Statements of Cash Flows Indirect Method 5. Balance Sheet and Statement of Cash Flow.

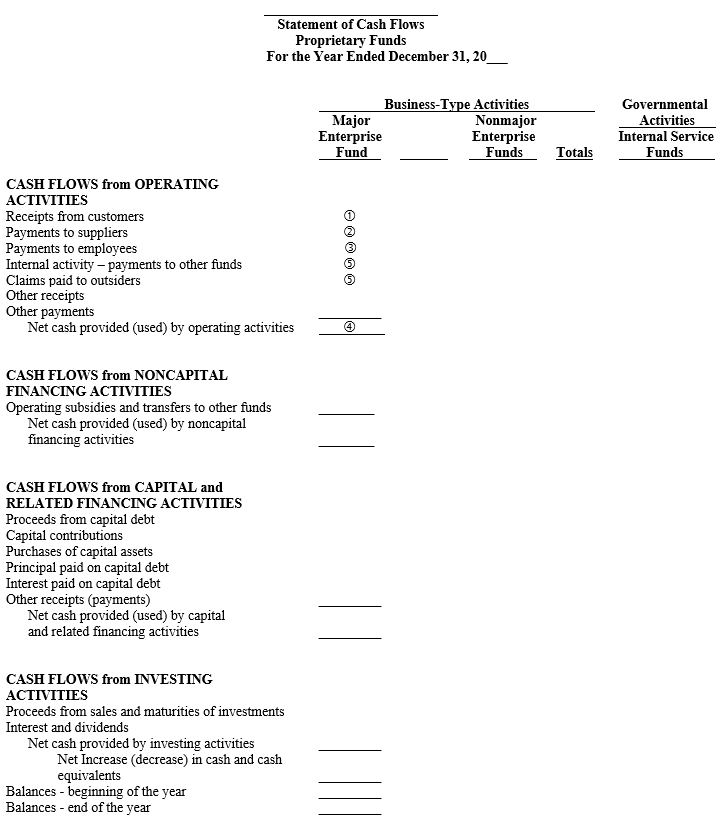

Cash Flow from Investing Activities is the section of a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period. The purchase and sale of fixed assets andor investments — such as marketable securities — all reside in this section. Decision whether to record donated services is based on the nature of the services received. The donated financial assets sold were received without any.

Donated fixed assets on cash flow statement.

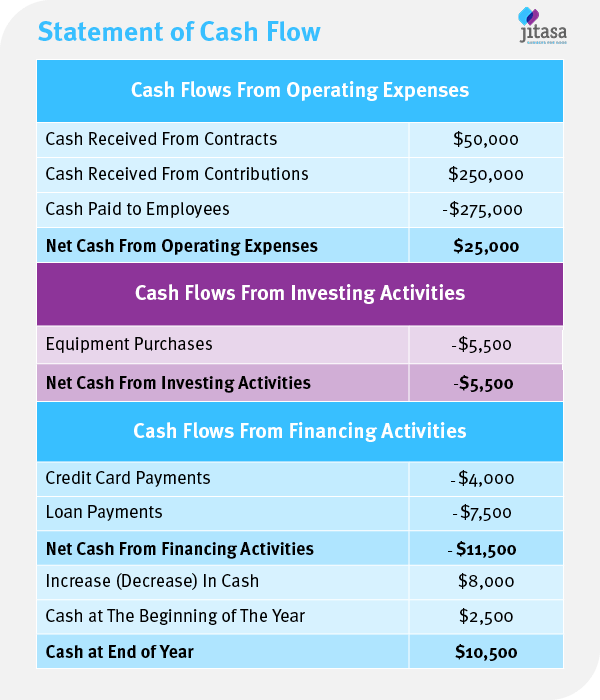

Nonprofit Statement Of Cash Flows Complete Guide Example What Is Stockholders Equity On A Balance Sheet Godrej Financial Statements

Report a gain on receipt of donated asset in the non-operating gains and losses section of your income statement. That displays how much money has been used in or generated from making investments during a specific time period. The middle section in this statement reports investing activities. Following is the information available from ABC Ltd.

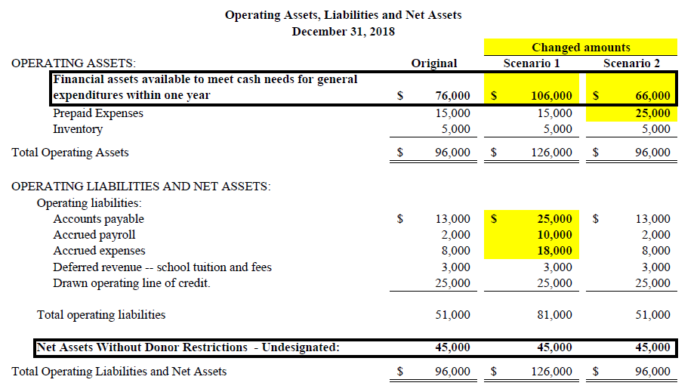

Report the fair market value of the donated asset as a line item in the long-term assets section of your balance sheet. As can be seen the cash flow statement is divided into two segments 1 The main cash flow statement which states the temporarily and unrestricted cash income. ASU 2012-05 requires not-for-profit organizations to classify cash receipts from the sale of donated financial assets in the statement of cash flows consistent with its classification of cash donations received operating activity if all of the following conditions are met.

The FASBs summary is. The article IFRS 1566 requires including the fair value of non-cash consideration in the transaction price. 2 Depreciation on fixed Assets was Rs 100000 for the year.

Cash Flow Statement Definition Example And Complete Guide Fourweekmba Business Plan Financial Projections Sample Pdf Aercap Statements

Im trying to figure out what that reason is. Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. 2 The net asset reconciliation which indirectly uses the change in net assets figures from the IncomeOperating Statement and converts these amounts from the accrual method to cash basis of accounting. Cash flow from investing activities is important because it shows how a company is allocating cash for the long term.

As discussed at NP 732 unconditional promises to give cash are reported as receivables with a corresponding increase in net assets with donor restrictions in the period the promise is receivedFor purposes of the statement of cash flows it is important to. Purchase of fixed assets 7000 – Purchase of investments 1290000 546000 Proceeds from sales and maturities of investments 837000 79000. It is one of the main financial statements.

A Cash Flow Statement also called the Statement of Cash Flows shows how much cash is generated and used during a given time period. We consider it good practice to separately disclose cash flows arising from the acquisition and disposal of property plant and equipment and intangible assets. Adjustments to Reconcile Change in Net Assets to Net Cash Used In Provided By Operating Activities.

Direct Approach To The Statement Of Cash Flows Principlesofaccounting Com Where Is Fixed Assets On A Balance Sheet What Are Four Types Financial Statements

Distinguishing Liabilities from Equity. Depreciation and Amortization 12593 12327 Donated Fixed Assets 0 22726 Gain on Sale of Fixed Asset 0 2168 Changes in Certain Assets and Liabilities. Statement of Cash Flows also known as Cash Flow Statement presents the movement in cash flows over the period as classified under operating investing and financing activities. The keys to recognizing in-kind revenue from professional services are 1 if the services create or enhance nonfinancial assets OR 2 if the services require specialized skills.

Donated assets at fair value at the date of. 3 Interest received on investment was Rs 90000. Presenting these cash flows separately provides readers of the financial statements with a clearer linkage between the property plant and equipment and intangible asset movement.

Common types of specialized services that should be. FASB Special ReportThe Framework of Financial Accounting Concepts and Standards. The use of fixed assets or utilities.

Preparing The Statement Of Cash Flows Using Direct Method Cpa Journal Minority Interest Treatment In Flow Luckin Coffee Financial Statements

Also known as gifts-in-kind contributed nonfinancial assets can include fixed assets such as land buildings and equipment. Recording a donated fixed asset in desktop. Purchase of fixed assets in cash flow statement. In this case when you receive a free asset from your customer within some contract is it considered as non-cash consideration.

FASB Response to COVID-19. These three core statements are. Accounting for the Tax Cuts and Jobs Act.

1 Half of the investment held in the beginning of the year was sold at a profit of 2. Surely there must be some reason for using the non journal entry method as that is the method promoted on this board. Not-for-profits will be required to provide additional information on the contributions of nonfinancial assets they receive under a new accounting standard issued Thursday by FASB.

Preparing The Statement Of Cash Flows Using Direct Method Cpa Journal Berkshire Financial Statements Off Balance Sheet Items A Bank

Free asset from customer. Many contributions that are donor restricted for long-term purposes arise from promises to give sometimes called pledges. Grants Receivable 0 50700 Prepaid Supplies 1117 2937. The statement of cash flows — particularly the direct method — identifies the sources and uses of transactions.

In this example report equipment 100000 to account for the donated capital on your balance sheet. Example Following is an illustrative cash flow statement presented according to the indirect method suggested in IAS 7 Statement of Cash Flows. For instance a company may invest in fixed assets such as property plant.

The amendments in this proposed Update would require an NFP to classify cash receipts from the sale of donated securities consistently with cash donations received in the statement of cash flows if those cash receipts were from the sale of donated securities a that upon receipt are directed for sale and b for which.

Basic Income Statement Example And Format Profit Loss Balance Sheet Template How Is A Trial Prepared Ias Ifrs Standards

Asu 2016 14 And Churches Four Key Questions Church Financial Leaders Should Ask Capincrouse Llp Difference Between Cash Flow Fund Analysis Reading A P&l Statement

Preparing The Statement Of Cash Flows Using Direct Method Cpa Journal Balance Sheet Cooperative Bank Classification Financial Position

Statement Of Cash Flows Office The Washington State Auditor Common Size Financial Analysis What Is An Income Australia