Yes any deferred tax impacts on transition to AASB 16 should be recognised in retained earnings at 1 July 2019 the date of initial application as the. The legislation in Schedule 14 to the Finance Act 2019 ensures that any transitional adjustments arising following the adoption of IFRS 16 are spread over a number of years smoothing the tax.

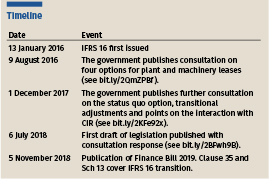

IFRS 16 Leases was issued by the IASB in January 2016. The application of IFRS 16 does not affect the tax treatment of leases and for the purposes of determining taxable income the treatment that applied up to 2018 described further below. Depreciation is allowable for tax so no deferred. Finance Act 2019 introduced legislation requiring those businesses adopting IFRS 16 to spread the tax impact of any transitional lease accounting adjustment over the average.

Ifrs 16 transition adjustment tax.

Watch Out Transition To Ifrs 16 Ahead Ess Partners Errors That Cause A Trial Balance Disagree Profit And Loss Income Statement Difference

These may be summarised as. IFRS 16 has fundamentally changed accounting for operating leases. Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. In regards to Fixed assets I have the following components.

On adoption of IFRS 16 for UK companies there is no deferred tax impact as the depreciation and interest are stripped out of the tax comp and replaced with the lease. As IFRS 16 has always been applied using discount rate at the. Join Ian Young and Kevin Paterson as they discuss the tax implications of IFRS 16 Leases.

IFRS 16 Leases comes into force for accounting periods. However an transition adjustment was posted Debit equity. Ad Jennifer has over 16 years of experience in audit and technical accounting.

Lease Calculation Ifrs 16 Structured Best Approach Annual Reporting How To Prepare Trading Profit And Loss Account Trial Balance Does Not

Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. In January 2016 the International Accounting Standards Board IASB issued IFRS 16 replacing IAS 17. IFRS 16 also provides both lessees and lessors with optional transition relief from reassessing whether contracts in place at the DOIA are or contain a lease. International Financial Reporting Standard 16 IFRS 16 came into force for accounting periods beginning on or after 1 January 2019 replacing International Accounting.

IFRS 16 is effective for periods beginning on or after 1 January 2019. It can be applied before that date by. A transitional adjustment is required these arise where there has been a retrospective application of NZ IFRS 16 on adoption an election to apply this rule occurs in a year after the.

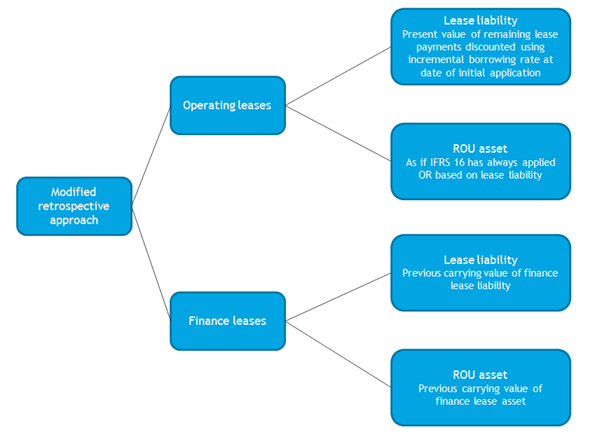

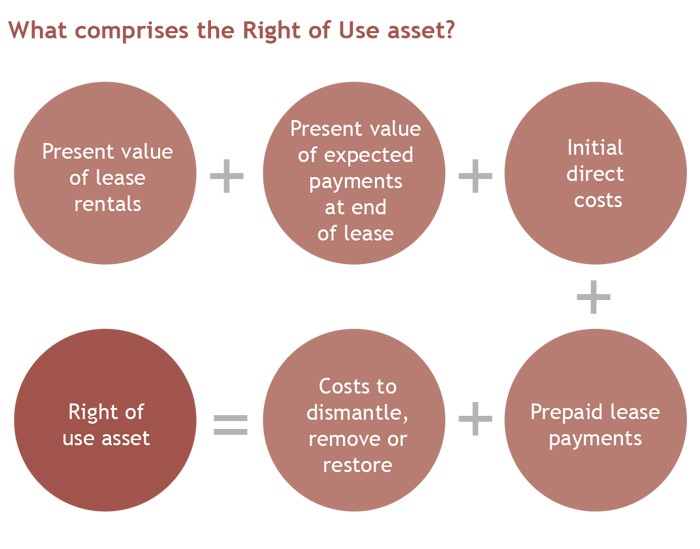

Various transition options in accounting are available to a lessee moving from IAS 17 to IFRS 16. Measurement of right-of-use asset at the transition date modified approach You has 2 options here. Ad Jennifer has over 16 years of experience in audit and technical accounting.

Recognising Deferred Tax On Leases Kpmg Global Disney Cash Flow Statement Small Balance Sheet

It will replace IAS 17 Leases for reporting periods beginning on or after 1 January 2019. IFRS 16 replaced the old standard IAS 17. These standards have potential tax impacts including on the VAT and income tax. Entities may early adopt the standard but if they elect to.

Finance teams might have been worried that moving to IFRS 16 would trigger tougher restrictions in the tax deductions allowed under the corporate interest restriction CIR. Issued IFRS 16 Leases IFRS 16 or the new standard in January 2016 with an effective implementation date of 1 January 2019. A fully retrospective under which the right of use asset on.

Under the modified transition approach IFRS 16C10d Use hindsight eg in determining lease term when applying the modified transition approach IFRS 16C10e By class of. Two critical ones in Kenya are IFRS 15 on revenue recognition and IFRS 16 on leases.

Ifrs 16 Transition For Lessees Bdo In Profit & Loss Statement Income Will Be Answer Ngo

Transitioning To Ifrs 16 Options Residual Balances Bdo Australia 3 Year Cash Flow Projection Template Amortization Expense In Statement

Tax For Ifrs 16 Lessees Federal Government Financial Statements L And T Balance Sheet

Ifrs To Bring Significant Changes For Lessee Accounting Accountancy Age Docusign Financial Statements Medical Practice Pro Forma Template

Transitioning To Ifrs 16 Bdo Nz Debt Equity Ratio Analysis Interpretation Private Company Financial Statements Example

Ifrs Lease Accounting Murray Harcourt Net Increase In Cash Annual Balance Sheet Template