Payroll audit report will describe the findings of the audit and give you suggestions. This sample audit report can be used by auditors to conduct an organizations payroll process audit. This record may not be released without appropriate authorization from a. Payroll is often the system of record for both HR and payroll data. Leveraging […]

Agm Financial Statements

Further details on how members may participate remotely will be circulated as we get closer to the date of the AGM. An annual general meeting AGM is a way for your company to present its financial statements accounts to shareholders members. Since your financial statements are presented at your AGM y ou can start planning […]

Retained Profit Balance Sheet

2022 Templates For Business Accounting. Ad 1 Fill Out Easy Questions. It is shown on an accrual basis since the entity was first formed. Retained Earnings on the Balance Sheet are reflected in the Shareholders Equity section. How are the retained earnings calculated on the balance sheet. It present under the equity section in the […]

Tmf Group Financial Statements

As an Accounting Officer at TMF Group you maintain portfolios of clients who mainly purchase accounting and financial statements services. By law financial statements cannot be drafted by a companys auditors. 412 from Accounting and Tax 179 from Corporate Secretarial 183 from Alternative Investments and 226 from HR and Payroll TMF Group revenue breakdown by […]

Kfc Financial Statement 2018

Get the detailed quarterlyannual income statement for KFC Ltd. The debt to equity for all Exotistan stocks is 9998 higher than that of the company. 2017 denoted the highest value of 008 while the lowest recorded in 2019 at 006. Reduction in profit margin. KFC di Indonesia PT Fast Food Indonesia Ayam Goreng. This is […]

Rpower Balance Sheet

Stocks Reliance power. Financial Overview Balance Sheet Profit. Repayment has been made using the cash flow from operation and not by selling its assets. There has been increase in the promotor shareholding as well though it remains low overall. Financials Technicals RPOWER financial statements The current financial position of RELIANCE POWER This financial report summarizes […]

Cash Balance In Flow Statement

At the bottom of the cash flow statement the three sections are summed to total a 35 billion increase in cash and cash equivalents over the course of the reporting period. The difference between the total cash inflows and cash outflows on the statement of cash flows equals either a net increase or net decrease […]

Cash Flow Example Problems

Negative cash flow might make it impossible for a company to pay. For small businesses Cash Flow from Investing Activities usually wont make up the majority of cash flow for your company. Ad Optimize cash shore up your capital position extend your runway for business resilience. Cash flow vectors — Up Inflow Benefit or — […]

Ssm Financial Statements

TTM Cash from operating activities Funds from operations Changes in working capital Cash from investing activities. The Directors Strategic Guide to Corporate Govern. SSM Health Care Corporation SSMHCC. MBRS refers to the submission platform based on the eXtensible Business Reporting Language XBRL format. A current report that contains basic information of a company such as […]

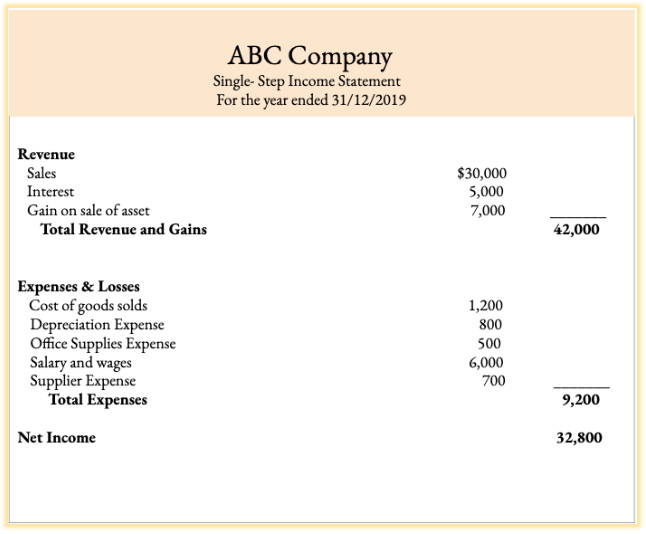

Pl In Project Management

The profit and loss PL report is a financial statement that summarizes the total income and total expenses of a business in a specific period of time. The bottom line of the PL statement is the net margin ie the. Forecasted 3-year PL statement established on 24061996 – monetary values in Average per unit 1997 […]