The widgets cost 200000 to make and his. Operating expenses include all the cost or expenses which are directly related to the business activity.

Do not forget to include vacancy rates in your Gross Operating Income GOI calculations as this will give a clearer picture of what a property can reasonably return in a year. Operating income refers to the money that a business earned from its primary operations rather than other one-off sources of revenue. For example a retailers principal operations include running stores and selling goods to customers. The operating revenue doesnt include income from extraordinary activities.

Operating income includes.

Operating Income Vs Ebitda What S The Difference Perform Financial Analysis Fifth Third Bank Statements

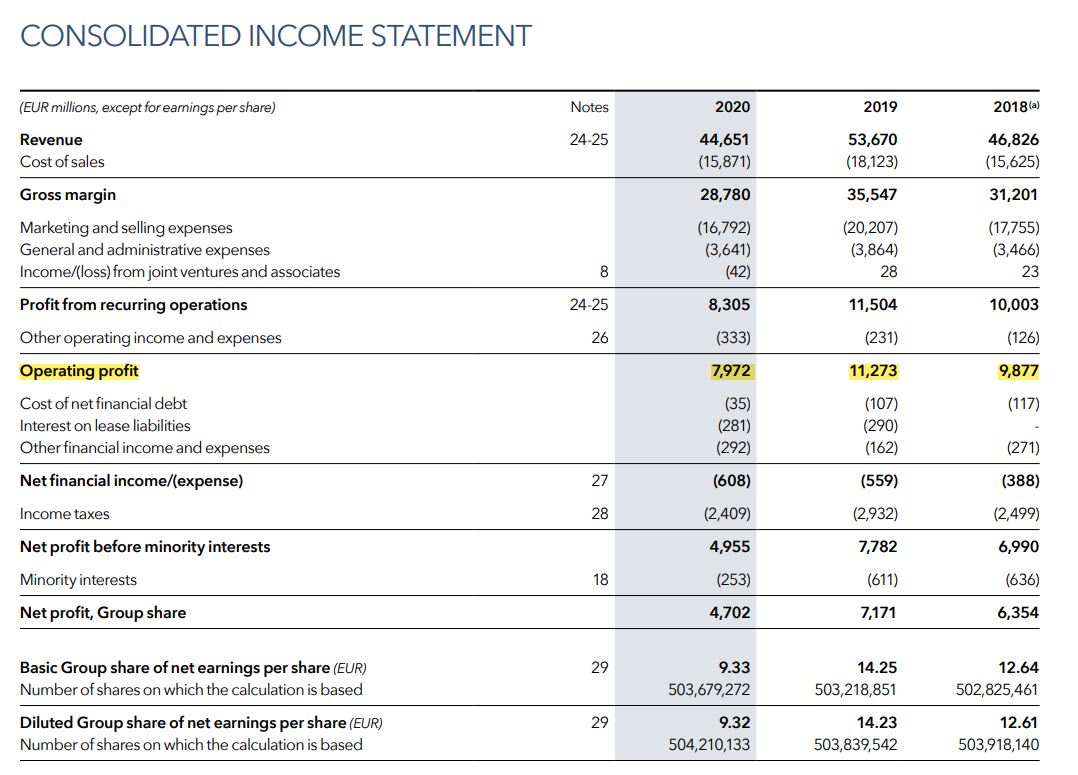

There are two formulas to calculate after-tax operating income. EBITDA stands for earnings before interest taxes depreciation and amortization. EBIT is net income before interest and income taxes are deducted. Revenue from real estate includes rental income parking fees service changes vending.

Trending Questions Post navigation. The operating income is the profit the business earns after deducting operating expenses. B Operating income takes into account income taxes whereas net income does not take income taxes into account.

In other words operating expenses include all type of cost which is required to be incurred in running the day to day operations of the business. Comps and includes a free template and many examples. Synonyms for operating income include earnings before interest and taxes.

Operating Income Vs Ebitda What S The Difference Deloitte Financial Statements 2019 Nse

To calculate net operating income subtract operating expenses from the revenue generated by a property. Operating income measures how much of your businesss profit comes from business operations. To calculate EBITDA non-cash items like depreciation taxes and capital structure are stripped from the equation. Operating income includes both COGSor cost of salesand operating expenses.

Operating income is a measure of profitability that is directly related to a companys operations. Operating income includes more expense line items than gross profit which primarily includes the costs of production. Operating Expenses the operating expenses of commercial real estate include property management fees property taxes insurance premiums and repairs and maintenance.

Operating income includes a companys profits after deducting its operating expenses from its gross profits. For example a widget manufacturer earns 1000000 in gross revenue from the sale of widgets. Operating incomes is a companys profit less operating expenses and other business-related expenses such as SGA and depreciation.

Operating Income Overview Formula Sample Calculation Non Current Liabilities List In Balance Sheet Prior Period Adjustment Note Disclosure Example

Operating income includes expenses. We can see in the above example that the 2021 operating income of 6523 billion was less than the EBIT of 6714 billion. Below is an example calculation of EBIT. Are NOI and EBITDA the same.

EBIT equals the amount after operating expenses and COGS are deducted from the total revenue. Net operating income is similar to earnings before interest taxes depreciation and amortization EBITDA because they both measure the profitability of an entity before. The total revenue includes all channels of income including all operating income investment income interest from loans offered etc.

It refers to the revenue and expenses resulting from the companys core business and includes selling general and administrative expenses. The operating income does not include losses from interest payments or income tax. And you usually wont subtract extraordinary gains and losses.

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Ebit Vs Operating Income What S The Difference Pl Account Format Aapl Balance Sheet

Operating income excludes non-operating items such as investments in. Net income on the other hand includes all income and expenses including investment income and expenses debt service payments taxes etc. Operating income is sometimes referred to as Earnings Before Interest and Taxes but they arent synonymous terms. NOI is a mathematical formula used to calculate how profitable a potential investment property is in a single year by subtracting total annual expenses from income.

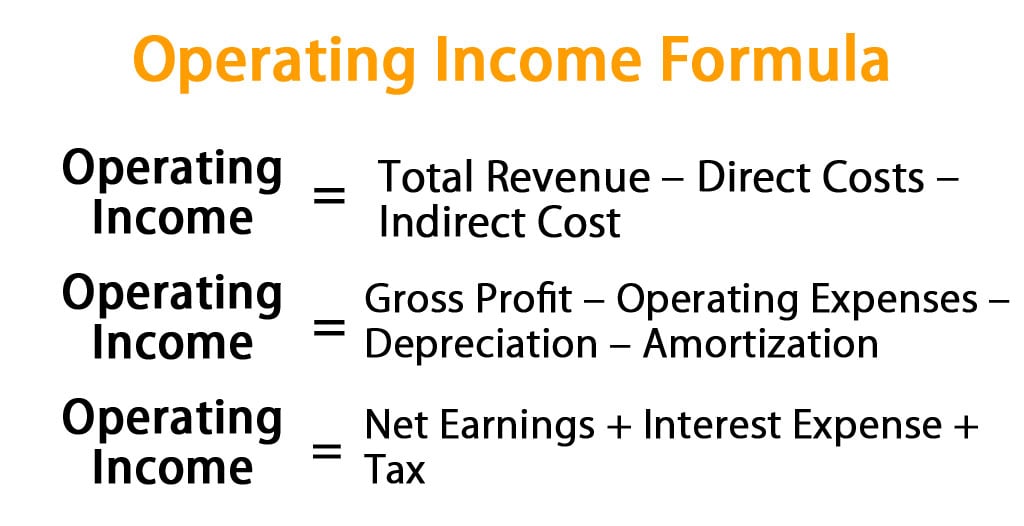

Operating Income real estate revenue any commercial real estate produces income including rents and various fees like laundry machines vending machines parking fees and more. Operating income Total Revenue Direct Costs Indirect Costs. Usually this figure can help in measuring a companys operating efficiency.

A sports teams activities include merchandising selling tickets to games and concession sales. Non-operating income includes the gains and losses expenses generated by other activities or factors unrelated to its core business operations. Operating income is revenue less any operating expenses while net income is operating income less any other non-operating expenses such as interest and taxes.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating And Net Income Ledger To Trial Balance Examples Sheet Liabilities List

You will not subtract interest and income taxes. Non-operating income can include such items as dividend income. Operating Income A companys income from the goods and services it provides less its operating expenses and depreciation. Operating income Gross Profit Operating Expenses Depreciation Amortization.

The difference in operating profit and operating income formula is that EBIT also deducts the costs associated with cost of goods sold COGS which includes the expenses businesses pay for manufacturing sourcing and shipping products or services. What Is Not Included in Operating Income. Operating income includes the companys overhead and operating expenses as well as depreciation and amortization.

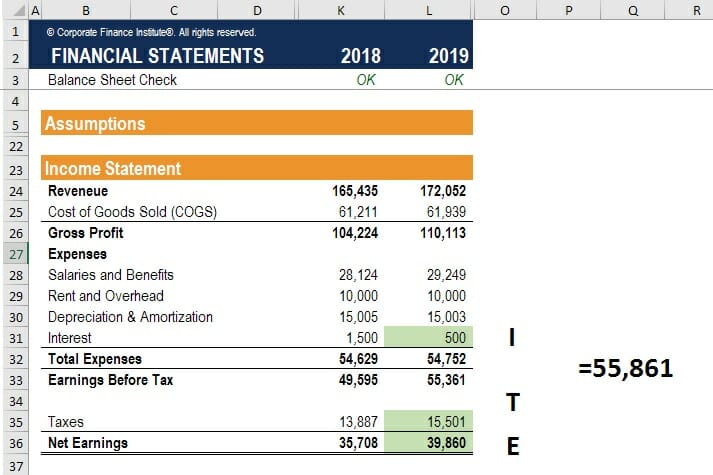

39860 Earnings 15501 Taxes 500 Interest 55861 EBIT. Operating income is your gross income minus operating expenses. The reason for the difference is that operating income does not include.

Operating Profit Simtrade Blogsimtrade Blog The Big Four Audit T2125 Statement Of Business Activities

Non-operating income is the portion of an organizations income that is derived from activities not related to its core operations. A Net income includes cost of goods sold in its calculation whereas operating income does not. After-tax operating income is similar to operating income but it also accounts for taxes. The key difference between EBIT and operating income is that EBIT includes non-operating income non-operating expenses and other income.

Distinguish between operating income and net income. Operating income is a term used in accounting to refer to the amount of money earned by an entity by providing goods or services before subtracting costs for items such as depreciation or rent on real estate. The costs deducted include capital expenses taxes and all operating expenses.

EBIT also includes other income or expenses that arent central to a companys business. A companys operating income and non-operating income are identified in a multi-step income statement as shown below.

Operating Income Vs Gross Profit Horizontal Analysis Of Comparative Financial Statements Includes Coca Cola Performance

Operating Income Formula Calculator Excel Template Aapl Statement Consolidated Accounts Meaning

:max_bytes(150000):strip_icc()/Walmart202010KIncomestatement-365d4a49671b4579a2e102762ada8029.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)