The going concern financial statements are prepared under the assumption that the business will continue to operate for the foreseeable future. The non–going concern financial statements are prepared under the assumption that the business will not continue to operate for the foreseeable future.

Differentiating Equity from Liabilities. A corporation does not prepare financial statements on a going concern basis when it decides it is no longer a going concern.

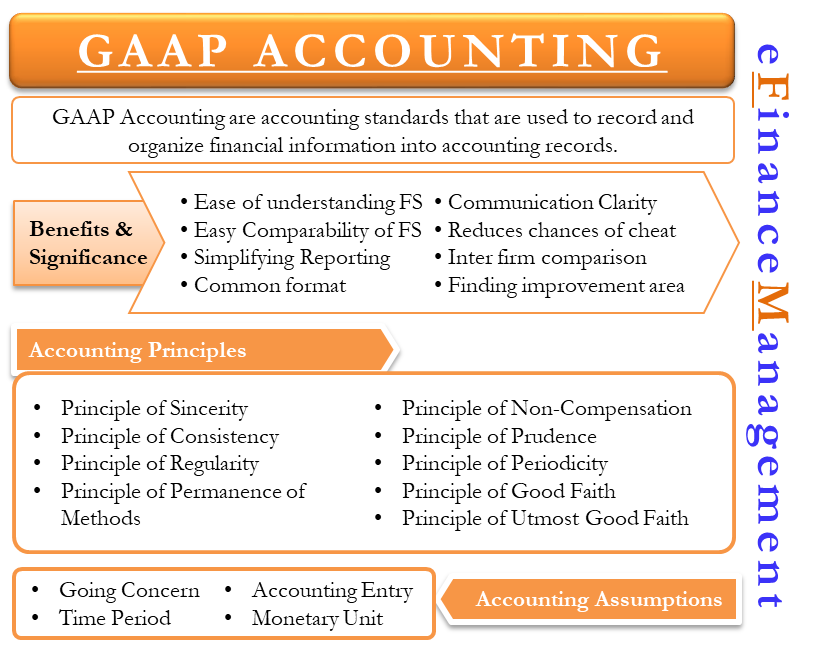

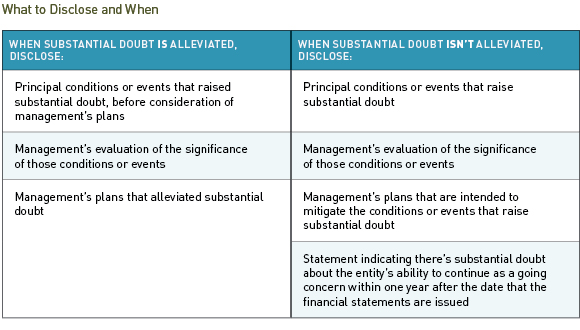

When an entity does not prepare financial statements on a continuing concern basis, it is required to disclose this fact, the methodology used to do so, and the justification for why the entity is not viewed as a going concern. IAS 125. Pattern of fact 1 The financial statements for past periods that have not yet been authorized for release cannot be prepared on a going concern basis by a business that is no longer a going concern, according to paragraphs 25 of IAS 1 and 14 of IAS 10. Requirements that are more broadly applicable are included in IAS 1 Presentation of Financial Statements. According to ASC 205-40, footnote disclosure is required where there is “serious question” as to a reporting entity’s capacity to continue as a going concern. Within one year of the financial statement issue date or the date, management shall assess whether there are circumstances that give rise to considerable doubt for each annual and interim reporting period.

Non going concern financial statements.

Unqualified Opinion Definition Example Vs Qualified Accountinguide Gasb 45 External Audit Management Letter

If not, a company is a going concern. The going concern foundation of accounting was used to produce the company’s financial statements. is frequently referred to as a foundation other than a going concern. If the entity is no longer a going concern, financial statements.

Considering that the financial statements for those earlier periods will be current financial in nature. They failed to find any entity that had updated comparative data to take into account the non-going concern foundation. The management either has no other practical option except to liquidate the firm and halt trading.

Special Report by FASB

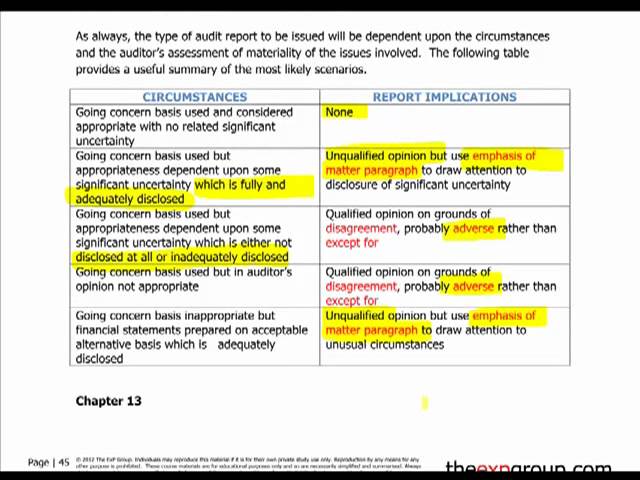

The Conceptual Framework for Financial Accounting. There are some circumstances where applying the going concern basis may not be appropriate. A significant portion of the advice deals with the duties of the auditors in examining the going concern analysis and disclosures in financial reports.

2 Example Of A Cash Flow Reconciling Items Balance Sheet

halt business operations either intends to liquidate or has no practical choice except to do so. According to IAS 1 paragraph 25, the entity must disclose the basis on which the financial statements were generated, the fact that they were not prepared on a continuing concern basis, and the reasons why they are not considered to be a going concern. Ace Financial Statements for a Non-Going Concern. Determining whether it is appropriate to prepare the financial statements on a going-concern basis or whether doing so would be improper and the financial statements should be prepared on a non-going-concern basis is part of this process.

Then, IAS 1 seems to imply that when the specified, a departure from the going concern foundation is necessary. Therefore, if you use the break-up basis, the goal of financial statements is not to evaluate an entity’s financial performance on an ongoing basis. June 2018 In our opinion It does not follow automatically that a going concern premise is incorrect.

You must assess this. Regarding the restatement of comparative information in financial statements issued on a non-going concern basis, IFRS Standards are silent. There are considerable questions about specific circumstances or actions that could seriously undermine the entities.

Acca F8int 10 Going Concern Youtube Income Statement Cheat Sheet Accrued Expenses In

Additional Fillable Forms in the MS Personal Financial Stmt Sign up and subscribe right away. The management either has no other practical option except to liquidate the firm and stop operations. COVID-19 Response from FASB. The staff pointed out that there is no mention of this in the IFRS Standards.

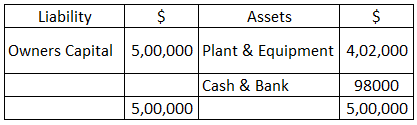

The ability of the company to continue as a going concern is materially questionable as of the date of the financial statements due to certain events or circumstances. Financial statements are produced in accordance with IFRS Standards on a continuing concern basis unless management intends to liquidate the business or has no other viable option. Financial statements of subsidiary NetSol Innovation Private Limited utilized for consolidation have been prepared on a non-going concern Net Realizable Values basis due to the subsidiary company’s measurement as a non-going concern firm.

When financial statements are prepared on a basis other than going concern, this information should be disclosed together with the justifications. Investor Views on Transparency, Credibility, and Volume July 2013 noted that investors needed information regarding going concerns. Taking into account the Tax Cuts and Jobs Act.

Going Concern Meaning Assumption Accounting Principle 12 Month Profit And Loss Projection Example Prepaid Insurance Income Statement

When an entity doesn’t prepare financial statements on a going-concern basis, it must disclose this fact as well as the methodology used to do so and the reasoning behind it. 4 IFRS Viewpoint 7. If an entity does not prepare financial statements on a going concern basis, it must disclose this fact, the methodology used to do so, and the grounds upon which the entity is not regarded as a going concern. IAS 125. recurring issue It is no longer suitable to prepare on a going concern basis.

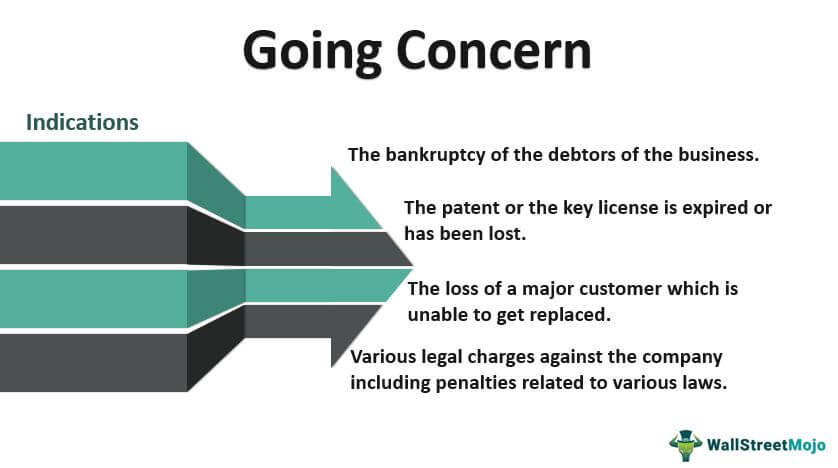

Risks that are disclosed that could potentially have an impact on whether anything is in doubt. In the case of going-concern financial statements, a non-financial asset may be stated at a value that is higher than its net realisable value as long as it does not exceed its recoverable amount. This includes situations where no problems are found, problems are found but are fixed, there is a significant amount of uncertainty, and the entity is determined to no longer be a going concern.

4 Financial Reporting Disclosures are reported by the Chartered Financial Analyst CFA Institute. Warning Signs a Company Is Not a Going Concern Financial statements of publicly traded corporations may contain some warning signs that could suggest a company won’t be a continuing concern. Whether the corporation has enough assets to pay off its debts.

Going Concern Overview Conditions And Red Flags Comparative Thesis Income Spreadsheet For Small Business

There is no liquidation foundation of accounting under IFRS, unlike US GAAP. A non-going concern premise was used to prepare the financial statements. An entity that is no longer a going concern is permitted to prepare financial statements under MFRS 101 Presentationof Financial Statements. The absence of a restatement of comparative information was specifically disclosed by two businesses.

Then, IAS 1 seems to imply that when the specified, a departure from the going concern foundation is necessary. In order to answer the second question, the team conducted research on publicly-traded IFRS reporters who prepare financial statements on a non-going concern basis. Users of PdfFiller can edit, sign, fill out, and distribute any kind of document online.

Gaap Accounting All You Need To Know Efinancemanagement Total Debt Formula Balance Sheet Bank Of America Cash Flow Statement

Key Considerations When Adopting Asu 2014 15 Waren Sports Supply Statement Of Cash Flows 2017 Flow Investing Activities Examples

How To Prepare Financial Statements When Going Concern Does Not Apply Cpdbox Answers Youtube Statement Of Total Income Pricewaterhousecoopers Big 4 Companies

Going Concern Statement Of Financial Position Accounts Fasb Concept 6