These result from the translation of foreign subsidiaries balance sheet assets and liabilities at current exchange rates when consolidating the foreign subsidiaries financial statements. Components of OCI for full IFRS include.

Other comprehensive income comprises items of income and expense including reclassification adjustments that are not recognised in profit or loss as required or permitted by other IFRS. Cumulative gain loss previously recognised in other comprehensive income arising from reclassification of financial assets out of fair value through other comprehensive income into fair value through profit or loss measurement category. The accounting treatment of comprehensive income is. ABC Fund has no other comprehensive income items.

Comprehensive income ifrs.

Sample Financial Report Templates Analysis Template Illustrative Interim Statements 2019 Balance Sheet Of Private Limited Company

IFRS in respect of the classification of gains or losses in other comprehensive income or profit or lossprofit and loss is directed by the notion that all. All income and expenses have previously been reported in the income statement. Of comprehensive income renamed to statement of profit or loss and other comprehensive income. Hedging gains losses for hedge of group of items with offsetting risk positions.

156 Income statement and statement of comprehensive income. Like US GAAP the income statement captures most but not all revenues income and expenses. In general revenues and expenses are recorded on the accounts when the transactions are both.

Profit loss before tax. IFRS 9 requires gains and losses on financial liabilities designated as at FVTPL to be split into the amount of change in fair value attributable to changes in credit risk of the liability presented in other comprehensive income and the remaining amount presented in profit or loss. The most significant difference between the frameworks is that under IFRS an entity can present expenses based on their nature or their function.

Mariyambari I Will Do Financial Accounting Taxation And Auditing Work For 5 On Fiverr Com In 2021 Statement Analysis Cost Trial Balance Xero Purpose Of Comprehensive Income

Comprehensive income comprises net income profit or loss and items of other comprehensive income OCI. Dalam Pelaporan Keuangan IFRS telah mengatur standar pelaporan Laba rugi yang di sebut pelaporan Laba Rugi Komprehensif. Gains losses on PPE revaluations IAS 16. Examples of statement of profit or loss and other comprehensive income when IFRS 9 Financial Instruments is applied XYZ Group Statement of comprehensive income for the year ended 31 December 20X7 illustrating the presentation of profit or loss and other comprehensive income in one statement and the classification of expenses within profit.

Businesses incur expenses in the course of producing revenues. In business accounting other comprehensive income OCI includes revenues expenses gains and losses that have yet to be realized. Us IFRS US GAAP guide 156.

Examples include the fair value remeasurement of certain equity instruments remeasurements of. Like IFRS Standards comprehensive income is the total change in equity during the period excluding changes that arise from transactions with owners in their capacity as owners. Presentation of Financial Statements introduces changes to the presentation of items of other comprehensive income.

Completed Contract Methods Under Ifrs And Gaap Financial Statements Accounting Method Statement Google Docs Balance Sheet Template Current Profit

Statement of comprehensive. Other items of comprehensive income OCI do not flow through profit and loss. On 16 June 2011. Net income or net loss is equal.

IFRS 16 requires separate presentation of the interest expense on the lease liability and the depreciation charge for the right-of-use asset in the lessees statement of profit or loss and other comprehensive income. So to clarify there are 6 instances under full IFRS for OCI and three for IFRS for SMEs as follows. Under both IFRS and US GAAP there are four types of items that are treated as other comprehensive income.

Presentation of Items of Other Comprehensive Income Amendments to IAS 1. Laba Rugi Komprehensi adalah selisih total pendapatan dengan total beban perusahaan tidak termasuk komponen dari penghasilan lainnya Other Comprehensive income OCI. Comprehensive income and other comprehensive income are two components of the income statement that can have a material effect on the profitability.

Ifrs Vs Gaap Accounting Student Common Stock Spreadsheet To Track Expenses And Income Financial Analysis Report For Hotel

IFRS 9s new model for classifying and measuring financial assets after initial recognition Loans and receivables Basic loans and receivables where the objective of the entitys business model for realizing these assets is either. Under IFRS the income statement is labeled statement of profit or loss. Ini dikenal sebagai penghasilan bersih. Gains and losses on remeasuring an investment in equity instruments where the entity has elected to present them in other comprehensive income in accordance with IFRS 9 The effects of changes in the credit risk of a financial liability designated as at.

Foreign currency translation adjustments. Through Other Comprehensive Income FVOCI. This paper gives an overview of the international fi nancial reporting standards requirements for companies comprehensive income reporting examines the existing approaches to the interpretation of the comprehensive income term analyzes possible options of the comprehensive income reporting as well as gives attention to discussions in relation to the.

It is a more robust document that often is used by large corporations with investments in multiple countries. Comprehensive Income in Financial Statements. Other comprehensive income comprises items of income and expense including reclassification adjustments that are not recognised in profit or loss as required or permitted by other IFRSs.

The Balance Sheet Complete Guide To Corporate Finance Investopedia Good Essay Effective Resume Asc 606 Cash Flow Statement Ngo Audited Financial Statements

I have been getting queries on the differences between full IFRS and IFRS for SMEs with regards to Other Comprehensive Income. Comprehensive Income Revenues and Expenses. It was issued by the IASB. Collecting contractual cash flows.

IFRS describes total comprehensive income as the change in equity during a period resulting from transactions and other events other than those changes resulting from transactions with. Whereas other comprehensive income consists of all unrealized gains and losses on assets that are not reflected in the income statement. One of the most important financial statements is the income statementIt provides an overview of revenues and expenses including taxes and interest.

Key Differences Between The International Financial Reporting Standards Ifrs And Indian Accounting Ind As Cash Flow Statement What Are General Purpose Statements 16 Illustrative Disclosures Pwc

Ifrs Vs Gaap Accounting Student Common Stock Illustrative Financial Statements 2018 Kpmg Google Balance Sheet

Pin By Vona Cynn On Bookkeeping Training Accounting Basics Education Business Current Account In Balance Sheet Provisions For Doubtful Debts

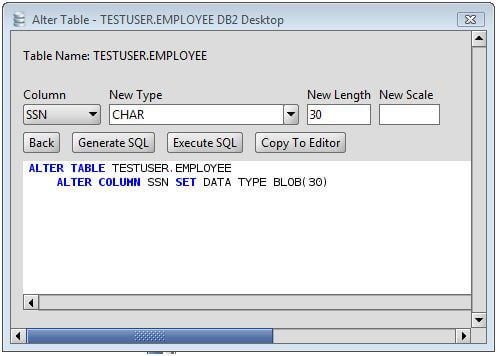

Guide To Parallel Operating Systems With Windows 7 And Linux 2nd Edition Pdf Version Book Program Learn Code Cengage Learning Trial Balance Accounts Payable Tjx Sheet