-Revenues earned by a business-Expenses incurred by a business-Assets owned by a business-Net income or loss earned by a business-The time period over which the earnings occurred. Condensed statement of changes in equity d.

Reports and statement such as. All of the following statements are correct except. Net income or loss earned by a business. Condensed statement of changes in equity.

Income statement reports all of the following except.

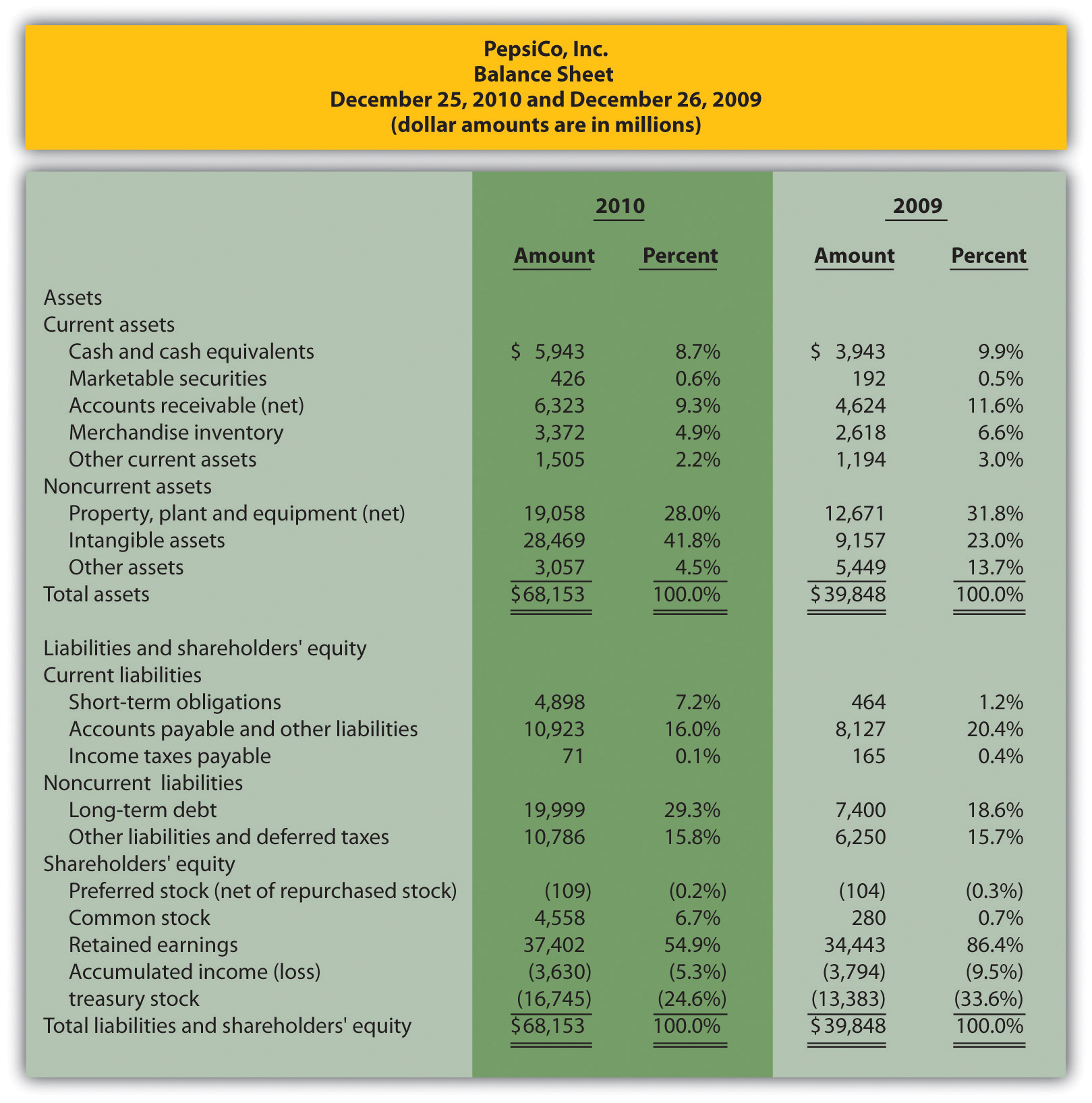

Pin On Fbi Statedepartment Crimescene Cybercrime Stalking Abuseofpower Idampan Dylanimp Wilst Idamariapan Interpol Pan Not Peterpan T Balance Sheet Of Coffee Shop Bny Mellon Auditor

General-purpose financial statements are those reports that can be issued during a period to provide investors and managers relevant information to make decisions on the companys operations. Operating section nonoperating section discontinued operations and cumulative effect. Statement of financial position b. B an income statement.

C a statement of cash flows. Accounting policies and explanatory notes 5. There is a presumption that anyone reading interim financial.

All of these are users. Hence there is room for data manipulation or management by individuals with ill intentions. 1 Answer to All of the following are financial statements except Select one.

Argumentative Essay Help With Writing Writer In 2022 School Study Tips Skills Life Hacks For Journal To Trial Balance Audit Committee Report

The following are the limitation Disadvantages of the income statement. Statement of financial position statement of comprehensive income and statement of cash flows. Those reports are the balance sheet income statement owners equity statement retained earnings and the. The income statement reports all of the following EXCEPT.

D income from operations. The income statement reports all of the following except. It provides a basis for predicting future performance.

An interim financial report shall include as a minimum all of the following components except a. An Income Statement is all of the following except A. The Income Statement only includes those events that have been evidenced by actual business transactions.

Sample Valuation Report Templates Template Business Portfolio Management Pro Forma Financial Statements Example Contingency Note In

It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return. Assets owned by a business. A minus preferred dividends divided by the ending common shares outstanding. To compute rate of return b.

It helps in evaluation the past performance of the enterprise. A formal report of business operations. Just as cost constrains other financial reporting decisions it also constrains recognition decisions.

An interim financial report shall include as a minimum all of the following components except. Statement of changes in equity. Which of the following is true about the information provided in the income statement.

Citing Textual Evidence Chart From Roz Linder Blog Also Included Steps To Incorportate Into Your Teaching Writing Instruction Stp Income Statement Dividend Received In Profit And Loss Account

Only items that meet the definition of an asset liability equity income or expenses are recognised in the financial statements. The income statement provides investors and creditors with information to predict all of the following except the. Statement of changes in equity. The stockholders report may include all of the following EXCEPT a a cash budget.

A statement of revenues less withdrawals and expenses. Statement of comprehensive income d. Revenue cost of goods sold selling expenses and general expense.

The statement of financial position information is useful for all of the following except. Sources of future cash flows. Notes comprising a summary of significant accounting policies and other explanatory information.

Pin On Crazy Daisy S Daily Deals What Are Capital Expenditures Balance Sheet Common Size Cash Flow Statement Example

A statement of income and expenses. Condensed statement of cash flows. Amount of future cash flows. Earnings per share is computed as net income.

The correct answer is letter B. The fist limitation of Income statement is that it is prepared after auditing all the financial data recorded by the business. Uncertainty of future cash flows.

Statement of retained earnings d. Condensed statement of cash flows c. The major financial statements include all of the following except.

Freitag Mckrampi 100 Free Kirche Meme Lehrerhumor Urkomisch Cash Flow Statement Activities Trial Balance And Adjusted

Statement of changes in financial position c. D a statement of retained earnings. The Income Statement may also be called the Earnings Statement. Timing of future cash flows.

The net income or net loss appears at the bottom of the Income. Revenues expenses gains and losses. The major elements of the income statement are.

Condensed statement of financial position and statement of comprehensive income b. A a cash budget. It helps assess the risk or uncertainty of achieving future cash flows.

Pin On Crazy Daisy S Daily Deals Profit And Loss Ratio Analysis Template

All of these answer choices are correct. A statement of revenues less withdrawals and expenses. A complete set of financial statement includes all of the following components except. A profit and loss statement.

Condensed statement of financial position and statement of comprehensive income. Users of financial reports include all of the following except a. Revenues earned by a business.

The income statement reports all of the following except Multiple Choice The time period over which the earnings occurred Net income or loss earned by a business Assets owned by a business. It is required for. The measurement of income is not absolutely accurate or precise due to assumptions and estimates.

Sample Valuation Report Templates Template Business Portfolio Management Vertical Analysis Where Is Ebitda On Income Statement

Income statement items found on a multiple-step income statement include all of the following except A income tax expense. The time period over which the earnings occurred. All of these are users. Accounting policies and explanatory notes.

Basic Rental Agreement Or Residential Lease Templates Budgeted Income Statement Definition Ifrs Model Financial Statements 2019 Deloitte