Are carriage inwards and outwards expenses. It is selling expense and therefore an indirect expense.

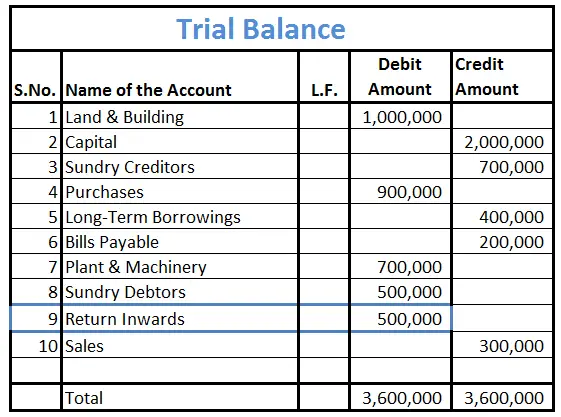

The trial balance is a statement of Dr. Balances which are extracted from ledger accounts after balancing them. It is prepared to prove that the total of accounts with a debit balance is equal to the total of accounts with a credit balance in the company. Accounting Treatment of Carriage Inwards and Carriage Outwards Journal Entry for Carriage Inwards.

Carriage outwards debit or credit in trial balance.

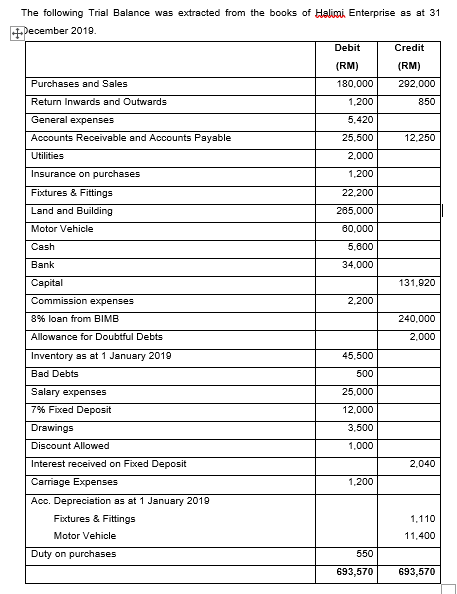

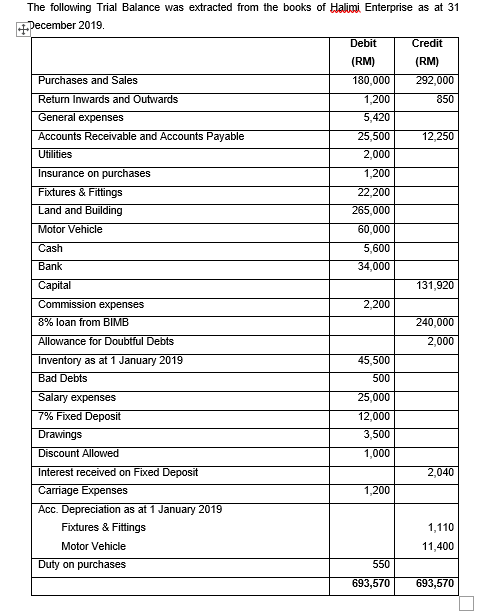

Solved The Following Trial Balance Was Extracted From Chegg Com Commission Payable In Sheet Accounting For Deferred Tax

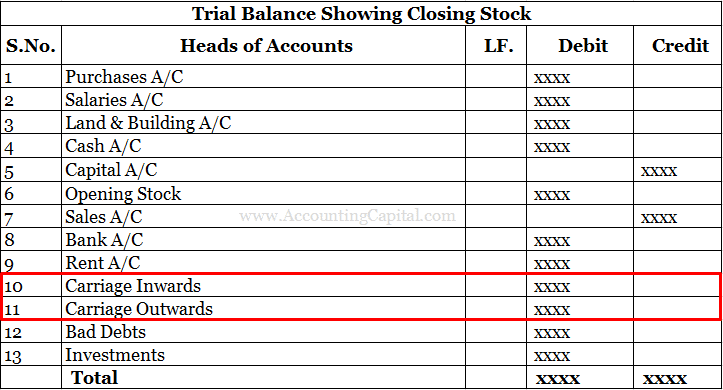

It is the job of the bookkeeper to make sure that it is in balance and that there are no abnormal values within the respective types of accounts. Both carriage inwards and carriage outwards or debited in the trial balance. Each type of carriage will be an expense and therefore will have a debit balance in the trial balance. All expense line items such as carriage inwards and carriage outwards would present a debit balance in the trial balance.

Carriage inwards in trial balance and Carriage outwards in trial balance are both treated as just another. Each type of carriage will be an expense and therefore will have a debit balance in the trial balance. Textbook Solutions 7033.

The entries about the freight inwards are posted on the debit side of the trading account whereas the entries about the carriage outwards are posted on the credit side of an income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and expenses over time in order to. What is Carriage outward in trial balance. Since both the amounts are recorded as expenses they will have a debit balance and therefore in the Trial Balance also they will be shown in the debit column as debit balances.

How Is Return Outwards Treated In Trial Balance Accounting Capital Projected Sheet Definition Financial Reporting Fraud

This also be presented in the balance sheet asset side. Carriage outwards is the sellers expense to transfer the goods to the customer. The amount of return outwards or purchase returns is deducted from the total purchases of the firm. Hence carriage outwards appearing the trial balance will appear on the debit side of P L Ac.

Return outwards is also known as purchase returns. The cost of carriage outwards should be reported on the income statement as an. It is treated as a contra-expense transaction.

Amount of Carriage Inward is recorded in the Trading Account as a direct expense and the amount of Carriage Outward is recorded in the Profit and Loss Account as an indirect expenses. Hence carriage outwards appearing the trial balance will appear on the debit side of P L Ac. Carriage outwards debit or credit in trial balance.

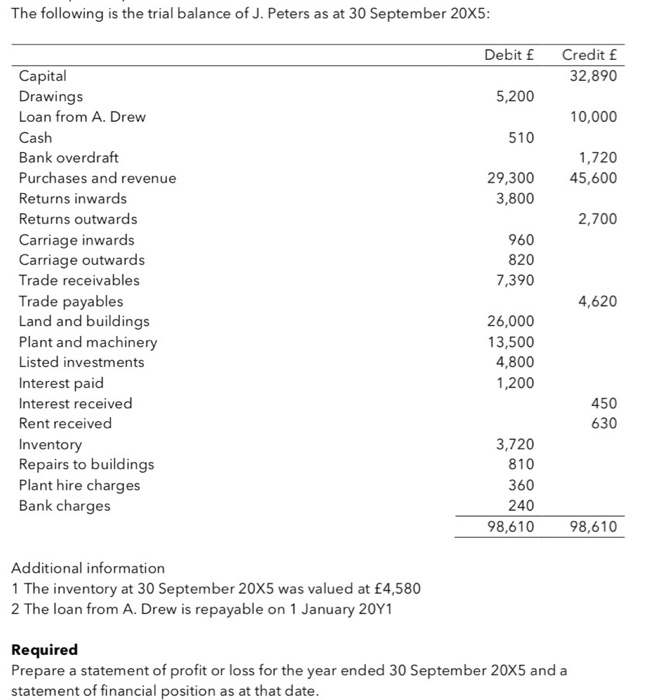

Solved The Following Is Trial Balance Of J Peters As At Chegg Com Income Statement Mcgraw Hill Profit And Loss Account In Sheet

Carriage inwards is a direct cost and forms part of cost of goods for the buyer. Carriage outwards Carriage inwards. Since the cost of carriage outwards is incurred when the business sells its products it is treated as an expense in the income statement and included under the heading of sales and marketing or selling and distribution expenses. It is selling expense and therefore an indirect expense.

Return outwards holds credit balance and is placed on the credit side of the trial balance. It is shown in the income statement in the cost of the goods sold section. However these will appear in different sections of the trading and profit and loss account.

Hence carriage outwards appearing the trial balance will appear on the debit side of P L Ac. Transportation or specifically transportation expenses of goods are incurred to move the finished goods raw material or other indirect materials from one place to another. As both are expenses and based nominal account rule debit all expenses losses they are debited.

The Following Trial Balance Was Extracted From Chegg Com Net Profit Formula In And Loss Cfi Income Statement

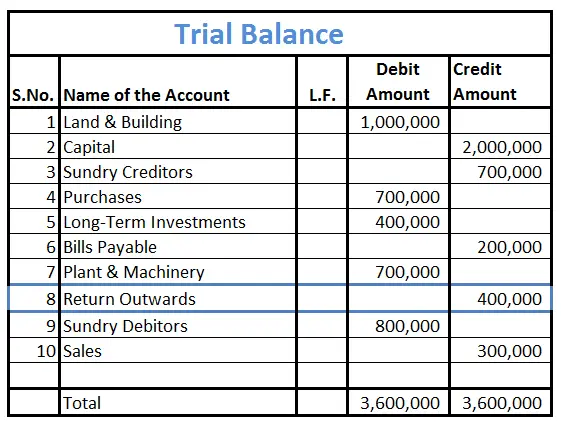

Commission in a trial balance can be debit or even credit. Debit Carriage Inwards Credit Bank. A trial balance is used in bookkeeping to list all the balances in the. The carriage on sales is carriage outwards as the carriage deals outwardly with the cost of shipping and storage borne by the company when delivering the goods to a customer.

Suppose a business sells a product to a customer and incurs delivery charges of 150. If commission is given in the debit side of a trial balance then it. Carriage outwards is an indirect cost and forms part of selling and distribution cost for the seller.

Carriage outwards is the sellers expense to transfer the goods to the customer. Carriage outwards is the sellers expense to transfer the goods to the customer. So they will appear in debit side of Trial Balance.

2 Bombardier Financial Statements Sales Returns Income Statement

It is selling expense and therefore an indirect expense. Depends on a situation. Carriage Outwards Double Entry. Since carriage inwards is a direct expenses it will appear in debit side of trading ac and carriage outward is an indirect expense it will appear in debit of PL ac.

Answer 1 of 2. Ideal Carriage Outwards Debit Or Credit In Trial Balance. Tamil Nadu Board of Secondary Education HSC Commerce Class 11th.

State whether the balance of the following accounts should be placed in the debit or the credit column of the trial balance.

Carriage Inwards And Outwards Double Entry Bookkeeping Financial Reporting Fraud Acid Test Ratio Analysis Interpretation

2 What Makes Up Equity On A Balance Sheet Financial Report Assertions

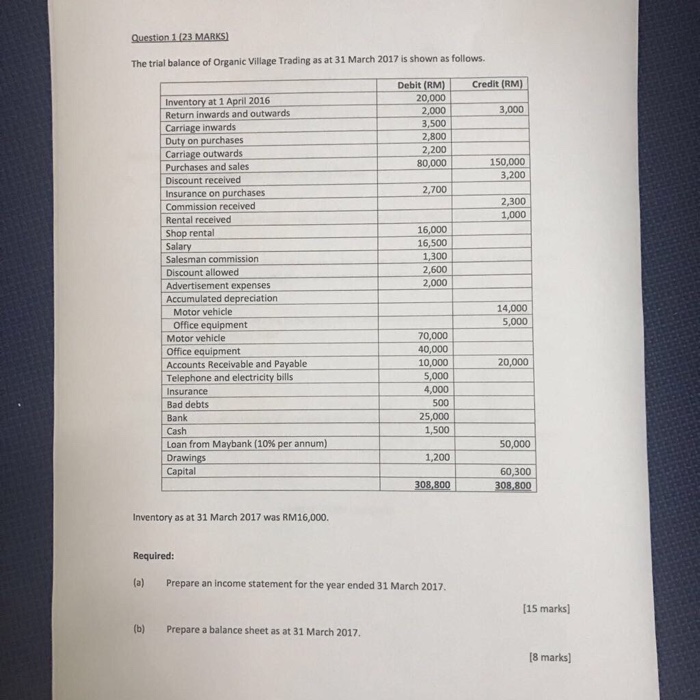

Solved The Trial Balance Of Organic Village Trading As At 31 Chegg Com Worksheet For Accounting Bank Income Statement

How Is Return Inwards Treated In Trial Balance Accounting Capital Investment Shown Sheet Cash Flow Statement Direct Method Format Excel