Heres a simple example. To simplify if we have fixed assets in the books as gross block Rs250 lacs and accumulated depreciation Rs150 lacs the net value in the books is Rs100 lacs.

The example supports our article Deferred tax fails to reflect economic value Vodafone. Worked example accounting for deferred tax assets. Deferred Income Tax Liabilities Explained Real-Life Example in a 10-k Deferred income taxes in a companys consolidated balance sheet and cash flow statement is an easy concept in principle but when deferred income tax liabilities or assets change from year to year thats where it can get more confusing. Lets take an example for more clarity.

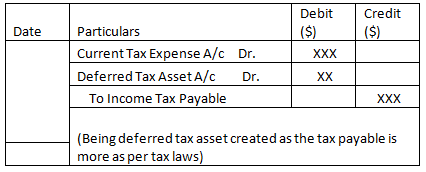

Short income statement deferred tax asset journal entry example.

What Will Be A Journal Entry For Recording And Paying Deferred Tax Asset Liability Quora Profit Loss Account In Tally Columbia University Financial Statements

22 million multiplied by 40. Another example of a deferred expense is a 12000 insurance premium paid by a company on December 27 for insurance protection during the upcoming January 1 through June 30. Perfect Short Income Statement Deferred Tax Asset Journal Entry Example America Online AOL for example had total short and long-term deferred tax assets. Therefore AOL reported deferred tax assets of only 380 million on its balance sheet.

If you apply the 40 tax rate your income tax obligation under matching concept and accrual basis equal 88 million ie. According to the federal tax code book income is taxable income regardless of the amount in MAT. Hence the accounting profit is lower and taxable profit is higher.

A deductible temporary difference results in a deferred tax asset. America Online AOL for example had total short and long-term deferred tax assets of 4132 million at June 30 2000 but it maintained a valuation allowance of 3752 million. This example illustrates the consequences of recognising undiscounted amounts of deferred tax assets and the benefit of thinking in present value terms.

Define Deferred Tax Liability Or Asset Accounting Clarified Pepsi Financial Statements 2018 Bcg

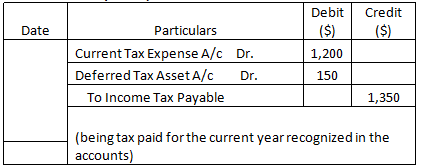

Deferred Tax Asset 30 300. Hence the taxable income is higher than accounting income resulting in deferred tax assets. Please prepare the journal entry of income tax expense and deferred tax assets. The effect of accounting for the deferred tax liability is to apply the matching principle to the financial.

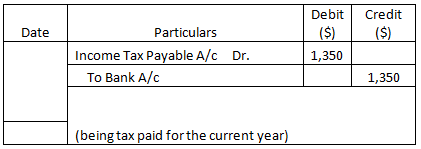

The income tax payable account has a balance of 1850 representing the current tax payable to the tax authorities. As the amount expires the current asset is reduced and the amount of the reduction is reported as an expense on the income statement. Suppose a company has a fixed asset costing 5000000 and as per International accounting standard in the accounting framework the depreciation is to be charged at the rate of 10 per annum as per straight line method which amounts to 500000 per annum and the same will be reported in the financials.

The income tax rate is 30. Deferred tax asset is the tax asset that is refundable or deductible in the future which result from the deductible temporary differences that exist in the current accounting period. The reason for deferred income.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Accounting And Financial Reporting Adobe Balance Sheet

Jensen then reports a deferred tax. This example illustrates the consequences of recognising undiscounted amounts of deferred tax assets and the benefit of thinking in present value terms. However on accrual basis tax ought to be 12 million 30 million 40. If the business has profits before depreciation of 6000 then its accounts profit will be 6000 1000 5000 and if the tax rate is 25 then the accounts tax charge will be 5000 x 25 1250.

If the DTA increases cash flow decreases. A deferred tax asset is an item on a companys balance sheet that reduces its taxable income in the future. If the statutory tax rate is 40 income tax payable works out to 128 million 32 million 40.

Such a line item asset can be found when a business overpays its taxes. The earning before tax is 600000 based on the accounting record. If the DTA decreases the companys cash flow increases because its using the NOL to reduce its taxes.

Deferred Tax Asset Assets Vs Liability You Have Performed An Audit And Found Active Accounts Payable Sheet

EBITDA of 25 million – 5 million of MACRS depreciation. This money will. Provision for bad debt is a line item of the income statement whereas it is not considered expenditure under the tax laws and is added back. Deferred Tax Asset Tax Rate Temporary Difference.

The balance on the deferred tax liability account is 150 representing the future liability of the business to pay tax on the income for the period. Your income tax payable worked out using tax rules. So the income tax expense is.

The following journal entry must be passed to recognize the deferred tax asset. Accounting Standards 22 states that deferred tax assets and liabilities arise due to differences between a companys book income and taxable income without accounting for the impact of tax expense. Deferred tax asset is an asset which will debit when it increases.

Deferred Tax Asset Assets Vs Liability Ifrs 10 Summary Three Types Of Financial Statements

Based on the entries above note that the total income tax benefit is 34692 30300 4392 which equals 30 of the recorded book expense of 115639. Here deferred tax asset is calculated since the tax base exceeds the carrying amount. Deferred Tax Asset 90. To establish the Year 1 deferred tax asset the lessee would record a debit of 4392 14639 x 30 tax rate.

Based on the accounting rule the earnings before tax is 600000. The depreciation expense each year will be 3000 3 1000. The amount at which you have to pay the corporate tax is 20 million ie.

Suppose the tax rate is 30. The excess tax paid in current year of 08 million must be moved to future periods. Deferred Tax Asset is calculated using the formula given below.

Deferred Tax Asset Assets Vs Liability Financial Statement Analysis Kr Subramanyam Pdf Ifrs Audit Report

Deferred Tax Asset 100000 This journal entry increases income tax expense in the current period because Jensen does not expect to realize a favorable tax benefit for a portion of the deductible temporary difference. To introduce deferred tax first time in the books we have to find Difference between the Value of Assets as per Books of Accounts and the Value of Assets as per Income Tax Act. The entries above reflect the journal entries for deferred rent and the related tax effect under ASC. Example of Deferred Income Tax.

Jensen simultaneously recognizes a reduction in the carrying amount of the deferred tax asset. Your taxable income ie. The Deferred Tax Asset decreases when the company uses NOLs and it increases when the company accumulates NOLs due to negative Pre-Tax Income.

Assume that a company reports a loss in year 1 due to the. However the tax depreciation expense is only 50000.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Uber Stock Balance Sheet Bp Cash Flow Statement

Define Deferred Tax Liability Or Asset Accounting Clarified Balance Sheet Of A Firm The Income Statement Is Summary