Operating profit does not necessarily equate to the cash flows generated by a business since the accounting entries made under the. Different financial statements record varying operating activities.

2101634 5705068 037 or 37. What is Operating Income. Revenue500COGS250Gross Profit250Operating Expenses100Operating Profit EBIT150Interest30Taxes50Net Profit70Following this basic format you can determine how to calculate operating profit. The operating profit of a company is often put on the income statement as a subtotal.

Operating profit income statement.

Net Operating Profit After Tax Nopat Accounting And Finance Financial Strategies Business Quotes Income Statement Loss Takeda Statements

Operating profit is stated as a subtotal on a companys income statement after all general and administrative expenses and before the line items for interest income and expense as well as income taxes. Next on the income statement is operating profit. After gross profit is calculated other operating expenses are deducted in order to calculate the firms income from. The formula components are defined as follows.

Features of an income statement include revenue cost of sale gross profit overheads operating profit tax and interest payments and net profit. Rather its a snapshot of the profit-making potential of. Operating profit is stated as a subtotal on a companys income statement after all general and administrative expenses and before the line items for interest income and interest expense as well as income taxes.

Over a period of time. Generally speaking companies with a higher profit margin are in a better financial position than businesses with lower profit margins. A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time.

Income Statement Format Accounting Simplified Of Earnings Template Starbucks Financial Performance Balance Sheet Liabilities

Using the statement above. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non-operating activities. Operating profit does not necessarily equate to the cash flows generated by a business since the accounting entries made under the accrual. The formula for operating profit is fairly straightforward.

EBIT is also sometimes referred to is the amount of revenue left after deducting the operational direct. Gross profit is a very helpful measure but it is only the first of several provided by the income statement. The companys income statement represents all the business entitys revenues expenses and net profitability.

It is prepared based on. Your operating profit margin is the portion of each dollar your business keeps after taking into account both COGs and general expenses. Operating Profit Formula Example 1.

Self Employment Income Statement Template Unique Example Format In E Free Down Profit And Loss Ifrs 16 Illustrative Disclosures Pwc P L Balance Sheet

Operating income is an accounting figure that measures the amount of profit realized from a businesss operations after deducting operating expenses such as wages depreciation and cost of goods. Its important to note that this calculation is not necessarily equal to the cash flow of a business. The operating activities of a business entity are consolidated in the income statement or profit loss statement of the business entity. As in any part of financial analysis Analysis of Financial Statements How to perform Analysis of Financial Statements.

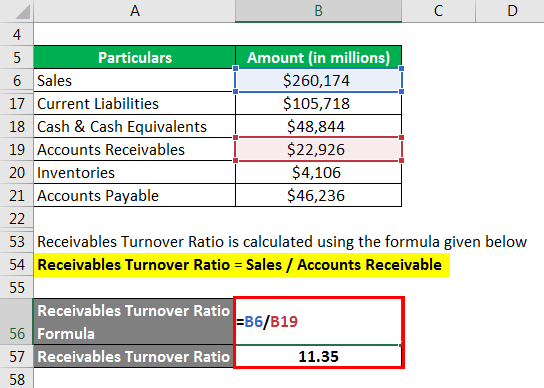

Net profit margin is calculated from a businesss income statement which looks at the revenues expenses and overall profit or loss generated by a business over a specific period of time. Operating Profit Margin Operating Income Total Revenue. Operating profit is the profit earned from a firms normal core business operations.

To calculate a companys operating profit refer to the income statement published in the companys annual report. This value does not include any profit earned from the firms investments such as earnings from firms in which. Limitations of Using the Operating Profit Margin Ratio.

The Income Statement In A Nutshell Fourweekmba Cash Flow Microsoft Profit And Loss Template What Does Show

A companys operating income is the profit associated with regular business operations before considering the financial leverage of the business and its associated interest expense as well as taxes. Operating income is the amount of profit left after considering all operating expenses and subtracting those expenses from the companys revenue. Operating income sits in the middle of the income statement as seen below in a snapshot of Cokes income statement. The numbers needed to plug into the operating profit formula may be found as line items.

Profit and Loss Statement PL A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a. For instance this income statement table illustrates how you can calculate the operating profit beginning with the revenue. Derived from gross profit operating profit reflects the residual income that remains after accounting for all.

The PL statement shows a companys ability to generate sales manage expenses and create profits. This guide will teach you to perform financial statement analysis of the income statement any number of interest requires additional research to understand the reasons behind the number. The income statement is crucial for managers to decide whether they want to expand into new areas or increase their manufacturing capabilities.

Income Statement Templates 29 Free Docs Xlsx Pdf Profit And Loss Template Small Church Financial Audit

This type of income is listed on the income statement which includes a summary of a businesss revenue and expenses for a specified period. Let us take the example of the company having the total revenue earned during the year of 5000000. Operating income also referred to as operating profit or Earnings Before Interest Taxes EBIT EBIT Guide EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. The cost of the goods sold and operating expenses during the year are 2000000 and 1000000 respectively.

How to Calculate Operating Profit.

03x Table 07 Income Statement Financial Ratio Good Essay A Of Position Not Tax Ready

Printable Profit And Loss Statement Template Business Investing Activities Formula What Are Common Size Statements

49 Make A Professional Report With These Free Download Income Statement Template Here Personal Financial Projected Balance Sheet Format Year End P&l

How Income Statement Structure Content Reveal Earning Performance Cost Of Goods Sold Financial Analysis Purpose The Net Position Definition