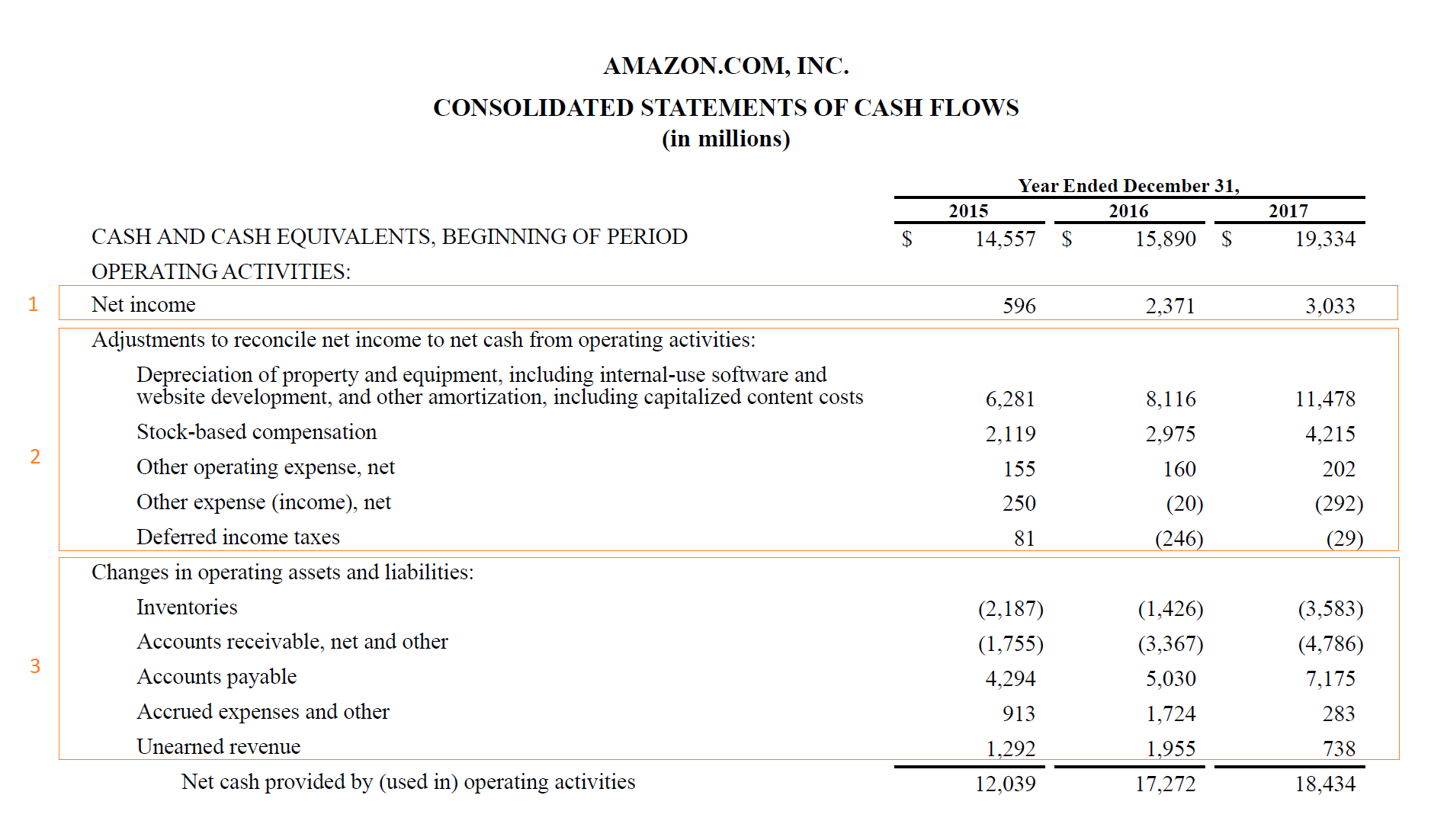

Net Income Net Income is a key line item not only in the income statement but in all three core financial statements. О O Interest and dividends received.

47 Net income differs from net cash flows from operations because of all the following except. Operating activities include changes in _____select all that apply. Operating activities or. Obtaining cash from issuing debt.

Operating activities include.

How Are Cash Flow And Free Different Simple Income Expense Sheet Depreciation

One thing to note here is that operating activities do not include any long-term capital expenditure or. In addition the interest paid is used to calculate the operating profit before taxation. Cash receipts from the issuance of capital stock b. These transactions normally affect income statement accounts.

The buying or selling of land buildings equipment and other long-term investments. The repayment of loan proceeds to the bank. Operating activities include generating revenue Revenue Revenue is the value of all sales of goods and services recognized by a company in a period.

Shy Payments of dividends. Declared and paid cash dividend. The purchase of merchandise.

Disposal Of Assets Accountingcoach Tax Basis Financial Statements Bank America Balance Sheet 2019

Cash flows from operating activities result from providing services and producing and delivering goods. While it is arrived at through. On the statement of cash flows the cash flows from operating activities section would include a. C Payments of interest.

Under the indirect method the net cash flow from operating activities is determined by adjusting profit or loss for the effects of. Some people prefer to classify them as operating activities because the funds are used to facilitate the trading of the company. Cash flows from operating activities include all of the following except.

Examples of cash inflows from operating activities are cash receipts from the sale of goods and. Interest paid on a bank loan. All other items for which the cash effects are investing or financing cash flows.

Preparing The Statement Of Cash Flows Using Direct Method Cpa Journal Main Accounting Statements Basic Financial Ratio

C payments to employees for hours worked. Obtaining a bank loan to cover the payment of. Financing activities include transactions that enter into the determination of profit or loss. 1From sales of goods or services.

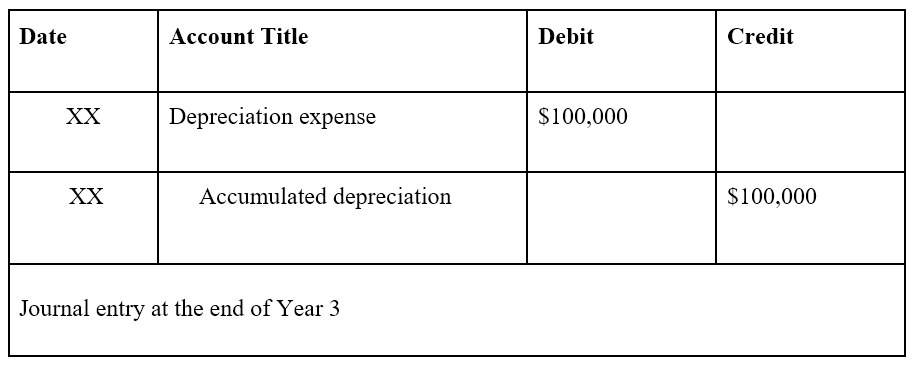

The reporting of operating activities helps in determining the focus of the business and its earning potential. View the full answer. 102 billion adjustment for depreciation and.

Operating Cash Flow OCF is the amount of cash generated by the regular operating activities of a business within a specific time period. OCF begins with net income. Items classified within this area are an entitys primary revenue-producing activity so cash flows are generally associated with revenues and expenses.

What Are Operating And Non Activities Bdc Ca Spreadsheet For Monthly Income Expenses Jumia Balance Sheet

Multiple Choice Payments of interest. Cash inflows from operating activities include-cash sales to customers-collection of accounts-receivable arising from credit sales-cash dividends received-interest received on investments in equity and debt securities Cash outflows from operating activities include payments-to suppliers for goods and services-to employees for wages and salaries. The company recorded an annual net income of 484 billion and net cash flows from operating activities of 636 billion. The principal operating activities include any cash flows that relate to the core or activity that business performs to earn a profit.

It is calculated by taking a companys 1. Operating activities include transactions that affect long-term assets and other non-operating assets. Accounting questions and answers.

Operating activities Cash inflows. The next sections of the cash flow statement are investing activities and financing activities respectively. CFO focuses only on the core business and is also known as operating cash.

Three Types Of Cash Flow Activities Profit And Loss Balance Sheet Format A Lists Assets In Order Their

Operating activities is a classification of cash flows within the statement of cash flows. Cash payments for sales commission expenses 25. A a purchase of land. – current liability accounts for amounts owed to employees – noncurrent assets that affect net income – current notes payable accounts – noncurrent assets that are not included in income.

If the company is not generating money from core operations it will cease to exist in a few years time. Non-cash items such as depreciation provisions deferred taxes etc. Include those transactions and events that affect long term liabilities and equity.

Cash flows from operating activities include all of the following except. 1changes in long-term liabilities 2. Changes during the period in inventories and operating receivables and payables.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples Plant Assets Are Ordinarily Presented In The Balance Sheet Excel Free Download

The cash flow from operating activities is the first part of the cash flow statement. Collections from customers for sales of goods. Cash flow from operating activities does not include long-term capital expenditures or investment revenue and expense. Cash receipts from the disposal of long-term assets c.

Changes in investing 2. If balance of an asset decreases cash flow from. And if it lasts a long time it indicates a severe problem with the companys business.

D receipt of cash dividends. Cash payments for dividends to stockholders d. B Interest and dividends received.

How Do Net Income And Operating Cash Flow Differ Financial Accounting Statement Example P&l Same As

Expenditures to operate the business. In addition cash flows from operating activities include all other transactions that do not fit one of the three other classifications for example capital and related financing activities noncapital financing activities and investing activities. Cash flow from operating activities is an essential part of your companys cash flow statement. 46 Cash flows from operating activities include all of the following except.

D Payments of dividends. Revenue also referred to as Sales or Income paying expenses and funding working capital. B collections from customers on account.

A Collections from customers for sales of goods.

Cash Flow From Operations Definition Formula And Example Aicpa Ssae 16 Slack Financial Statements

The Statement Of Cash Flows Boundless Accounting Stockholders Equity Section Balance Sheet Example Concurrent Audit Report