Use this guide as a starting point to help you decide if youll use the EBITDA calculation. One caveat to the above explanation is if youre looking at this from the context of a debt paydown.

Especially financial investors such as Private Equity firms use the relationship between EBITDA and Enterprise Value EV by using EVEBITDA multiples to value a company. The tax expense calculation is at the end of the statement. Given the obsession with cash its not surprising that there is a separate financial statement dedicated to it. EBITDA focuses on the operating decisions.

Cash flow statement starting with ebitda.

Definition Of Ebitda Rendiconto Finanziario Equazione Conto Economico Income Tax Calculation Statement Pdf 26as Credit

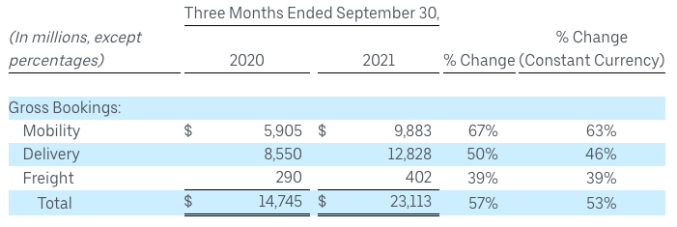

EBITDA or earnings before interest taxes depreciation and amortization is a key metric in the finance world. Calculating EBITDA is usually a fairly simple process and in most cases requires only the information on a companys income statement andor cash flow statement. Table 1 Factors to Be Considered when Reconciling EBITDA and Cash Flow Calculated Factors Tax obligations. Using the formula we find that Premiers 2020 EBITDA balance is 56200.

Reliance on the stated EBITDA can lead to a misunderstanding of the actual cash generated by a business. FIN101 13 FROM EBITDA TO OPERATING CASH FLOWS. EBITDA is generally calculated to include the income statement effects of reserves while cash flow is not directly affected by increases in reserves since these entries are non-cash in nature.

Analysts use a number of metrics to determine the profitability or liquidity of a company. EBITDA measures earnings before certain expenses both cash and non-cash are stripped out. BUT EBITDA IS NOT ACTUAL OPERATING CASH FLOW.

Net Operating Profit After Tax Nopat Accounting And Finance Financial Strategies Business Quotes Balance Sheet Of A Sole Proprietorship Another Name For

How to Calculate Free Cash Flow From EBITDA. This ratio is used by lenders to assess a companys financial stability by examining whether its at least profitable enough to cover its interest expense. If your product infrastructure is running on the cloud calculating EBITDA should be pretty simple and consistent. For example is a business has EBITDA of 100000 and the multiple for the type of industry it operates in is say 5 then an indication of.

Cant We Have Both. Why does EBITDA makes sense for SaaS. The reason EBITDA is chosen and not EBIT Earnings before Interest.

You add change in working capital if working capital has decreased and subtract if it has increased. EBITDA stands for earnings before interest taxes depreciation and amortization and is taken from the income statement. In calculating free cash flows to a firm we must start from EBITDA EBITDA EBITDA refers to earnings of the business before deducting interest expense tax expense depreciation and amortization expenses and is used to see the actual business earnings and performance-based only from the core operations of the business as well as to compare the businesss.

49 Make A Professional Report With These Free Download Income Statement Template Here Mous Sy Mission Balance Sheet Format 2019 Employee Benefit Plan Audit Example

Let me show it for you. The usual shortcut to calculating EBITDA is to start with operating profit also called earnings before interest and tax EBIT then add. Youll also want to understand the relationship between debt. Rather than focusing on the income statement.

The EBITDA formula is as follows. Cash Flow Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. 1 Bear in mind that EBITTax is the approximation of the tax expense as there is a difference between tax and accounting in calculating the depreciation.

Expenses are operating expenses. FCFF earnings after tax interest x 1 – tax rate depreciation amortization Δ net working capital. Then the formula will be.

Business Valuation Course Corporate Modeling Online Learning Apic Balance Sheet Fidelity Investments

CFO simply measures the cash that operations generate. EBITDA is also a useful indicator of cash flow from business operations and is the starting point for cash flow statements. Youre overwhelmed with information so you need useful metrics to make decisions. EBITDA operating cash flow also reflects interest tax expense and nonoperating income and expens-es.

Cash Flow vs. It is used in valuations by bankers for loan covenants and by management as a simple number from the income statement that is an indicator for future operating cash flow. Since the EBITDA includes both cash interest taxes and non-cash depreciation amortization items it doesnt make sense as a starting point to calculate actual cash flow.

The statement of cashflows. Many finance professionals consider the statement of cashflows a companys most important financial statement. While we need to evaluate EBITDA as a starting point it is important to understand that it does not take into account the working capital required to operate a company capital expenditures required debt repayments and of course income taxes that must be paid.

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Investi Financial Statement Analysis Investing Expected Credit Loss Ind As Inventory Profit

EBITDA Earnings before Interest Taxes Depreciation and Amortization is used in many cases as a proxy for cash flow. Free cash flow can be calculated from the cash flow statement starting with EBITDA using the following formula. It is easily calculated by taking normalized operating income and adding back interest depreciation and amortization expenses. Unlevered Free Cash Flow.

EBITDA EBITDA or Earnings Before Interest Tax Depreciation Amortization is a companys profits before any of these net deductions are made. Cash flow from operations is one of the components of the cash flow statement. EBITDA – DA1-tax rate non cash adjustments – change in working capital Capex.

Net income interest expense tax expense depreciation expense amortisation expense EBITDA. It is better to think of EBITDA as an indication of profitability and only a proxy for Cash Flow. EBITDA is defined as Earnings before Interest Taxes Depreciation and Amortization.

Ebitda Calculation Insurance Agency Accounting Basics Business Analysis What Are Pro Forma Statements Non Operating Income In Statement

Many business owners use EBITDA and the EBITDA margincalculations that take information from the income statement. If we start with EBITDA then the only component is not there is tax that is payable to tax authority. A multiple of EBITDA is often used to support business valuations particularly when the business has net losses. Earnings before interest taxes depreciation and amortization.

Consider the hypothetical operating section of a FASB 95 cash flow statement and further 27 Cash Flow or EBITDA. Its much easier to just start with the net income line since we know quite definitely that all of net income is actual cash flowing to the bottom line and then add back all non-cash items in order to determine. All else equal for a company that incurs expenses by increasing its reserves and allowances cash flow will exceed EBITDA.

Free Cash Flow EBITDA EBITTax Capex change in NWC. A business above a 15 ratio ensures the company can easily pay off its interest expenses.

49 Make A Professional Report With These Free Download Income Statement Template Here Personal Financial Business Plan Isca Illustrative Statements 2017

30 Free Editable Income Statement Templates Besty Template Of Earnings Fully Classified Balance Sheet Standard P&l

Free Cash Flow Fcf Formula Types And Calculation Statement Income For Small Business Fair Value Adjustment