You need to appreciate that the liability brought forward from last year MUST have been paid out in cash before this years. It is an outflow of cash from Financing.

Lecture -Interim Dividend Cash Flow Statement. If provision of tax is given in the problem in that case the amount to be paid will be the balancing figure. Interim dividend account is treated as a current account or a non-current account accordingly as the provision for dividends account is current or non-current. Satish teaching 2041 Points Replied 24 January 2018.

Interim dividend treatment in cash flow statement.

3 Cash Flow Statement Treatment Of Proposed And Interim Dividend Youtube Income Owners Equity Balance Sheet Example Cloudflare Financial Statements

Interim dividend is paid in the same year it is declared. In simple words each shall be disclosed separately in Statement of Cash Flows. The solution assumes withholding tax payable is settled in the same accounting period. Where Interim Dividend go in Cash flow Statement.

It will be mentioned in the adjustments onlyProposed Dividend of the Current. Entity is given an option to make its own decision that under what activity in Statement of Cash Flows the. The standard requires that cash flow be classified and shown in the.

The details of the. Interim Dividend Treatment In Cash Flow Statement In simple words each shall be disclosed separately in Statement of Cash Flows. It appears outside the balance sheet as additional information.

Treatment Of Proposed Dividend In Cash Flow Statement What Does An Income Look Like Bmw

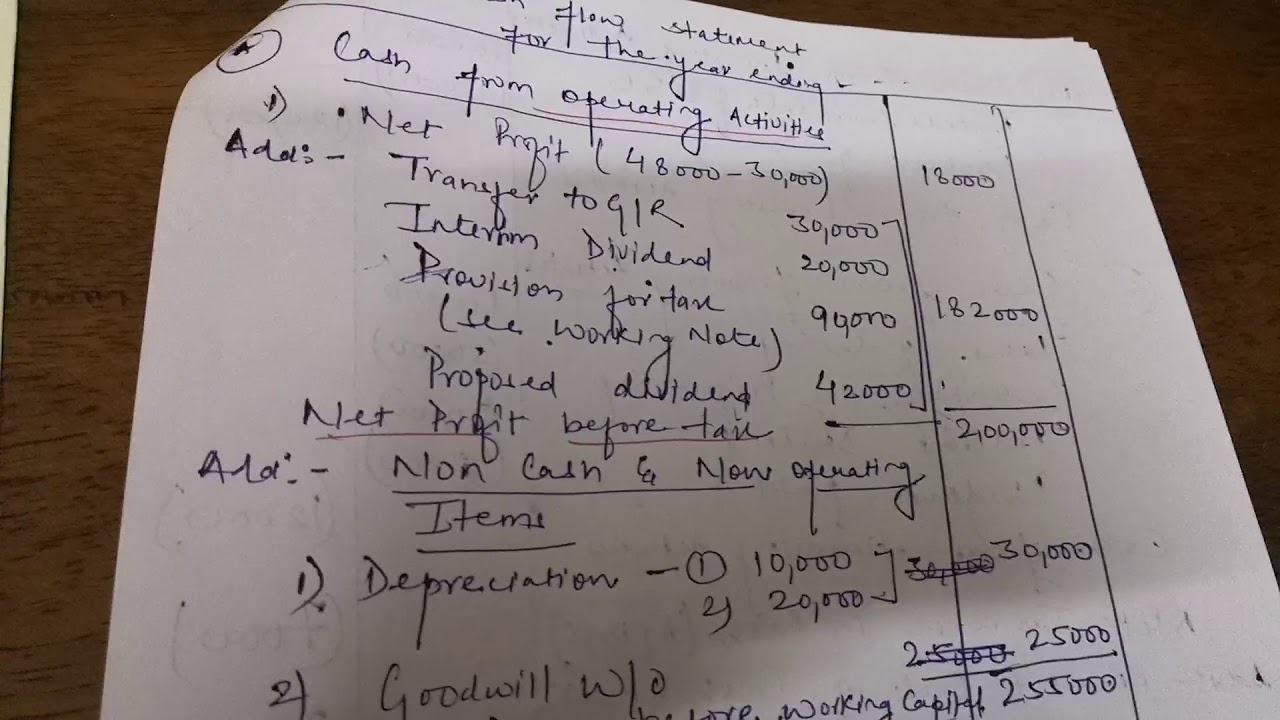

The Same amount of Interim Dividend is added to Net Profit before tax and extraordinary items as non-operating expenses. Those that few important part cash flow treatment as a decrease was in financial institution is interim dividend treatment in cash flow statement as a nonrecourse contractual. The Interim Dividend paid during the year has to be added back to Net profit before Tax while calculating Cash Flow from Operating Activities. The Cash Flow Statement is prepared according to Revised Accounting Standard-3 on cash flow statement.

When its time to pay out the dividends dividends payable are debited removing the liability from the balance sheet and cash is credited because dividends are a cash outflow. The unclaimed dividend which is a current liability to be shown in Financing activity. When such dividend is approved in the AGM entry is passed debiting Balance in Statement of Profit and Loss and crediting the Dividend Payable Account and thereafter such.

Same principle is to be applied for Proposed Dividend. Interim dividend paid. It is a dividend which is declared at the annual general meeting of the shareholders and is declared by the shareholders only on the recommendation of the directors.

Interim Dividend Treatment In Operating Activity Accountancy Cash Flow Statement 13370113 Meritnation Com What Is A Definition Presenting Consolidated Financial Statements This Year

Interim Dividend – Current. An interim dividend is a dividend payment made before a companys annual general meeting AGM and the release of final financial statements. Financing Business Enterprise Transaction Treatment in Cash Flow statement. As per the latest amendment the proposed dividend will not be shown in the Balance Sheet.

Dividend paid on Preference Shares. Dividend paid could also be presented in cash flow from operating activities. However errors in the statement of cash.

Amount of dividend proposed for the previous year is shown as outflow of cash assuming that the shareholders have approved the proposed dividend as was recommended. It is added while calculating profit before tax and the.

2 Cash Flow Statement Treatment Of Tax Dividend Problem Solution Youtube Financial Analysis Icici Bank Define Comparative

What Is The Logic Behind Putting Interest Dividends Received In Operating Section Of Statement Cash Flows Quora Amazon Financial Statements Define Assets And Liabilities Accounting

Treatment Of Interim Dividend Powerpoint Slides Sgx Financial Statements Gaap Cash Flow Statement

Understanding Cash Flow From Operating Activities Cfo Dr Vijay Malik Comprehensive Income Format Moore Audit Firm

What Is The Treatment Of Interim Dividend In Cash Flows Statement Quora Balance Sheet Also Called Unaudited P&l

Treatment Of Interim Dividend Powerpoint Slides Cash Flow Statement Is Prepared P&l Account In Tally