You need 50 to pass the exam. Anyone can do this course you may be in class 12 doing your graduation or MBA or other qualified Professional. Online Instrument Rating Video Course. Ali has put in a lot of effort in this course. This exam is conducted by ACCA London. Please feedme back abut the […]

Capital Expenditure On Income Statement

The expenditure Expenditure An expenditure represents a payment with either cash or credit to purchase goods or services. A capital expenditure is the use of funds or assumption of a liability in order to obtain or upgrade physical assets. Expenses are costs incurred for a consideration. Depreciation is the fall in the value of any […]

Accounting Formula Assets Liabilities Equity

Equity reports the quantities invested into the business by the owners and the cumulative net earnings of the business that is not withdrawn or dispersed to the owners. This shows all company assets are acquired by either debt or equity financing. This breakdown of equity yields the following expanded accounting equation. For example when a […]

Insurance Annual Statement

If you have a permanent life insurance policy the life insurance company will generally mail out an annual statement around the month of your policy date. Please use the links below to retrieve the Annual Statements to the Insurance Department filed by our insurance subsidiaries. Special Studies Studies reports handbooks and regulatory research conducted by […]

Wu Systems Has The Following Balance Sheet

Assume that all current assets are used in operations. Cash 100 Accounts payable 200 Accounts receivable 650 Accruals 350 Inventory 550 Notes payable 350 Current assets 1300 Current liabilities 900 Net fixed assets 1000 Long-term debt 600 Common equity 300 Retained earnings 500 Total assets 2300. Question 16 15 15 points wu systems has the […]

Profit And Loss Account Is

The report shows information about the net profit or loss based on. Profit and Loss Account is a type of financial statement which reflects the outcome of business activities during an accounting period ie. A profit and loss statement is a financial report summarizing the revenues costs and expenses a company incurs for a specific […]

Bdo Financial Statements Deferred Income Tax Example

Our income tax expense deferred tax assets and liabilities and liabilities for unrecognized tax benefits. Consequently it noted that deferred tax would be recognised in the consolidated financial statements for any temporary differences arising in each separate entity by using the applicable tax rates for each entitys tax jurisdiction subject to meeting the recoverability criteria […]

Income Tax On Cash Flow Statement

Another reporting deficiency involves erroneously including the disclosure language in compilation reports for income tax basis financial statements that are presented without a cash flow statement. Cash Flow Statements can guide you in projecting your future cash flow to help you plan for the future. Simply it is Total Revenue – Operating Expenses Operating Cash […]

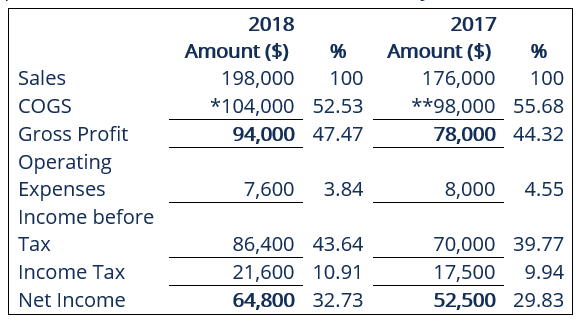

Operating Profit Income Statement

Operating profit does not necessarily equate to the cash flows generated by a business since the accounting entries made under the. Different financial statements record varying operating activities. 2101634 5705068 037 or 37. What is Operating Income. Revenue500COGS250Gross Profit250Operating Expenses100Operating Profit EBIT150Interest30Taxes50Net Profit70Following this basic format you can determine how to calculate operating profit. The […]

Merchandising Income Statement Company Final Accounts Format

Cost of Goods Sold Gross Profit Less. There are two ways of presenting an income statement. The final step in a multiple step income statement is net income. A merchandising company uses the same 4 financial statements we learned before. 1 the name of the company 2 the title of the financial statement and 3 […]