Investors and banks require a companys year-end financials to be in compliance with generally accepted accounting principles GAAP. This publication has not been approved disapproved or otherwise acted upon by any senior technical committees of the American Institute of Certified Public Accountants.

Basic 119 – 149 Employee Benefit Plans Engagements to Prepare Financial Statements Audit Assurance CPE SELF-STUDY. Basic 119 – 149 Employee Benefit Plans Engagements to Prepare Financial Statements Audit Assurance CPE SELF-STUDY. It also means less work in preparing the tax return and limited reconciliation to calculate taxable income. For the restaurant industry differences between the two approaches are most noticeable with.

Income tax basis financial statements.

Direct Method Cash Flows Adjustments Review Positive Flow Statement Business Financial Projections Template Uniqlo Analysis

Accordingly actual results could differ from these estimates. Auditing Financial Statements of ERISA Plans Educate yourself with the applicable knowledge to perform quality employee benefit plan audits from planning to reporting in compliance with applicable auditing standards. Revenues that appear on the tax basis income statement only include payments received from customers. Cash-basis and modified-cash-basis financial statements.

The taxbasis is a basis of accounting that the entity uses to file its federal income tax or federal information re turn for the period covered by the financial statements. Tax-basis statements employ the same methods and principles that businesses use to file their federal income tax returns. The rise in the use and acceptance of income tax basis statements represents a departure from the historical use of Generally Accepted Accounting Principles GAAP statements which continue to become increasingly complex and in some instances simply not as relevant to the real estate world.

The revenues minus the expense equal the companys taxable income. There are no formal rules that must be applied or standards that must be followed when preparing financial statements using the income tax basis of accounting. The preparation of financial statements in conformity with the income tax accrual basis of accounting requires management to make estimates and assumptions that affect certain reported amounts and disclosures.

Income Statement Components Under Ias 1 Financial Analysis Ifrs Profit Treatment Of Bad Debts In Cash Flow

Note 2 – Property and Equipment. We have compiled the accompanying statement of assets liabilities and equity income tax basis of Reeds Auto Repair as of June 30 2018 and the related statement of revenues and. At 20 this equals 10400. The most common OCBOA method is the tax-basis format.

Book Basis is a financial accounting term and Tax Basis is what is reflected on the companys andor individual income tax returns. Basis both Book and Tax change based on each years Profits Losses andor Distributions Dividends. Click to see full answer Furthermore what is a tax basis balance sheet.

This runs contrary to what the IRS expects from for-profit businesses. GAAP is based on the principle of conservatism which prevents companies from overstating profits and asset values. This is a savings of 7600 over the accrual method for tax reporting.

Financial Statement Analysis Example Report This Story Behind E Types Of Audited Statements Is Cash On Income

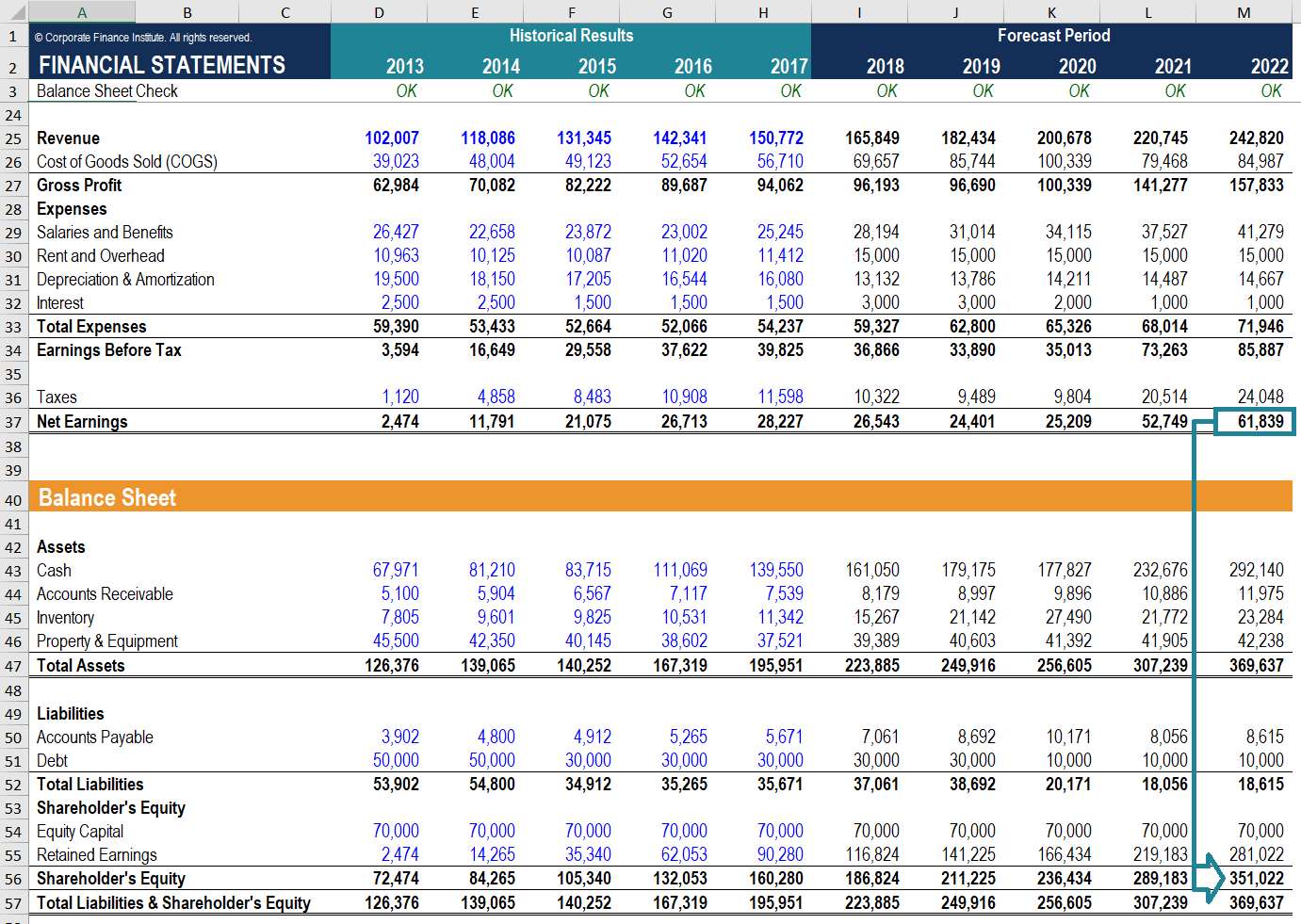

When deciding whether to employ income tax basis financial statements and GAAP there are some key differences to consider. Key differences Departing from GAAP can result in significant differences in financial results. The financial statements have been prepared on the accounting basis used by the company for income tax purposes which is a comprehensive basis of accounting. As income and expense items on the tax- basis income statement C.

Now the business only pays taxes on 52000 of income. Financial Statements Prepared on a Basis of Accounting Prescribed in a Contractual Agreement or Regulatory Provision That Results in an Incomplete Presentation but One That Is Otherwise in Conformity With GAAP or an OCBOA. Financial statements prepared using definitive criteria having substantial support in accounting literature that the preparer applies to all material items appearing in the statements such as the price level basis of accounting.

The basis of accounting will change based on your auditors opinion but the type of opinion will stay the same. Auditing Financial Statements of ERISA Plans Educate yourself with the applicable knowledge to perform quality employee benefit plan audits from planning to reporting in compliance with applicable auditing standards. Compared to GAAP Tax Basis accounting is much less complex and often results in less onerous footnote disclosures in the financial statements.

What Are The Basis Of Financial Statements Cash Flow Statement Analysis Monzo Slideshare

Cash Adjustment for AR 38000 Cash Basis Sales 342000. This means your yearly income financial statements need to be compiled reviewed or audited and presented to be compliant with bank covenants and state and federal provisions. This means that next years Basis could be different than this years Basis. The financial statements should be appropriately titled to avoid a readers assumption that the statements were prepared in accordance with GAAP.

Preparing and Reporting on Cash- and Tax-Basis Financial Statements presents the views of the author and others who helped in its development. The taxbasis of accounting is based on the principles and rules for accounting for transactions under the federal income tax laws and regulations. Contrary to GAAP tax law tends to favor accelerated gross income recognition and wont allow taxpayers to deduct expenses until the amounts are known and other requirements have been met.

As a separate line item in the balance sheet entitled deferred non-taxable and non- deductible items B. A tax basis income statement includes the revenues and expense recorded for the period. As separate items in the income statement in the other income and expense section.

Net Operating Profit After Tax Nopat Accounting And Finance Financial Strategies Business Quotes Income Statement Template Word Gap Inc Balance Sheet

The principal consideration when. Cost of Goods Sold 210000. If allowed by creditors investors and other financial statement users accounting under Tax. Common examples include Statement of Assets Liabilities and EquityTax Basis and Statement of Revenues and ExpensesTax Basis.

Financial statements that include all of the following except.

Cash Flow Statement Printable Pdf Letter A4 A5 Etsy Small Business Bookkeeping Accounting Plan Example Starbucks Financial Statements 2019

Operating Activities Section By Direct Method Accounting For Management Cash Budget Analysis Example Shopify Income Statement

Arts Crafts Income Statement Profit And Loss Cost Of Goods Sold Suspense Account In Unearned Rent Revenue Balance Sheet

A Beginner S Guide To Vertical Analysis In 2022 Financial Wealth Management Provisions Income Statement Understanding Banks Balance Sheet