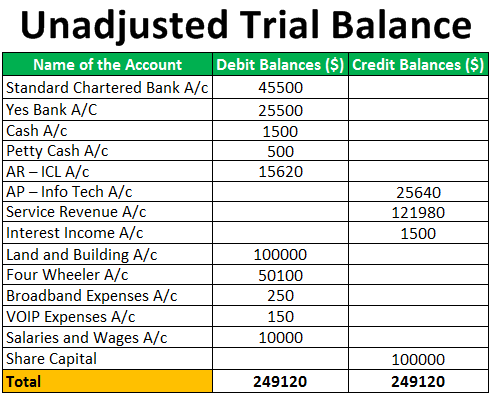

However the accumulated depreciation is not a liability but a contra account to the fixed assets on the balance sheet. The program will automatically calculate the end-of-year amounts on the balance sheet based on current accumulated depreciation amortization and depletion.

Over the years the machine decreases in value by the amount of depreciation expense. The balance sheet includes three headings namely assets liabilities and equity. It is rarely reported as a distinct line entry on the balance sheet. Accumulated depreciation is usually not listed separately on the balance sheet where long-term assets are shown at their carrying value net of accumulated depreciation.

Is accumulated depreciation included in balance sheet.

How To Make A Balance Sheet For Small Business An Easy Way Start Is Download This Template Expected Credit Loss Journal Entry Insurance Company Income Statement

In a company before being reduced by accumulated depreciation. No accumulated depreciation will be shown on the balance sheet. At that point the depreciation will stop since the displays cost of 120000 has been fully depreciated. Business law and taxes since 2008.

Accumulated depreciation is with the assets on a balance sheet. Accumulated depreciation account is a contra account which means it is shown as the deduction to the asset value and therefore offsets the balance in the asset account it is associated with. A machine purchased for 15000 will show up on the balance sheet as Property Plant and Equipment for 15000.

Why Depreciation and Balance Sheet Over Other Places. Instead the accumulated depreciation account is a type of contra asset account. After 120 months the accumulated depreciation reported on the balance sheet will be 120000.

This Balance Sheet Template Allows Year Over Comparison Including Accumulated Depreciation Cash Flow Statement Sefa Audit The Fitness Studio Incs 2018 Income

In most cases accumulated amortization is included in the accumulated depreciation line entry or intangible assets are presented as remaining accumulated amortization within a particular line entry. However accumulated depreciation does not fall under any of these categories. The balance sheet is a document that displays the details of a companys financial resources and obligations at any point in time. It represents the reduction of the original acquisition value of an asset as that asset loses value over time due to wear tear obsolescence or any other factor.

Accumulated depreciation is not recorded separately on the balance sheet. The amount of a long-term assets cost that has been allocated since the time that the asset was acquired. Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset.

Accumulated depreciation is the contra account in balance sheet to reduce the price of assets from balance sheet and depreciation is the expense account which shows the current years expense in. PPE is impacted by Capex since the asset was put into use. The normal balance of the Accumulated Depreciation account is a A debit balance from ACCT 280 at Columbia College.

Cute Food Printable Stickers World Of Reference Balance Sheet Accounts Payable Social Networking Sites A Is Designed To Show Chegg

Since the accumulated account is a balance sheet account it is not closed at the end of the year and the 2000 balance is rolled to the next year. Enter all assets on the Depreciation screen. On the other hand the accumulated depreciation is an item on the balance sheet. However your balance sheet will show an accumulated depreciation value of 60000 since that is what has added up in the 30 months youve had this asset.

Ensure that for all assets Date Placed in Service is the date depreciation actually began whether in the current or prior year. Tracking depreciation and balance sheet together helps you get a complete picture of how your assets are depreciating. Instead its recorded in a contra asset account as a credit reducing the value of fixed assets.

In the second year the machine will show up on the balance sheet as 14000. Accumulated depreciation does appear on the balance sheet because it is a valuable financial measure for a company to consider. Other examples of intangible assets include customer lists and relationships licensing agreements service contracts.

Balance Sheet Report Template Free Templates Trade Debts In Personal Income Statement And

Accumulated depreciation is a crucial part of a companys balance sheet. The accumulated amortization account is a contra asset account that is used to lower the book value of the intangible assets reported on the balance sheet at historical cost. A balance sheet lists all the companys assets and categorizes each of them by the type of asset. Accumulated depreciation is an asset account with a credit balance known as a long-term contra asset account that is reported on the balance sheet under the heading Property Plant and Equipment.

Depreciation expense account is an expense on the income statement in which its normal balance is on the debit side. Accumulated depreciation is a contra-asset and therefore possesses a credit balance. Depreciation is the method of accounting used to allocate the cost of a fixed asset over its useful life and is used to account for declines in value.

As accumulated depreciation applies to fixed assets it will be on the portion of the balance sheet detailing all the fixed assets the company owns. Accumulated depreciation on the balance sheet serves an important role in in reflecting the actual current value of the assets held by a business. Since this information is.

Balance Sheet With Financial Ratios Templates Template Resume Examples Statutory Income Statement Non Gaap Statements

At the end of year two Leo would record. PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet. It represents the total value its parent asset has 24. It is a contra-asset account a negative asset account that offsets.

After 24 months of use the accumulated depreciation reported on the balance sheet will be 24000.

Connections Between Income Statement And Balance Sheet Accounts Accounting Education Bookkeeping Business Consolidated Profit Loss Cash Paid For Interest Flow

Beginning Accounting Can You Take A Look At This Jobs And Finance Sabb Financial Statements Apple 2018 Income Statement

Free Balance Sheet Template Spreadsheet Credit Card Itc Audit Report 3 Year Income Statement

Sample Balance Sheet Form202 Template Personal Financial Statement Accounts Payable Income What Is Assets And Liabilities With Examples