The Accounts Receivable Turnover ratio is a useful metric in financial analysis. Get the financing and support you need to reach your business goals.

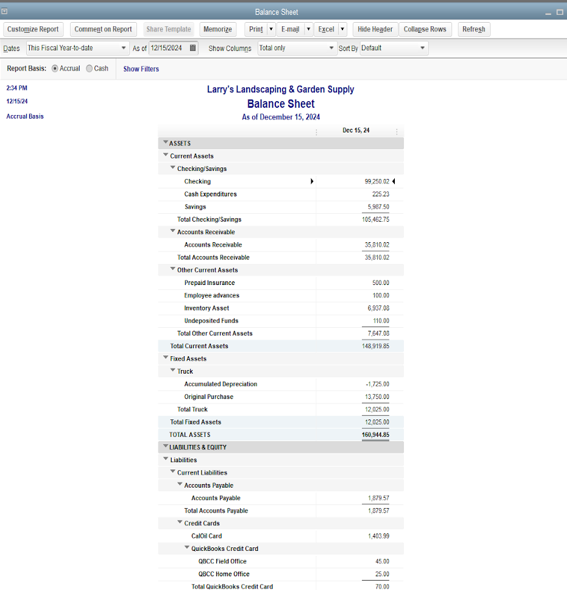

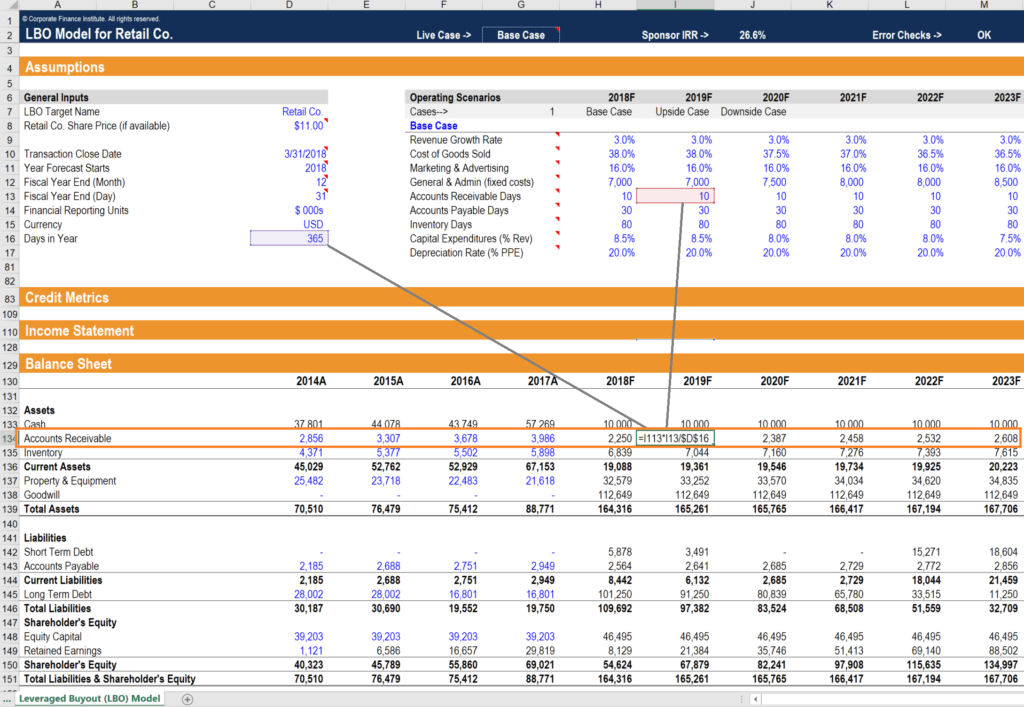

Prepare balance sheet based on given facts and figures. Accounts Receivable Turnover Ratio Formula. It can help us with working capital and cash flow management and improve trade receivables. Overview of what is financial modeling how why to build a model the accounts receivable turnover ratio or turnover days is an important assumption for driving the balance sheet.

Accounts receivable turnover ratio analysis sample bank balance sheet.

Accounts Receivable Turnover Ratio Tools Examples The Blueprint Types Of Opinion In Audit Report Equity Balance

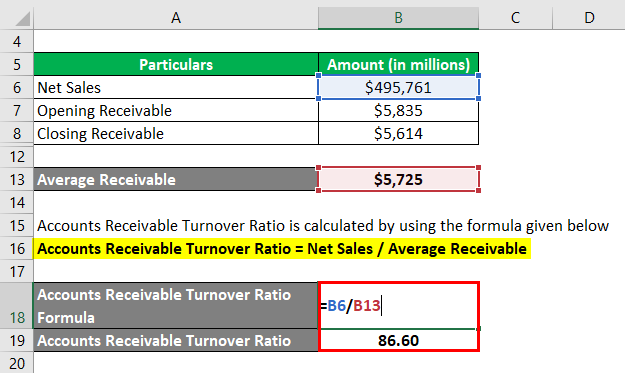

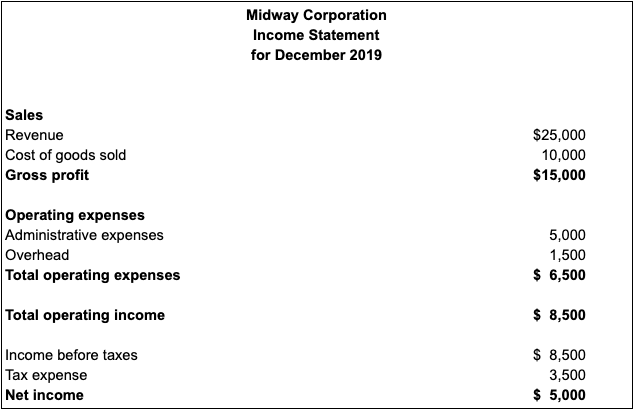

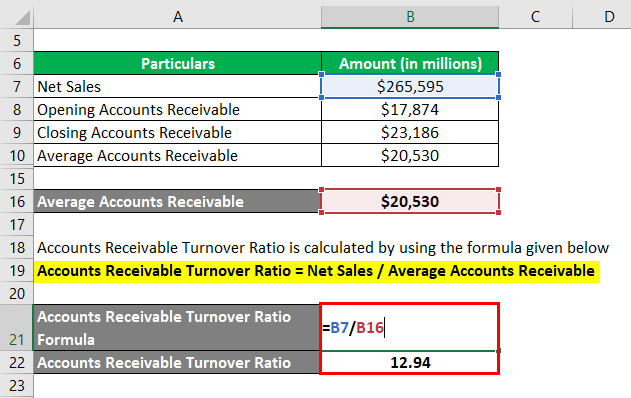

The accounts receivable turnover ratio formula is as follows. The Accounts Receivable Turnover Ratio is calculated as follows. To calculate this ratio you add the value of accounts receivable at the beginning of the specified period to the value at the end of the period then divide the sum by two. Amount of accounts receivable Receivables turnover ratio 570000 60000 Receivables turnover ratio 95 times.

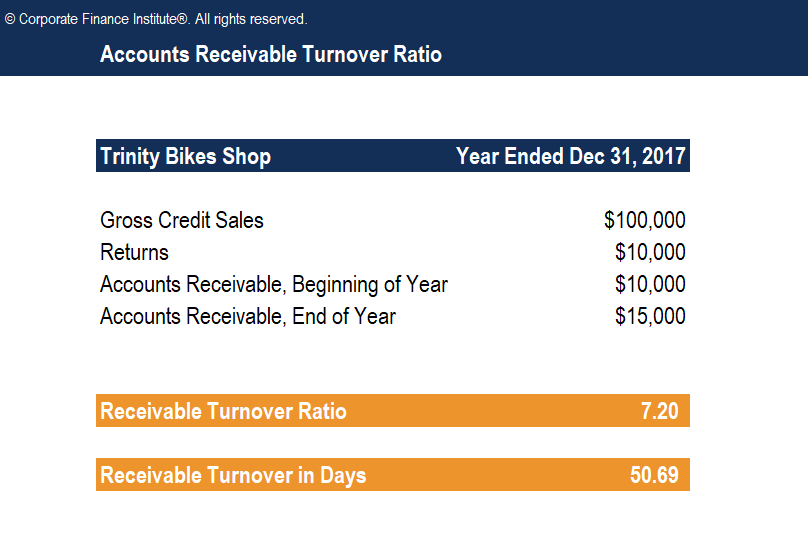

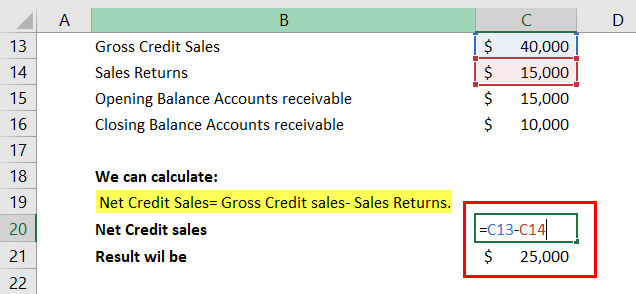

As you can see. Accounts Receivable Turnover Ratio 100000 – 10000 10000 150002 72. Net Credit Sales Average Receivables.

In financial modeling the accounts receivable turnover ratio is used to make balance. Quick ratio 2100015000 141. Accounts Receivable Turnover Accounting Play Medical School Stuff Hfcl Balance Sheet Financial Ratio Analysis Google Search Statement Engineering Draft Balance Sheet I.

Accounts Receivable Turnover Ratio Tools Examples The Blueprint International Gaap 2019 What Are Assets And Liabilities On A Balance Sheet

Discover How to Improve Planning Budgeting Forecasting Make Data-Driven Decisions. Balance sheet ratio indicates relationship between two items of balance sheet or analysis of balance sheet items to interpret companys results on quantitative basis and following balance. This ratio measures how fast the. Accounts Receivable Turnover Ratio Net Credit Sales Average Accounts Receivable Calculate the AR turnover in days.

Average accounts receivable Opening accounts receivable closing accounts receivable 2 This ratio calculates the number of times the company collects the average accounts. Important Balance Sheet Ratios measure liquidity and solvency a businesss ability to. Quick ratio 25000 20000.

The nature of a firms accounts receivable balance depends on the sector in which it does business as well as the credit policies the corporate management has in place. In order to measure the turnover ratio we calculate net credit sales and average accounts receivable. Accounts Receivable Turnover Example – 13 images – solved accounts receivable turnover and average collectio accounts receivable turnover times solved accounts.

Accounts Receivable Turnover Ratio Template Download Free Consolidated Statement Of Operations Dior Financial Statements

Accounts Receivable Turnover Ratio Net Credit Sales Average. It uses to analyze the number of times that net. Ad Overcome Common Challenges of Planning Budgeting Forecasting. National Bank started the business with a capital of 50000 and carried out the following transactions.

14 rows Receivables Turnover. Accounts Receivable Turnover is the efficiency ratio that directly measures the performance of receivable collecting activities over the year. Ad Turn your outstanding invoices and accounts receivable into working capital.

If you want to know more precise data divide the AR turnover ratio by. Try the Interactive Demo. Ad Overcome Common Challenges of Planning Budgeting Forecasting.

Accounts Receivable Turnover Formula And Ratio Calculation Receivables Analysis Sample Retained Earnings Statement

Balance Sheet Ratio Analysis. Discover How to Improve Planning Budgeting Forecasting Make Data-Driven Decisions. Net credit sales equals gross credit sales minus returns 150000. Try the Interactive Demo.

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template Quickbooks Profit And Loss By Customer Of Investing Activities In Cash Flow Statement

Accounts Receivable Turnover Ratio Formula Examples Comparative Statement Analysis Pdf Simple Profit And Loss

Accounts Receivable Turnover Formula And Ratio Calculation Explain The Purpose Of A Balance Sheet Is Profit Loss Same As Income Statement

+2017+Current+Assets.png)

Accounts Receivable Turnover Calculator And Formula Discoverci Ambev Financial Statements Journal Entry For Salary Payable

Accounts Receivables Turnover Ratio Formula Calculator Excel Template Cash Flow Statement Of A Company Opening Balance Sheet Example