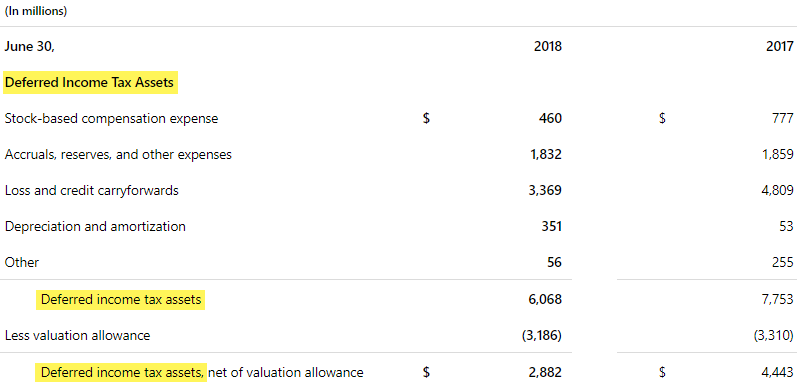

Journal entry for deferred tax Deferred Tax Asset Deferred Tax Liability Income Tax Expense Dr Cr 6 000 1 800 4 200 Additional explanations The deferred tax asset entry of 6000 relates to both the allowance and provision for LSL 3600 2400 The entries can be combined into a single entry for income. If the deferral is for more than one year then the liability is classified on an entitys balance sheet as a long-term liability.

Deferred tax assets are owed to the company while deferred tax liability is owed to the government. Deferred Tax Liabilities is the liability which arises to the company due to the timing difference between the accrual of the tax and the date when the taxes are actually paid by the company to the tax authorities ie taxes get due in one accounting period but are not paid in that period. The accounts reflected on a trial balance are related to all major accounting. 2000 Crores on April.

Bookkeeping to trial balance example of deferred tax liability.

Deferred Tax Asset Journal Entry How To Recognize Company Financial Records Segment Margin Income Statement

A deferred liability is also called a deferred credit or deferred revenue. Bookkeeping to Trial Balance Section A. Selling of Finish product in cash 3500000. A deferred tax liability is a line item on a balance sheet that indicates that taxes in a certain amount have not been paid but are due in.

The income tax payable account has a balance of 1850 representing the current tax payable to the tax authorities. In 2017 XY Internet Co. Accountant is preparing a financial statement for the company ABC.

Purchase of Raw Material on credit 2500000. Deferred Tax Liability Examples. The taxable profit is 40000.

2 Common Size Income Statement Problems And Solutions The Financial Position Of A Business Is

Example calculating deferred tax liability entity bought an asset for 5 000 and estimated the useful life to be 5 years and depreciate the asset on straight line basis. The tax authority gave an allowance of 2400 on the asset and the business charged a depreciation expense of 1000 the difference of 1400 at the tax rate of 25 is the deferred tax of 350. In most cases tax accruals and tax expense is the same amount. Example of Deferred Tax Asset.

It is recorded as a liability or asset in the balance sheet at the year-end. A deferred liability is an obligation for which settlement is not required until a later period. We have bought an machinery with Rs.

An accounting couple may only exist if two are present a company can only maintain deferred tax obligations or deferred tax assets. For example utility expenses during a period include the payments of four different bills amounting 1000 3000 2500 and 1500 so in trial balance single utility expenses account will be shown with the total of all expenses amounting 8000. When the trial balance is first printed it is called the unadjusted trial balance.

Deferred Tax Acca Global Blank Profit And Loss Form Audit Summary Report

The difference is mostly related to the depreciation method between tax and accounting. Purchase of Raw Material in cash 2500000. Depreciation is the one common point between deferred tax assets and liabilities that creates discrepancies in tax and accounting calculations. Deferred Tax Liabilities Meaning.

Gold Gems has reported the below transactions for the month of Feb 2019 and the accountant wants to prepare the trial balance for the month of Feb 2019. The company records 240 800 30 as a deferred. The income tax rate is 20.

Basic vat calculations mark-ups margins 15 marks question 3. Deferred tax assets and liabilities both represent an amount of money that is owed in two different ways. It is part of the accounting adjustment and gets eliminated as the temporary differences are reversed over time.

Deferred Tax Double Entry Bookkeeping Where Net Profit Is On A Balance Sheet Real Estate Company Financial Statements

Deferred tax and the framework As we have seen IAS 12 considers deferred tax by taking a balance sheet approach to the accounting problem by considering temporary differences in terms of the difference between the carrying amounts and the tax values of assets and liabilities also known as the valuation approach. An impression of this debt on the balance sheet is to identify the negative and positive balance amounts that are owed. However if there is a deferred tax liability or deferred. Based on the calculation the accounting profit EBT is 50000.

One common cause of deferred tax liability is if a company uses accelerating depreciation for tax calculation and the straight line method for accounting purpose. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. It is the opposite of a deferred tax liability which represents income.

A deferred liability can be recorded as a current liability or non-current liability depending on the. The Deferred Tax is created at normal tax rate. Received 20000 from its clients for internet service in advance.

Deferred Tax Liability Accounting Double Entry Bookkeeping Sfac Fasb Basic Financial Ratio

Deferred tax refers to income tax overpaid or owed due to the temporary differences between accounting income and taxable income. The balance on the deferred tax liability account is 150 representing the future liability of the business to pay tax on the income for the period. Types of Assets Common types of assets include current non-current physical intangible operating and non-operating. Deferred Tax Liability Journal Entry Example.

Trial Balance Example 2. Then when the accounting team corrects any errors found and makes adjustments to bring the financial statements into compliance with an accounting framework such as GAAP or IFRS the report is called the adjusted trial balance. The balance on the deferred tax liability account is 150 representing the future liability of the business to.

The difference of 300 will go to deferred tax liability on the companys balance sheet. The double entry bookkeeping journal to post the deferred tax liability would be as follows. Jonathan is an accountant in a retail company.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition Balance Sheet Permanent Accounts Funds Flow Statement

Types of Trial Balances. When Deferred Tax will be payable to income tax department it will be outstanding expense and it will be shown as liability in balance sheet. A deferred tax liability and a deferred tax asset. The effect of accounting for the deferred tax liability is to apply the matching principle to the financial.

A deferred tax asset is an item on the balance sheet that results from the overpayment or the advance payment of taxes. A listing of the account numbers and titles but without account balances is the _____ of accounts. Trial balance to income statement examples of temporary differences that create deferred tax assets.

Which recognizes both the current tax and the future tax deferred tax consequences of the future recovery or settlement of the carrying amount of an entity s assets and liabilities. The internet service of 20000 is for 2 years in 2018 and 2029 hence the company recognized it as revenues equally in 2018 and 2019 in the accounting base. Deferred tax liability commonly arises when.

Tax Basis Balance Sheet Financial Consolidation Companies Profit And Loss For Small Business

Balance bktb icb test 1a question paper apr 2018 to mar 2019 this test paper consists of 3 questions 50 marks 1 ½ hours question 1. Trial Balance is the report of accounting in which ending balances of different general ledger of the company are available.

Net Operating Losses Deferred Tax Assets Tutorial Trial Balance Quickbooks Desktop Cash Flow Statement Graph

Deferred Tax Asset Journal Entry How To Recognize Trial Balance All Entries Financial Risk Identification Based On The Sheet Information

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)