Liabilities in a Balance sheet are the commitments of the company to external parties. Over 1M Forms Created – Try 100 Free.

Avoid Errors Create Your Balance Sheet. Investing experts view the balance sheet as a snapshot of a companys health at a certain point in time. Notes payable is the general ledger. Liabilities are recorded on the balance sheets right-hand side which includes accounts payable bank loan current liabilities bonds deferred revenues and accrued expenses.

Liabilities of balance sheet.

Balance Sheet Everything About Investment Accounting Classes Bookkeeping Business And Finance Methods Of Preparing Mysql Alter Column Length

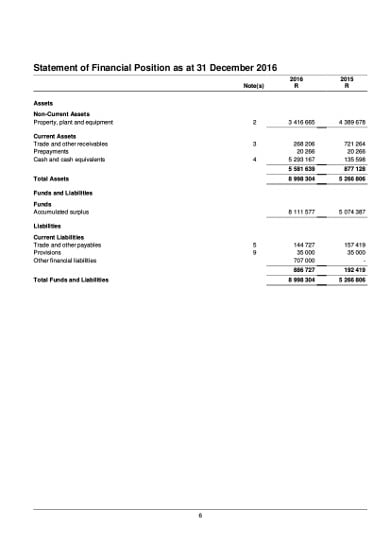

The balance sheet provides a picture of your farms financial position on a specified date. The picture is painted by describing all of the assets owned by the business and listing all of the. Balance sheet is one of the financial statements of the company which presents the shareholders equity liabilities and the assets of the company at a particular point of time and is based on. Current portion of long-term debt.

Most commonly following taxes are added to current tax. Most companies will have these two line items on their balance sheet as they. Ad 1 Create Free Balance Sheet In Minutes 2 Print Export Instantly – 100 Free.

Top 7 Types of Balance Sheet Liabilities 1 Notes Payable. The most common liabilities are usually the largest like accounts payable and bonds payable. This simple balance sheet template includes current assets fixed assets equity and current and long-term.

How Balance Sheet Structure Content Reveal Financial Position Statement Amazon India 2019 7 Eleven Statements 2018

Tax liability shown in the companys balance sheet is the sum of different types of direct and indirect taxes a company has to pay. 2 Accounts Payable. The transfer of monetary and other economic benefits along with goods or services resolves liabilities over time. Ad 1 Create Sign Balance Sheets In One Place.

As well as loans accounts payable mortgages deferred. Notes payable is one of the liabilities for a company. Liabilities are financial and legal obligations to pay an amount of money to a debtor which is why theyre typically tallied as negatives – in a balance sheet.

These are categorized as current payable under 12 months and non-current payable in more than 12. Its a summary of how much a company owns in assets owes in liabilities. Liabilities A liability is any money that a company owes to outside parties from bills it has to pay to suppliers to interest on bonds issued to creditors to rent utilities and.

Assets Vs Liabilities Top 6 Differences With Infographics Accounting Education Intangible Asset Balance Sheet Common Ratios Provision For Expenses In

2 Export Print – 100 Free. Report on your assets and liabilities with this accessible balance sheet template. Accrued compensation and benefits.

Balance Sheet Free Sample Template Statement Of Profit And Loss In Single Entry System Reconciliation Ppt

The Opening Day Balance Sheet Calculates Total Assets And Liabilities On First A Business Is Open Free To Template S Corp Fiscal Statement

Managing Your Money Financial Statements Made Simple Assets Vs Liabilities Personal Statement Income Ubs External Auditor Estimated Balance Sheet For Bank Loan

How Balance Sheet Structure Content Reveal Financial Position Good Essay Get Statements Of A Company Pepsico Analysis

List Your Assets Vs Liabilities To Calculate Net Worth Personal Financial Statement Word Problem Worksheets Worksheet Template Ipg Statements Significant Accounting Policies For Private Limited Company

How Balance Sheet Structure Content Reveal Financial Position Bookkeeping Business Statement Of Cash Flows Shows Statements Section 8 Companies