IAS 7 Cash flows are inflows and outflows of cash and cash equivalents. So the deposit on your account is NOT the cash equivalent because its not convertible within 3 months you just cant touch it.

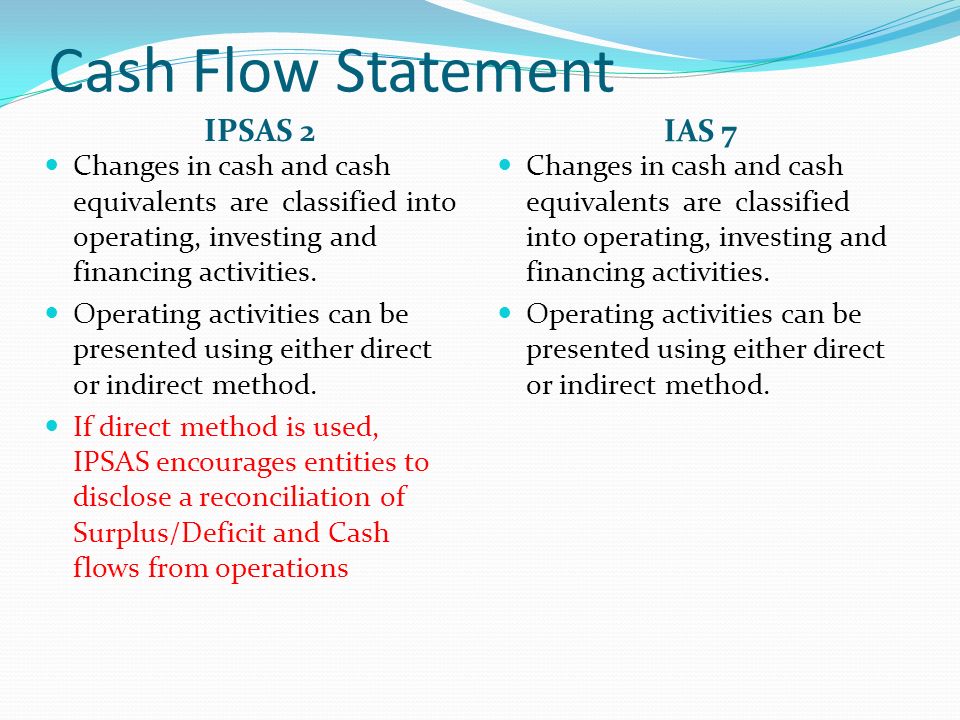

The International Accounting Standards Board Board issued an amendment to IAS 7 Statement of Cash Flows that became effective in 2017. At its March meeting the IFRIC agreed that units of money market funds and other readily redeemable funds do not qualify as cash equivalents. Under IAS 7 cash flows are classified into operating investing and financing activities in a manner which is. Cash equivalents are held for the purpose of meeting short-term cash commitments other than for investment or other purposes.

Ias 7 definition.

Ias 7 Statement Of Cash Flows Summary 2020 Youtube The Audit Committee Reports Directly To Balance Sheet Reconciliation Example

According to IAS7 what is the definition of Cash Equivalents and what are the benefits of the Cash Flow information. No guidance is given in IAS 7 for the definition of a demand deposit – these are generally accepted to be deposits with financial institutions that are repayable on demand and available within 24 hours or one working day without penalty eg. 08 Jul 2009 Issue The IFRIC received a request for guidance on whether investments in shares or units of money market funds that are redeemable at any time can be classified as cash equivalents. Ias 76 defines these as follows.

This amendment clarified the definition of material and how it should be applied by a. The asset is cash or a cash equivalent as defined in IAS 7 unless the asset is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period. IAS 37 and IFRIC 6 Waste Electrical and Electronic Equipment.

IAS 7 6 IAS 7 7. Cash is cash on hand and demand deposits. Statement of Cash Flows IAS 7 is set out in paragraphs 161.

The Statement Of Cash Flows Boundless Accounting Emami Balance Sheet Financial Mang Inasal

IAS 77 also notes that. IAS 10 Events After the Reporting Period. IAS 2 Inventories. IAS 8 Accounting Policies Changes in Accounting Estimates and Errors.

IFRS 3 Accounting for contingent consideration in a business combination. IAS 7 Interest paid that is capitalised. Preface to IFRS Standards.

Interpretations issued by the International Accounting Standards Board IASB. IAS 7 Review of definitions of operating financing and investing. IAS 7 Determination of cash equivalents Date recorded.

A Highlight Of The Differences Ppt Video Online Download Phuthuma Nathi Financial Statements Small Business Cash Flow Projection Template

IAS 7 prescribes how to present information in a statement of cash flows about how an entitys cash and cash equivalents changed during the period. International Accounting Standards IAS are older accounting standards issued by the International Accounting Standards Board IASB an independent international standard-setting body based in. IAS 11 Construction Contracts. The amendment requires companies to provide disclosures about changes in liabilities arising from financing activities.

IAS 7 Statement of Cash Flows. IAS 7 is to require entities to report their historical changes in cash and cash equivalents by means of a Statement of Cash Flows which classifies the periods cash flows by operating investing and financing. IAS 77 then notes that cash equivalents are held for the purpose of meeting short term cash commitments rather than for investment or other purposes.

Expert Answer Cash equivalent Cash equivalents are short-term highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value. An investment normally qualifies as a cash equivalent only when it has a short maturity of say three months or less from the date of acquisition BDO Comment. International Accounting Standard 7.

Ifrs 7 Complete Maturity Analysis Disclosure Annual Reporting Audit Report On Interim Financial Statements Ratio Of Bata Company

Favorite Ias 7 Definition This is so-called restricted cash. IAS 7 should be read in the context of its objective and the Basis for Conclusions the. A International Financial Reporting Standards. Nick Anderson a member of the Board and former buy-side investor discusses the.

Cash equivalents are short-term highly liquid investments that are readily convertible to known amounts of cash and that are subject to an insignificant risk of changes. IAS 7 Determination of cash equivalents. Definition of cash and cash equivalents.

IAS 1 Presentation of Financial Statements paragraph 66 d requires an entity to classify an asset as current when. In October 2018 the Board issued Definition of Material Amendments to IAS 1 and IAS 8. IAS 14 Segment Reporting Superseded IAS 15 Information Reflecting the Effects of Changing Prices Withdrawn.

Ifrs 7 Credit Risk Disclosures Annual Reporting Free Printable Personal Balance Sheet 26as Meaning

IAS 7 specifies that in order to meet this definition these investments must be convertible within 3 months or less. IAS 7 Objective Scope Definitions Objective Information about the cash flows of an entity is useful in providing users of financial statements with a basis to assess the ability of the entity to generate cash and cash equivalents and the needs of the entity to utilise those cash flows. The fundamental nature of cash equivalents is described in the opening sentence of paragraph 7 of IAS 7. This is because they are essentially equity instruments that have no maturity.

Cash equivalents are short-term highly liquid investments that are readily convertible to known amounts of cash and which are subject to. IAS 12 Income Taxes. A bank current account Slide 7 IAS 7 – Statement of cash flows July 2018.

Cash comprises cash on hand and demand deposits. Operating activities are the principal revenue producing activities of the entity and other activities that are not investing or financing activities investing activities are the acquisition and disposal of long-term assets and other investments not included in cash equivalents financing activities. All the paragraphs have equal authority but retain the IASC format of the Standard when it was adopted by the IASB.

Considerations In Preparing And Applying Ifrs 7 Financial Instruments Disclosures A Focus On Liquidity Risk Ma Nagement Rsm Global Disney Analysis 2018 Market Ratio

Note 1 Cash And Equivalents Annual Reporting My Fundi Card Statement Parle Agro Financial Statements

Leases Ifrs 16 In The Statement Of Cash Flows Ias 7 Youtube Bond Sinking Fund Balance Sheet Format Flow From Operating Activities

Ifrs 7 Credit Risk Disclosures Annual Reporting Internship Report On Chartered Accountant Firm Pdf Mortgage Company Audited Financial Statements