Types of Assets Common types of assets include current non-current physical intangible operating and non-operating. This type of Balance Sheet Ratio Analysis ie efficiency ratio is used to analyze how.

Here you will find an extensive library of Excel Tools and Templates to help you save time. For opening day balance sheet you need to put values for those item but if you just start to tidy up your financial transaction you need to do some adjustment to make them balance. Types of Liabilities There are three primary types of liabilities. When you enter your asset and liabilities this balance sheet template will automatically calculate current ratio quick ratio cash ratio working capital debt-to-equity ratio and debt ratio.

3 types of financial ratios opening balance sheet format.

Financial Ratios Income Statement Accountingcoach Ratio Bookkeeping Business Accounting Basics Trading Account Profit And Loss Balance Sheet Intangible Assets Section Of The

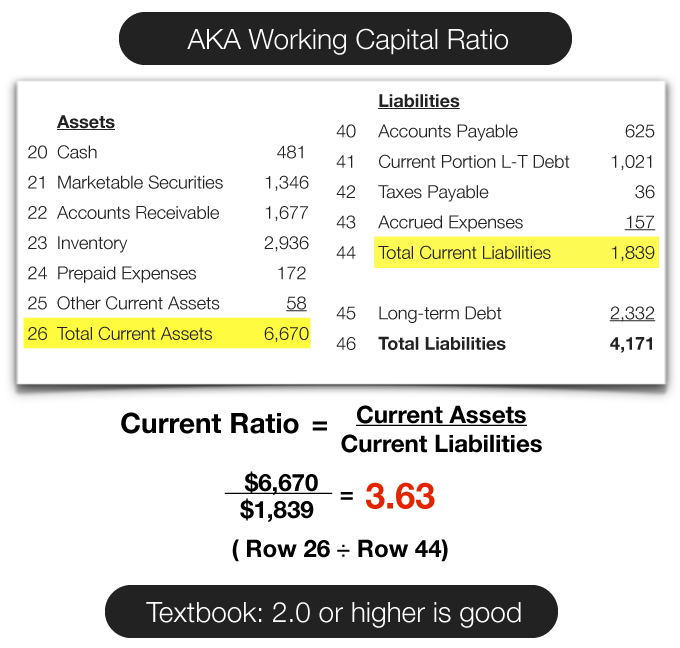

Types of Balance Sheet Ratio 1 Efficiency Ratios. Growth Ratios Profitability Ratios Activity Ratios Liquidity Ratios and Solvency Ratios. From performance measurement and management analysis to strategic planning and due diligence and feasibility studies modeling the three financial statements income cash flow and balance sheet and benchmarking restaurant performance goes hand-in-hand with operational key. Ratio 1 Working capital.

Enter Phone Number to Start Download. Some key balance sheet ratios include but arent limited to. These ratios provide information on a corporations use of debt or financial leverage.

Liquidity ratios that look at the availability of cash for operations. Simple calculation Visual representations of the different financial liquidity solvency price return cash flow ratios. Absolute Liquidity Ratio 4.

Financial Ratios Top 28 Formulas Type Ratio Debt To Equity Format Of Comparative Balance Sheet Negative Cash Flow From Operating Activities Means

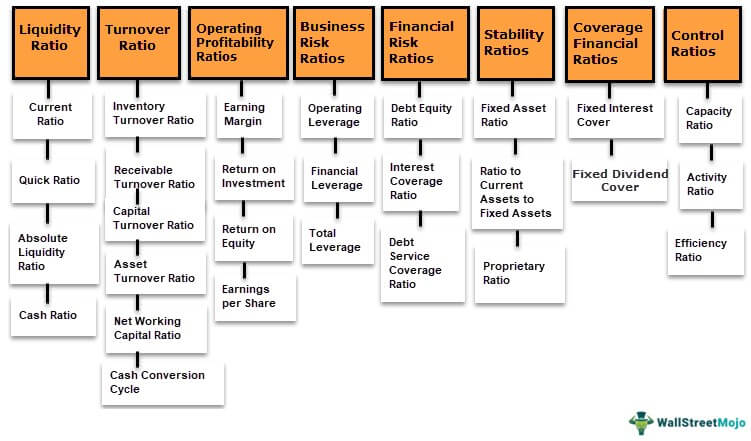

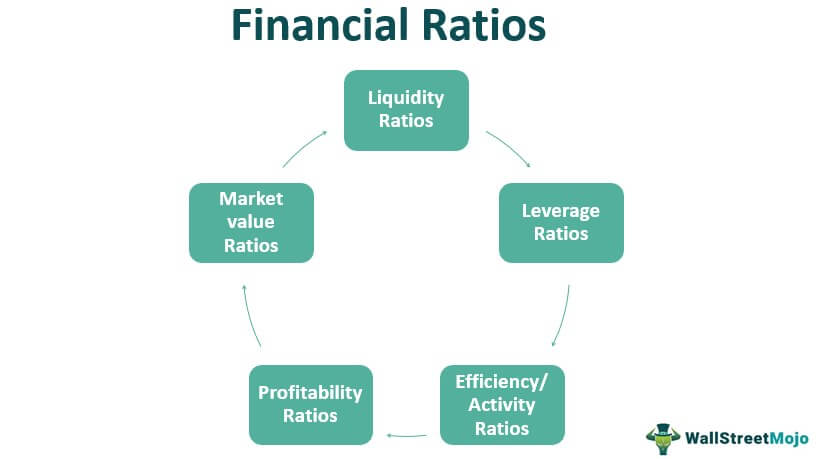

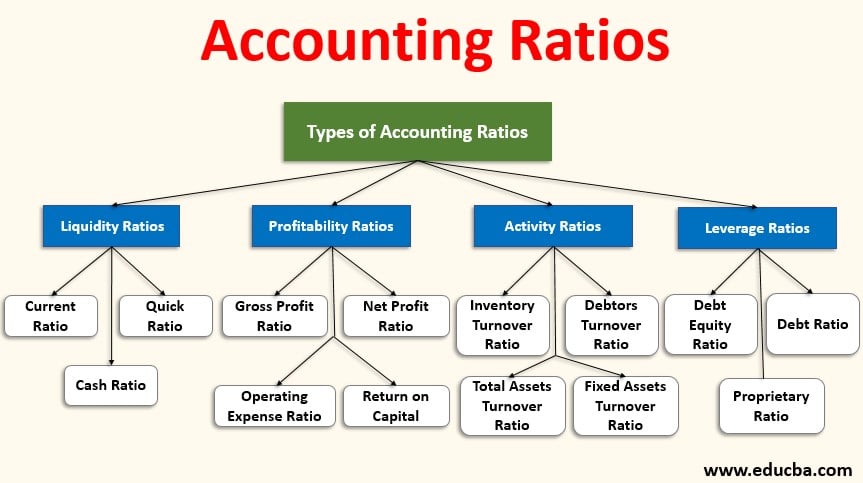

This type of Balance Sheet Ratio analysis is also known as bankers ratio. Types of Financial Ratios. Financial ratios are the ratios that are used to analyze the financial statements of the company to evaluate performance where these ratios are applied according to the results required and these ratios are divided into five broad categories which are liquidity ratios leverage financial ratios efficiency ratio profitability ratios and market value ratios. Debt management ratios keep track of debt to be within reasonable bounds and keep the debt level at its optimal level.

Ratio 3 Quick acid test ratio. Balance sheet with financial ratios. This balance sheet template provides you with a foundation to build your own companys financial statement showing the total assets.

This ratio analyzes the. The ratios may be divided into these types. Calculate financial ratios with this Excel balance sheet template.

Balance Sheet Excel With Ratios Business Insights Group Ag Statement Template Financial Reporting Principles Beiersdorf Statements

Ratio 1 Working capital Ratio 2 Current ratio Ratio 3 Quick acid test ratio. In balance sheet assets having similar characteristics are grouped together. Financial ratios help to convert the data in the balance sheet into information that helps manage the business and make informed decisionsThere are four important financial ratios. Please Provide a valid Phone Number.

This is a marketplace of Financial Ratios Templates and Tools. There are two additional financial ratios based on balance sheet amounts. A balance sheet represents a snapshot of an organizations assets liabilities and shareholders equity at any particular point of time.

Thus Ratio Analysis Template will simplify your task of analysis. 2 Liquidity Ratio. If a company experiences a debt ratio greater than one the company has more debt than assets on its balance sheet.

Financial Ratio Analysis How To Interpret Ratios Analyse A Company Getmoneyrich Cash Flow Statement Using Indirect Method Business Projections

The main objective of any liquidity ratio is to measure the companys short term solvency status of the company. Check this template Financial Ratio Analysis Template Item above are item that you usually see in balance sheet statement. In this section all the resources ie assets of the business are listed. Each of these sections is briefly discussed below.

Here is a balance sheet example that well use for a sample balance sheet analysis. Ratio 2 Current ratio. Balance sheet income statement and cash flow statement.

You can get more insight about your business by looking at and using balance sheet ratios. Example 1 Liquidity Ratios. The balance sheet and the profit and loss PL statement are two of the three financial statements companies issue regularly.

Balance Sheet Everything About Investment Accounting Classes Bookkeeping Business And Finance Saa Financial Statements 2018 Cleveland Clinic

A thorough understanding of restaurant finance can help inform a myriad of decisions. The more common are the classified common size comparative and vertical balance sheets. The debt ratio shows the relationship between a companys debts and its assets. Also referred to as Balance Sheet ratios liquidity ratios are further branched out into the Current Ratio Quick Ratio and Cash Ratio.

Balance sheet ratios are formulas you can use to assess your finances based on your balance sheet information. This sheet consists of 5 major categories of ratios. 14 rows 12 Types of Balance Sheet Ratios Ratio.

We can broadly divide a balance sheet into three sections assets section liabilities section and owners equity section. Asset management ratios evaluate the efficient utilization of the resources. The three main leverage ratios include the debt debt-to-equity and interest-coverage ratios.

Introduction To Financial Statements Balance Sheet Analysis The Kaplan Group Vivendi Unpaid Expenses In

Assets to Proprietorship Ratio 6. An income statement talks about the companys revenue and expenses during a specific period. This article throws light upon the top six types of balance sheet ratios. There are several balance sheet formats available.

The balance sheet is part of the financial statements issued by a business informing the reader of the amounts of assets liabilities and equity held by the entity as of the balance sheet date. Financial trouble at a company.

Types Of Financial Ratios Step By Guide With Examples What Is A Cash Inflow Ipsas Accrual

Accounting Ratios Example Explanation With Excel Template Of A Personal Financial Statement Types Cash Flow