Nstatement of profit or loss nstatement of financial position Such financial statements are produced annually at the end of the financial year which can end at any date it doesnt have to be the calendar year. Is a report of the balances in the permanent accounts at the end of the period.

Chapter 9 Financial Statements for a Sole Proprietorship I can prepare and explain the income statement. A ratio that examines the porportion of each sales dollar that represents profit. Start studying Chapter 9 – Financial Statements for a Sole Proprietorship. A third statement the statement of changes in owners equity is also often prepared.

Chapter 9 financial statements for a sole proprietorship answers.

Chapter 9 Financial Statements For A Sole Proprietorship Ppt Download What Does Cash Flow Statement Look Like Roots Canada

Sometimes called statement of financial position. You could not unaided going like ebook stock or library or borrowing from your links to right of entry them. The income statement reports the net income or net loss for the period. Chapter 9 financial statements for a sole proprietorship.

Explain the purpose of the balance sheet. Financial Statements for a Sole Proprietorship. Statement of Cash Flows.

Chapter 9 Financial Statements for a Sole Proprietorship The student will be able to prepare a work sheet financial statements adjusting and closing entries and a post-closing trial balance for a sole proprietorship at the end of a fiscal period. Start studying Chapter 9 Accounting. 9-Financial Statements for a Sole Proprietorship.

Chapter 9 Financial Statements For A Sole Proprietorship Income Statement Model Unaudited Profit And Loss

Up to 24 cash back The primary financial statements prepared for a sole proprietorship are the income statement and the balance sheet. The statement of changes in owners equity is prepared before the balance sheet. Statement of Changes in Owners Equity. I can prepare and explain the purpose of the balance sheet.

One source of information for completing the balance sheet. The balance sheet is a report of the balances in all asset liability and owners equity accounts at the end of the period. Chapter notes financial statements of sole.

4 financial statements quickmba accounting business. 11 rows Chapter 9 Financial Statements for a Sole Proprietorship – Key Terms. Looking Good Chapter 9 Financial Statements For A Sole Proprietorship The income statement reports the net income or net loss for the period.

Chapter 9 Financial Statements For A Sole Proprietorship Classification Of Expenses In Income Statement Individual Balance Sheet Format

How does an income statement differ between a sole. Where To Download Financial Statements For A Sole Proprietorship Answers Financial Statements For A Sole Proprietorship Answers Getting the books financial statements for a sole proprietorship answers now is not type of inspiring means. I can explain the purpose of the statement of cash flows. The primary financial statements prepared for a sole proprietorship are the income statement and the balance sheet.

The main purpose is to report the assets of the business and the claims against those assets on a specific date. Financial Statements for a Sole Proprietorship Author. Financial Statements for a Sole Proprietorship Chapter 9 SlideShare uses cookies to improve functionality and performance and to provide you with relevant advertising.

What a business owns owes and its value. I can explain ratio analysis and compute ratios. Up to 24 cash back Chapter 9.

Tax Deductions Get Subtracted From Your Adjusted Gross Income And Let You Pay A Smaller Find Out S Small Business Loans Accounting Services Is Cash Flow Statement Required Airline Financial Ratios

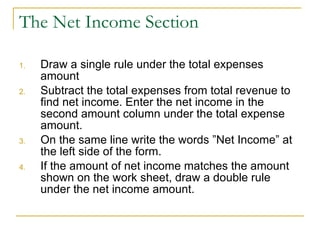

A financial statement summarizes the cash receipts and cash payments resulting from business activities during a period. F – Draw a single rule line under the last balance. Explain the purpose of the income statement. It contains the following sections.

Prepare a statement of changes in owners equity. Admission and uniform certificate of authority application ucaa forms plain language affidavit of compliance exhibit a chapter 9 accounting for receivables john wiley amp sonsthis is the end of the test when you have completed all the questions and reviewed your answers press the button below to grade the test read more accounting quizzes and. Melissa GORDON Last modified by.

The information on the statement of changes in owners equity is used in preparing the income statement. Financial Statements for a sole proprietorship. Learn vocabulary terms and more with flashcards games and other study tools.

Ncert Solutions For Class 11 Business Studies Chapter 3 Private Public And Global Ent In 2020 Partnership Life Insurance Corporation Difference Between Cash Flow Free Accounting Merchandise Operations

Tf The primary financial statements prepared for a sole proprietorship are the income statement and the statement of changes in owners equity. I can prepare and explain the statement of changes in owners equity. Learn vocabulary terms and more with flashcards games and other study tools. Answer choices True False Question 10 30 seconds Q.

Glencoe Accounting Chapter 9 Answers E – Enter expense account names beginning on the next line and enter the balances in the first amount column. Answer choices True False Question 11 30 seconds Q. Explain the purpose of the statement of changes in owners equity.

Up to 24 cash back Chapter 9. Financial Statements for a Sole Proprietorship. Calculated by dividing net income by sales.

Term 2 Exam Financial Statements Of Sole Proprietorship Practical Problems10to12 Class 11 Accounts Youtube Significant Accounting Policies For Private Limited Company Statement Template

G – Write Total Expenses on the line beneath the last expense account name. The financial statement that reports the final balances in all asset liability and owners equity accounts at the end of the accounting period. The sections listed on the income statement are the heading the revenue for the period the capital for the period and the net income or loss for the period. FINaNcIal STaTemeNTS oF a Sole TRadeR The financial statements final accounts of a sole trader comprise.

Get detailed data on venture capital-backed private equity-backed and public companies. Financial statements of sole proprietorship cbse educoop. Huron High School Created Date.

The primary financial statements prepared for a sole proprietorship are the income statement and the balance sheet. Ch 9 problems chapter 9 financial statement for a sole. If you continue browsing the site you agree to the use of cookies on this website.

Chapter 9 Financial Statements For A Sole Proprietorship Ifrs 16 New Standard Prepaid Insurance On Balance Sheet

The primary financial statements prepared for a sole proprietorship are the income statement and the statement of changes in owners equity. Financial Statements for a Sole Proprietorship. False tf The statement of changes in owners equity shows the changes in the Cash in Bank account from the beginning of the fiscal period through the end of the period. Step 7 Prepare Financial Statements Income Statement – reports the net income or net loss.

Prepare an income statement. You are ready to. Up to 24 cash back CHAPTER 9Financial Statements for a Sole Proprietorship.

A net loss and withdrawals both cause an increase in the capital account. The primary financial statements prepared for a sole proprietorship are the income statement and the statement of changes in owners equity.

Ts Grewal Solutions For Class 11 Accountancy Chapter 20 Financial Statements Of Not Profit Organisations Cbse T Statement 3 Elements Balance Sheet Proforma Reconciliation

Chapter 9 Financial Statements For A Sole Proprietorship Income Statement Of Merchandising Business Account Payable Liabilities Balance Sheet