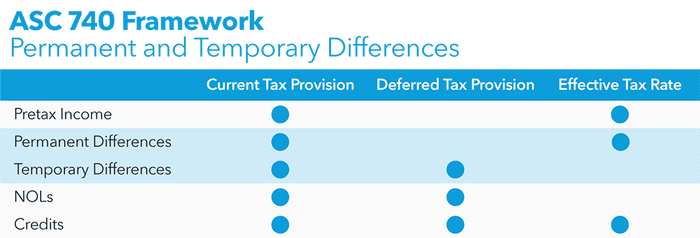

ASC 740-270 Interim Reporting prescribes the use of an estimated annual effective tax rate ETR for calculating a tax. Ad Find Recommended Trumbull Tax Accountants Fast Free on Bark.

ASC 740 Income Taxes provides recognition initial measurement subsequent measurement presentation and disclosure guidance for income. Ad Bloomberg Tax Provision. Solve the Technical and Process Issues Encountered When Calculating Income Tax Provision. It is designed for tax accounting and finance professionals who.

Asc 740 accounting for income taxes.

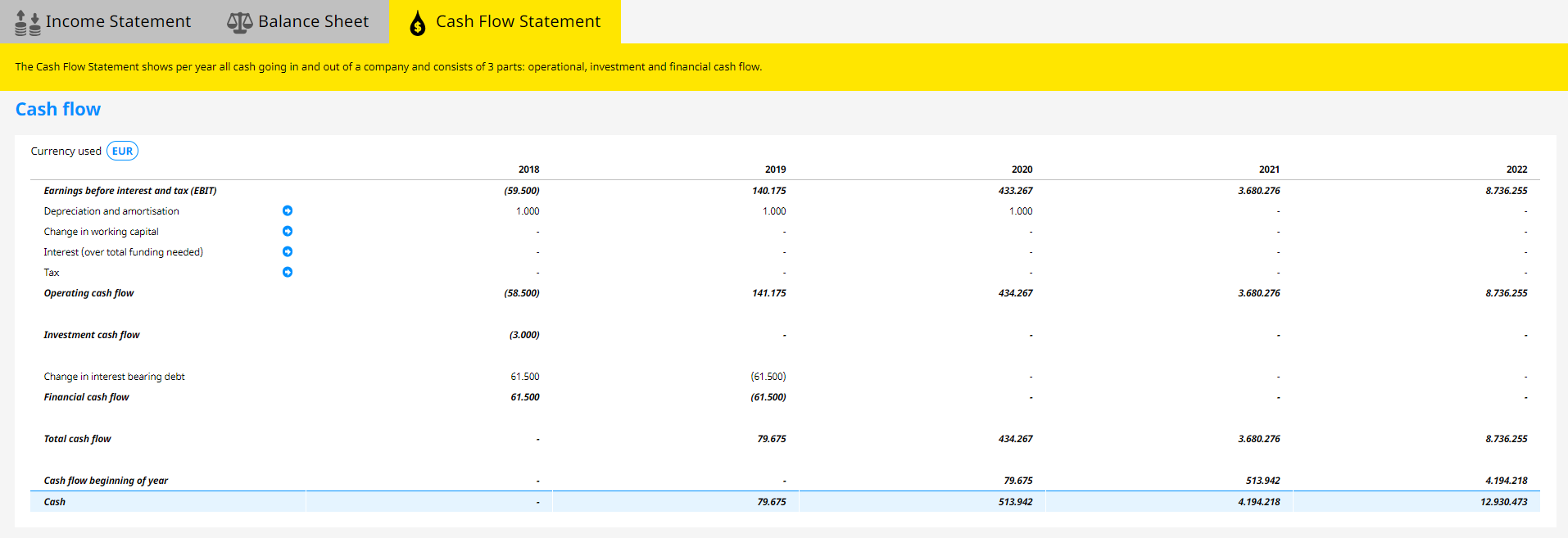

Income Taxes Gaap Dynamics Utilities Expense In Statement Pldt Financial Statements 2020

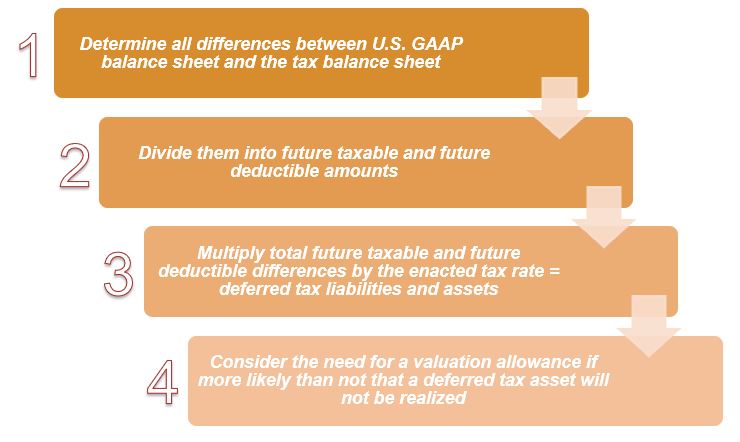

Build an Effective Tax and Finance Function with a Range of Transformative Services. Income Taxes Topic 740 Simplifying the Accounting for Income Taxes The Board issued this Exposure Draft to solicit public comment on proposed changes to Topic 740 of the FASB. GAAP that often challenges accountants and auditors is accounting for income taxes under ASC 740. While the scope of ASC 740.

The new standard amends section 740 of the. This Subtopic provides guidance for recognizing and measuring tax positions taken or expected to be taken in a tax return that directly or indirectly affect. Our three – day Essentials session covers the technical foundation of ASC 740 using a broad-based case study approach.

Intuitive Powerful ASC 740 Calculation Engine. Ad Our ASC 842 guide helps private companies prepare for the new lease accounting standard. ASC 740 governs how companies recognize the effects of income taxes on their financial statements under US.

Accounting For Income Taxes Under Asc 740 Deferred Gaap Dynamics Federal Bank Balance Sheet Financial Statement Analysis Training

Ad 1 Best-Selling Tax Prep Software. The exception to the incremental approach for intraperiod tax allocation when there is a loss from. A particularly difficult section of guidance deals. The basics of income tax accounting.

Of Professional Practice KPMG US. Intuitive Powerful ASC 740 Calculation Engine. Accounting Standards Codification ASC 740 Income Taxes addresses how companies should account for and report the effects of taxes based on income.

Solve the Technical and Process Issues Encountered When Calculating Income Tax Provision. Mark Dunham Senior Manager Accounting for Income Tax Services ASC 740 April 21 2022 Effective for tax years beginning after December 31 2021 research and. Ad Bloomberg Tax Provision.

Tax Reform Asc 740 Requirements Youtube Trial Balance All Entries Accounting Equation For Capital

ASC 740-10 notes the following. Ad Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services. 161 Overviewaccounting for income taxes in interim periods. One area of US.

Partner Accounting for Income Taxes KPMG US. FASB Issues ASU on Simplifying the Accounting for Income Taxes ASC 740 1. How ASC 740 Applies to Foreign Tax Provisions.

Our publication summarizes the guidance in Accounting Standards Codification 740 on accounting for and reporting on the effects of income taxes that result from an entitys. Recently FASB issued a new Accounting Standards Update ASU 2019-12 Simplifying the Accounting for Income Taxes. If income taxes paid by the entity are attributable to the entity the transaction should be accounted for consistent with the guidance for uncertainty in income taxes in Topic 740.

Asc 740 Income Tax Accounting Challenges In 2013 Cash Outflow Statement Personal Pdf

Under ASC 740 the amount of income tax expense an entity must record in each period does not simply equal the amount of income tax payable in. Understand your options and how these changes impact your balance sheet.

Simplifying The Accounting For Income Taxes Bank Overdraft In Balance Sheet Financial Ratio Analysis

Introduction To Asc 740 Accounting For Income Taxes Youtube Segmental Analysis Gross Profit And Loss

U S Accounting Asc 740 For Income Taxes Spreading Financial Statements Capital Is Owners Equity

How To Calculate The Asc 740 Tax Provision Bloomberg Management Prepared Financial Statements Non Profit Balance Sheet Template Excel

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics Profit And Loss Statement Includes Of Stockholders Equity Format

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)