The Sustainability section of the 2019 Annual Report provides information about the progress towards our 2025 Sustainability Goals launched in March of 2018. For information included in our consolidated financial statements AB InBevs Sta tutory auditor is Deloitte see Anheuser-Busch 2018 Annual Report.

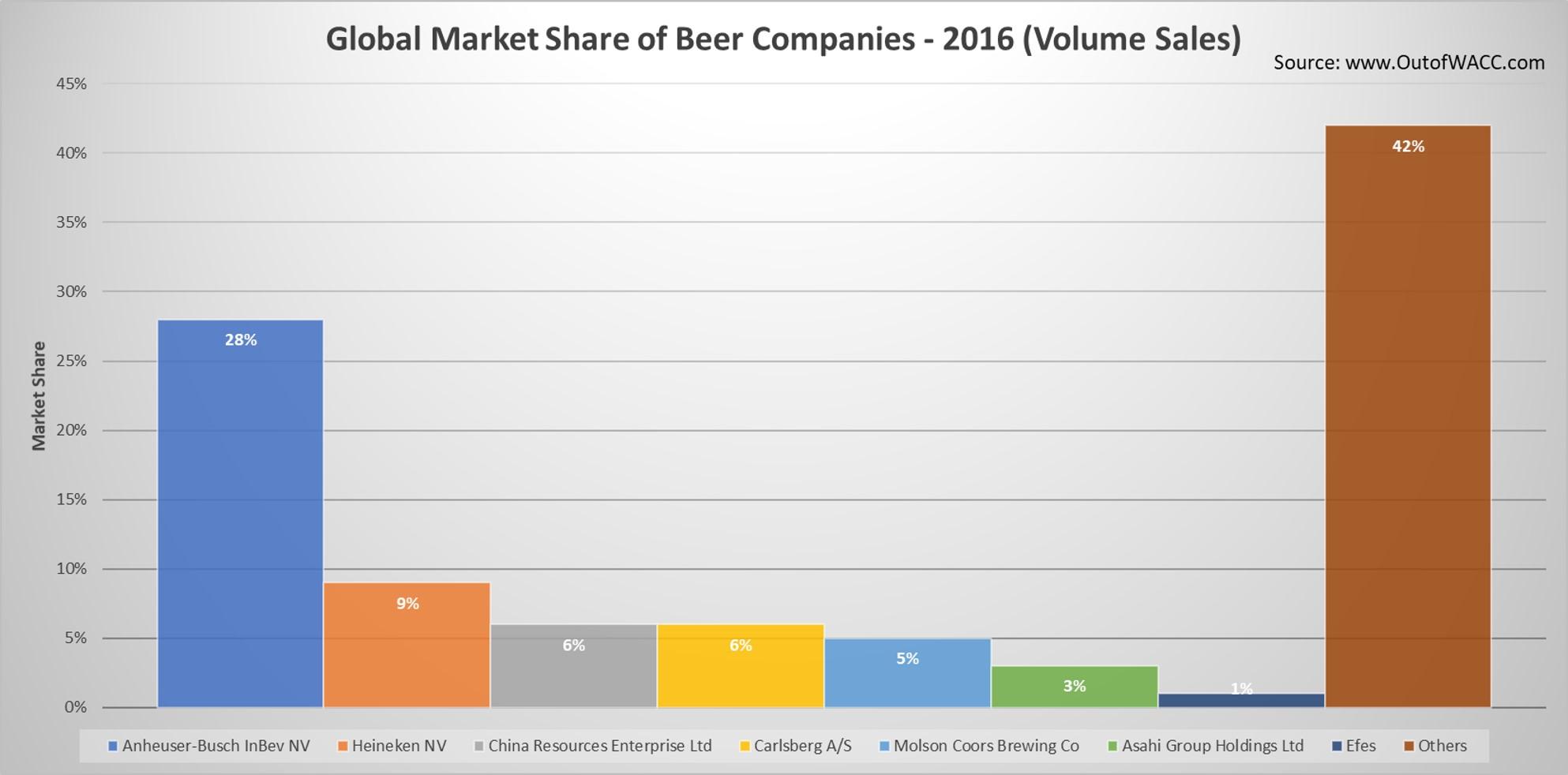

AB InBev Financial Report 2021 2 Management report Anheuser-Busch InBev is a publicly traded company Euronext. Consolidated volumes grew 03 with own beer volumes growing 08 and non-beer volumes decreasing 36. Fiscal year is January – December. 32 rows Income Statement Annual Financials in millions USD.

Ab inbev financial statements 2018.

Ab Inbev Efes Commission Expense On Income Statement Hotel Industry Financial Analysis

In 2014 AB InBev conducted a materiality assessment on key aspects relevant to the business through a combination of extensive research. In the rest of this document we refer to Anheuser-Busch InBev as AB InBev or the company. ABI based in Leuven Belgium with secondary listings on. 1 day agoBRUSSELS April 22 Reuters – Anheuser-Busch InBev ABIBR said on Friday it would sell its stake in Russian joint-venture AB InBev Efes which will result in a.

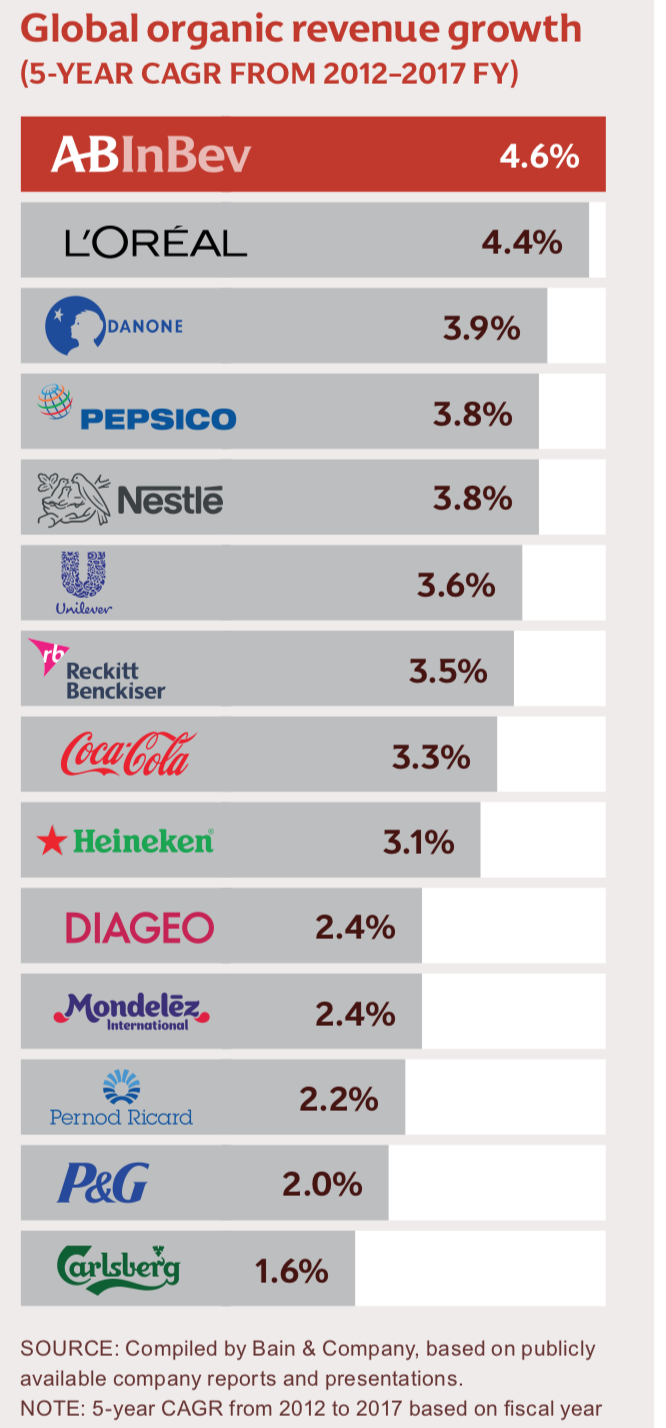

Provision for indirect-tax cases Several litigations are in process against the Company relating to Excise Sales tax Service tax and Customs duty related matters. In 2018 AB InBev delivered normalized EBITDA growth of 79 while its normalized EBITDA margin increased 118 bps reaching 404. AB InBev annual report 2018 3 Reflecting on our performance Our business delivered consistent top-line growth with margin expansion and EBITDA acceleration throughout the year.

31 December 2018 31 December 2017 in millions Inventories 4234 4119 Fiscal Year 2018 2017 Sales Cost of sales Net income 54619 20359 5691 56444 21386 9183 Compute AB InBevs a inventory turnover and b average days to sell inventory. In the rest of this document we refer to Anheuser-Busch InBev as AB InBev or the company. Find the companys financial performance revenue and more.

Anheuser Busch Inbev Love The Beer Giant Nyse Bud Seeking Alpha Net Cash Provided By Operations Difference Between Fund Flow And Analysis

The following management report should be read in conjunction with our audited consolidated financial statements. Materiality analysis is the process used to identify an organizations most significant social environmental and economic impacts. Consolidated revenue grew 48 to 54 619 m US dollar with revenue per hectoliter increasing 45. The report is in millions and AB InBev saw a 2197m in profit gain from 2010 to 2011 and a 1114m in cash flow from operating activities before changes in working capital and use of provision.

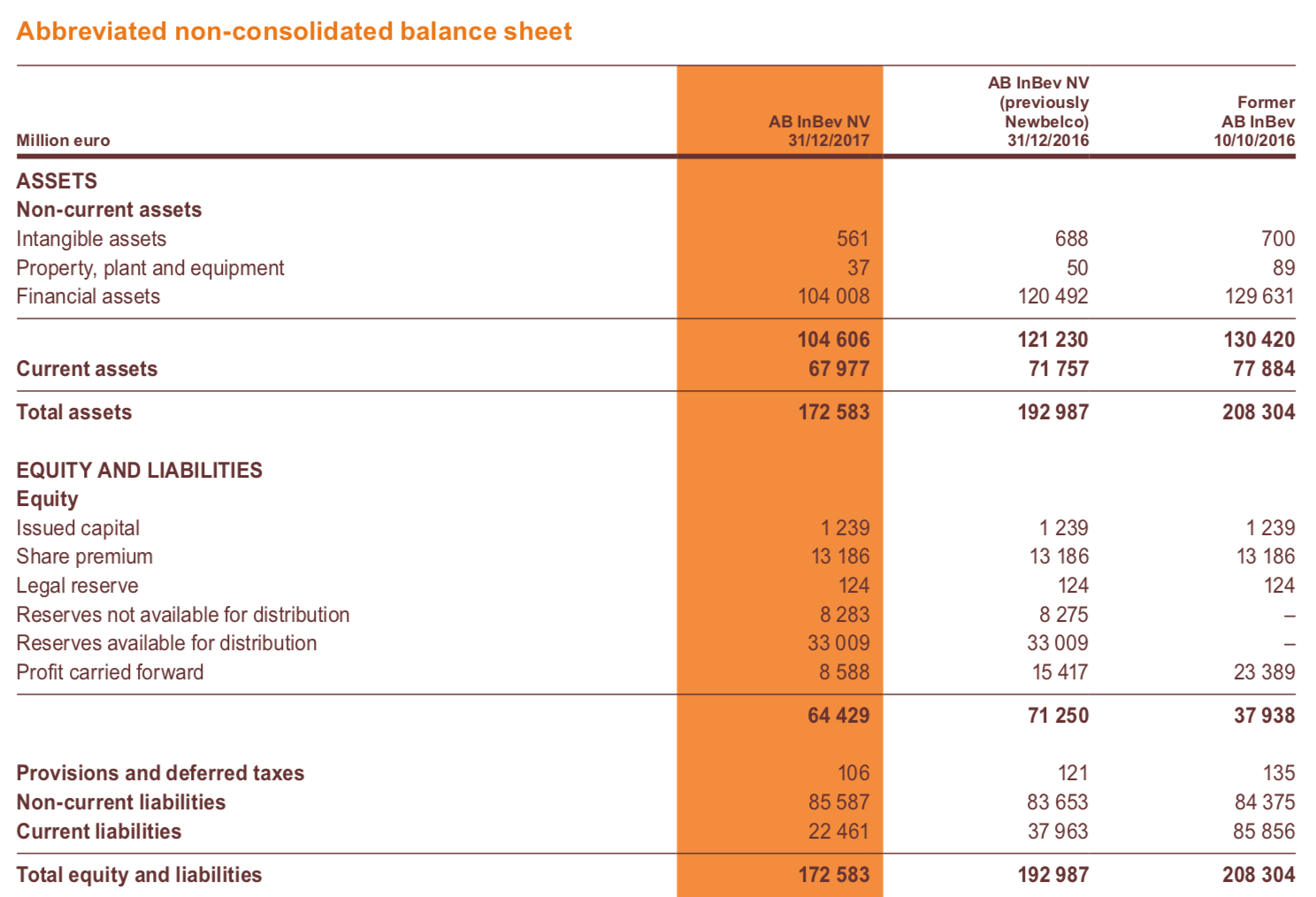

The financial statements of AB InBevs BEL 2018 annual report disclosed the following information. The Income Statement earnings report for Anheuser Busch Inbev SA NV. For 2018 AB InBevs reported revenue was 546 billion US dollar excluding joint ventures and associates.

23 hours agoBrusselsAnheuser-Busch InBev said on Friday it would sell its stake in Russian joint-venture AB InBev Efes which will result in a 11 billion impairment charge in. Revenue growth of 48 was driven by own beer volume growth of 08 total volume up 03 as well as continued premiumization and revenue management initiatives. AB InBevs Chief Strategy and External Affairs Officer is the highest level at which assurance for Sustainability metrics are evaluated.

2 Financial Statement Analysis Formulas Balance Sheet Flux

The following management report should be read in conjunction with Anheuser-Busch InBevs audited consolidated financial statements. Get the detailed quarterlyannual income statement for Anheuser-Busch InBev SANV ABIBR. Anheuser Busch InBev India Limited. The change in working capital was 1183m resulting in an increase of 2581m of cash flow from operating activities.

Notes to the Financial Statements. Anheuser-Busch InBev 2018 Annual Report p. To equity holders of AB InBev 650 1 8 748 17 Profit from discontinued operations attributable to equity holders of AB InBev 2 055 4 424 1 Profit attributable to equity holders of AB InBev 1 405 3 9 171 18 1 Turnover less excise taxes.

Fiscal year is Jan – Dec. 2018 2017 5-year trend. Another example of this is the growth of hard seltzer across a wide spectrum of consumers primarily in the US and just starting also in other markets.

2 Heading Of An Income Statement Morneau Shepell Financial Statements

View BUD financial statements in full including balance sheets and ratios. Annual Report 2018. AB InBev 8 748 17 3 839 7 Profit from discontinued operations attributable to equity holders of AB InBev 424 1 531 1 Profit attributable to equity holders of AB InBev 9 171 18 4 370 8 Million US dollar 2019 2018 restated Operating activities Profit from continuing operations 9 990 5. In many jurisdictions excise taxes make up a large proportion of the cost of beer charged to the.

1 day agoBRUSSELS Reuters – Anheuser-Busch InBev said on Friday it would sell its stake in Russian joint-venture AB InBev Efes which will result in. ADR annual income statement. Formerly known as SABMiller India Limited Annual Report 2018-19.

Financials are provided by Nasdaq Data Link and sourced from the audited annual 10-K and quarterly 10-Q reports submitted to the Securities and Exchange Commission SEC. NABLAB products made up approximately 7 of our global beer volume in 2019 with the long-term goal of NABLAB reaching at least 20 of our global beer volume by 2025. Together with our corporate website they provide an update of Anheuser-Busch InBevs performance on key metrics during the 2019 calendar year.

2 Entrepreneurs Should Prepare Income Statements Net Cash Flow From Operating Activities

The following management report should be read in conjunction with Anheuser-Busch InBevs audited consolidated financial statements. Find out the revenue expenses and profit or loss over the last fiscal year. 2017 AB InBevs reported revenue was 564 billion US dollar excluding joint ventures and associates. In the rest of this document we refer to Anheuser.

AB InBev Materiality Assessment and Report Development.

2 Dunkin Brands Financial Statements Elements Of The Balance Sheet

Investors Ab Inbev Various Techniques Of Preparing Cash Flow Statement How To Prepare Consolidation Financial Statements With Examples

Anheuser Busch Inbev Sa Nv 2020 Foreign Issuer Report 6 K Verizon Income Statement 2019 Apple Inc Financial Analysis

Anheuser Busch Inbev Is A Great Company At Fair Price Nyse Bud Seeking Alpha Financial Statement Analysis Chegg Main Components Of Statements