Accounting Profit And Loss – 17 images – management accounting part 1 balance sheet profit loss free cash flow statement templates smartsheet cash management. A profit and loss PL statement is a financial tool that summarizes the costs revenues and expenses incurred by a business during a particular period typically a year or a fiscal […]

Excel Sheet For Accounting

Some basic excel functions let you perform. In order to manage your basic bookkeeping using Excel youll want to start with a template that includes a chart of accounts transaction sheet and income statement sheet. Using the Excel accounting template saves you time you can spend with your family and saves you money you can […]

Balance Sheet Template Simple

This simple balance sheet template includes current. For those that value the ability to keep track of. A Balance sheet is a document that characterizes the overall condition of the assets and liabilities of the enterprise at a certain point date in monetary terms. This balance sheet template provides you with a foundation to build […]

Cash Flow To Balance Sheet

PPE Depreciation and Capex. The statement is divided into three sections operations investing and financing. Here this date will be 31st March. The cash flow statement measures the performance of a company over a period of time. Provides information about resources obligations to creditors and equity in net resources. Changes in the balance sheet accounts […]

Financial Audit And Cost

It examines the reliability of the system which produce cost information. What is Financial Audit. Cost Audit can be defined as a searching examination of cost records made by a competent personIt is a system of identification and communication which signals i whether there are. The number of audit hours required for a public audit […]

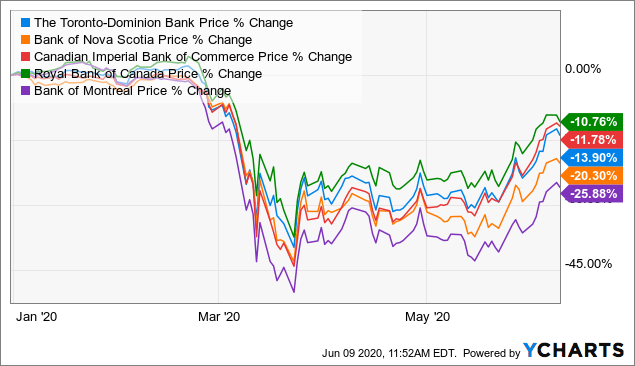

Td Bank Stock Performance

Check Toronto Dominion Probability Of Bankruptcy Ownership Toronto Dominion Bank shows a total of one billion eight hundred twenty million outstanding shares. Toronto Dominion Bank reports about 53073 B in cash with 5662 B of positive cash flow from operations. TD Complete Toronto-Dominion Bank stock news by MarketWatch. View real-time stock prices and stock quotes […]

Secured Loan Comes Under Which Head In Balance Sheet

Examples of long term debts are 102030 years bonds and long term bank loans etc. In the long term debt some portion of the debt is to be paid in less than one year. In other words we classify bank loans under the liability side of a balance sheet. ICICI Bank gave loan at 75 […]

Primary Purpose Of The Statement Cash Flows

It describes the money spent on non-core activities. A The cash receipts and cash disbursements of an entity during a period. About the operating investing and financing activities of an entity during a period. 2 Information about Non-Cash Investing and Financing Activities. That is useful in assessing future cash flow prospects. Calculation of the entitys […]

Minority Interest In Consolidated Financial Statements

Minority interest is defined as the ownership value of an individual or business that owns less than 50 percent of a business. The main objective of financial statements is to aid in decision making. Consider the following example of Entity A having 40 interest in Entity B. IFRS 10 outlines the requirements for the preparation […]

Balance Sheet Accrual Basis

Why is a Balance Sheet in CashAccrual Basis Out of Balance. We convert QB accrual to cash basis by putting the trial balance in software and posting the. Accounting is based on a double-entry accounting system which requires the following. Expert Answer Under accrual method of. If the IRS wants support they. Where accruals appear […]