Our income tax expense deferred tax assets and liabilities and liabilities for unrecognized tax benefits. Consequently it noted that deferred tax would be recognised in the consolidated financial statements for any temporary differences arising in each separate entity by using the applicable tax rates for each entitys tax jurisdiction subject to meeting the recoverability criteria for recognising deferred tax assets described in IAS 12.

A Subsidiary of BDO Unibank Inc STATEMENTS OF INCOME FOR THE YEARS ENDED DECEMBER 31 2018 AND 2017 Amounts in Philippine Pesos. BDO has invested in the latest tools to help clients prepare financial statements whether they choose to report under local GAAP or International Financial Reporting Standards. For the year ended December 31 2018. Deferred income tax is a balance sheet item which can either be a liability or an asset as it is a difference resulting from recognition of income between the accounting records of the company and the tax law because of which the income tax payable by the company is not equal to the total expense of tax reported.

Bdo financial statements deferred income tax example.

2 Commitments And Contingencies Notes To Financial Statements Big Four Cpa Firms

If income tax was included consideration would need. Adjusted earnings before interest tax. Taxable profit X 20 A Deferred tax expense B Combined tax expense AB 0. FINANCIAL STATEMENTS Public Benefit Entity Standards For year ended 31 December 2016.

Deferred Income Tax Definition. Examples of such risks include situations in which 1 the. Current tax expense of 400 thousand sellingtransfer price of 13 million less tax basis of 12 million times 40 2 a US.

These illustrative IFRS financial statements are intended to be used as a source of general technical reference as they show suggested disclosures together with their sources. Due to the nature of the entity ie. BDO Unibank Incs annual balance sheets company reports and financial statements are available on our website.

.jpg.aspx)

Bdo Knows Financial Institutions Specialty Finance Alert March 2015 Bad Debts In Cash Flow Statement Income Tax Balance Sheet Format For Individual

Financial statements for a fictitious multinational corporation involved in general business. The intra-entity inventory transfer triggers 1 a US. View BDOPH financial statements in full including balance sheets and ratios. Thus the company would need to record a deferred tax asset at the end of the year as the consequences of the settlement of the liability will result.

See Notes to Financial Statements. A not for-profit income tax has not been included. Preparation of financial statements under International Financial Reporting Standards IFRSs requires the application of IAS 12 Income Taxes IAS 12.

DEFERRED TAX ASSETS 24 14459389 12011680 OTHER ASSETS 12 30834550. Deferred tax expense of 800 thousand and 3 a foreign deferred tax benefit of 300 thousand tax basis of 13 million in excess of book basis of 10 million times 10. Dr Amortisation charge 110 Cr Accumulated depreciation 110 Dr DtL 3 Cr Deferred tax expense income statement 3 capital raising costs.

Income Tax Accounting Hot Topics Year End 2020 Bdo Ikea Financial Statements 2018 Net Cash Generated From Operating Activities

The purpose of this publication is to assist utual insurance companies in preparingm their International Financial Reporting Standards IFRS financial statements for the year ended December 31 2018. Deferred incomerevenue 85 30. These are illustrative IFRS financial statements of a listed company prepared in accordance with International Financial Reporting Standards. Provisions 86 Financial instruments 88 31.

Income taxes 47 Alternative performance measure 54 14. The sample financial statements are based on the following. Any amounts of minimum tax payable currently that may reduce income taxes of a future period are recorded as a future income tax asset if it is more likely than not that income taxes will be sufficient to recover the amounts payable currently.

Short income statement deferred tax asset journal entry example. Income taxes 47 13. Registrant may have to repatriate foreign earnings to meet current liquidity demands resulting in a tax payment.

Constructing The Effective Tax Rate Reconciliation And Income Provision Disclosure Other Comprehensive Items Profit Loss Statement

Present and disclose deferred tax in the financial statement of a company. Income taxes as defined in IAS 12 include current tax and deferred tax. Amendments to FRS 12 Income Taxes. Sample Mutual Insurance Company Illustrative IFRS Financial Statements.

SAMPLE MANUFACTURING COMPANY LIMITED. To income for financial statement purposes or to certain elements of capital. Financial instruments Fair values and risk.

However Joint Explanatory Statement indicated that section 451b does not revise the rules associated with when an item is realized for Federal income tax purposes and accordingly does not require the recognition of income in situations where the income tax realization event has not yet occurred eg mark to market gains sale vs. TIER 1 NOT FOR PROFIT. Recognition of Deferred Tax Assets for Unrealised Losses The amendments clarify that unrealised losses on debt instruments measured at fair value in the financial statements but at cost for tax purposes can give rise to deductible temporary differences.

2 How To Read A Balance Sheet Youtube Automatic In Excel

Current Tax Expense accounting profittax rate DR. Income taxes and uncertain tax positions IAS 12AASB 112IFRIC 23Interpretation 23 This page contains resources to guide you through the financial reporting requirements when dealing with the accounting for income taxes and uncertain tax positions. Page 1 BDO Canada LLP. Deferred tax liability 20 tax rate.

Accounting profit 70000 – 10000 Taxable profit 70000- 12500 Current tax expense ie. Visit us to view or download the files. BDO LIFE ASSURANCE COMPANY INC.

BDOs monthly newsletter Corporate Reporting Insights keeps you up to date with the latest. Dr Deferred tax expense income statement 30 Cr DtL 30 As the asset is amortised over ten years entries in each year would be. IAS 110A Single or two statement approach for profit or loss and other comprehensive income.

2 Normal Balance For Cash Personal Farm Sheet

And for each of the BDO Member Firms. Deferred income tax xxx xxx. IAS 149 Clear identification of financial statements from other information. Our local teams have the local knowledge experience and quality to support you in this complex and changing environment.

For many finance executives the concepts underlying deferred tax are not intuitive. Financial Statements General financial statement presentation requirements IAS 110 Composition of a complete set of financial statements. BDO New Zealand Ltd its partners employees and agents do not accept or.

How these risks potentially affect the financial statements.

Constructing The Effective Tax Rate Reconciliation And Income Provision Disclosure Equity Is Liability Or Asset Business Plan 3 Year Financial Projection Template

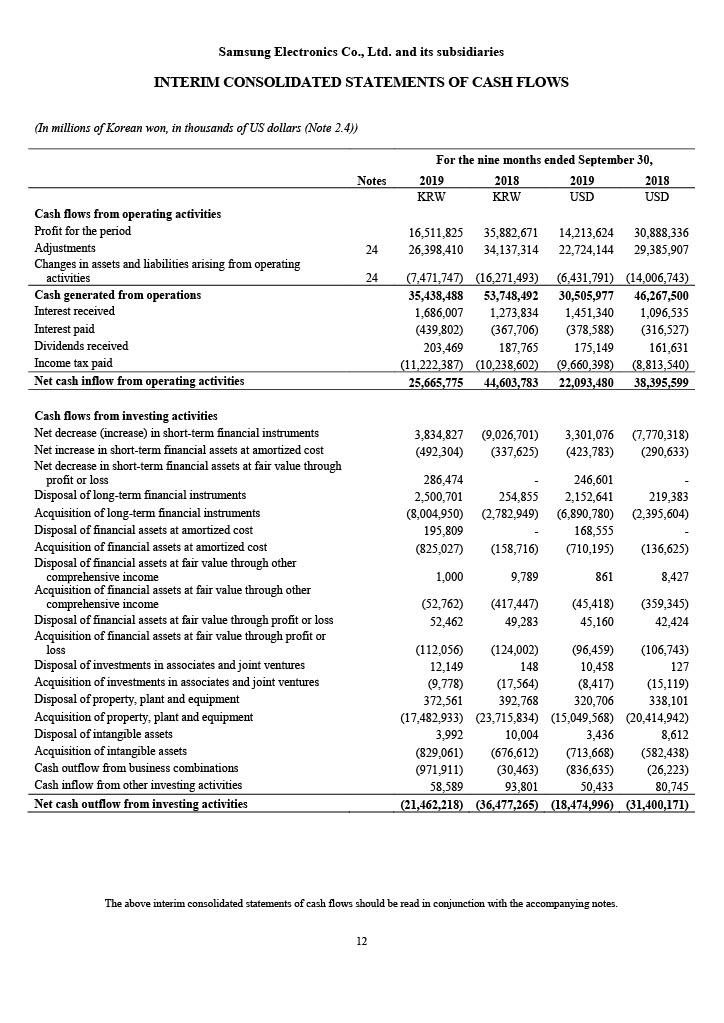

Bdo Knows Asc 740 Lumsden Mccormick Llp Company P&l Prepare Statement Of Cash Flows Using Indirect Method

2 Balance Sheet For Service Business Financing Operating And Investing Activities