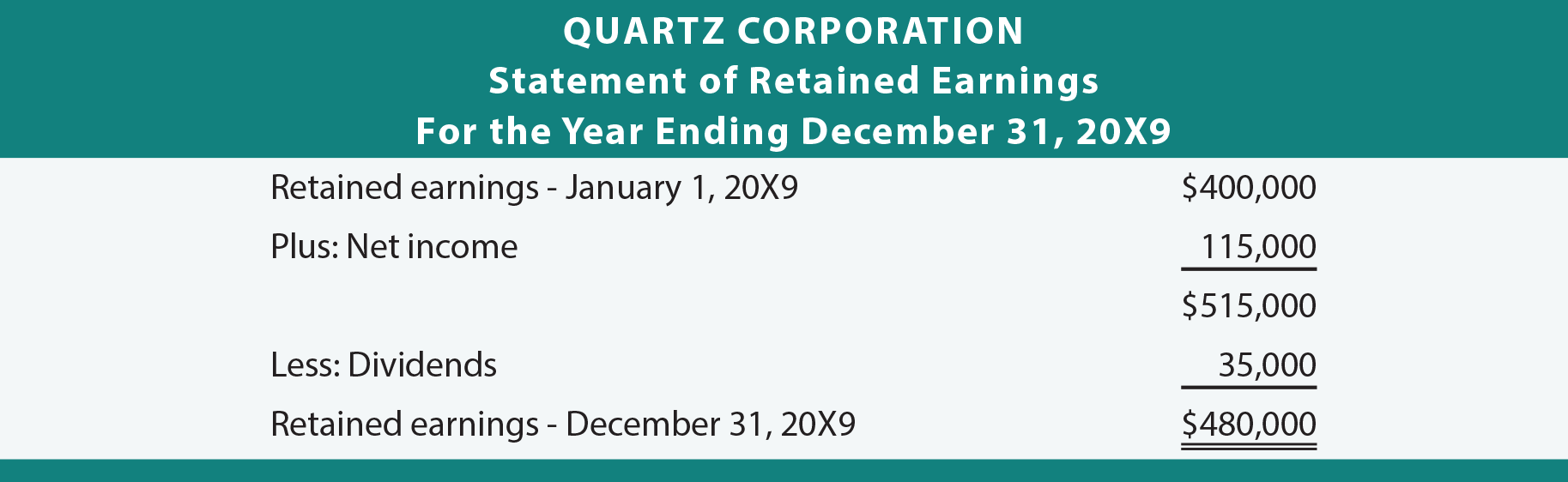

Retained earnings are sometimes known as unallocated profit earnings surplus or aggregated profits Retained earnings can also be used to establish whether or not a company is profitable. 5 rows Beginning retained earnings Net income – Dividends Ending retained earnings.

1 Retained Earnings Statement Shows All Following Except Which One 1. The information needed to determine whether a company is using accounting methods similar to those of its competitors would be found in which of the following. The statement shows how the business retained earnings have changed over time using the formula above. Ending RE Opening RE Income earned during the year after tax – Dividend.

The retained earnings statement shows.

Statement Of Retained Earnings Reveals Distribution Cdc Financial Statements Company Accounts Balance Sheet

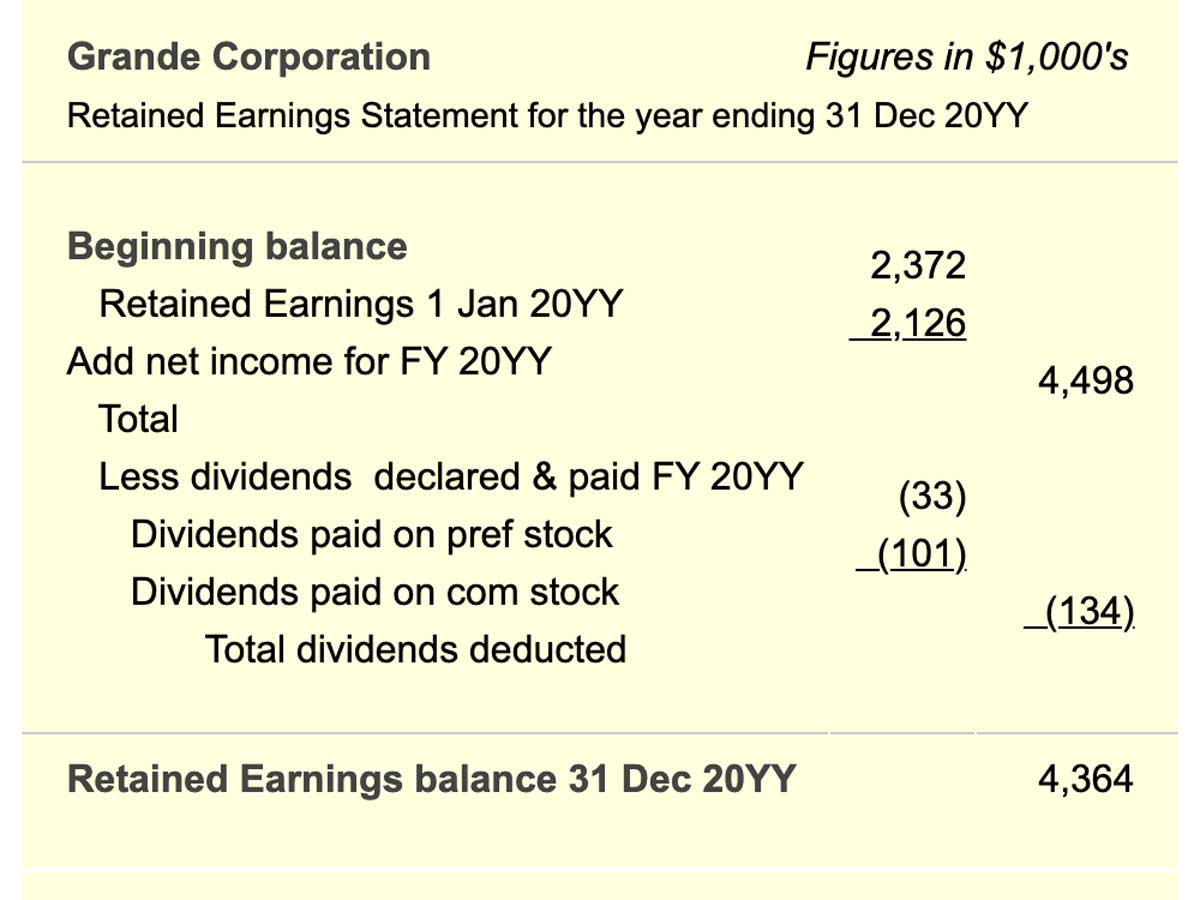

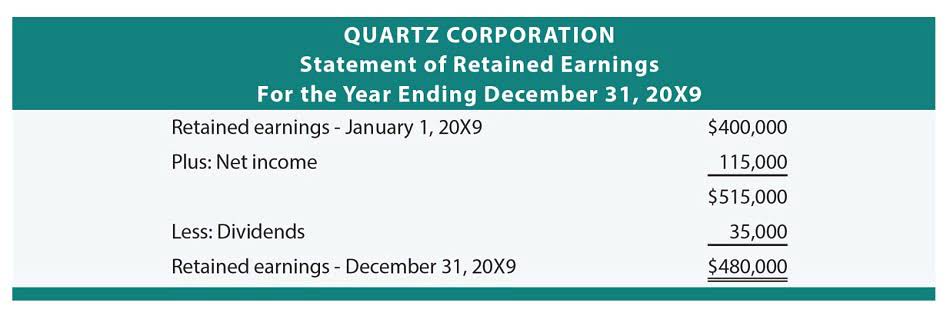

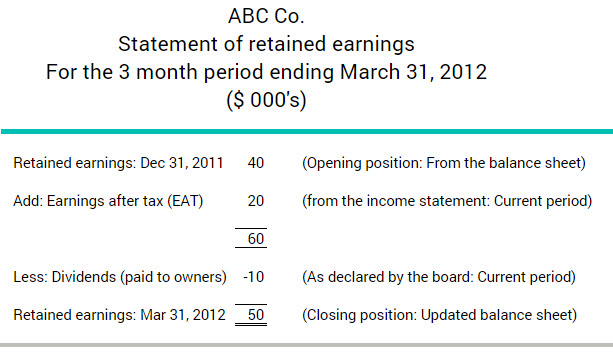

To calculate RE the beginning RE balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted. Management discussion and analysis section. Beginning retained earnings on the first line of the statement. The statement is a financial document that includes.

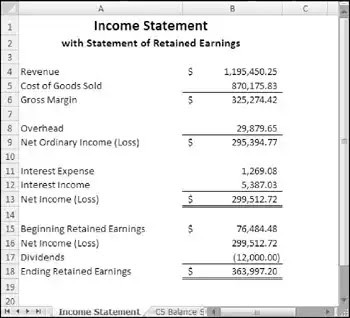

Beginning retained earnings on the first line of the statement. The amounts of changes in retained. Some companies list the retained earnings as part of a longer balance sheet but many companies choose to provide a separate retained earnings statement.

The ending RE shows the balance retained by a company at the end of a year. The retained earnings statement shows all of the following except. Retained Earnings are reported on the balance sheet under the shareholders equity section at the end of each accounting period.

Statement Of Retained Earnings Everything You Need To Know Bookstime Samsung Electronics Financial Statements Sections Cash Flows

Retained earnings RE are the cumulative earnings of a company after paying dividends to the shareholders. He retained earnings statement shows Donly net income beginning balance of retained earnings and dividends Donly net income beginning and ending balance of retained earmings inning and ending balance of retained earnings and all the changes in retained earnings as a result of net income loss. The statement begins with a beginning balance of retained earnings previous years then adds the net earnings for that year to it or subtracts the net loss of that year from it and finally subtracts the number of dividends paid or. Next the retained earnings statement shows how retained earnings changed during thereporting year.

The formula to determine the ending RE is. The causes of changes in retained earnings during the period. View the full answer.

The retained earnings statement shows all of the following except which one. At the very least it might show that the company ought to lower its dividend. The retained earnings statement shows all of the following except which one.

What Is A Statement Of Retained Earnings Bdc Ca The Aicpas Statements On Auditing Standards Can Be Described As Assets And Liabilities Meaning

The retained earnings statement shows all of the following except 1. The statement of retained earnings shows the effects of net income loss and dividends on the earnings the company maintains. Statement of Retained Earnings. The retained earnings statement shows all of the following except which one.

A statement of retained earnings shows the changes in a companys retained earnings over a set period. The information needed to determine whether a company is using accounting methods similar to those of its. The retained earnings statement shows all of the following except beginning retained earnings on the first line of the statement.

If a company has a net loss for the accounting period a companys retained earnings statement shows a negative balance or deficit. The time period following the one shown for the income statement. A statement of retained earnings is a document or a portion of a corporations financial statement that shows the current value of the organizations profits that remain after paying dividends to shareholders.

What Are Retained Earnings Guide Formula And Examples Financial Year For Income Tax Statement Related Information

The amounts of changes in retained earnings during the period. Since retained earnings are what is left from the net income afterpayment of dividends you can see net income being added to the previous yearsretained earnings fewer dividends paid for the reporting year. The causes of changes in retained earnings during the period. The amounts of changes in retained earnings during the period.

This information shows the funds the business owner can retain and reinvest back into the company. The information needed to determine whether a company is using accounting methods similar to. End retained earnings are a measure of a companys actual worth since they are what persists after all commitments have been satisfied.

A statement of retained earnings refers to a financial statement that shows the changes in a companys retained earnings during a specific period of time. The amounts of changes in retained. This statement of retained earnings can appear as a separate statement or as an inclusion on either a balance sheet or an income statement.

Statement Of Retained Earnings A Comprehensive Guide Categories Income Hotel Example

This statement is the extended version of the statement of change in equity and this statement shows the detail of changes in retained earning of the periodYou have beginning retained earnings of 4000 and a net loss of 12000. The time period following the one shown for the income statement. Beginning retained earnings on the first line of the statement. Investors or analysts can use the statement of retained earnings to determine whether a company pays dividends out on a regular basis and whether it is keeping enough of its profits to.

The time period following the one shown for the income statement. Other names for this statement include a statement of owners equity or an equity statement. Alternatively a positive balance is a surplus or retained.

Notes to the financial statements. The causes of changes in retained earnings during the period. The amounts of changes in retained earnings during the period.

The Four Core Financial Statements Principlesofaccounting Com Statement Of Changes In Equity Format Trial Balance Definition

What Are Retained Earnings Guide Formula And Examples Netflix Balance Sheet 2018 Rental Property Excel

Balance Sheet And Statement Of Retained Earnings Youtube Iocl Colgate

How To Calculate Retained Earnings Formula Statement Agiled App Balancing Ledger Accounts Worksheet Airbnb Financial Performance

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)