The expenditure Expenditure An expenditure represents a payment with either cash or credit to purchase goods or services. A capital expenditure is the use of funds or assumption of a liability in order to obtain or upgrade physical assets.

Expenses are costs incurred for a consideration. Depreciation is the fall in the value of any tangible asset with a company over a period of time. It instead reports the capital expenditure as an asset on the balance sheet. Key Takeaways A capital expenditure CAPEX is an investment in a business such as a piece of manufacturing equipment an office.

Capital expenditure on income statement.

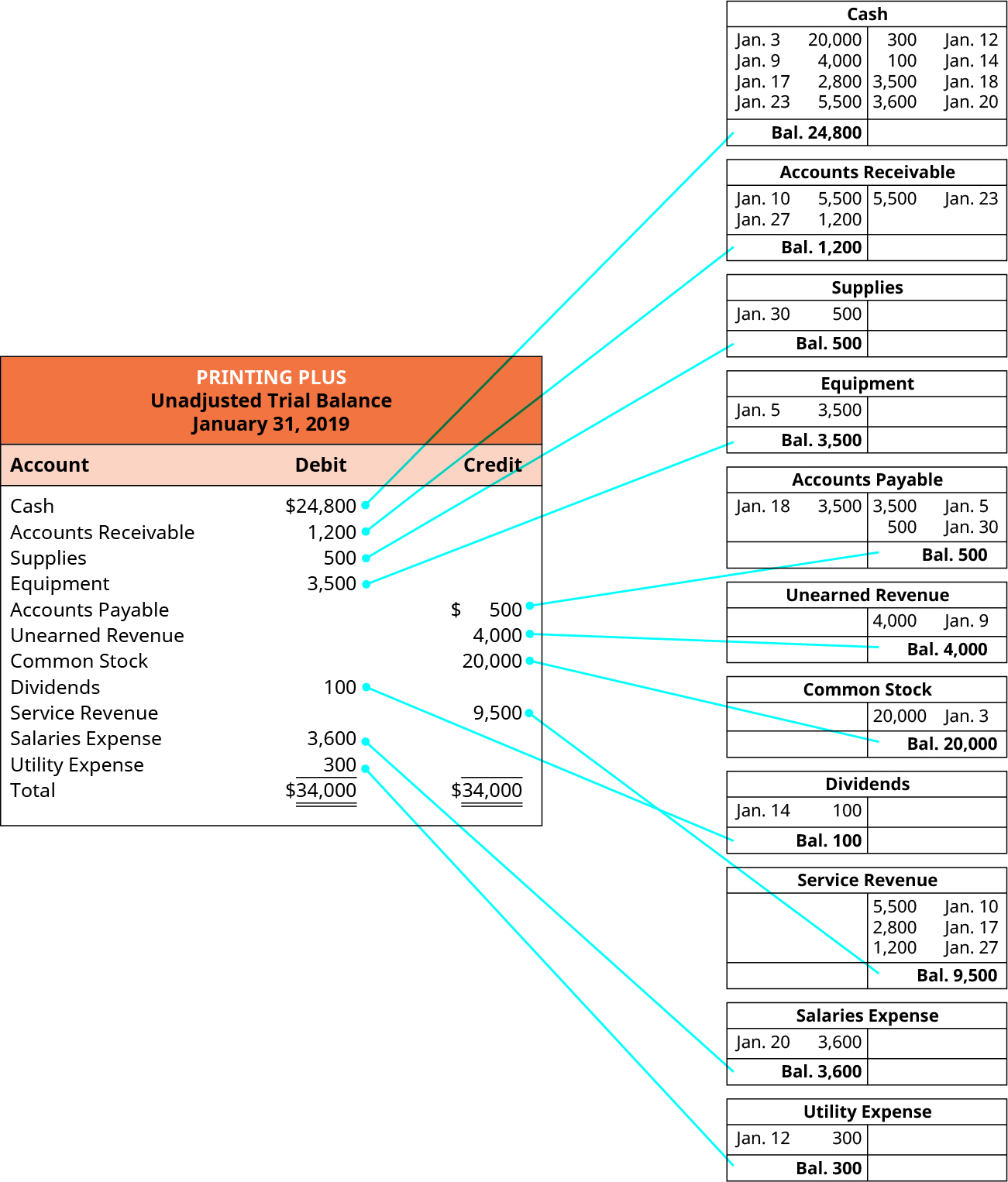

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Cost Accounting Business Plan Off Balance Sheet

Capex and Opex refer to capital expenditure and operating expenditure respectively. Business expenditures are accounted for in either one of the two ways. Unlike revenue expenditure which is recorded as an expense in income statement capital expenditure is recorded as an asset in balance sheet and depreciatedamortized over its useful life using any of the acceptable depreciationamortization methods. An expenditure is recorded at a single point in time s are capitalized ie not expensed directly on a companys income statement on the balance sheet and are considered an investment by a company in expanding its business.

CapEx spending is important for companies to. They are either expensed in the income statement revenue expenditures or capitalized as fixed assets in the balance sheet capital expenditures. PPE is impacted by Capex PPE on the balance sheet.

Capital expenditure CapEx is a payment for goods or services recordedor capitalizedon the balance sheet instead of expensed on the income statement. A CAPEX is typically geared towards the goal of introducing a new product line or expanding a companys existing. Locate the current period property plant equipment.

Income Statement Example Template Format Business Interest Received In Profit And Loss Account Sheet

In accounting a capital expenditure is added to an asset account thus increasing the assets basis the cost or value of an asset adjusted for tax purposes. After looking at this net PPE property plant and equipment figure you can add back the depreciation from the period on the income statement to find the capital expenditure of the period. Because a capital expenditure benefits a business over multiple periods a business does not report an entire capital expenditure on the income statement when the money is spent. Property plant and equipment PPE constitute long-term tangible assets that businesses.

Analyzing a firms income statement indicates to investors whether top managements profit commitment. Capital expenditure is money a company uses to acquire new assets add to current assets or improve assets for the benefit of improving a business such as buying new equipment. As capital expenditure is spent on items which are used over more than one accounting period the expenditure is not treated as an expense in the income statement but is included in the balance sheet as a non-current asset of the business usually under the heading of property plant and equipment.

Examples of CAPEX include physical assets such as. Capital expenditures usually take two forms. Acquisition expenditures and expansion expenditures.

How To Analyze Common Size Income Statement Microcap Co Template Cash Flow Reclassified Stock

Money spent on CAPEX purchases is not immediately. They can also be recognized by agreeing to pay off an obligation eg. Use the formula below to arrive. Income Statement and CAPEX.

Must be expensed on the income statement. A capital expenditure is a purchase that a company records as an asset. Capital expenditure CapEx is a payment for goods or services recordedor capitalizedon the balance sheet instead of expensed on the income statement.

Capital expenditures CAPEX are a companys major long-term expenses while operating expenses OPEX are a companys day-to-day expenses. An expenditure is recorded at a single point in. 3 Effect on Cash Flow Statement The reduction in the cash balance of an entity is reflected in the balance sheet at the end of the taxable year.

Restaurant Sample Statement Income Template Example Pdf Easy To Dow Bookkeeping Templates Small Business Adani Group Balance Sheet Naic Annual Instructions 2018

Locate the prior period PPE on the same balance sheet. The intent is for these assets to be used for productive purposes for at least one year. A revenue expenditure is an amount that is spent for an expense that will be matched immediately with the revenues reported on the current periods income statement. 2 Effect on Income Statement The capital expenditure costs are amortized or depreciated through profit and loss statements over the assets useful life.

The income statement reports depreciation every year and reduced profit. How do you project capital expenditure. Capital expenditures do affect the income statement though in an indirect way in the form of depreciation or amortization expense.

An expense may be capital or revenue in nature and usually incurred by disbursal of money. Where Do Capital Expenditure Goes In Income Statement. Jobs that work with capital expenditures.

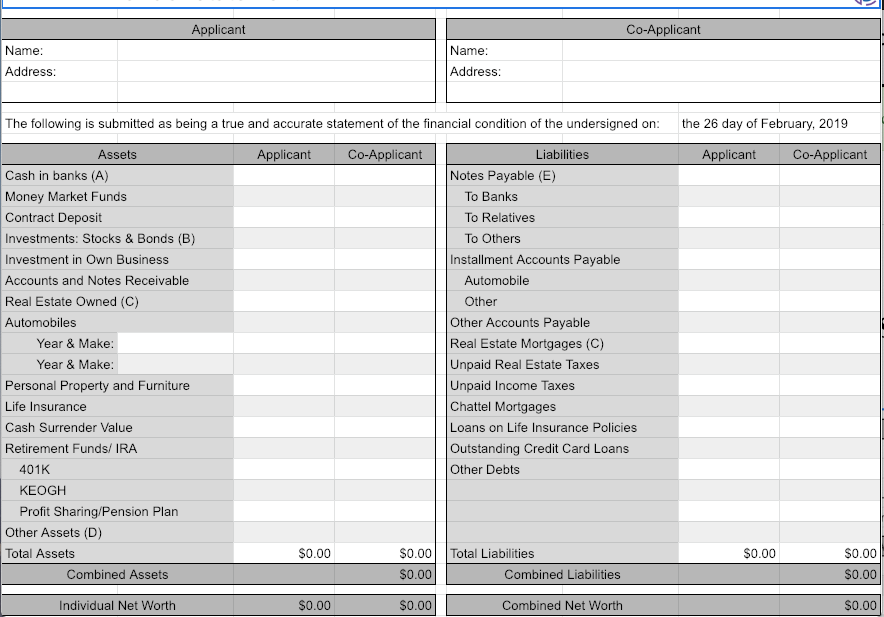

Owners Equity Net Worth And Balance Sheet Book Value Explained In 2021 Financial Position Statement Format For Sole Proprietorship Excel Horizontal Analysis Formula

Do Capital Expenditures Immediately Affect the Income Statement. If you are new to accounting the difference between capital expenditures and revenue expenditures can seem a bit confusing. How Do Capital Expenditures Affect the Income Statement. Capital expenditures PPE current period – PPE prior period depreciation current period capital expenditures 15000 – 10000 20000 capital expenditures 5000 20000 capital expenditures 25000 Therefore your companys capital expenditures for 2018 was 25000.

The first step to calculating capital expenditure is to look at the change to property plant and equipment between balance sheet period one and two. This type of expenditure is made in order to expand the productive or competitive posture of a business. Capital expenditures are capitalized as an asset on the balance sheet and depreciate over time rather than showing as an expense on the income statement.

To win the economic competition a company articulates an overall policy aimed at developing. Paying rent buying machinery paying taxes etc. Such assets include things like property equipment and infrastructure.

Difference Between Financial Statement Capital Expenditure Different Company Balance Sheet Format Meaning Of Corporate Reporting

Capital expenditure is recorded or capitalised as payment for goods or services on the balance sheet rather than being expensed on the income statement. If an asset has a useful life of less than one financial year it should be expensed on the income statement instead of. Locate depreciation and amortization on the income statement. Compared with revenue expenditure.

Capital expenditure is the money used to buy improve or extend the life of fixed assets in an organization and with a useful life for one year or more. This reduction in value occurs because of the usual wear and tear of the asset with usage over the financial year.

Income And Expenditure Account Definition Explanation Format Example Accounting For Management Fund P&l Credit Salary Statement Tax

Explain Capital And Financial Structures Position Statement Suncor Statements Process Audit Report

Capital Expenditure Report Template 2 Templates Example Financial Statement Analysis Quickbooks Online Profit And Loss Prepare Balance Sheet