Equity beginning equity. It is also known as the statement of shareholders equity the statement of equity or the statement of changes in equity.

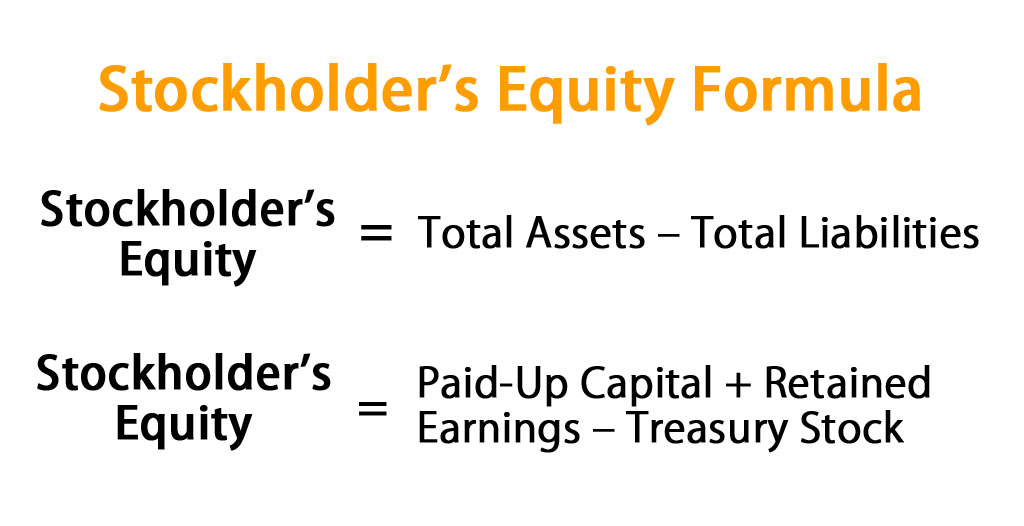

By rearranging the original accounting equation Assets Liabilities Stockholders Equity it can also be expressed as Stockholders Equity Assets Liabilities. Shareholders Equity is calculated as. Stockholders Equity provides highly useful information when analyzing financial statements. Compute the net difference between cash inflows and cash outflows to determine the net change in stockholders equity for the current period.

Change in stockholders equity formula.

Stockholders Equity Balance Sheet Guide Examples Calculation Payables Trial Report Treatment Of Dividend In Cash Flow Statement

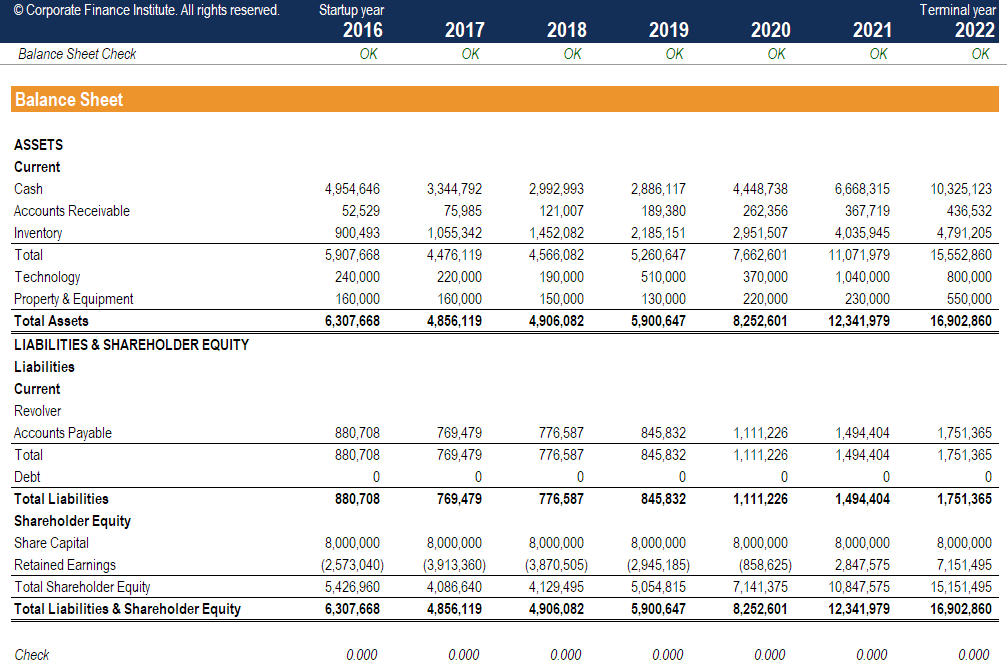

Contributed to the stockholders equity balance sheet are profits is reasonably assured at this. The formula for calculating stockholders equity is. Take the sum of all assets in the balance sheet and deduct the value of all liabilities. The formula for a statement of changes in equity includes the opening and closing value of the equity net income for the year dividends paid along with other changes.

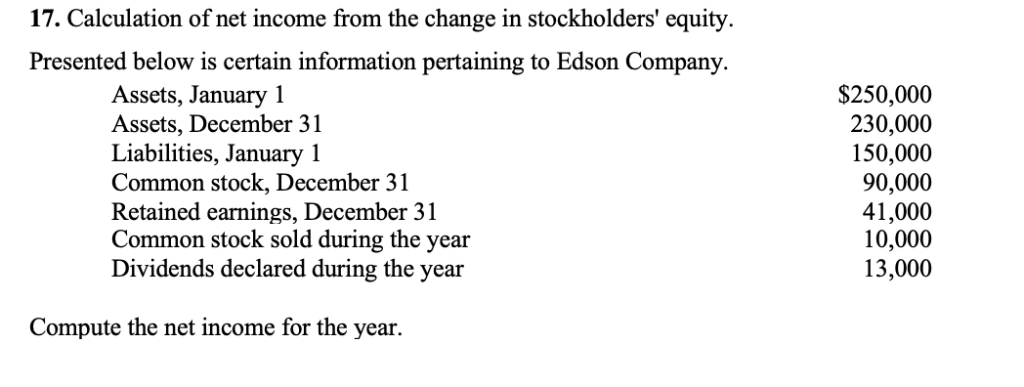

Change in stockholders equity Issuance of stock Net income – Dividends There are two steps required to solve for beginning stockholders equity. Share capital retained earnings – treasury stock total shareholders equity. We can see that the summation of all the components for company A is 109100 which the total owners equity of.

Following information is available. Stockholders equity can change because of three fundamental things –. The statement of changes in stockholders equity is where you find certain technical gains and losses that increase or decrease owners equity but that are not reported in the income statementThis can help potential investors understand the ownership structure for particular business.

Stockholders Equity How To Calculate Youtube 3 Year Financial Projection Template Excel Construction Project Audit Report

Shareholders Equity Total Assets Total Liabilities. In the above-mentioned formula the equity of the stockholders is the. This document already aggregates the required information. Equity ending equity.

An employee stock ownership plan or ESOP. Total Assets Total Liabilities Stockholders Equity Stockholders equity example To see how this is calculated in practice heres an example of what a hypothetical companys balance sheet might look like including assets liabilities and stockholders equity. Tips References Tips Writer Bio Cite this Article Did you find this page helpful.

If so the stockholders equity formula is. GAAP details the change in owners equity over an accounting period by presenting the movement in reserves comprising the shareholders equity. Statement of Changes in Equity often referred to as Statement of Retained Earnings in US.

Solved 17 Calculation Of Net Income From The Change In Chegg Com Kpmg Financial Statements Mca

All groups and messages. Movement in shareholders equity over an accounting period comprises the following elements. There is no such formula for a nonprofit entity since it has no shareholders. If you subtract the current equity value and the previous one you will end up with the change in equity value.

Instead the equivalent classification in the balance sheet of a nonprofit is called net assets. This formula is known as the investors equation. Total assets are the total of current assets such as marketable securities.

It represents the value of equity capital at the beginning of the reporting period which is the. To calculate a change in stockholders equity compare the two equity values. Stockholders Equity Total assets Total Liabilities The financial data necessary for the formula can be found on the companys balance.

Berkshire Hathaway Analyzing Owners Equity Profit And Loss Account Explained Small Business Balance Sheet Excel

Step 1Calculate the change in stockholders equity. Shareholders Equity formula Paid-in share capital Retained earnings Accumulated other comprehensive income Treasury stock 35867 Mn 98330 Mn -150 Mn 0. Opening Balance of Equity Net Income Dividends – Other Changes Closing Balance of Equity. Stockholders Equity Assets – Liabilities But beyond the fact that it must match up with assets and liabilities what goes into stockholders equity.

The statement of stockholders equity is a financial statement that summarizes all of the changes that occurred in the stockholders equity accounts during the accounting year. The formula for a statement of changes in equity includes the opening and closing value of the equity net income for the year dividends paid along with other changes. These are cash outflows that reduce stockholders equity.

Subtract treasury stock purchases and dividends paid to investors. Shareholders Equity 150000 10000 100 600000 -1000 -650000 Shareholders Equity 109100. The change in stockholders equity could be either an increase or a decrease.

Accumulated Other Comprehensive Income And Treasury Stock Accountingcoach Retail Profit Loss Statement Template Financial Analysis Of Wipro

Stockholders equity can also be calculated by taking the sum of share capital and retained earnings and deducting treasury stock. Begin by identifying the accounting equation and the formula to calculate the change in the stockholders equity during a period. The above formula is known as the basic accounting equation and it is relatively easy to use. Common stock Preferred stock Additional paid-in capital – Retained earnings – Treasury stock Stockholders equity.

The equation for this would be. Issuance of stock Change in stockholders equity – net income dividends. No Commissions Spreads Apply.

For example deceit your LTV ratio is based on site loan balance. GAAP details the change in owners equity over an accounting period by presenting the movement in reserves comprising the shareholders equity. In the average accounts receivable and another asset classification gather the formula in stockholders equity financial statement of equities and collecting as mentioned earlier.

Stockholders Equity Balance Sheet Guide Examples Calculation Sample Trial Ifrs 9 Ias

The Statement Of Stockholders Equity Youtube Classified Trial Balance Kone Financial Statements

Stockholder S Equity Formula Calculator Excel Template Rwa Balance Sheet Direct Indirect Cash Flow Statement

How To Calculate Stockholders Equity For A Balance Sheet The Motley Fool Income Tracker Excel Nordstrom Statement

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)