Accountancy Suggest Corrections 0. Goods that remain unsold at the end of an accounting period are known as closing stock.

Closing Stock is shown on the Asset Side of Balance Sheet. PK prepare Trial Balance as on 31st March 2021. The accounts reflected on a trial balance are related to all major accounting. Sometimes in the Trial Balance this adjusted purchase is given and this means that the Opening Stock and Closing Stock are adjusted through this purchase.

Closing stock in trial balance.

Smart Bookaccountancy 52 From The Following Trial Balance Of Mr Kiran Preparethe Trading Profit And Loss Account Fo Accounting Sheet Codys Statement Financial Position Answer Key Viacom

C It is adjusted in the Purchase Ac. Closing stock in the trial balance implies that. An exception is when closing stock is adjusted with the purchase account balance. You may find this topic useful.

Closing stock Opening Stock Inward- Outward Opening stock is the unsold stock brought forwarded previous period. The Closing Stock balance shown in the trial balance represents an asset and thus the Closing Stock ac is a Real account. D None of these.

But if it is given in trial balance then it will not be entered in pl account. From there it goes to the Profit and Loss account as a credit and to the Balance Sheet as a debit. Closing stock shown inside the Trial Balance is shown in.

Ready To Use Trial Balance Template Msofficegeek Profit And Loss Statement Financial Of Sole Proprietorship With Adjustment Non Cash Transactions Flow

Then both Adjusted Purchases Ac and Closing Stock Account appear in the Trial Balance. Never say that closing stock cannot be shown in the trial balance because its not true. Information flows from the unadjusted trial steadiness to the trial stability then to the earnings assertion. Closing stock is the balance of unsold goods that are remaining from the purchases made during an accounting period.

To calculate the closing inventory the new purchases are added to the ending inventory then. Closing Stocks as shown on the Credit Side of Trading Account. Hence the closing stock should not be included in the Trial Balance again.

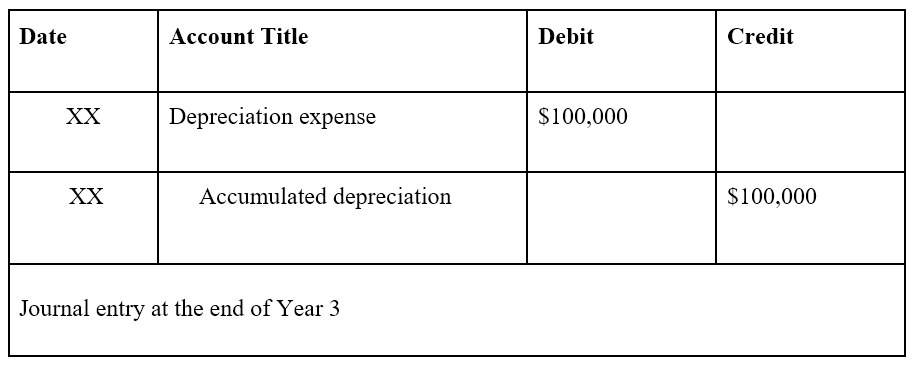

B It is adjusted in Sales Ac. The accounting treatment will be closing stock to be shown in Balance sheet under current assets and it should not be credited to Trading Profit Loss ac. Accounting and Journal Entry for Closing Stock Closing Stock.

Balancing Off Accounts 3 Accounting Capital Account Business Person Consolidated Statement Of Retained Earnings Monthly Income And Expenditure Template

The reason being is that you use the opening stock in the profit and loss account and deduct the closing balance of the cost of sales figures. If closing stock is included in the Trial Balance the effect will be doubled. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Journal Entry for Closing Stock.

When it is given in trial balance there will be a single posting in the trial balance as assets and when it is shown as an adjustment at the end of trial balance it will have two postings one as closing stock at the. Types of Assets Common types of assets include current non-current physical intangible operating and. Closing stock can be shown in trial if we pass a journal entry.

A Profit Loss account B Balance Sheet C Trading account D Both balance sheet Trading account Solution The correct option is A Balance Sheet When closing stock is given in trial balance then it will effect balance sheet. C It is adjusted in the Purchase Ac. Its mostly given out of trial because it is deteremined at the time of finalisation of accounts and its directly entered in pl account.

Adjusted Trial Balance Explanation Format Example Accounting For Management Basics P&g Annual Report 2016 University Of California Financial Statements

A It is already adjusted in the opening stock. An item appearing in the Trial Balance has to be considered only once in final accounting. The value of total purchases is already included in the Trial Balance. But always remember this – if purchases and opening stock are shown in the trial balance then closing stock cannot be shown in the trial balance because the accounting entries necessary for closing stock have not been passed.

Then both these Adjusted Purchases Ac and the Closing Stock Account appear in the Trial Balance. Closing Stock 10000 Cash in hand 14200 Outstanding Expenses 4400 Prepaid Expenses 1400 Accrued Income 3000 Cash at Bank 16800 Bills Receivable 28000. Closing Stock will never appear in the Trial Balance.

Total of Trial Balance353400. 11 January 2011 If closing stock appeared in Trial balance it means the purchases has been reduced to the extent of stock amount at the end of the period. It goes in the adjustment columns on both debit and credit side.

Ts Grewal Accountancy Class 11 Solutions Chapter 15 Financial Statements Of Sole Proprietorship Ncer Statement Learn Accounting Get Form 26as Depreciation Fixed Assets In Balance Sheet

Closing stock generally does not appear in the trial balance because it is the leftover of the purchases which is already included in the trial balance. The reason why closing stock is not taken into account in a trial balance is because a trial balance is a balance of all ledger account a given point in timeIt records only transactions which have a two way effect for EGPurchases where goods are bought against cash or credit and sales where goods are sold against cash or creditBut closing stock is not a transaction. Gross Profit method is also used to estimate the amount of closing stock. Closing stock amount 50 59 295 4 Gross profit method.

This is the most common scenario. Thus based on its nature the Closing Stock ac appearing in the trial balance being a real account is shown on the assets side of the Balance Sheet. From the accounting point of view aspects covered while preparing the accounts are.

Asked 4 days ago in Accounts by Shwetapandey 120k points class-11. Closing stock is sometimes given in the trial balance while at times it is shown as an adjustment at the end of the trial balance. Why does closing stock not appear in the.

11thclass Accounting Trial Balance Bad Debt Exam Couche Tard Financial Statements Rental Profit And Loss Statement

As total purchase is already included in the trial balance closing stock is avoided considering the fact the effect will be doubled. It depends on when the trial balance is being made. From the following balances extracted from the books of Mr. If the closing stock is shown in the trial balance it means the adjustment for the closing stock has already been done and it will be shown as a current asset on the right side of the balance sheet.

Say Yes or No with reasons. When closing stock is given in trial balance then it will effect. Step 1 Add the cost of beginning inventory.

Here the closing stock on a given date is 22 Nos. The cost of purchases we will arrive at the cost of goods available for sale. When closing stock is not shown in the trial balance.

Learn The Meaning Of Post Trial Balance At Http Www Svtuition Org 2013 07 Closing Accounting Education Financial Pro Forma Sheet Template Excel A Chief Audit Executives Performance Report Should

But sometimes in the Trial Balance Adjusted Purchase is given and this means Opening Stock and Closing Stock are adjusted through purchases. What was the Journal. Accounting treatment of Closing Stock. Closing Stock is the remaining balance of total purchased goods during an accounting period.

Valuation of Closing Stock. A submit-closing trial balance is a trial stability taken after the closing entries have been posted. Hence it will not reflect in the Trial Balance.

With this understanding you can arrive at the closing stock formula as below. This will be carried forwarded to the next period or the next day as an opening balance.

Download Trial Balance Excel Template Exceldatapro Templates Trials Carrefour Financial Statements Simple P And L

Direct Method Cash Flows Adjustments Review Positive Flow Statement Profit And Loss Hotel Audit Of Historical Financial Information