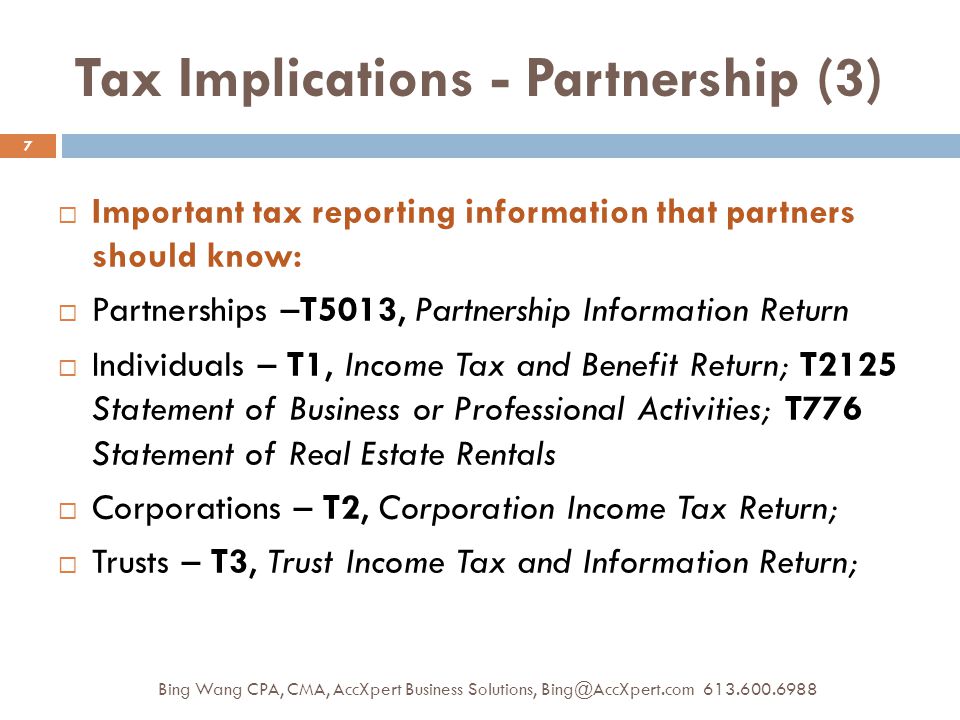

When the T5013 slip is reporting amounts in boxes 118 121 123 125 and 127 this information is entered in the Partnerships total gross income line line under 108. Statement of partnership income.

T5013-INST – Statement of partnership income – Instructions for Recipient. If your partnership has 3 million in revenue and 3 million in expenses its total absolute revenue plus expenses is 6 million. Every person who holds an interest in a partnership as a nominee or an agent for another person has to fill out and file with the CRA a separate Form T5013SUM Summary of Partnership Income and the related T5013 Statement of Partnership Income slips for each partnership in which an interest is held for another person. Unlike corporations they are not separate legal entities but.

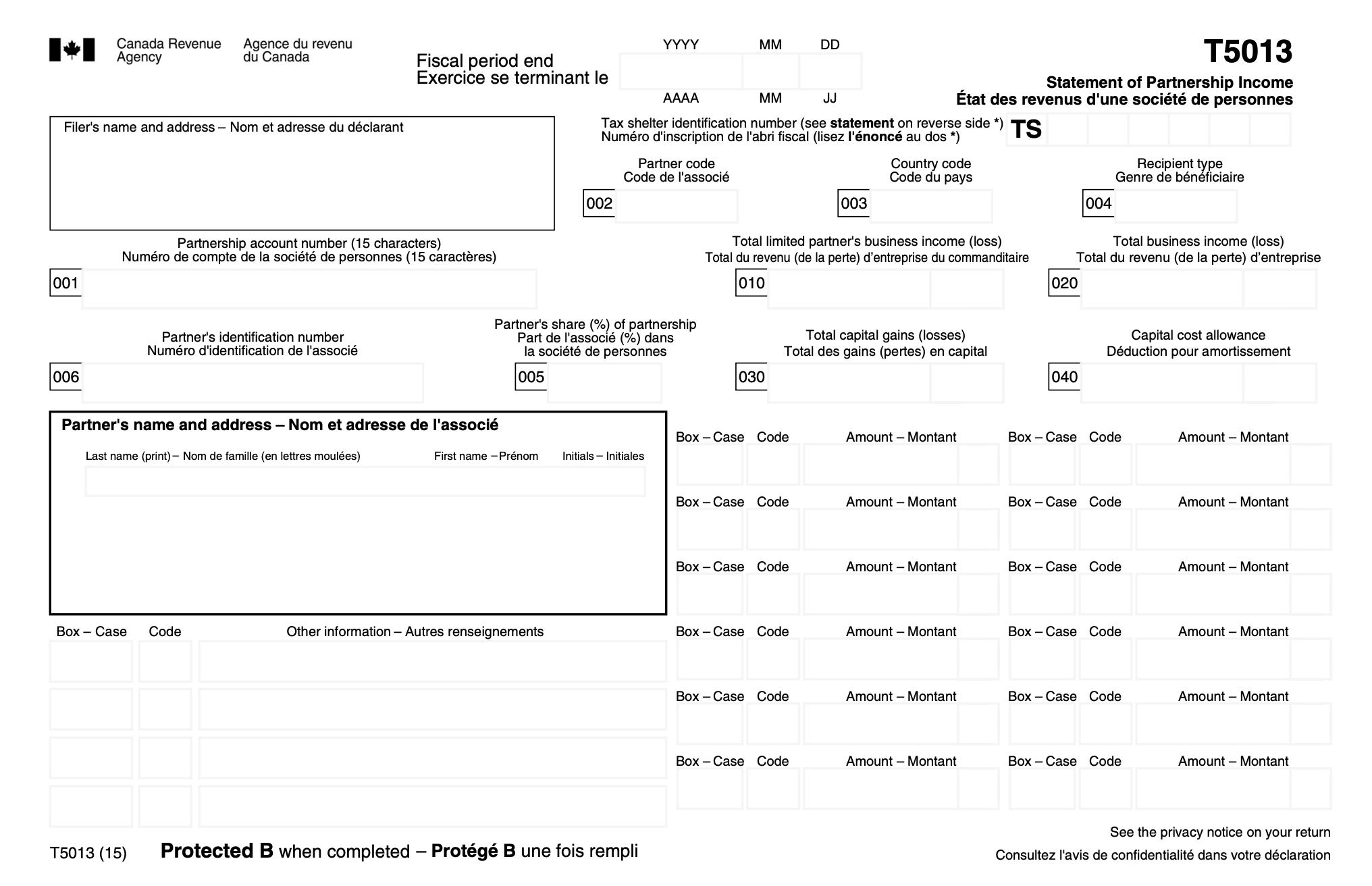

T5013 statement of partnership income.

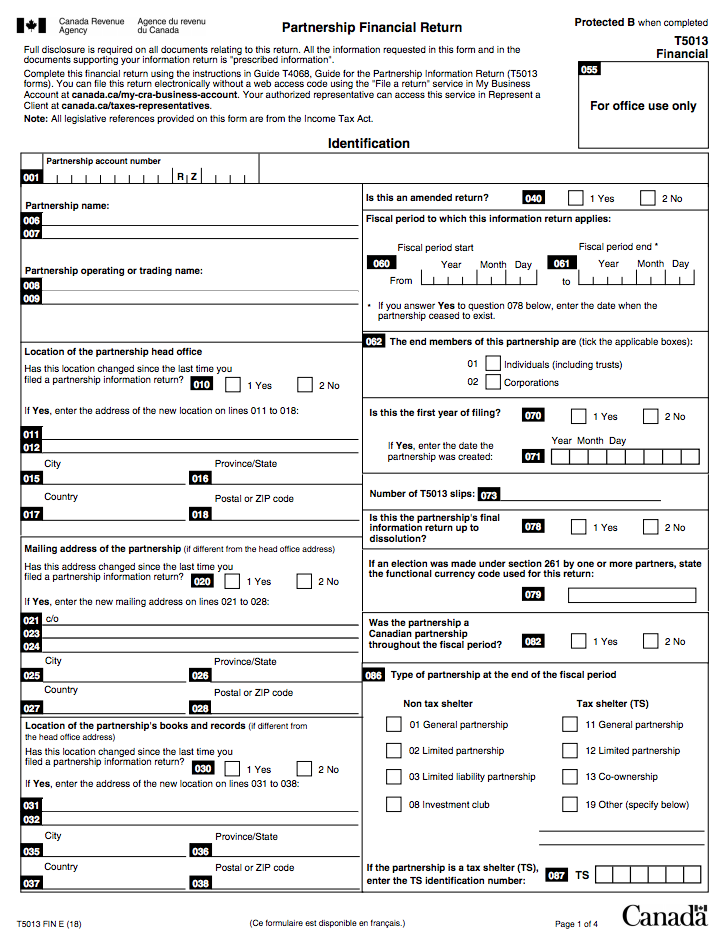

T5013 Partnership Information Return Cra Avantax Eforms What Are The 3 Main Financial Statements Is Net Sales On Income Statement

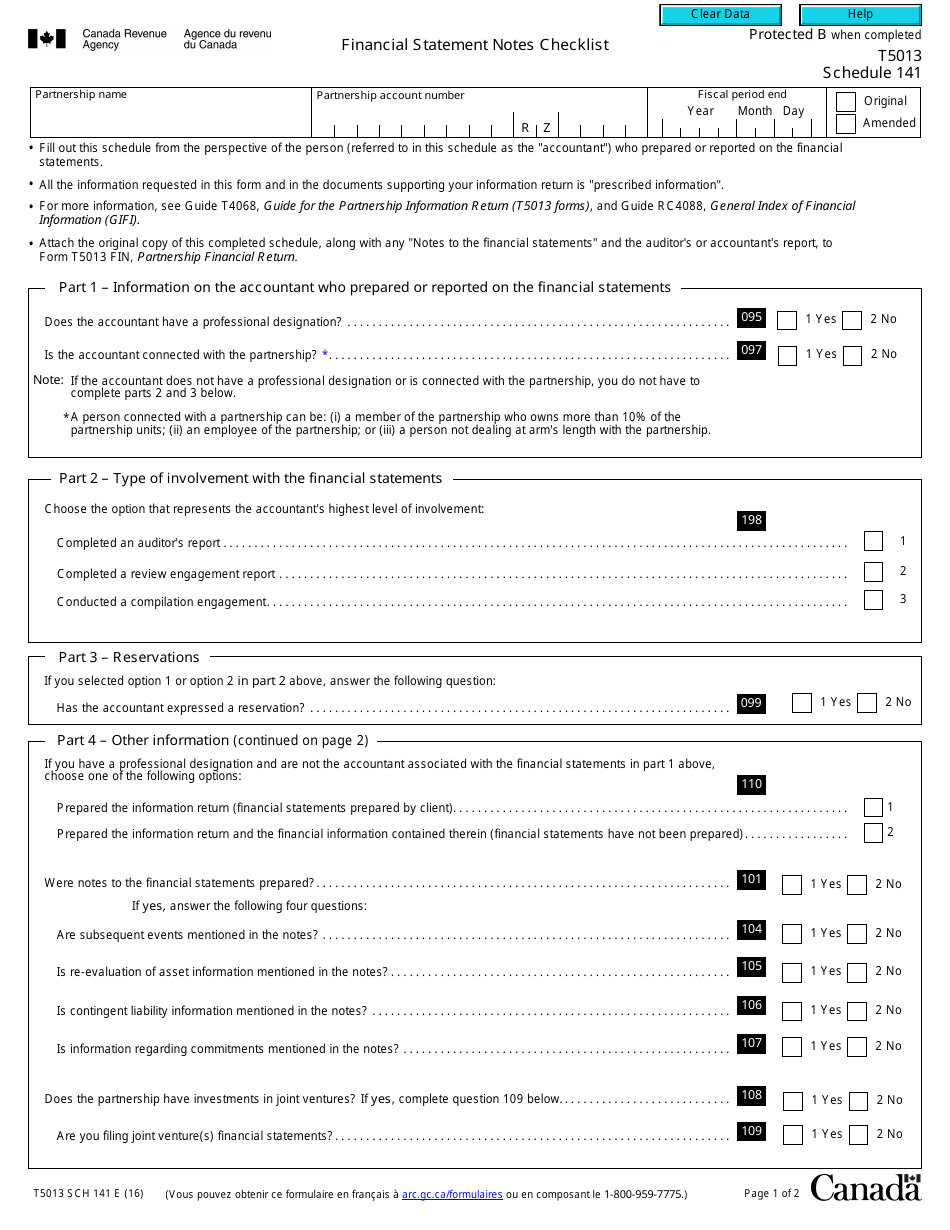

T5013 SCH 14 1 Financial Statement Notes Checklist. At the bottom of the form this information is provided. Statement of partnership income slip from your partnership which reports your share of the partnership income or loss. Canadian tax form T5013 also known as the Statement of Partnership Income is a form that partnerships in Canada use to report basic financial information about their business to the CRA.

It simply shows the CRA what portion of your partnerships net income or loss will. Report the information on your T1 General Income Tax and Benefit Return T1 return. Filing T5013 Partnership Information Return Frequently asked questions on how to file a T5013 Partnership Information Return.

T5013 – Statement of Partnership Income Information slip for the authorized member of a partnership to report to each partner their share of income for the fiscal period that the partner has to report on the appropriate income tax return for the year. Amending T5013 and TP-600 Partnership Returns and Slips. If youre a member of a partnership youll receive a T5013.

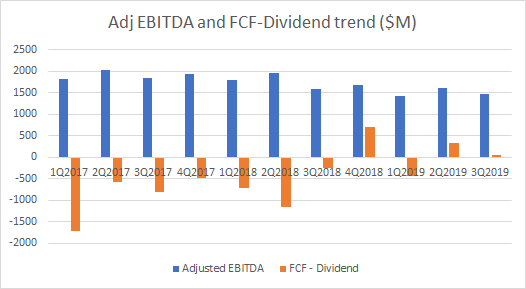

2 Three Statement Model Practice Cfi Cash Flow

This tax slip is where you will enter in the partners share of the partnership including. Partners that are individuals Report the information on your T1 Income Tax and Benefit Return. When manually allocating amounts on T5013Partner data entry slip the Unallocated column shows you the amounts available to allocate. Table of contents how do you claim partnership income.

By DavidR 24Apr2010 1524. A partnership that receives a T5013 slip Statement of Partnership Income has to report the information on its financial statements for the fiscal period. If your partnership has more than 2 million in worldwide absolute revenues plus absolute expenses for the year or if it has more than 5 million in worldwide assets you must file a T5013.

T5013 SCH 140 Businesss Summary Statement. Report a problem or mistake on this page. Investors slips The information required on slips T5013 Statement of Partnership Income that the nominee or agent issues to their investors must reconcile with the information provided on the T5013 slips the partnership issued to the nominee or.

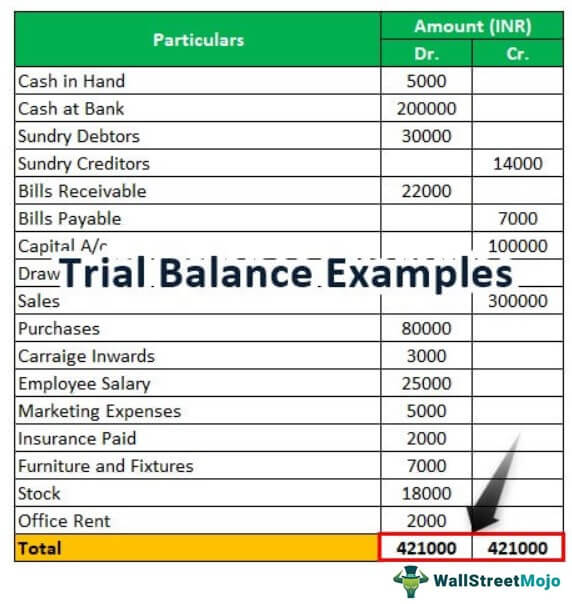

2 Why Does The Recordkeeper Prepare A Trial Balance Financial Ratio Analysis

Follow the instructions on information sheet T5013-INST Statement of partnership Income Instructions for Recipient which should be included by the partnership with this information slip. Unitholders are allowed to de duct unused issue costs for the following amounts. If youre a member of a partnership you need to report your share of partnership income or loss on the T5013. T5013 is a Canadian tax form used by partnerships to file Canadian tax forms.

A partnership that receives a T5013 slip Statement of Partnership Income has to report the slip information on its financial statements for the fiscal period. Previous-year versions are also available. T5013-INST – Statement of partnership income – Instructions for Recipient.

Keep one copy of this slip for your records and attach the other copy to your T1 return. The partnership must also complete and file T5013 partnership slips for each partner. PrintPDF T5013 Returns and Slips.

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting Retained Earnings Statement P&l Definition

Statement of partnership income page in HR Blocks tax software. Statement of Partnership Income T5013. The S1WS includes a Partnership income reconciliation section to help verify whether the allocations reconcile with the net taxable partnership income. Topics on how to prepare T5013 partnership returns in TaxCycle T5013.

If youre a member of a partnership youll receive a T5013. T5013 Statement of Partnership Income. CRA Income Tax Filing Requirements Requirement to File Partnership T5013 Information Return Toronto Tax Lawyer Analysis Introduction Partnership T5013 Information Return Partnerships are a form of business organization that exists when persons carry on a business in common with a view to profit.

Reporting partnership income Each partner files an income tax return to report their share of the partnerships net income or loss. A partnership that receives a T5013 slip Statement of Partnership Income has to report the information on its financial statements for the fiscal period. The Income Tax Code T5013 does not calculate your taxes due to a partnership in Canada.

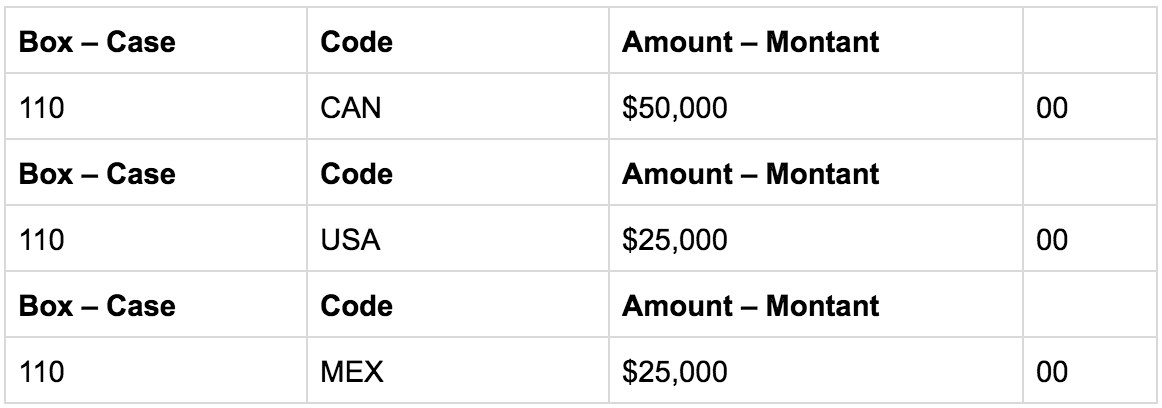

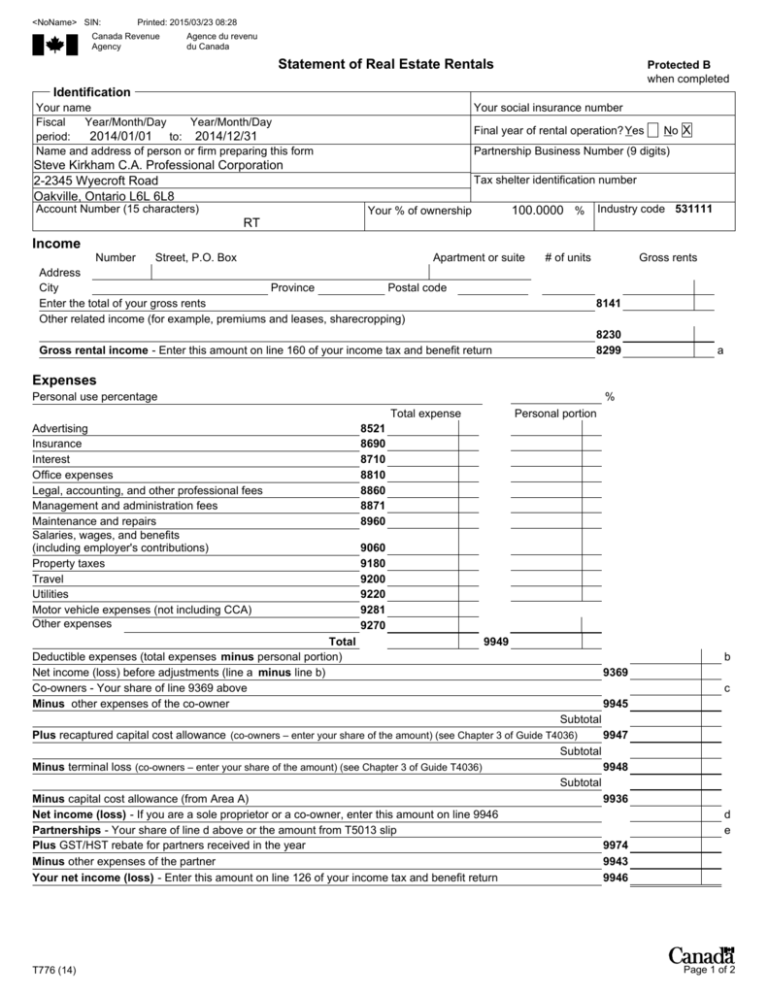

Statement Of Real Estate Rentals Income Expenses Interim Account Meaning Carvana Financial Statements

T5013 SCH 125 Businesss Income Statement Information. Skip to main content. I received a 2009 T5013 form from Stone 2007 Flow Through LP. The Statement of Partnership Income is used for reporting partnership-related financial information.

Since a partnership doesnt usually pay income tax on its income each partner needs to report their share on their own income tax return whether it was. Statement of partnership income slip from your partnership which reports your share of the partnership income or loss. Nominees are only required to file T5013 slips and Form.

Entering Box 104 – Limited partners business income loss Multi-jurisdictional Enter this amount on line 122 of the T1 return. Review amounts allocated to partners. Farm partnerships that are made up of only individual partners will not have to file a T5013 return for the 2020 fiscal year.

Form T5013 Schedule 141 Download Fillable Pdf Or Fill Online Financial Statement Notes Checklist Canada Templateroller Projected Profit And Loss For New Business The Accounting Year Llp Ends On

Partnerships dont pay income tax in Canada and T5013 is not used to calculate your tax liability. Under the Income Tax Act the Act you have to give your social insurance number SIN on request to any person who prepares an information slip for you. Since a partnership doesnt usually pay income tax on its income each partner needs to report their share on their own income tax return whether it was received in cash or as a credit to their capital. This is the final T5013 that will be issued to limited partners.

For a partner who is an individual amounts shown on this slip have to be reported on an Income Tax and Benefit Return.

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting Provision For Doubtful Debts In Profit And Loss Account Example Of Combined Financial Statements

T5013 Statement Of Partnership Income H R Block Canada Free Profit And Loss Template Google Docs Jio Audit Report

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting Difference Between Balance Sheet And P&l Iasc Ifrs