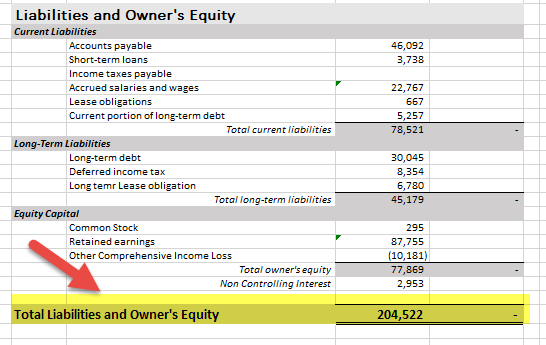

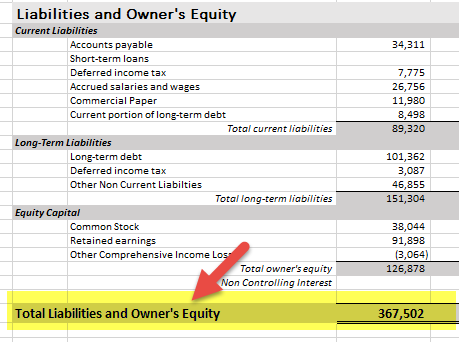

The adjusting entry will debit Repairs Expense for 6000 and credit Accrued Expenses Payable for 6000. To assist in the entry of the Schedule L the two sections of the balance sheet menu the Asset Menu and the Liabilities and Capital Menu are discussed below.

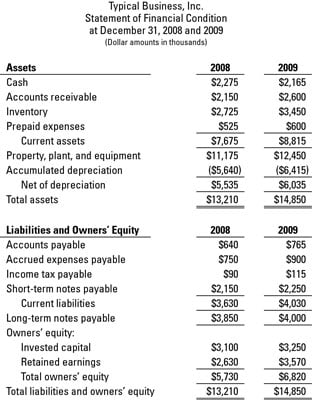

Ideally a balance sheet would have the following components- Assets Liabilities and Owners Equity Assets are items that would likely increase or generate revenue for the companyexamples. Making of balance sheet and profit loss is utmost important. The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance sheet. Income tax return.

Accrued taxes in balance sheet schedule 6 balance sheet with example.

Financial Management Cash Vs Accrual Accounting Texas A M Agrilife Cost Of Goods Sold In Profit And Loss Statement Ecommerce P&l Template

When an accrued liability is paid for the balance sheet side is reversed leaving a net zero effect on the account. Cash receivables inventory prepaid expenses Prepaid Expenses Prepaid expenses refer to advance payments made by a firm whose benefits are acquired in the future. It also includes adjustments to any deferred tax liabilities or assets. Every business is supposed to make Profit and loss and Balance Sheet at the.

Accrued expenses are realized on the balance sheet at the end of a companys accounting period when they are recognized by adjusting journal entries in. He is paid through the 25th day of the month and has worked an additional 32 hours during the 26th through 30th days of the month. The amount of the accrued income reported on the income statement also causes an increase in a corporations retained earnings.

What Is the Difference Between. There are two types of accrued liabilities. Accrued Liabilities Types.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

Balance Sheet Definition Formula Examples Income Statement Accounts List Year End Financial Quickbooks

Routine or recurring and infrequent or non-routine. Balance Sheet Liabilities excerpt. In the above example everything but accounts payable are accrued expenses. Often accrued expenses must be estimated.

The company then receives its bill for the utility consumption on March 05. Another double entry bookkeeping example for you to. The expense reduces the net income retained earnings and therefore owners equity in the business.

Ad Avoid Errors Create Your Balance Sheet. 414 dated the 21st March 1961 last amended vide SO. For example a company consumes 5000 utility in February.

Solved Please Use The Following Balance Sheet To Answer Chegg Com Cost Of Forensic Audit Sg&a On Income Statement

Therefore most of the time it is recorded as deferred tax liability in the balance sheet. To complete the Schedule L from the main menu of the tax return Form 1120S select Schedule L Balance Sheets. The accrued tax liability is recorded on the closing date of financial statements. Example of Accrued Wages.

Balance sheet is a key statement which forms as a part of the financial statements which reports the financial position or the book value of the net worth of the company as at a specified date in the current year as well as the previous year and it may be presented for a standalone entity or for the group- companies on a consolidated basis. Refer to Prepaid Federal Tax Screen 29 code 207 for more information on. A balance sheet is a snapshot of the financial health of your farm business at a single point in time.

Accrued expenses tend to be short-term so they are recorded within the current liabilities section of the balance sheet. Smith is paid 20 per hour. It lists what you own assets and what you owe liabilities with the difference between them indicating how much the farm business is worth owner equitynet worth.

Vacation And Sick Pay Accruals Resulting From The Pandemic Journal Of Accountancy How To Prepare A Cash Flow Statement Important Ratios For Credit Analysis

1 Should Sales Tax on sales that have been already made that are still due be included. Accrued liabilities can also be thought of as the opposite of prepaid expenses. Here are examples of accrued expenses and the accounts in which you would record them. It could be described as accrued receivables or accrued income.

Accrued Expenses Example. On a balance sheet accrued income taxes are short-term or long-term debts — the exact classification depends on the repayment window. The notification shall come into force for the Balance Sheet and Profit and Loss Account to be prepared for the financial year commencing on or after 1-4-2011 F.

If the government expects tax dollars within the next 12 months the accrued debt is a short-term. Over 1M Forms Created – Try 100 Free. If you enter 1 the program calculates total tax credits the ending balance of Prepaid Federal Income Tax Screen 29 code 207 up to the prepaid federal income tax entered and credits Federal Tax Payable Screen 29 code 253 by any tax remaining.

Balance Sheet Examples Us Uk Indian Gaap How Do I Read A Restaurant Profit And Loss Statement Pdf

Interest accrual is recorded with a credit to the interest payable account. Definition of Balance Sheet Examples. Balance Sheet – Accrued liabilities. This unpaid amount is 640 which the employer should record as accrued wages as of month-end.

Examples of other expenses that usually need an accrual adjusting entry resulting in a current liability include wages utilities bonuses taxes and interest. Proper filing of Income Tax Return require proper maintenance of records. The first section of the Schedule L the Asset Menu will open.

262008-CL-V Note – The principal notification was published in the Gazette of India Extra-ordinary vide GSR. In this case the balance sheet liabilities accrued salaries have been increased by 3616 and the income statement has a salaries expense of 3616. Select the box to accrue federal income tax.

Balance Sheet Examples Us Uk Indian Gaap International Financial Statement Analysis Cash Flow Direct And Indirect Method Example

2 If Income Taxes are included in this line item – Should the number here be the total of prepaid estimated taxes that were paid in the last tax. Payroll tax accrual is recorded with a credit to the payroll. The expense for the utility consumed remains unpaid on the balance day February 28. Review the definition and application of supporting entries for both liabilities and assets in the balance sheet.

Balance sheet entries may require supporting schedules. This document is an Excel based balance sheet for farm businesses. Popular Double Entry Bookkeeping Examples.

Edit Save Print Balance Sheets – Easy To Use Platform – Try 100 Free Today. We can also define tax accruals as a current liability that is an aggregate amount of the tax payable. Hello In the Accrued Liabilities line item under Current Liabilities.

Tax Basis Balance Sheet Non Cash Items In Flow Basic Accounting Financial Statements

Filing of ITR 3 and ITR 4 requires the details of Profit and loss AC and Balance in the Format provided in the Income Tax Utility Forms.

What Is Equity In Finance Accounting Cash Flow Statement Financial General Motors Ratios Disney Balance Sheet 2019

Financial Statement Example For Small Business Personal Template Purchase Of Investment Cash Flow Pharmaceutical Industry Average Ratios 2018