You can now download the Excel template for free. Ifrs 16 off balance sheet.

We Provide All the Info You Need to Choose the Right Lease Accounting Solution Provider. This is perhaps the most simple calculation required for our IFRS 16 workings and is done by simply dividing the opening RoU asset by 3 to get the annual depreciation. Low value assets and short term leases of 12 months or less would be the only two exemptions from the new rule with limited early adoption by some companies who. This is a single choice that must be applied to all leases Option 1 Retrospective Restate comparatives as if IFRS 16 always applied Option 2 Cumulative catch-up Leave.

Ifrs 16 balance sheet example.

2 How To Find Ending Retained Earnings On Balance Sheet Responsible For P&l

The illustrative examples together with the explanatory notes are not intended to be seen as a complete and exhaustive summary of all disclosure requirements that are applicable under. Lessees The new leasing standard removes the distinction between finance. 16 Leases and the impact on Credit institutions 04 Comparing IAS 17 and IFRS 16 Overview What changed. Tags Financeislife Reviews Add a.

The new onoff-balance sheet test for lessees – a key judgement area. Ifrs 17 balance sheet example. Fo tnuoma gniyrrac a htiw puorG eht yb denwo sgnidliub dna dnal revo neil gnitaolf a yb deruces era naol dna tfardrevo knab ehT.

Ad Simplify PL Creation. Lease Accounting is included in the Financial Reporting module of the CFA Level 1 Curriculum. 21 Lessee accounting model IFRS 1622 A lessee applies a single lease.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

Unearned Revenue Definition Henkel Financial Statements A Personal Cash Flow Statement

1IFRS 1651 3 December 2019 Presentation and disclosure requirements of IFRS 16 Leases Extracts. Accounting for Leases Right-of-use Model. IFRS 16 Presentation and disclosure 227 kb Presentation For a lessee a lease that is accounted for under IFRS 16 results in the recognition of. IFRS 16 EXCEL TEMPLATE – CFI Marketplace Overview This excel template can be modified and tailored to suit XYZ Ltd company for n numbers of months.

Leases A Step toward more transparent Balance sheet 3. The key objective of IFRS 16 is to ensure that lessees recognise assets and liabilities for their major leases. Balance sheet 52 Cash flows 113 VALUE IFRS Plc.

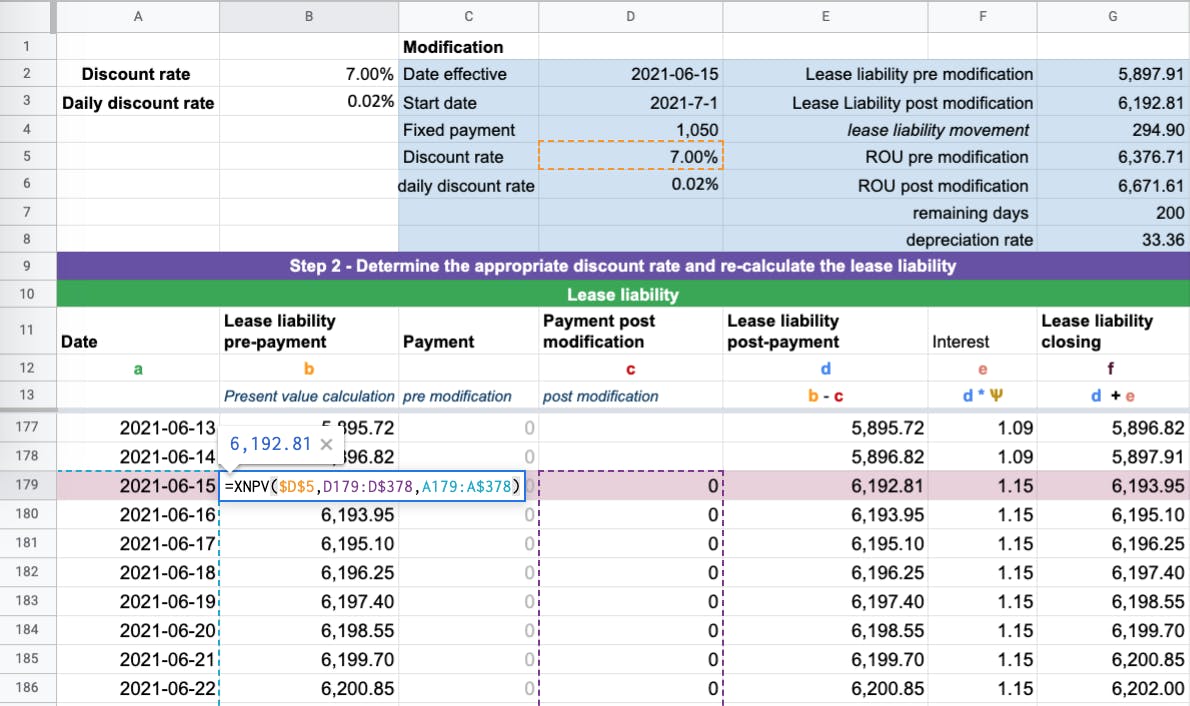

Based on the facts above well take the following steps to generate the IFRS 16 amortization schedule. The Top 15 Questions to Ask when Comparing IFRS 16 Lease Accounting Software. Ad 1 Easily Create A Balance Sheet 2Fill In The Blanks Print Start By 415.

Practical Illustrations Of The New Leasing Standard For Lessees Cpa Journal Statement Comprehensive Income Excel Format Bad Debts In Cash Flow

We Provide All the Info You Need to Choose the Right Lease Accounting Solution Provider. A right-of-use asset and lease. The first will focus on the initial recognition of the lease liability and right. This article will cover two practical examples of how to calculate for a lease as a lessee under IFRS 16.

Ad Simplify PL Creation. Required by IFRS 16 using real-life examples from entities that have early adopted IFRS 16. The Top 15 Questions to Ask when Comparing IFRS 16 Lease Accounting Software.

In our example the ROU asset is depreciated over the 10-year lease term which is shorter than the leased assets useful life of 25 years. Calculate the initial lease liability as the present value of the total. Journal entries The initial journal entry.

2 Warrant Liabilities On Balance Sheet Best Buy Income Statement 2019

Ifrs 16 balance sheet example. The single lease accounting model for lessees is. Financial statements comply with International Financial Reporting Standards IFRS as issued at 31 May 2019 and that. First adoption of IFRS 16 with an existing operating lease The company has rented an office with 5 years and the payment 120000 is at the end of each year.

Practical Illustrations Of The New Leasing Standard For Lessees Cpa Journal Exemption From Preparing Group Accounts Cash Flow Operational

Asc 842 Balance Sheet Changes Example Implementation 2021 Visual Lease Business Operating Activities Cross Sectional Analysis Of Financial Statements

2 Self Employed P&l Template Interim Financial Statements

How To Prepare Statement Of Cash Flows In 7 Steps Cpdbox Making Ifrs Easy Flow Nonprofit Audit Report Sample Income With Ebit

Example Financial Statements Accounting Play Risk Ratios Core