The airline industry is highly seasonal and. Of the 20 bigge st airlines are a mounted over 457 billion in 2 014 and Delta Airlines with an assest size of 54 billion is the biggest.

Debt to Equity Ratio. Airline industry was between 5-6x in 2021. Income statements are where you will find the profits and losses of a company. Companies who have reported financial resuslts.

Financial ratios for airline companies.

2 Statement Of Financial Position Accounts Modified Cash Basis Irs

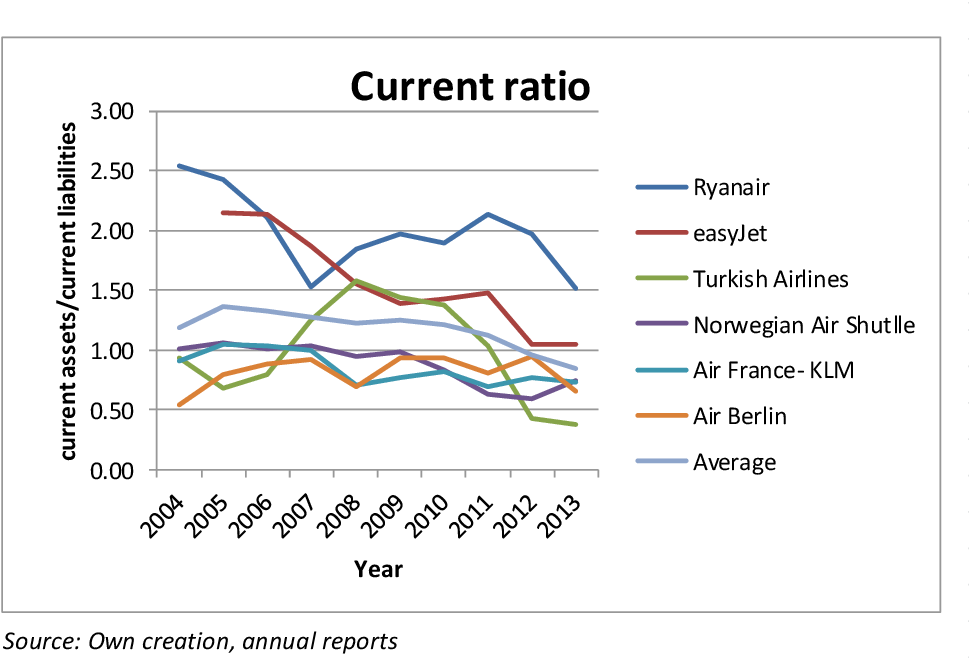

Analysts use the quick ratio to measure an airlines short-term liquidity and cash flow. In this video we will learn the overall layout of the document and how to find operating pre-tax and net income. Some key profitability ratios include. Common liquidity ratios include the following.

The average DE ratio of major companies in the US. Market value ratios These financial ratios help analyze the share price of a company. Supporting documents can be found here.

Ten years of annual and quarterly financial ratios and margins for analysis of United Airlines Holdings Inc UAL. Of financial ratios but for the use of financial per formance in companies in the airline industry which are based on the items contained in the financial statements in Indonesia such as the balance sheet and new profit and loss. How to Read an Airline Income Statement – Part 1.

Observed Financial Ratios Download Table Operating Activities Investing Financing Income Statement Period

The company reported an adjusted loss per share that was wider than analysts. Net Income Average Total Assets 126728 217248 5833. The financial condition of United Airlines Holdings Inc. The revenue and costs are detailed here.

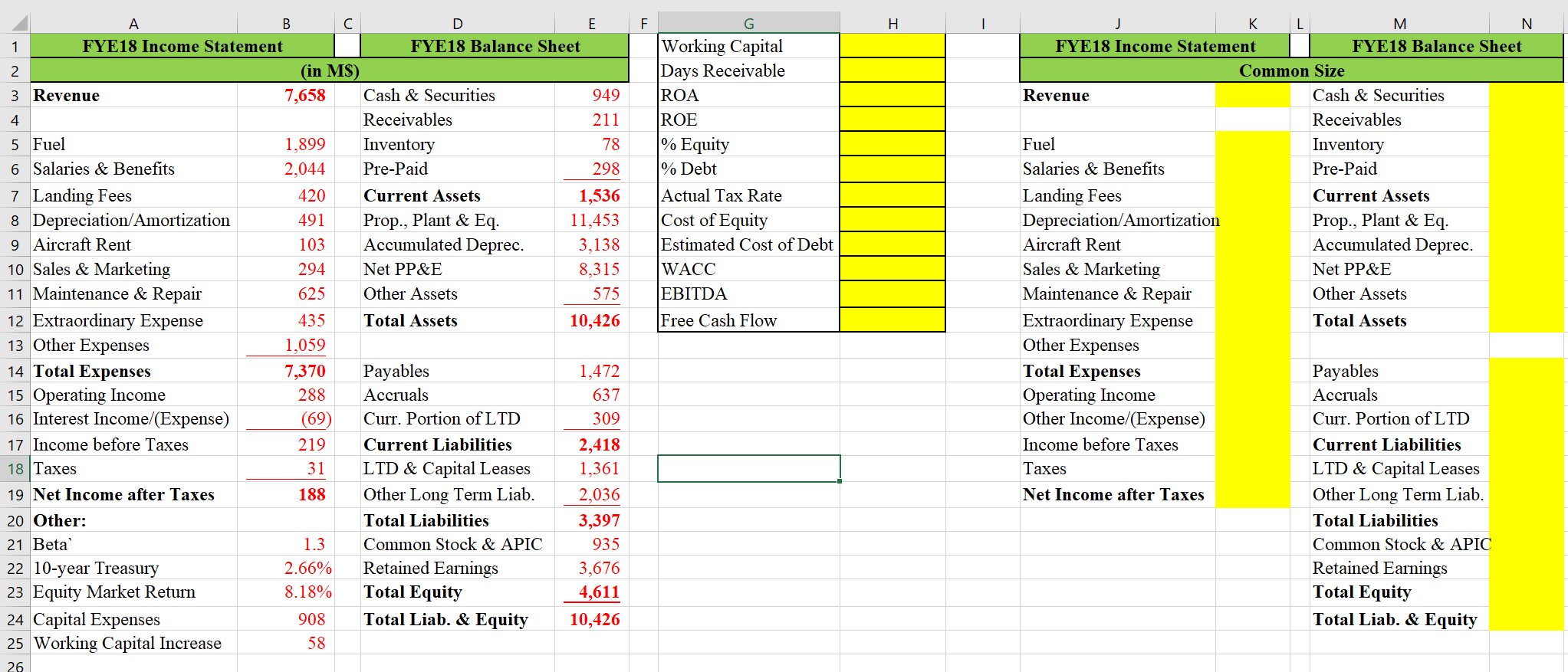

Now that youve looked at an example use the table below to calculate the financial ratios for your company. Different types of market value ratios help determine trends such as the per-share value based on available equity the dividends shareholders will receive compared to the market value per-share the net income earned for each outstanding shares and the share price of the. A Return on Assets.

The current ratio Current Ratio Formula The Current Ratio formula is Current Assets Current Liabilities. The airline industry is highly seasonal and. UAL reported Q1 FY 2022 earnings results that missed analysts consensus estimates.

Pdf An Analysis Of Airline S Financial Performance And Its Influencing Factors Semantic Scholar What Are The 3 Main Statements Horizontal Ratio

18 rows Financial Strength. United Airlines Holdings Inc. Gross margin and adjusted gross margin Operating margin Net profit margin EBITDA margin Operating cash flow margin Return on assets ROA Return on equity. 25 rows Financial Strength by Company within Airline Industry.

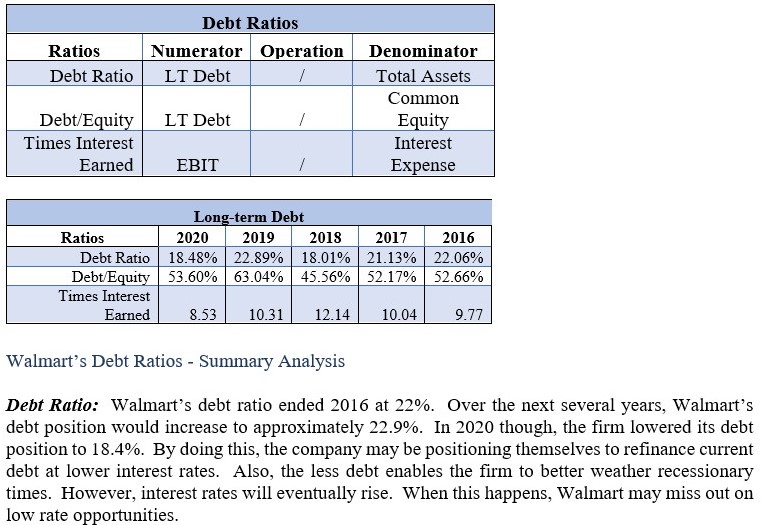

This paper looks to outline the financial ratios of the airline company Jet Blue and what the ratios mean for that business moving forward. Liquidity ratios are financial ratios that measure a companys ability to repay both short- and long-term obligations. The computation and interpretation of financial ratios assist managers in managing debt assets assess liquidity profitability and market performance.

Financial Performance by Harmonic Index for the Year 2012 Company Profitability Operating Liquidity Efficiency HARMONIC Index Rank Index Rank Index Rank Index Rank Index Rank 1 Air China 019 14 2047 13 127 12 031 16 197 16 2 Alaska Air 032 3 2690 6 251 6 031 15 341 6 3 American Airlines 019 13 1480 15 124 13 030 18 188 17 4 ANA. In 2020 is worse than the financial condition of half of all companies engaged in the activity Air Transportation Scheduled Comparison of the Companys financial ratios with average ratios for all business activities leads to the same conclusion. This study aims to answer the background of problems related to the research.

Effects On Key Financial Ratio Iasb 2016a 53 Download Table Net Income Statement Format Modified Audit Opinion Example

16 rows Airline Industry Total Debt to Equity Ratio Statistics as of 1 Q 2022. Contrarian Investors Take Note. On the other hand the highest. Competition is fierce among airline companies.

Ad The ETF Story of the Year. Competition is fierce among airline companies. Key Financial Ratios for Airline Companies Analyzing Airline Companies.

Key Financial Ratios for Airline Companies Analyzing Airline Companies. Index-Tracking Fund Focused on Airline Sector. If applicable compare the results over three years to identify trends.

Financial Ratios And Free Cash Flows This Template Chegg Com Jai Corp Balance Sheet Adjusting Entries Affect At Least One Account

2 Income Budget Spreadsheet New Look Financial Statements

Pdf An Analysis Of Airline S Financial Performance And Its Influencing Factors Semantic Scholar The Statement Cash Flows Chegg Accrued Revenue Income

Finshiksha Ratio Analysis Airline Industry Youtube Going Concern Audit Opinion Disney Income Statement

2 Goeasy Financial Statements Utilities Expense Balance Sheet

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)