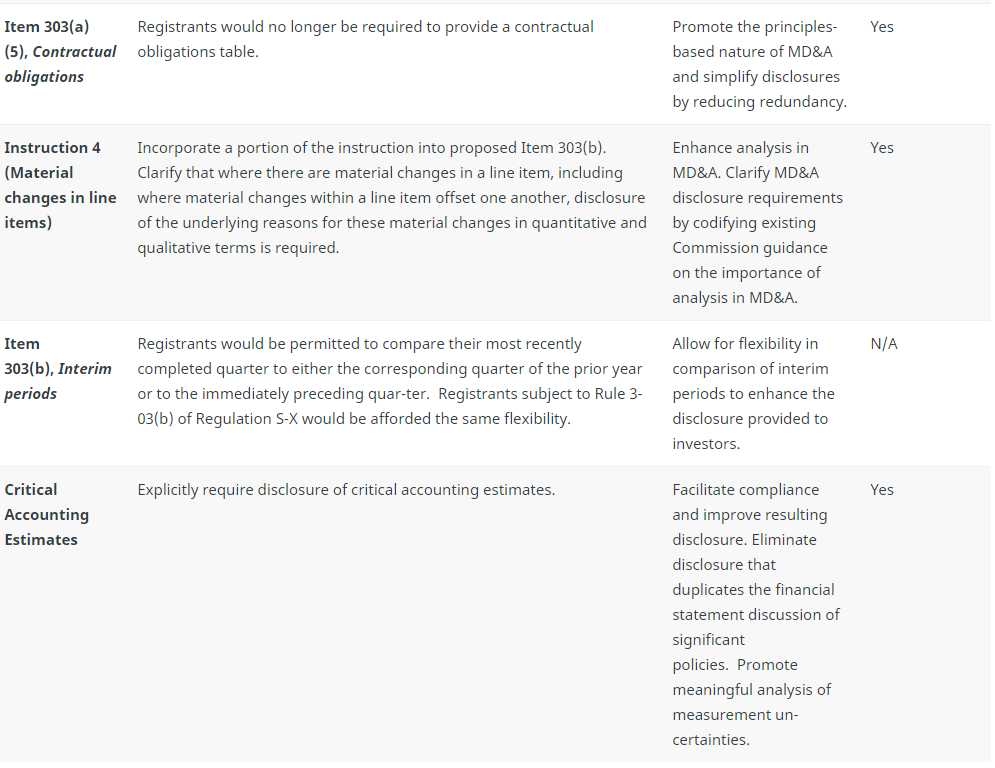

In the online course Financial Accounting pro forma financial statements are defined as financial statements forecasted for future periods. How Do I Create A Pro Forma Template. It is not a true invoice because it is not used to record accounts receivable for the seller and accounts payable for the buyer. However it is recommended that such purchase of fixed assets as well as issue of securities to pay for them is revealed in Funds Flows Statement Actual collection on issue of shares should be recorded.

Preparation of Funds Flow Statement is done in the following three steps Statement depicting differences in working capital According to the formula for working capital calculation Working capital Current assets Current liabilities This particular statement focuses on the effects that modify working capital. The message that will be sent will be simple and clear Pinson 2001. A pro forma cash flow is a statement which predicts the rate at which money will flow into and out of a company in the future.

Individual energy projects are often evaluated using PL and Cash Flow statements that jointly are known as the pro forma Unlike the PL and Cash Flow statements for a company which should represent actual historical data the pro forma represents the analysts evaluation of the financial worthiness of a potential energy project. A pro forma cash flow statement refers to a type of cash flow statement. In other words a Funds Flow Statement is prepared to explain the changes in the Working Capital.

14 Fund Flow Statement Templates In Google Docs Sheets Word Pages Pdf Numbers Free Premium Ratio Analysis Interpretation Big Four Ca Firms

There are five steps to creating a pro forma income statement. Sources and Applications of funds for a particular period. A fund flow statement is a statement prepared to analyse the reasons for changes in the financial position of a company between two balance sheets. To create a pro forma cash flow statement.

This can give the companys management some insight into whether they are likely to have to make temporary arrangements such as borrowing to cover a cash flow shortage. Lets say you want to increase in income by 18000 over the course of one year. Packaging will therefore involve the methods that the public relations will use to enhance the good image of the company the methods of.

The funds flow statement definition is a statement that explains the working capital change in a company.

What Is Fund Flow Statement Definition And Steps For Preparation Business Jargons Invested Capital Balance Sheet Clinical Audit Report Example

Get To Know Rules And Format Prepare Fund Flow Statement By Suresh Jacob Medium What Is A Profit Loss Used For Fasb Concept Statements

Fund Flow Statement Format How To Prepare Step By Of Changes In Equity Questions And Answers Stock Profit Loss Spreadsheet

Difference Between Cash Flow Statement And Fund With Format Example Comparison Chart Key Differences What Is Retained Earning In Balance Sheet Commercial Financial