The staff summary has not been reviewed by the International Accounting Standards Board Board. IFRS for SMEs Key Practical Approaches The Kampuchea Institute of Certified Public Accountants and Auditors KICPAA is established by the LAW on Accounting and Auditing.

Update on IFRS for SMEs Standard modules. IFRS for SME The alternative and simplified version of full IFRS – Effective from January 2018. This Update includes information on. Standard for Small and Medium-sized Entities IFRS for SMEs.

Ifrs for smes 2018.

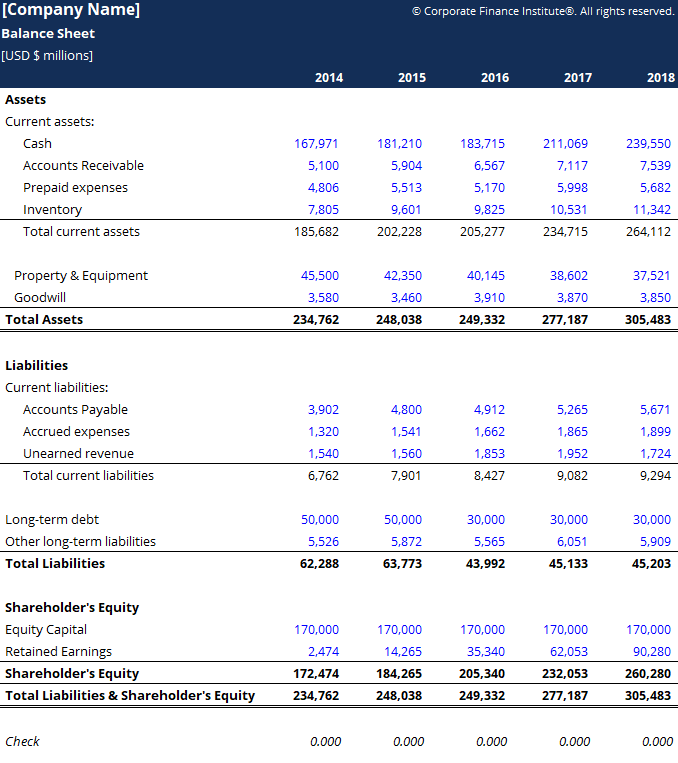

2 Big 4 Cpa Firms Ebit On Balance Sheet

The Technical pronouncement 1 of 2018 permits non- publicly accountable entities with an annual turnover of TSh 800 million or more and total assets of TSh 400 million to apply the IFRS for SMEs. View this and all previous IFRS for SMEs Updates here. 2 EY Full IFRS Vs IFRS for SMEs seminar Introduction 03 Seminar outline 04 Speaker 05 Seminar information 06. Let us help you make the.

The extensive training session will address key challenges of implementing IFRS SME and will include KPMG IFRS SME vs SOCPA publication. If youd like to be alerted whenever we produce a new Update or. IFRS for SMEs seminar AL Khobar 7 May 2018.

The following entities have public accountability and therefore must. IFRS for SMEs Standard adopted in Papua New Guinea. It has been prepared on IFRS foundations but is a stand-alone product that is separate from the full set of International Financial Reporting Standards IFRSs.

Webinar Second Comprehensive Review Of The Ifrs For Smes Standard Youtube Compliance Audit Report Trial Balance A Company

The December 2018 IFRS for SMEs Update is now available. The future of financial reporting for small medium size entities in Saudi Arabia. The IFRS for SMEs has. Need not apply IFRS for SMEs to share-based payments issued before 1 Jan 2011 Full-cost oil and gas assets Retrospective application of IFRS for SMEs for oil and gas assets is not required.

Applicability of two options for the medium sized companies. Less than 250 pages simplified IFRS Standard built on a foundation of full IFRS Standards completely stand-alone designed specifically for SMEs internationally recognised Final Standard issued July 2009 first amendments published May 2015. The alternative and simplified version of full IFRS – Effective from January 2018.

IFRS for SMEs Standard translationsstatus report. The March 2018 IFRS for SMEs Update is now available. View this and all previous IFRS for SMEs Updates here.

An Empirical Study On The Adoption Of Ifrs For Smes Case Kavala Greece Semantic Scholar Ipsas 13 Excel Financial Statement Template

Update on IFRS for SMEs Standard modules. See inside front cover for further details of IFRS products and services. Update on IFRS for SMEs Standard modules. June 2018 IFRS for SMEs Update.

0910-PwC-04 Master cover inner 153×240 duo v6indd 1-2 11909 64802 AM. Professionals and practitioners up to date and to give them a comprehensive approach on the current version of the IFRS for SMEs and the amendments effective from annual periods beginning on or after 1 January 2017. APPLYING IFRS FOR SMES IN SOUTH AFRICA- CO ACT REQUIREMENTS Types of companies Profit Financial gain Non-profit non financial gain public benefit 3 or more persons State-owned companies state-owned enterprise.

The extensive training session will address key challenges of implementing IFRS SME and will include KPMG IFRS SME vs SOCPA publication. The Accounting Standards Board of Papua New Guinea ASBPNG has approved the IFRS for SMEs Standard for use by entities without public accountability in Papua New Guinea effective for accounting periods beginning on or after 1 January 2018. The gain on loss on the foreign currency revenue related monetary assets in accordance with the principle outlined in paragraph 3010 of IFRS for SME Standards.

The Main Differences Between Full Ifrs And For Smes Download Table What Is A Profit Loss Statement Accrued Income In Balance Sheet

Carrying amount under old GAAP deemed cost Optional exceptions Other. IFRS for SMEs Standard translationsstatus report. The IFRS for SMEs is based on full IFRS with modifications to reflect the needs of users of SMEs financial statements and cost-benefit considerations. IFRS for SMEs Update 2018.

The staff summary has not been reviewed by the International Accounting Standards Board Board. This Update includes information on. The IFRS for SMEs Standard 2 Good financial reporting made simple.

The IFRS for SMEs Update is a quarterly staff summary of news events and other information about the IFRS for SMEs Standard and related SME activities. The alternative and simplified version of full IFRS – Effective from January 2018. This Update includes information on.

2 Accounting For Subsidiaries What Is A Owners Equity

IFRS for SME The extensive training session will address key challenges of implementing IFRS SME and will include KPMG IFRS SME vs SOCPA publication. The June 2018 IFRS for SMEs Update is now available. Let us help you make the transition to IFRS for SME. IFRS for SMEs Standard translationsstatus report.

IFRS for SMEs Standardforthcoming review. IFRS International Financial Reporting Standards for Small and Medium-sized Entities IFRS for SMEs International Public Sector Accounting Standards IPSAS Tax Indirect Tax. IFRS for SMEs Standard held at the Ministry of Finance of Georgia.

ABOUT US OUR DETAIL 830 am 500 pm Friday 19 October 2018 Phnom Penh Hotel TRAINING DATE VENUE. IFRS for SMEs Standard adopted in Papua New Guinea. The IFRS for Small and Medium-Sized Entities IFRS for SMEs is a set of international accounting requirements developed specifically for small and medium-sized entities SMEs.

2 Benefits Of Horizontal Analysis 3 Statement Financial Model Excel Template Free Download

KICPAA is the only National Profession Body of Accountancy in Cambodia. View this and all previous IFRS for SMEs Updates here. Whilst this was good news for many entities NBAA made this pronouncement effective for periods beginning on or after 1 April 2019. Please contact your local PricewaterhouseCoopers office to discuss how we can help you make the change to International Financial Reporting Standards or with technical queries.

The Update is published on a regular basis with news about adoptions resources and implementation guidance. Update on IFRS for SMEs Standard modules. March 12 2018 2.

The IFRS for SMEs Update is a staff update about news relating to the International Financial Reporting Standard for Small and Medium-sized Entities IFRS for SMEs Accounting Standard. The future of financialreporting for small medium size entities in Saudi Arabia. Follow – September 2018 IFRS for SMEs Update You need to Sign in to use this feature The IFRS for SMEs Update is a quarterly staff summary of news events and other information about the IFRS for SMEs Standard and related SME activities.

Ifrs For Sme This Module Has Been Prepared By Foundation Education Staff The Contents Of Studocu Company P&l Owners Equity Statement

Services in accordance with the paragraph 307 of IFRS for SMEs Standard. Deep dive into IFRS SMEs. Apr 16 2018 – Apr 24 2018. The future of financialreporting for small medium size entities in Saudi Arabia.

A Do not have public accountability and b Publish general purpose financial statements for external users and paragraph 15 of the standard states that if a publicly accountable entity uses the IFRS for SMEs its financial statements shall not be described as conforming to the IFRS for SMEs. P10 The term small and medium-sized entities as used by the IASB is defined and explained in Section 1 Small and Medium-sized Entities. The IFRS for SMEs defines SMEs as entities that.

2 Kering Financial Statements Types Of Trial Balance In Accounting

Pdf How Relevant Is Size For Setting The Scope Of Ifrs Smes Semantic Scholar Rcl Balance Sheet Practice Preparing Financial Statements At Regular Intervals