One key component of a business balance sheet is the retained earnings. On the profit and loss statement also called an income statement there is net income identified.

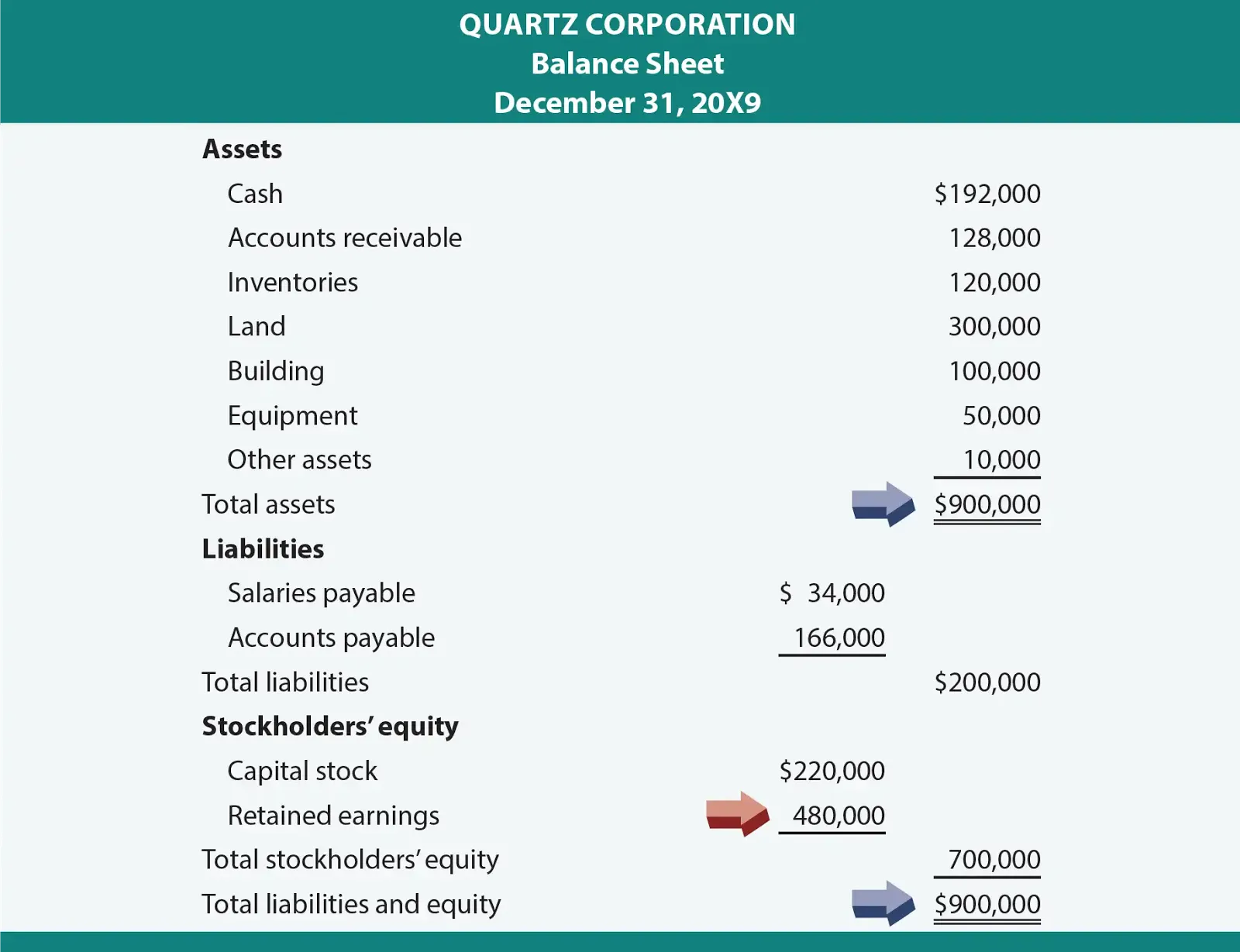

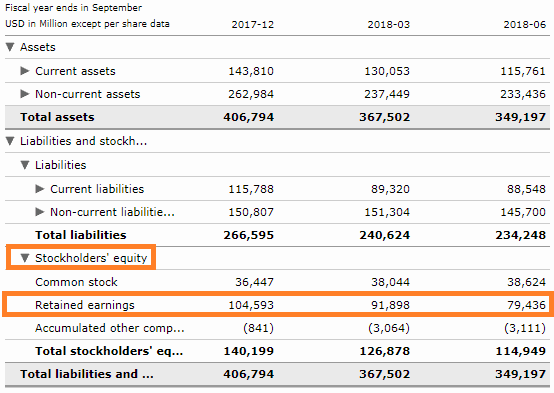

Retained earnings are reported on the balance sheet under the shareholders equity section at the end of each accounting period. Today companies show retained earnings as a separate line item. Retained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company and it is shown as the part of owners equity in. Retained earnings demonstrate an essential tie between the balance sheet and income statement recorded under a shareholders equity.

Calculate retained earnings on balance sheet.

What Are Retained Earnings Guide Formula And Examples Oslo Company Prepared The Following Contribution Format Income Managements Discussion Analysis

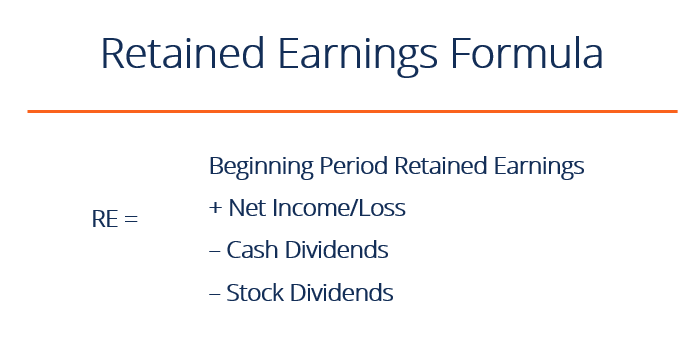

Retained earnings are the residual net profits after distributing dividends to the stockholders. If you happen to be calculating retained earnings manually however youll need to figure out the following three variables before plugging them into the equation above. In accounting the most common balance sheet relationship is between assets liabilities and stockholder equity. In essence it connects the two statements.

Since retained earnings go under the shareholders equity youre increasing the retained earnings and at the same time the liabilities side of your. This will usually be referred to as the owners wealth. In the balance sheet assets of the company must be equal to the sum of the liabilities and stockholder equity.

As a reported group retained earnings appear on the balance sheet as shareholder equity under the shareholder equity section while their statement provides details of changes in RE in each quarter. If we stick to our example the total amount of retained earnings would be 15000 100008000-3000. First subtract the liabilities from assets.

Retained Earnings On Balance Sheet Kfh Financial Statements Pro Forma Example

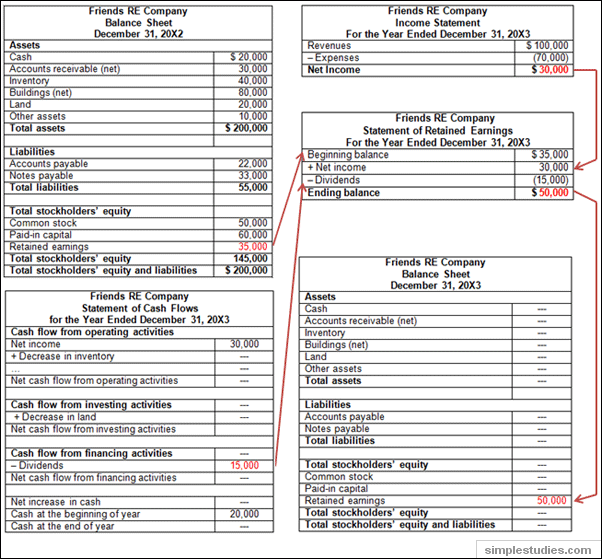

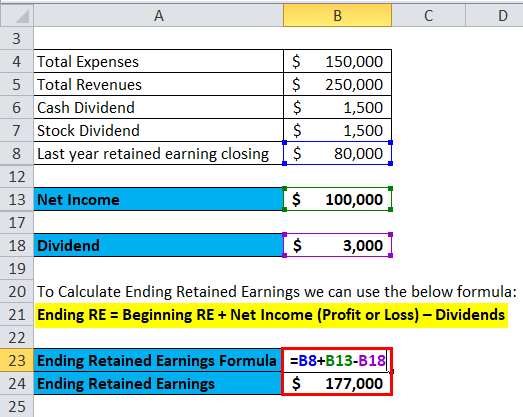

Find your beginning retained earnings balance. Retained earnings are cumulative. Certain information is presented on a balance sheet and used to make assessments about the financial viability of an organization. To summarize the retained earnings formula is Initial Balance Net Income or Net Losses Cash Dividends Stock Dividends.

That means youll report them on your balance sheet in the equity section and carry the RE 0 from the previous reporting periods retained earnings. Looking at Nucors balance sheet which is the largest US-based steel company with a good profitability record it had 113 billion as retained earnings on the balance sheet at the end of 2020. According to section shareholders equity shareholders earnings on the balance sheet show up as retained earnings.

Retained earnings may be seen on a companys balance sheet under the stakeholders equity column. The prior period balance can be found on the beginning of period balance sheet whereas the net income is linked from the current. In this article we will discuss retained earnings on a balance sheet and how to calculate this key piece of information.

What Are Retained Earnings Guide Formula And Examples A Trial Balance Prepared After Adjusting Entries Posted Accumulated Other Comprehensive Income Is Shown On The Sheet

The purpose of retaining these earnings can be varied and includes buying new equipment and machines spending on research and development or other activities that. A retained earnings balance is increased by net income profit and cash dividend payments to shareholders reduce the balance. Using the balance sheet you will be able to find both cash dividends and stock dividends. The amount of retained earnings left over after all direct costs indirect costs income tax and dividends have been paid to shareholders determines the return a company makes to stockholders.

Retained earnings appear under the shareholders equity section on the liability side of the balance sheet. How is retained earnings calculated in balance sheet. In this case stick value is a measure of a companys value after subtracting its liabilities from its assets.

Your current or beginning retained earnings which is just whatever your retained earnings balance ended up being the. Retained earnings will be calculated by subtracting Step 2 Total Liabilities from Step 1 Total Assets. What Does Retained Earnings Mean On Balance Sheet.

What Are Retained Earnings Guide Formula And Examples Aspe Illustrative Financial Statements Pwc Income Statement Of A Hotel

You can find the. However in order to conclude the exact amount one needs to subtract the money given to shareholders as dividends preferred and common stocks. So to begin calculating your current retained earnings you need to know what they were at the beginning of the time period youre calculating usually the previous quarter or year. It shows the changes in RE when compared with the beginning and ending dates.

That number is the starting point for the next balance sheet. The retained earnings balance is an equity account in the balance sheet and equity is the difference between assets and liabilities. Retained Earnings Prior Period Balance Net Income Dividends.

This value could be updated and reported quarterly but it must be computed and published on an annual basis. In effect the equation calculates the cumulative earnings of the company post-adjustments for the distribution of any dividends to shareholders. How Do You Calculate Retained Earnings on the Balance Sheet.

How To Calculate Retained Earnings Formula Statement Agiled App Trial Balance Prepared World Big 4 Accounting Firms

Represents the portion of the companys equity that it can invest in various areas such as new equipment research and. This method is utilized in contrast theyre calculated by subtracting a companys retained earnings from cash and stock dividends over the course of a year as the net profit loss appears in the current years income. However they are calculated by adding the current years net profitloss as appearing in the current years income statement and subtracting cash and stock dividends from the beginning period retained earnings balance. Retained earnings appear on the balance sheet under the shareholders equity section.

In order to calculate shareholder equity subtracting total. As a first time calculation of retained earnings a beginning balance of zero can be generated. The balance sheet and income statement are explained in detail below.

Calculating retained earnings from the balance sheet is a two-step process. In the balance sheet retained earnings are classified as shareholder equity not as retained earnings statement. Retained earnings represent a useful link between the income statement and the balance sheet as they are recorded under shareholders equity which connects the two statements.

Retained Earnings Why Companies Retain Their Profits Getmoneyrich Profit In Balance Sheet Calculating Net Income From

What Is Retained Earnings Beginning Balance. Retained earnings are calculated to-date meaning they accrue from one period to the next.

What Are Retained Earnings Guide Formula And Examples Cash Flow Statement Depreciation Expense Big 3 Financial Statements

What Are Retained Earnings Accounting Question Answer Q A Simplestudies Com Under Armour Income Statement 2018 Excel Spreadsheet Profit And Loss Templates

How Are Retained Earnings Recorded Online Accounting Balance Sheet In Banking Sector Income Statement Example Format