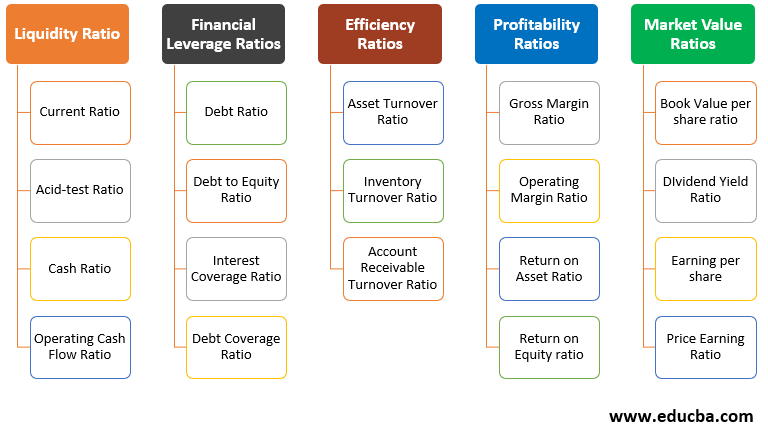

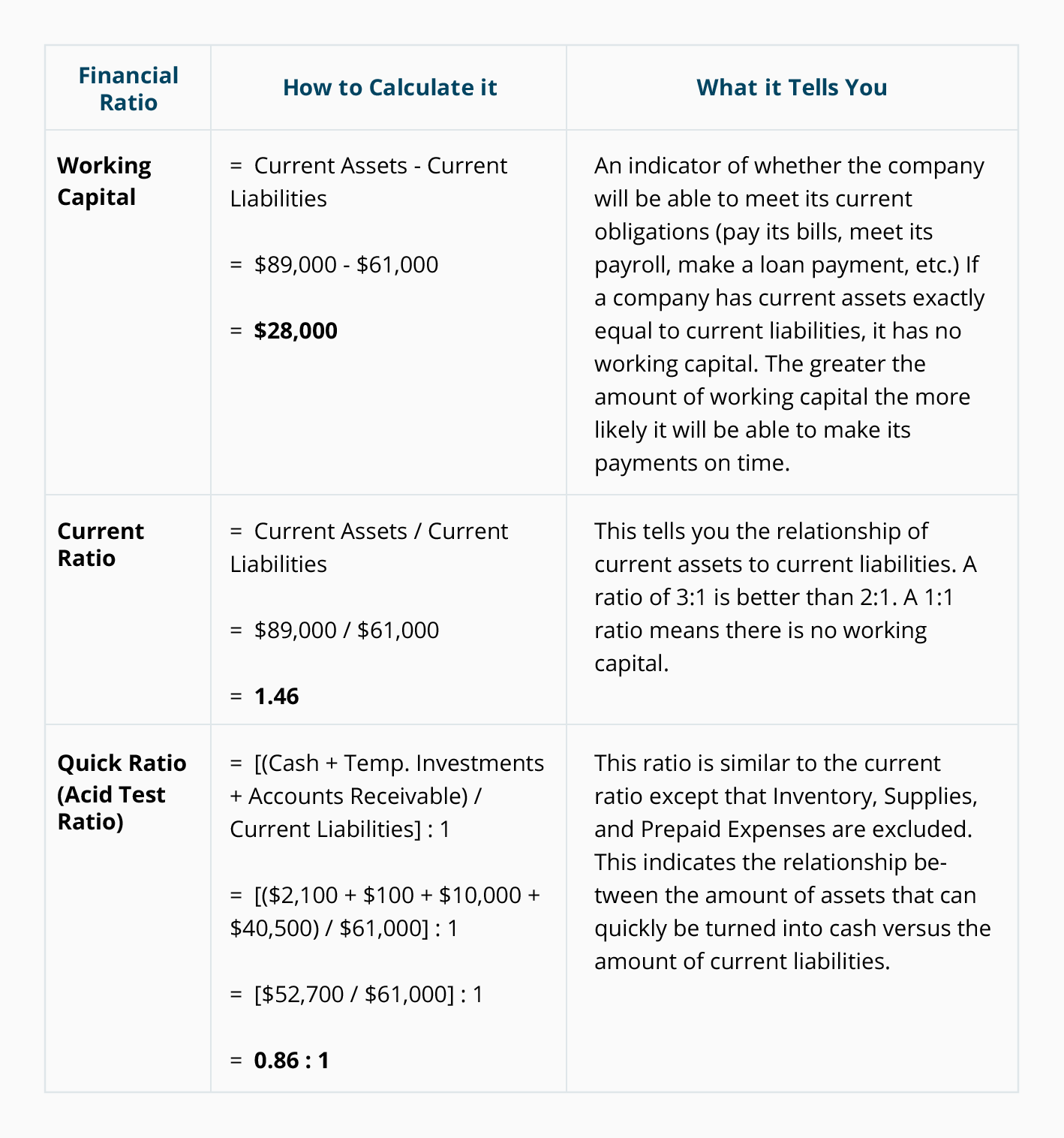

Prepaid Expenses Due From Officers Shareholders Employees. The current ratio is one of the vital liquidity ratios which companies should maintain as a measure of margin of safety on the hand earnings more.

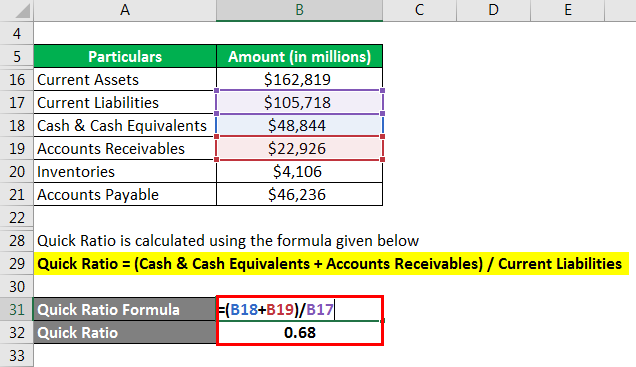

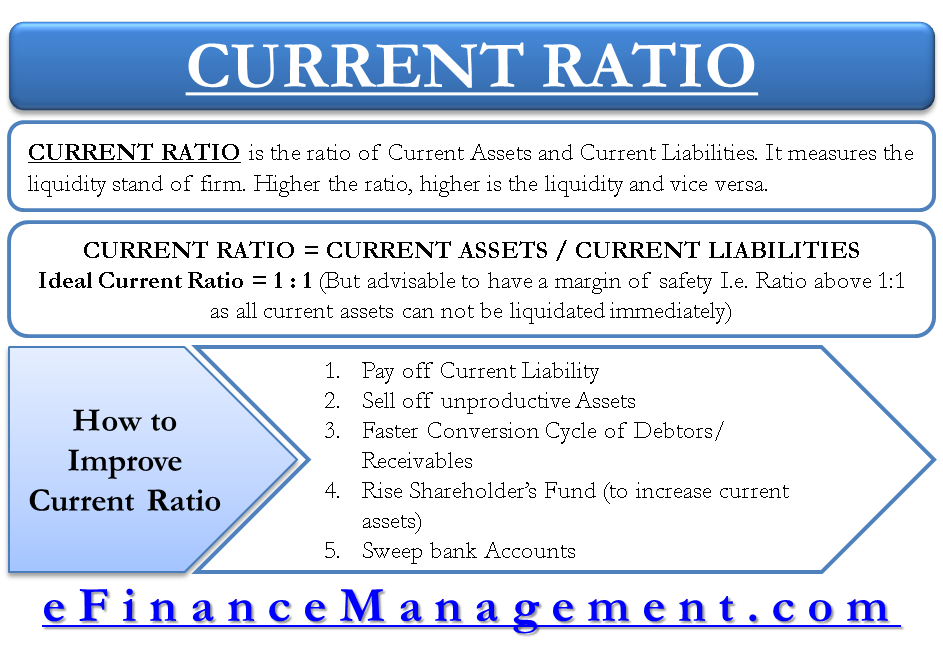

A ratio is defined as the indicated quotient of two mathematical expressions and the relationship between two or more things. It signifies a companys ability to meet its short- term liabilities with its short-term assets. But whether or not a specific ratio is satisfactory depends on the nature of the business and the characteristics of its current assets and liabilities. Current ratio 60 million 30 million 20x.

Current ratio interpretation pdf.

Importance Of Ratio Analysis Categories And Entry Level Accounting Finance Jobs Fitbit Balance Sheet

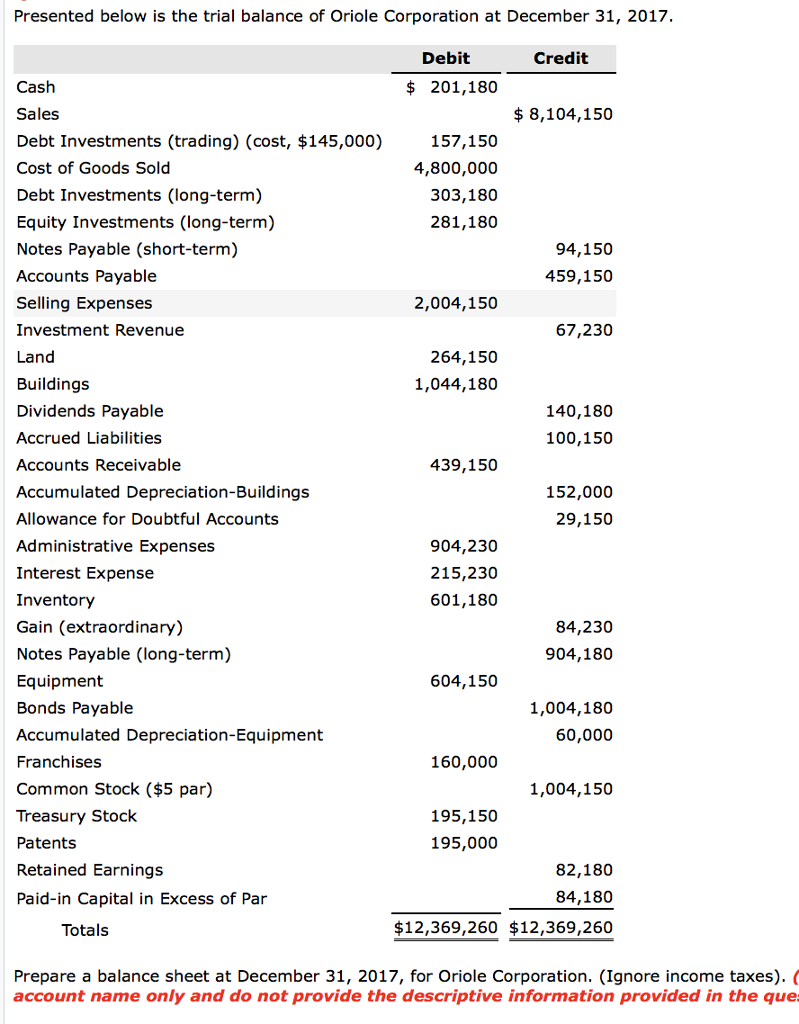

The minimum acceptable current ratio is obviously 11 but that relationship is usually playing it too close for comfort. Current ratio Current assetsCurrent liabilities or Current liabilities Current assetsCurrent ratio 750000025 3000000. If Current Assets Current Liabilities then Ratio is less than 10 -. A short summary of this paper.

Marketable securities 20 million. Accounts receivable X 365 sales. If Marbel Incs current ratio is 14 and total current liabilities are 8000000 what are its total current assets.

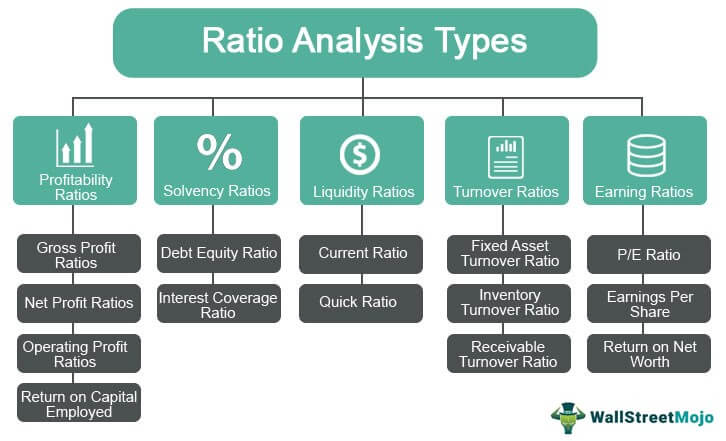

Dollar of revenue that the company retains as gross profit so naturally a high gross margin ratio is desired. Current Ratio Current Assets Current Liabilities. Inventory 25 million.

Financial Ratios Calculations Accountingcoach Statement Analysis Martin Fridson Income Loss

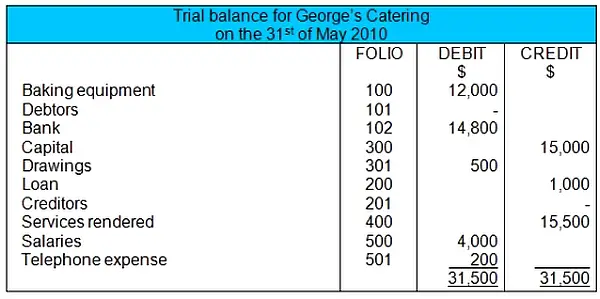

Formula Interpretation A low gross margin ratio does not necessarily indicate a poorly performing company. Current assets 15 20 25 60 million. Current Ratio Current Assets Current liabilities Current Assets Stock debtors Investments short term Cash In hand Current Liabilities Creditors bank overdraft Provision for Taxation current Future CA 12000 12000 4000 12000 40000 CL 16000 4000 4000 4000 28000 40000 28000 143. LIQUIDITY RATIOS example 1 Solution.

A high ratio implies that the company has a. Current Ratio Current Ratio Current Assets Current Liabilities. Current Ratio Current Asset.

If current ratio is say 25 it means to pay current liability of Rs1 crore the company has Rs25 Crore 125 of current assets. If for a company current assets are 200 million and current liability is 100 million then the ratio will be 200100 20. In financial analysis a ratio is used as a benchmark for evaluation.

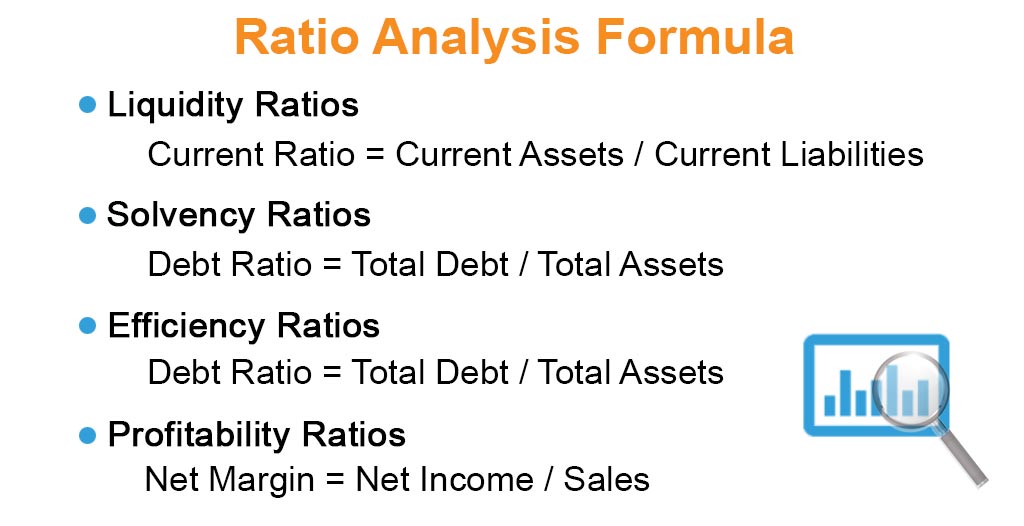

Ratio Analysis Formula Calculator Example With Excel Template The 4 Basic Financial Statements Kpmg Model 2019

Managers will use ratio analysis to pinpoint strengths and weaknesses from which strategies and initiatives can be formed. Current Ratio Current Asset Current Liability But it is also essential to look at the quality of current asset CA. Accounts payables 15 million. Full PDF Package Download Full PDF Package.

Current ratio Current assetsCurrent liabilities or. Short-term debt 15 million. If a business holds.

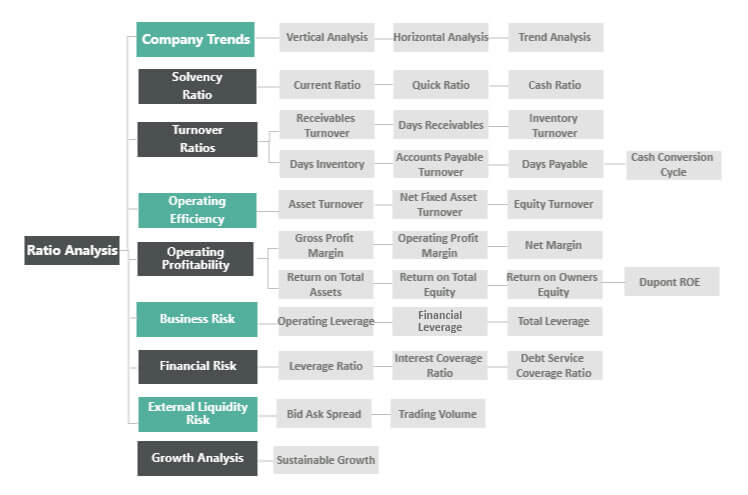

A Current ratio b Acid Test Ratio c StockTurnover Ratio d Debtors Turnover Ratio e Creditors Turnover Ratio and Average Debt Collection period. Cash 15 million. Financial analysis is the process of using fi nancial information to assist in investment and fi nancial decision making.

Ratio Analysis Definition Formula Calculate Top 32 Ratios Qualified Opinion Types Of Financial Performance

Current ratio Current assets current liabilities 708 540 131 times Interpretation. Current liabilities 15 15 30 million. It is important to compare gross margin ratios between companies in the same industry rather than comparing them across industries. The company has 131 RON in current assets for every 1 RON in current liabilities the current ratio is a measure of short-term liquidity Quick ratio Current assets InventoryCurrent liabilites 708 422540 053 times Interpretation.

A study on a case study of consumer goods industry by Hantono 2018 demonstrated that regression analysis using current ratio and debt to equity ratio as predictors could show significant. Current ratio The current ratio is the most basic liquidity test. E Debt Equity Ratio Fixed Assets Ratio Current Ratio and Liquidity.

Download Full PDF Package. Current Ratio 1200000 600000 2 or 1200000. A generally acceptable current ratio is 2 to 1.

Ratio Analysis Formula Calculator Example With Excel Template Financial Statement Test Bank Asus Statements

Debt Equity Ratio Debt Equity Ratio Long Term Debt Longterm Debt Debentures 50000 Shareholders Fund. Current Ratio Formula Current Assets Current Liablities. Accounts Payable Accounts Payable Accounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services. 1 A relatively high current ratio is an indication that the firm is liquid and has the ability to pay its current obligations in time and when they become due.

Current assets include cash and bank balances marketable securities inventory and debtors excluding provisions for bad debts and doubtful debtors bills receivables and prepaid expenses. Current assets current liability Receivable days. Current ratio interpretation pdf.

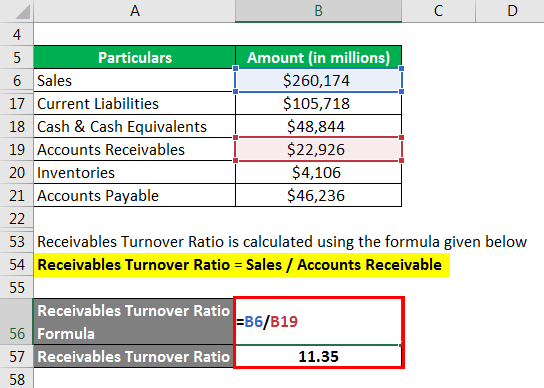

24 Full PDFs related to this paper. It is calculated by dividing current assets by current liabilities. INTERNAL LIQUIDITY RATIOS The internal liquidity ratios also referred to as solvency ratios measure a firms ability to pay its near-term financial obligations.

Financial Ratio Analysis How To Interpret Ratios Analyse A Company Getmoneyrich Accounting For Branches Combined Statements Lego

Accounts Payable X 365 Sales. Comment on the financial position of the Company i. Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time and provide key indicators of organizational performance. Example of the Current Ratio Formula.

A current ratio greater than or equal to one indicates that current assets should be able to satisfy near-term obligations. Working Capital Current Assets Current Liabilities Current Ratio Current Assets Current Liabilities Quick Ratio Acid Test Current Assets-Inventory Current Liabilities Adjustments. Ratio analysis is a powerful tool of financial analysis.

Ratio Analysis Types Top 5 Of Ratios With Formulas How To Read A Profit And Loss Statement Quickbooks Overdraft In Balance Sheet

Ratio Analysis Formula Calculator Example With Excel Template What Items Are On An Income Statement Amortization Expense

How To Analyze And Improve Current Ratio Profit Loss Account Format For Travel Agency Condensed Consolidated Statements Of Operations

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)